Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 26 May 2020 00:31 - - {{hitsCtrl.values.hits}}

No one anticipated a global pandemic of this nature as we experience now – Pic by Shehan Gunasekara

By Jayasri Priyalal

There are clarion calls for tightening of belts to cope with the hard economic times unfolding in the post-pandemic era. The global economy and the flows of investment and funds will undoubtedly experience a reverse trend in the days ahead.

The World Economic Outlook report released by IMF recently predicts the most significant global downturn since the Great Depression, forecasting the global economy will contract by 3%. The drop will be particularly sharp in advanced economies, with the US expected to shrink by 5.9% in 2020 and the Euro Area by 7.5%.

A previous research study commissioned by OECD following the 2008 financial crisis warned that if the average global economic growth drops below 2%, it is expected to take over 35 years to record a positive growth in the world measured on the current indicators. The pertinent question remains and demands answers – whether the world should still follow the same patterns of ill-conceived growth and fake prosperities even after the COVID-19 pandemic?

The great ‘Debterioration’ already exploded in 2008, and all the unconventional monetary policy measures introduced by the industrialised economies in the global north managed to stabilise the financial markets in the short run, leaving the burdens in the emerging economies. And many of them are sagging with excessive debt build-ups such as Sri Lanka.

Quantitative easing is a refined terminology used for printing money by the Federal Reserve Bank in the USA and the European Central Bank, which managed to infuse liquidity in the financial markets by accumulating all the toxic assets – including corporate junk bonds – in the banks’ bloated balance sheets.

The culture of negative or near-zero interest rates has now become the new normal without any inflationary trends to ease debt levels. No one anticipated a global pandemic of this nature as we experience now, where the whole world is in lockdown conditions, bringing about a severe economic downturn even before the restoration of the world economy from the 2008 financial and economic meltdown.

Mythical belief in markets for efficient allocation of resources to invent solutions to human problems, enabling many to derive satisfaction, has failed miserably, challenging the prudence of the neo-liberal ideology. Just imagine a situation without government intervention to curb the COVID-19 outbreak from transforming into a pandemic in the hands of the market makers and takers.

It has now proven beyond a reasonable doubt that all economic sectors, including finance and others, operate with the underline principle of ‘aligned incentives’ trickling down from the policymakers’ for-profit engineering for the benefit of few. Capitalism which propelled the industrial revolutions and national revolutions was founded not for mere allocation of resources to exploit highest returns, but to create and innovate new products and services to meet human wants and needs.

Thomas Piketty attributes the reciprocal relationship between the privileged class (educated, high income earning and wealthy segments) teaming up with the politicians for mutual benefits as contributing to the dangerous levels of inequality in all societies across the continents.

During the period between 1990 and 2020, investment capital has exploited all other factor inputs of production to transform into speculative financial wealth, including natural resources such as minerals and fossil fuels.

French economist Thomas Piketty defines this period as the era of ‘Hypercapitalism’ in his latest book, ‘Capital and Ideology’. Blindly following the growth models of the first industrial revolution, we measure all productivity and performance of businesses disregarding the social costs accumulated on destroying natural resources and habitable ecosystems, on top of that unsustainable inequality levels.

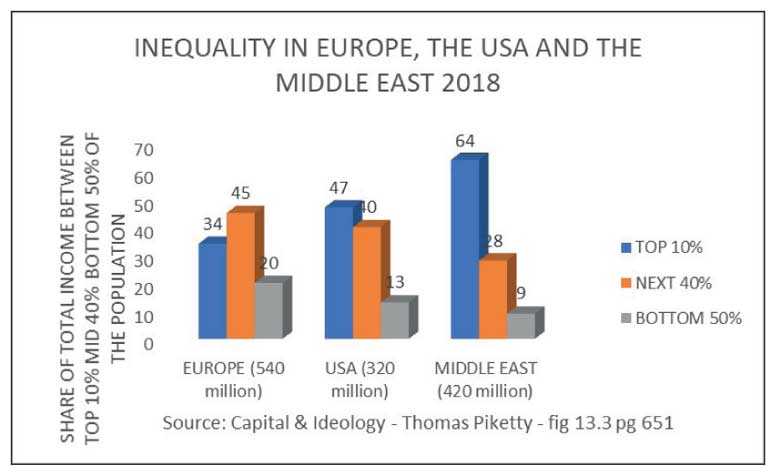

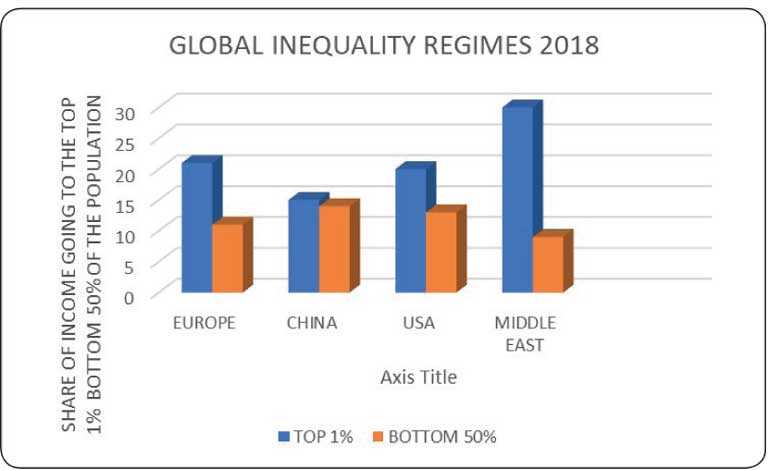

Piketty illustrates this anomaly in the bar chart graph in his book, highlighting the uneven wealth and income distribution in 2018.

