Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 5 July 2019 00:02 - - {{hitsCtrl.values.hits}}

On 24 June, the Government of Sri Lanka completed an international placement of $ 2 billion euro bonds (known as International Sovereign Bonds or ISBs). This was the second issue of euro bonds for the year. The first issue of $ 2.4 billion took place on 7 March this year.

On 24 June, the Government of Sri Lanka completed an international placement of $ 2 billion euro bonds (known as International Sovereign Bonds or ISBs). This was the second issue of euro bonds for the year. The first issue of $ 2.4 billion took place on 7 March this year.

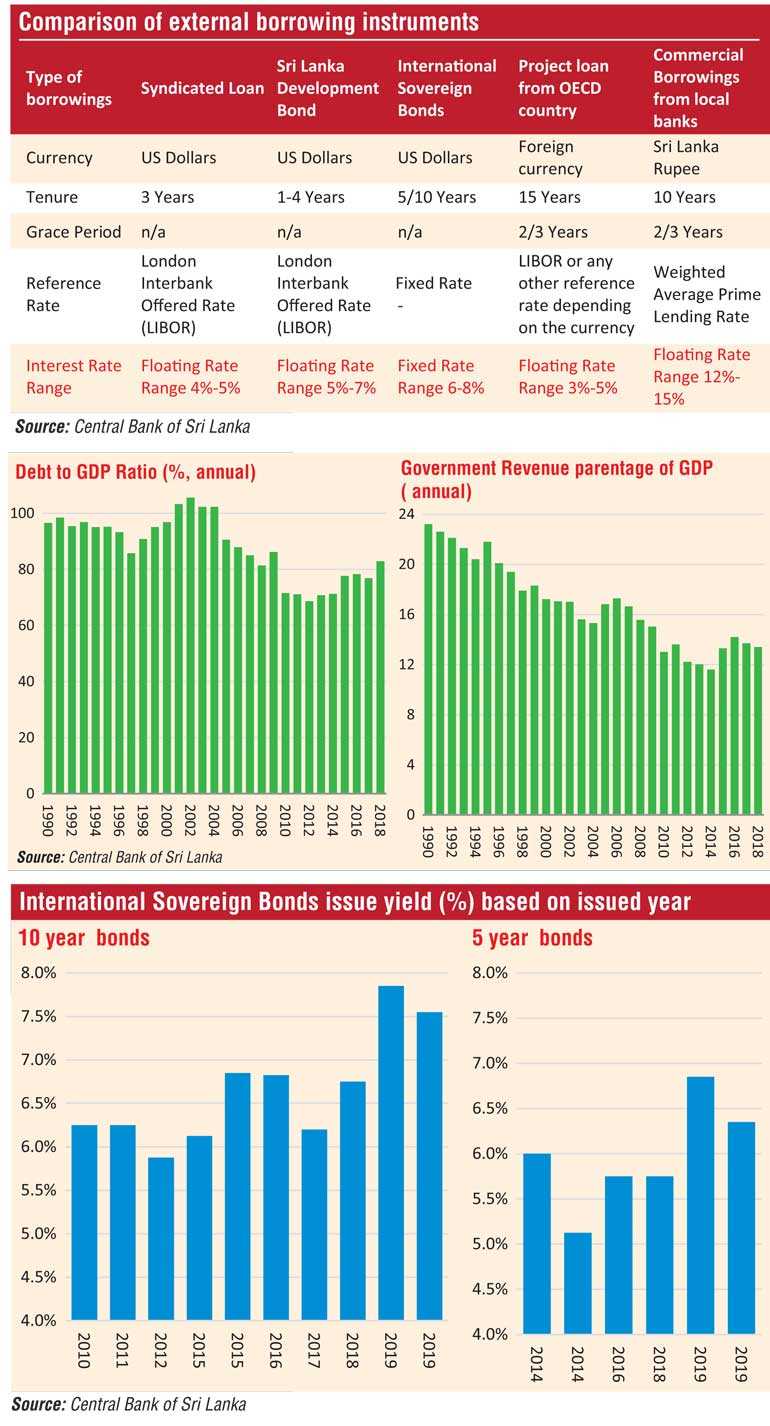

Altogether, Sri Lanka had issued $ 4.4 billion worth of euro bonds during the year, the highest number in a single year. With the issue of $ 4.4 billion euro bonds this year, total euro bonds outstanding reached approximately $ 15 billion, accounting for nearly 25% of total borrowings.

