Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 2 November 2018 00:00 - - {{hitsCtrl.values.hits}}

Last Friday night was a long night for many politically-conscious citizens of the country. In an unprecedented move, the main coalition partner of the National Government, the United National Freedom Alliance (UPFA), led by the President, decided to quit the National Government. Immediately, a new Government led by the former President as the new Prime Minister was formed.

While the debate is going on the legitimacy of the action taken by the Executive and whether such Government can show a simple majority in the House, it appears the new administration is swiftly consolidating its position with administrative changes necessary to discharge their duties. Leaving political matters to be resolved by the politicians in the respective political parties, this article intends to comprehend the economic challenges faced by the new Government.

Challenging external environment

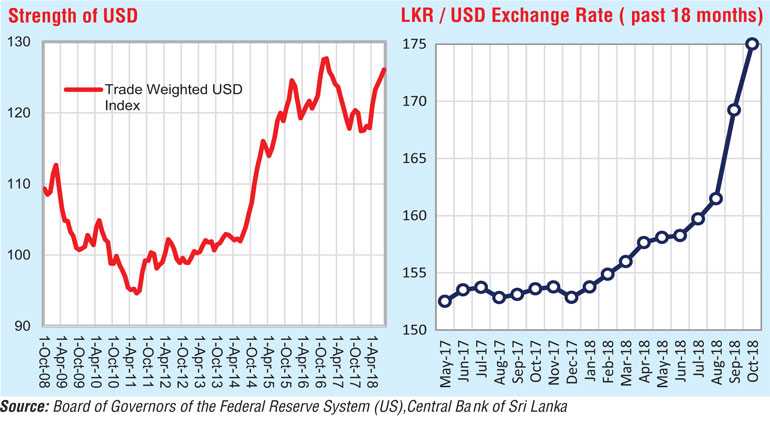

The external environment is quite different from 2015 and the challenges are multifaceted. The strength of the USD, induced by the combined effect of tightening US monetary policy, US trade negotiation and strong US economic indicators has created many difficulties to emerging market economies (EM) including sharp depreciation of their currencies.

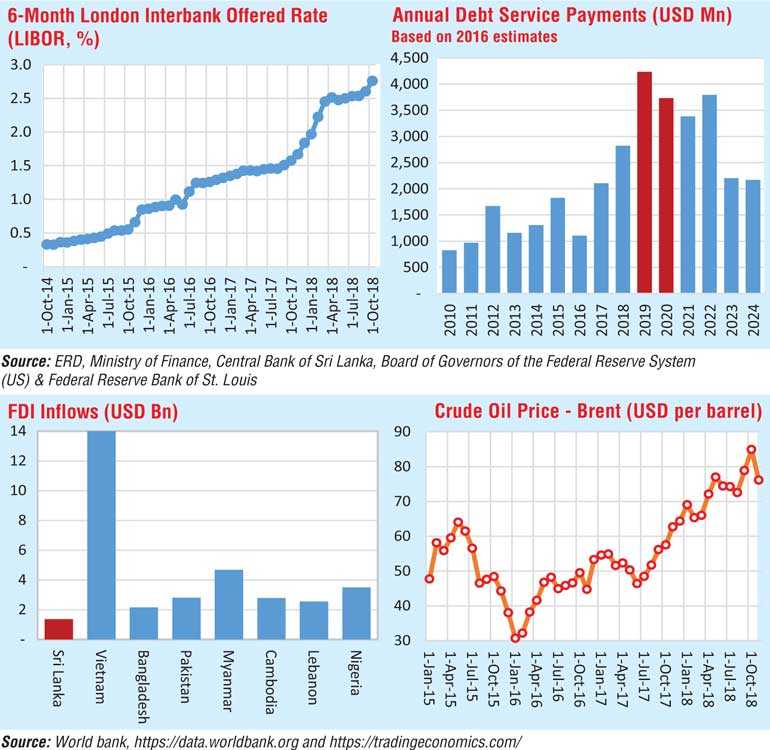

As result of the US exit strategy, the interest has been on the upward trajectory. The most widely-used benchmark for USD borrowing, 6-Month LIBOR (London Interbank Offered Rate) has risen from 0.38% in Jan 2015 to 2.76% in Oct 2018. This means interest rate payable on most foreign currency denominated floating rate debt and future borrowings (USD) will be much higher in comparative terms.

The capital flows are reverting back to the developed world (primarily to the US) as result of higher interest rates. After the financial crisis in 2008, the Fed lowered its benchmark interest rates to fight against the deflationary condition. The ultra-low interest environment prevailed at that time, motivated many investors to search for higher returns elsewhere. The EM countries received disproportionately large foreign capital flows due to attractive local currency returns. With US interest rates moving upwards, these capital flows have started its reversed journey.

The prevailing commodity price movement are not favourable for emerging countries like Sri Lanka, dependent on many imported commodities. Prevailing higher prices of some essential commodity imports such as oil increase import bills while prevailing low prices for agriculture exports (Tea, Rubber) generate lower export income. The disparity of import expenditure and export income widen the trade gap

Debt bunching 2019-2023

The Sri Lankan Government needs to refinance historically highest amount of public debt in the year 2019. Total debt service payments in 2019 is in excess of $ 4,500 m according to 2016 estimates published by Department of External Resources (ERD). This figure should be higher due to new short term debt (i.e. SLDB) and the amortisation of capital in the debt, obtained in subsequent years (i.e. 3-year Syndicated Term Loan Facility in 2016 and 2017).

