Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 9 November 2020 00:13 - - {{hitsCtrl.values.hits}}

The COVID-19 crisis has become a financial crisis for hundreds of thousands of Sri Lanka’s senior citizens, savers and charitable institutions. Those who have invested their life savings in fixed deposits and were living on the interest income will take an over 50% reduction of their income with the plummeting of bank and finance company deposit rates.

The COVID-19 crisis has become a financial crisis for hundreds of thousands of Sri Lanka’s senior citizens, savers and charitable institutions. Those who have invested their life savings in fixed deposits and were living on the interest income will take an over 50% reduction of their income with the plummeting of bank and finance company deposit rates.

Elderly people could risk running out of money before they die. Charitable institutions will have to half their philanthropic activities. The unprecedentedly low interest rates, whilst could be a boon for borrowers, will hurt those who depend on modest nest eggs for a safe income. Live on less, dip deeply into savings or take on more risk: Those are the nasty choices that many people will be facing. The dilemma is most pressing for those planning for retirement or already in it.

All time low interest rates have reduced interest income by 52%

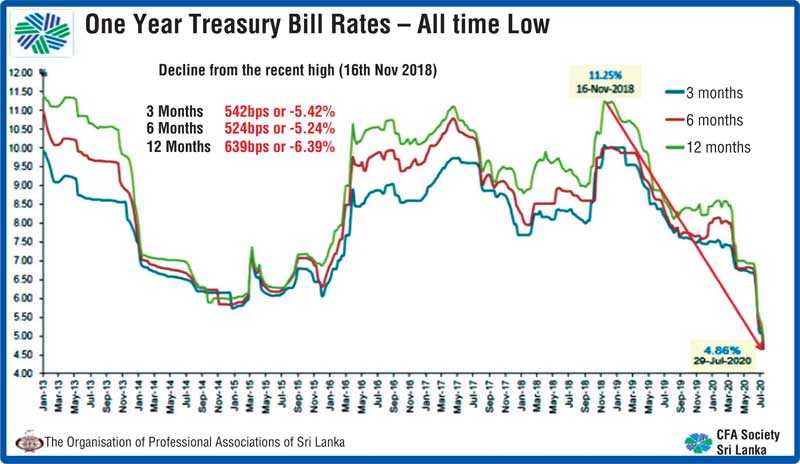

The one-year Treasury bill Weighted Average Yield Rate at the auction held on 23 October recorded a new all-time low of 4.13%.

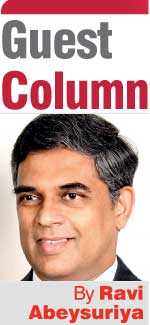

Deposit rates offered to customers have come down faster as banks hasten to cut their funding cost in a bid to maintain margins, which are narrowing in line with the falling lending rates Interest paid on one year fixed deposit by banks is now around 5.5% per annum resulting in a reduction of interest income for fixed deposit income by 52.2% for a non-tax payer.

Interest income of tax payers will be further impacted due to the removal of 5% final withholding tax (WHT) that was previously applicable for interest income depending on the tax bracket they may fall into if their total income (i.e. employment, investment and business income) exceed Rs. 3 million per annum.

The Government allows a special senior citizens’ (for those who are over 60 years of age) one Fixed Deposit at 15% per annum or 14.06%. Monthly in a commercial bank up to a maximum of Rs. 1.5 million to minimise the impact. However, such a deposit will generate only an income of Rs. 17,575 monthly.

The real income of those however, will depend on the rate of inflation in the economy. The Department of Census and Statistics in its 21 October press release indicated that the Year-on-Year (YOY) inflation as measured by NCPI is 6.4% and the YOY inflation of the Food Group was 12.7% in September 2020. This mean the people and charitable funds who depend on interest income will not be able to buy the same bucket of food or carry out their benevolent activities with the interest income from their Fixed Deposit investments for a few years or more.

Investors around the world are facing the same problem. Bank accounts, money-market accounts and other short-term instruments no longer offer a decent return and perhaps negative in real terms when compared with inflation. With rates going nowhere anytime soon, get ready for even more difficult times ahead.

How low interest rates effect the economy

Governments throughout the world supported by their central banks have been on a path to push interest rates down. The envisaged objective is to stimulate their economies that have fallen into negative growth by the ongoing COVID-19 pandemic. Since it has added to the misery of people, cutting down both employment and welfare levels, the governments have thought that the best way to help people is to flood them with bank credit at low interest rates.

However, when central banks allow interest rates to approach, or fall below, what is quaintly termed “the zero-lower bound” there are clear losers. Banks are presuming that households, obedient to monetary policy theory, will borrow more money at still lower rates. In fact, the reality is that “lower for longer” prevents a robust recovery because it makes economic inequality worse.

There is clear evidence that despite maintaining ultra-low interest rates, central banks of the world’s leading economies have largely failed to bring about steady and healthy growth.

