Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 1 December 2021 00:00 - - {{hitsCtrl.values.hits}}

A Lannister always pays his debts. Everybody knows. When Tyrion became a captive of Lysa Arryn's fortress home in the Eyrie, he made a deal with a guard to get a message passed to Lysa. As a result, he got his trial by combat. Bronn volunteered as Tyrion's champion, and won. Tyrion honoured the deal and paid his debts to the guard. Such prudent practices have made House of Lannister the best financially managed among all Seven Kingdoms.

House of Baratheon, on the other hand, was in deep ‘Chinese organic fertiliser’. While Robert Baratheon was a great fighter and military leader he wasn’t a good financial administrator. His fiscal profligacy was a huge burden for the crown and as he spent colossal sums of money on trivial events to keep his people happy. This made Robert popular but when he died after being attacked by a wild boar his widow Cersei was burdened with the debt: three million Gold Dragons to the Lannisters; one million to the Iron Bank, 0.5 million to the Tyrells and even one million to the Faith. (Exchange rate: 1 Gold Dragon = £ 500) Not very different from Venezuela in 2020. And ideal moment to revisit the debts. Perhaps leading to debt restructuring.

‘Debt restructuring’ is typically a term used by multilateral funding agencies. It means, against ‘debt repayment’, introducing structural changes to the debt profile before being settled. It is not the only option out when a country is as troubled as House of Baratheon. Once the decision is taken to introduce a solution, there are multiple ways to do it: restructuring (with IMF), repayment (without IMF) or a mix. Many have discussed the first option. One objective of this article, inter alia, is to further look at the prospects of doing debt repayment without IMF.

The gravity of a debt crisis

How serious is a debt crisis? Let’s first look this problem from the angle of a corporate entity. When a debt too hefty to be paid according to the initial plan, a firm may face the very end – we call that bankruptcy. In case of a sovereign debt crisis, the equivalent moment is defaulting. This may not mark the end of the nation, but it is far worse than an embarrassing moment. Such a country has to undergo a series of unpleasant repercussions as a result. Sometimes that can lead to the economic fall of an entire region for a significant period.

A century ago, during a more difficult period than even today, John Maynard Keynes advised the world against the risk of the unsustainable debt burden that the victorious powers imposed on Germany in Versailles. His warnings were prescient. The dual crises, First World War and Spanish Flu has devastated the world economy. European countries, both winners and losers of WWI, were saddled with unsustainable war debt. The consequences were delayed by a highly profitable, but perilous, global financial system emerged during the ‘roaring twenties’.

The United States, the largest creditor at the time, pumped money to Germany so that it could repay its war debt to the United Kingdom, France, Belgium, the Netherlands and others. These debtor countries in turn used the German debt payment to pay down their own debt to USA. Somehow, the debt issues were too large to be avoided. The ‘roaring twenties’ came to an end and with world economy plunging into the Great Depression, a decade later.

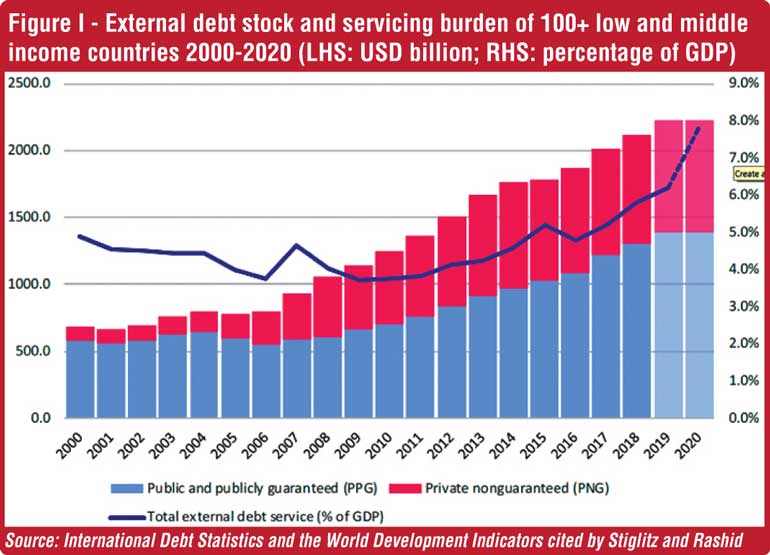

While it is hardly acknowledged, it was Keynesian economic approach that has paved the path to the more robust world we live in today. The world is far burdened with debt now than it was in 1920s. The external debt stock of 100+ low and middle income countries have reached $ 2 trillion by 2020 (that is only slightly less than the GDP of India and on par with that of Brazil) and reached 8% on average on the respective GDPs. (Figure I)