Yield on the five-year tranche show an improvement of 50 basis points (0.50%) to 6.35% compared to the yield of 6.85% in March 2019. Similarly, yield on the 10-year tranche also improved by 30 basis points (0.30%) compared previous issue in the year. Despite a marked improvements in the offered yield in this issue, compared to last issue in March, the yield was significantly higher compared to its previous issues.

State sector

Sri Lanka had heavily relied on foreign debt for the development of capital expenditure including the infrastructure development. The country also runs a massive welfare economy. State sector employments have grown massively in the recent past, especially since 2005.

As of today, the State sector employs more than 1.5 million people who are eligible for unfunded Defined Benefits Retirement Scheme. Unlike in the case of defined contributory schemes, the State sector employees do not contribute anything from current remuneration, hence it remains entirely a burden on the taxpayers. In contrast, most taxpayers have either no pension at all or fall under a Defined Contributory Pension scheme. The cost will continue to build up.

The Government has historically been running a massive fiscal deficit. While there is slight improvement in the recent years, the income of the Government is not sufficient to meet recurrent expenditure. As a result, all capital expenditure was funded through borrowings.

The country with per capita income slightly over $ 4,000 is categorised as upper middle-income economy. As a result, Sri Lanka doesn’t qualify for most of low cost international funding, received when the country was under the lower income bracket. Since 2007, Sri Lanka commenced tapping international euro bond market. The euro bond is a market-friendly commercial funding option. Commercial funding options are generally expensive compared to the soft loans we used to receive in the past.

Debt instruments

The Government of Sri Lanka uses a number of debt instruments for financing fiscal expenditure. Treasury bills are the primary short-term domestic debt instruments. For raising long-term funds, the Government issues Treasury bonds, a long-term marketable debt instrument. The bank overdraft within State banks is also used for cash management purpose.

To raise foreign currency denominated debt, the Government uses euro bonds, syndicated loans, Sri Lanka Development Bonds, FCBU facilities and project loans. Sri Lanka development bond is a domestic debt instruments primarily used to mobilise foreign currency savings from the local market. Euro bond or international sovereign bonds are used to raise long-term funds from international capital markets.

The Government has historically used five-year and 10-year benchmark issues. As a result of regular annual issues, there is a well-established euro bond yield curve for Sri Lanka now from one to 10 years. From 2016 onwards, the External Resource Department (ERD) has raised foreign funding through syndicated term loan facility. The typical syndicated loan is for three years with six monthly amortisation of principle. However, ERD had secured an eight-year term loan from China Development Bank in 2018.

The Government has raised project financing through bilateral and multilateral project loans from various countries to finance long-term projects. Lately, the Government has obtained bilateral financings from Export–Import Banks (EXIM bank) as buyer’s credit facilities. In addition, the Government has obtained financing from international commercial banks under the export credit insurance schemes.

Due to the fiscal constraints and over-reliance of borrowings for the infrastructure development, the Government has encouraged certain State-Owned Entities (SOEs) such as Urban Development Authority and Road Development Authority to borrow funds directly from the local financial institution under the guarantee provided by the Government. However, these SOEs have no sufficient income flow to service such debt and the Government allocates funds from the national budget for the repayment of those loans.

Expensive borrowings

Ideally, long-term infrastructure projects should be financed with relatively low cost and longer tenure debt instruments. Since there is an outflow of foreign currency for purchasing the construction materials such cement and steel, we have historically preferred foreign financing for such projects. However, the Government has opted local commercial bank borrowings for the construction of section 2 of the proposed Central Expressway.

The expected borrowing within the three-year construction period is estimated at Rs. 150 billion. If the chart provides any guide for the expected interest rates, the interest rate difference is around 7-8% per annum. The additional interest cost during the loan service period will be approximately Rs. 90 billion. To put this into perspective, it is similar to half the cost of the planned Ruwanpura Expressway.

Need for PPP

The Government has been extremely slow in the implementation of major infrastructure projects such as expressways. It is well understood that a country cannot finance total infrastructure spending by only through the debt.

To attract Foreign Direct Investments into the infrastructure sector, a well-designed Public-Private Partnership (PPP) framework is mandatory. There was no serious efforts during the past five years to design and implement a proper PPP framework. As a result, we have not been able to attract any meaningful investments in to infrastructure. The Government is left with only option – debt.

Debt trap

Since 2013, economic growth has been slow and subpar. This has resulted in escalation of the debt to GDP ratio. When the economy operates on a slow phase, the Government should step up and increase and fast-track spending projects. Then Government spending trickles down to the economy and starts generating income. Delay in large development projects and political paralysis have resulted in stagnation in the economy. Under such a scenario, if the Government continues with expensive borrowing options, the country may further slip into the debt trap.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)