There is a growing consensus among economists and a strong body of evidence that, traditional monetary measures to stimulate the economy actually do more harm than good. They contribute to rising inequality, for lower interest rates benefit mostly the wealthy, who already have large financial holdings, and hurt middle-class families and retirees who depend on their investments and savings for a living. It is doubtful that current lowering of interest rates will boost investment and help the economy.

The current problems in the world economy are the result of the shock produced by the COVID-19, both on demand and supply sides, as it disrupted global supply chains, prompted governments around the world to close borders and severely restrict people’s movement. Therefore, it is unlikely that rate cuts will generate productive investments at a time when companies prefer to save rather than to invest not due to high costs of borrowing and “high” interest rates but because of the uncertainty associated with the pandemic.

Further, fixing interest rates arbitrarily by a regulator should be done carefully. This is because there are two parties involved in the determination of interest rates and when the Central Bank reduces interest rates, one party is benefitted while the other party is harmed. No economy can move forward on a sustainable basis when one party is benefiting at the expense of the other party.

Dos and don’ts when interest rates are low

Dos:

1. If you have a housing loan re-finance or negotiate a lower rate to pay off debt may be your best investment, and low interest rates help you pay off loans faster and protection of scarce assets, and effective use of financial services.

2. If you are 60 years of age or more make use of the Special Senior Citizens Fixed Deposit scheme that offer 15% p.a. or 14.05% monthly for one Rs. 1.5 m deposit for one year from any one of the commercial banks.

3. Know your tolerance to risks – Find out the credit rating of the financial institution before you invest (Credit ratings can be obtained from the respective financial institution or by searching www.fitchratings.com and www.icralanka.com websites).

4. Shop around, switch financial institutions and hard negotiate your FD interest rate (depends on your relationship with the financial institution), before your FD mature; do not leave it to be automatically renewed.

5. Spread your fixed deposits among your family members from an estate and tax planning perspective.

6. Spread your money across different fixed income asset classes such as Money market and Income Funds offered by Unit Trusts Companies, listed debentures to increase returns and to reduce your overall risk.

7. Consider investing a small part of your wealth in more risky assets such as equity, start with high dividend paying stocks with dividend growth potential listed in the Colombo Stock Exchange. There are over 30 stocks that have given a dividend yield of over 6% and some over 10% historically, which should deliver a higher return over the long run, provided they can sustain their dividend pay-out.

Don’ts:

1. Trust third parties who may claim to be from well-known institutions, check the authenticity of deposit certificate vs. the institution – do not invest in un-licensed, un-regulated entities, Ponzi/pyramid schemes.

2. Invest in schemes that offer unusually high rates – Realise that if any institution to offer higher rates, they in turn have to take higher risks, which you may not know.

3. Shy away from investing in the stock market because the value of the principle you invest fluctuates daily. Volatility is a known risk when investing in stock markets. Understand what you are investing in and seek professional advice.

Become financially literate

Sri Lanka has the highest gap between print literacy and financial literacy in the region. On average, 65% of adults in advanced economies are financially literate. Financial literacy in Sri Lanka is about 35%. It is spread across all social strata from the poor to the professionals.

Many dishonest organisations operate illegally or outside of the legal framework in Sri Lanka. They mobilise high interest-paying deposits and thrive on the financially illiterate who, because of their sheer lack of financial knowledge, only focus on the rate of return and do not recognise the risks of the financial institution they entrust their hard earned money.

The first and foremost step is to educate yourself to become skilled at making, controlling and safeguarding your money. There is no shortcut to spending some time to learn, being financially literate clearly benefits individuals and their households, since they are able to make better and more informed decisions when it comes to saving and borrowing money.

I strongly encourage each and every one of you and also persuade your loved ones to download and read the 30 odd page booklet, available free of charge at www.cfasrilanka.lk. Further, a webinar recording is available on YouTube – search for ‘Financial Literacy: To survive the dark side of low interest rates’ on YouTube.

[The writer, CFA, functions as an Independent Non-Executive Director of Seylan Bank PLC, HNB Assurance PLC, Bio Foods Ltd., SenFin Asset Management Ltd. and Candor Group of Companies. He is also the Advocacy Chair and Board Director of CFA Society Sri Lanka, and Council Member of Sri Lanka Institute of Directors and Co-Chair – National Agenda Committee on Finance and Capital, Ceylon Chamber of Commerce. Formerly, he was the CEO of the Candor Group, Head of Strategic Business Development at Hayleys Group, Managing Director of Amba Research Lanka and Managing Director of Fitch Ratings Lanka. Abeysuriya also functioned as a permanent member of the Financial Sector Reforms Committee (FSRC), a Prime Ministerial Task Force appointment and was twice appointed as a commission member of the Securities and Exchange Commission of Sri Lanka. He was also a Director of Sri Lanka Insurance Corporation Ltd. (SLIC) and Chairman of its Investment Committee. Abeysuriya has also functioned as a member of Board Risk Oversight Committee and Financial System Stability Consultative Committee of the Central Bank of Sri Lanka and President of several finance and IT associations.]