Piketty has extensively used computing power to collect and analyse data objectively. The mere availability of information is not useful for practical judgement and decision making. Once the information is classified and presented in objectively analytical data forms, they become intelligence. We are all now marching into an unknown digitalised era. Therefore, it is high time that we move out of the analogue era of information processing and reporting.

Digitalisation of information has immensely assisted Piketty to highlight the causal factors behind the widening of inequality in communities clearly and comparatively for interpretation and motivating policymakers to take corrective action. The two graphs extracted from Piketty's ‘Capital and Ideology’ book apply to demonstrate the unequal distribution of wealth and income across countries and the impending dangers of social unrest.

The Annual Report of the Central Bank of Sri Lanka (CBSL) is the chronicle that many economists use to analyse and interpret the performance and productivity of our economy. Various agencies in Sri Lanka that collect data and statistics must present them objectively so that data serves the public interest. The legendary figures GDP per capita income, growth, or contraction of the economy as a percentage will show a trend in comparative terms but limits the ability to sense the critical symptoms that need urgent attention. Following the COVID-19 pandemic, many developed and advanced economies are now facing the reality of uneven distribution of wealth leading to fake prosperity, the trends very well highlighted in the bar charts. In the USA, it is disheartening to see how upper-middle-income groups having lost their jobs following the COVID-19 lockdown are queuing up in their luxury vehicle to collect food parcels donated by charitable organisations. A classic case study and proof of the statistics given in the graph.

Establishing a digital identity for all Sri Lankans needs to be introduced as a priority. It is encouraging to note that President Gotabaya Rajapaksa has taken steps to set up a task force for this purpose. The outbreak of COVID-19 reemphasised the importance of the public health system as one of the critical social protections in Sri Lanka.

We need to further upgrade this system in line with the digital era. Private and public hospitals and the Department of Registration of Persons must commission a centralised database on an urgent basis to start with to establish digital identities and work backwards to cover the population.

In the case of a newborn from 1 January 2021, we should at least be able to register the birth with a digital identity linked with a central database in public and private hospitals and the Department of Registration of Persons. With a barcode or a QR code, the person’s health conditions can be monitored from a remote operation. When the persons reach maturity, they too can be given a unique mobile communication number tied to the digital identity.

In this digital era, it will not be prudent to maintain controls introduced with analogue models. All machines are now responding to all five human senses, Artificial Intelligence and machine learning capabilities can process data in split seconds with the help of algorithms connected with smart phones and the Internet of Things. Contact tracing during pandemics is automated with fewer health hazards.

Hypercapitalism has thrived between 1990 and 2020 on free trade, zero tariffs and minus or near-zero interest rate regimes. By taking various tax benefits and arbitrages global value chains and corporations became super-rich and push all national governments into debt. The legitimate tax payments that are required to maintain the essential public services and public good such as infrastructure never reached the Government coffers, instead landed in tax havens.

Money laundering is a crime, all systems are in place to regulate anti-money laundering, but it is one of the most lucrative industries, worsening social inequalities. As per UNDP estimates, the hidden financial wealth in the world amounts to $ 300 trillion, which is almost three times the assets of all commercial banks operating in the world. These funds are sitting out of the formal economic activities, and they are a substantial contributor to the unsustainable global inequality.

Absence of fiscal transparency is one area that Piketty attributes to the shaky finances across the regions, and he proposes a creation of a global capital endowment fund to jumpstart ailing economies.

To unearth all the financial wealth and assets now being held in various offshore financial centres known as tax havens will be a mammoth task. Many of them are high net worth and well connected to political power centres. The progressive forces need to find essential resources to stimulate growth and bring livelihoods back in communities to drive the organic growth that is sustainable, not extracting the natural resources and destroying biodiversity and habitable ecosystems.

So, rains from tax havens need to germinate seeds of organic growth to show green shoots of sustainable recovery. For this to become a reality, the hydro-carbon empires should ready to phase out, putting an end to the environmental damage pushing the tolerable boundaries of Mother Nature. The inequality levels highlighted in the bar charts from the Middle East areas sounds the alarm bells.

Fresh air and freshwater have emerged as the most precious resources for all living beings following the COVID-19 pandemic. All other financial assets, the market capitalisation of corporations and accumulated profits have no value at times of battles between life and death. Therefore, destroying social values, biodiversity, ecosystems, and exploiting natural resources for the sake of accumulating economic value as profits is a futile exercise at the expense of the planet and people.