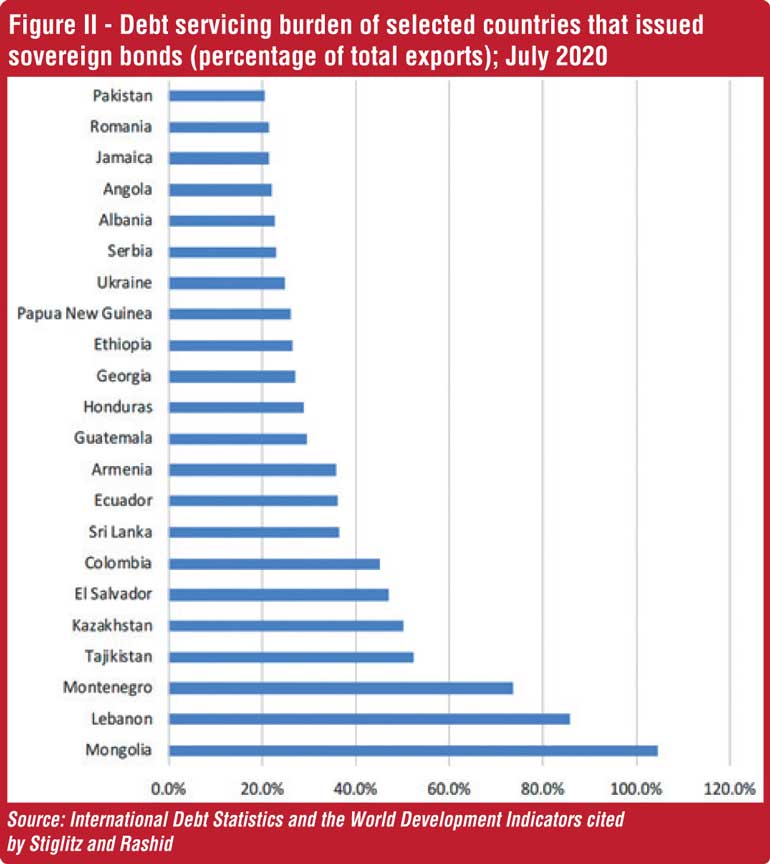

Most alarmingly, sovereign debt owed to private creditors increased nearly three-fold during the past decade, from $ 1.86 trillion in 2008 to $ 5.35 trillion in 2018. Some nations had significant debt servicing costs as a result (Figure II). Needless to add COVID-19 was one of the key reasons that has further deteriorated the situation.

Why and why not IMF

The International Monetary Fund (IMF) was founded to achieve three key objectives: oversee the fixed exchange rate arrangements between countries, thus helping national governments manage their exchange rates and allowing these governments to prioritise economic growth, and to provide short-term capital to aid the balance of payments. This assistance is further meant to prevent the spread of international economic crises.

Prima facie, IMF assistance to any country about to face an economic crisis looks a solution designed at above. IMF offers pro-bono technical advice from its competent economists. It succours the negotiation process with the creditors. It also offers concessionary loans to cover the immediate problems, out of the woes, so everybody could live happily ever after. Cersei Lannister would never have got such a deal from the Iron Bank. It looks good – too good. So why complain?

If the solutions are that easy and that straightforward we would have been living in utopia by now. IMF assistance, though many mainstream economists would not admit it openly, comes with strings attached. They are about money and policies. If that could be just about unpopular policies, it could have been tolerated. The question however, is whether all that short-term policy changes, which might sometimes involve ‘Shock therapy’ will actually help. Will that leads to as one critic out, too much shock and too less therapy?

In his 2002 book, ‘Globalization and Its Discontents,’ Nobel laureate Joseph Stiglitz denounced IMF as a primary culprit in the failed development policies implemented in some of the world’s poorest countries. He further argued that many of the economic reforms the IMF required as conditions for its lending—fiscal austerity, high interest rates, trade liberalisation, privatisation, and open capital markets—have often been counterproductive for target economies and devastating for local populations. Interestingly those who promote solutions with IMF in equation either never see or pretend not to, these aspects.