Rollover of external debt under tough external environment will be challenging. Secondary market yield of the euro bonds issued by the Government of Sri Lanka (known as International Sovereign Bonds or ISB) has shown dramatic increase since the assumption of the new Government. While assuming this may not be an indication of long-term trend in the interest rates, the Government needs to formulate strategy to tackle the issue of meeting the impeding debt maturities with reasonably good rates.

Keynesian growth model

The growth model of the previous Government led by the current PM appears to be inward-looking and heavily relied on Government spending on infrastructure developments. The infrastructure was largely financed through Government debt. While the socioeconomic benefits of such infrastructure projects were debated, the resultant construction boom was a major contributing factor to higher economic growth during 2010-2014.

The Keynesian economic model relies on government spending to spar growth engine when an economy is in a contractionary phase. However, the country is already in heavy deficit spending. Moreover, the agreement with the IMF specify certain limit for deficit spending. Unless the new government decided to exit from the IMF agreement though highly unlikely, the space for manoeuvring the deficit spending is limited. But, there are multitude of financing options available in the hands of new government to expedite spending on infrastructure. One such avenue is Public Private Partnership (PPP) in building large projects.

There is a pipeline of large infrastructure projects in the irrigation sector (i.e. Maduruoya Right Bank, Lower Malwathuoya, Thalpitigala Reservoir), roads and highways (i.e. Elevated Expressway from New Kelani Bridge to Athurigiriya, Ruwanpura Expressway and few sections of Central Expressway), power and energy sector (wind, solar and LNG projects).

Loan negotiation have been finalised for some projects, however construction has been delayed due to limitation of borrowings. While understanding that the country needs to repay huge amount of debt during next few years, further spending on large infrastructure by the Government may be difficult. If the Government faces such difficulty, the alternative is to use a expedite route for clearing large infrastructure projects offered on PPP basis.

Structural issues in the economy

Our growth strategy in the past was based on non-tradable sectors. The issue of such growth strategy is that higher income generated by the growth increase demand for imported goods and the export income is insufficient to meet the import demand. There is an urgent need to shift focus of the government from non-tradable sectors to tradable sectors. The government need to attract Foreign Direct Investments (FDI) into manufacturing industries. Our FDI record is comparatively very poor. Similar rated countries receive considerably higher FDI flows.

Without further delay, the Government should focus on developing investor friendly economic policy framework and devise measures to attract FDI into export industries. It is also desirable to consider facilitating Chinese backed Hambantota Economic Zone, which can act as a catalyst to attract FDI into export-oriented industries.

Need to think in broader sense about national assets

The new Government is believed to be anti-privatisation. The immediate alternative is to apply private sector style performance based management culture within the State-Owned Enterprises (SOEs) in order to improve the management and increase the productivity. In creating the assets which are beneficial to society at large, the ownership really doesn’t matter as long as the benefits of those assets are shared among the wider society. It requires to think in broader sense in developing public assets with effective partnership with private sector in order to overcome fiscal limitation and meet the public aspiration earliest possible time.

Big Government and possibility of a pension crisis

The headcount of the current Government sector employees is around 1.5 million. The productivity in the public sector is a serious issue and there is immediate need to increase the productivity. It appears that the government spends large amount in staff training and development, however that along is not sufficient. A culture shift and serious attitude change among the public sector employees are required. Understanding the PM and the new Government is strongly believe strengthening the public sector, an incremental focus is required reaping productivity gains from the public spending.

There was a ballooning in public sector employment during 2005-2010. Those employees will start retiring by 2030-2035. The payment of Defined Benefit Pension (DBP) will be challenging unless we start thinking of how to meet those future pension liabilities. The world history is full of examples of pension crisis. A government that believes in a large public sector needs to devise a strategy in meeting future unfunded pension liabilities.

Softening real estate market

There are indication of softening real estate market; especially in the high-end market. The sales of apartment sector and high-end housing appear to be slowing due to diminishing demand, caused by unaffordably higher prices and lack of debt finance.

Analyst believe the real estate sector will be heading towards a soft landing, however the danger of hard landing and subsequent impact of such adjustment on the overall economy should not be neglected. The Government needs to recognise the threat of softening real estate market, its interdependencies with the other assets in the economy and find appropriate policy solutions to quickly rectify the issues.

Labour market reforms

Our population is rapidly ageing and new addition to the labour force is slowing. There is a shortage of labour in the manual and unskilled category. Small and Medium Industries (SMEs) find it difficult to hire unskilled. As a result, the cost of such industries are comparatively higher and tends to marginalise in the competition.

The Government needs to think of inward labour migration and developing skills of female labour force as means to address the issue of labour shortage and higher labour cost. In addition, there is a need to control overall cost of living to suppress the increasing demand for higher wages. An appropriate policy framework and broader labour market reforms are required to address the issue of possible future labour shortage.

Policy inconsistency

Sri Lanka is engulfed with a plethora of policy inconsistencies. The negative but consistent policy is comparatively beneficial than inconsistent policy. One such example of inconsistent policy is property ownership of foreign investors. The policy with regards to foreign ownership of real estate properties has been on roller-coaster ride in recent years – allowing, disallowing, partially allowing and allowing with 100% taxes. Uncertainty is harmful in an economic sense. Even with such inconsistent policies, the country has received decent foreign investment into the property sector. The Government needs to carefully select a progressive and consistent policy choice for many such areas in the economy.

The new Government led by the former President as the new PM formed during the last weekend will confront a series of tough economic challenges. The effectiveness of the new Government will be tested based their response to find long-lasting solutions to such important socioeconomic issues as discussed above.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)