For a number of critics, the policies and reforms demanded of governments seeking assistance during East-Asian crisis demonstrate the insensitivity and, even worse, the arrogance of IMF and American officials and economists dealing with the crisis, writes Robert Gilpin, in his book ‘The Challenge of Global Capitalism’. These officials, according to critics, made little effort to understand local social and political conditions when they prescribed their economic medicine. For example, forcing Indonesia once to eliminate food subsidies failed to take into account the importance of these subsidies in the lives of tens of millions of ordinary people.

IMF does not necessarily guarantee an easy ride

Most mainstream economists are of the opinion that approaching the IMF is the end of the problem. Hardly. In the first place, there may be instances where IMF assistance might not even be available. An IMF-supported program can facilitate that adjustment, says the organisation’s website, but the IMF can only lend to a member if its debt is sustainable. There are cases where debt is unsustainable, even taking the adjustment efforts into account. If a member country enters into debt distress, only the country’s government can decide whether to solve this by negotiating a debt restructuring with its creditors.

Then, just the presence of IMF will not solve all the issues on the way. Sovereign debt restructuring negotiations, with or without IMF, can introduce complications, say a paper by Lee Buchheit, an international authority on the subject, et al. This is for three fundamental reasons:

One, debtors and some creditors may have their own reasons to stretch the process. Never forget, sovereign debtors are governments reacting to political incentives. Their agendas may not necessarily consistent. A confrontational approach, although it may not help reaching a deal, may sometimes be popular with public.

Two, the information asymmetry between debtor and its creditors. Sovereign debtors know their capacity to repay better than the creditors. They are in a better position to judge how much adjustment and reform is realistic, as a political and economic matter, to service future debt obligations. This creates a problem: Creditors may reasonably assume that governments are trying to lowball them and overcompensate by offering too little debt relief. The opposite too may be possible: Debtors cannot be quite sure how much debt relief creditors are willing to accept.

Three, there are conflicts of interest not just between the debtor and creditors collectively but also among creditors. The ability of the debtor to repay an individual creditor, or a group of creditors, will improve the more other creditors agree to debt relief. Hence, each creditor has an incentive to hold out for full repayment—that is, free ride on the debt relief agreed by others. This is referred to as the “creditor coordination problem,” or alternatively, the “holdout” problem.

Immediate reforms are necessary, with or without IMF

It must be clear now the inclusion or exclusion of IMF in the equation is purely due to political and economic reasons. Neither will result in miracles. Therefore, there is no reason for the subsequent process to change. Only thing whatever the solution that arrived at may not be called a ‘structural adjustment’.

As it cannot emerge from the same setting that created the problem, may be the first task is to change the environment. A substantial depreciation of local currency may address the USD liquidity issues – anyway, there is less reason to hold local currencies to artificially high values. Trade liberalisation nor privatisation per se can harm no economy. One advantage of taking these steps without IMF intervention is that they will be less unpopular.

Another advantage would be the flexibility in the solution. An IMF facilitated debt restructuring could be too strict. Take the recent agreement Pakistan has with IMF following several months of discussion. This agreement would make Pakistan have $ 750 million in IMF special drawing rights, but with a price tag. The government is barred from taking any more loans from State Bank of Pakistan, the country’s Central Bank. This would result in a sharp jump in the current taxes and even introduction of new taxes to maintain state earnings. That would be penalising the Pakistani citizens for nothing they have done.

Perhaps the key advantage of a locally brewed solution is the ability to focus long term. IMF remedies are more short-term ones aimed at getting out of an unfavourable situation at hand. That may not even be a ‘solution’ but postponement of the deadline. While the maturity periods be adjusted that will be at the cost of adding another loan – however concessionary – to the portfolio. It will not only places the same or more burden in debt servicing but also further expands the vulnerability window.

No doubt, a debt restructuring ‘solution’ with IMF support would be a choice, as a last resort. Still, as long as other better and less damaging options available, a government should be given the right to decide. There is no point continuously exerting pressure on a government to seek IMF support for financial issues it could confidently solve itself in the long run.

(The writer is an academic and a policy researcher. The opinions expressed are personal. He can be reached via [email protected])