Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 1 September 2021 00:05 - - {{hitsCtrl.values.hits}}

In a relentless push towards modernisation, and staying open throughout various lockdowns, the Colombo Stock Exchange (CSE) has experienced some remarkable changes over the last 18 months. Investing by domestic individuals has more than doubled, to 56% as of 2021 YTD (Year To Date), compared to its former level of 22% in 2018.

In a relentless push towards modernisation, and staying open throughout various lockdowns, the Colombo Stock Exchange (CSE) has experienced some remarkable changes over the last 18 months. Investing by domestic individuals has more than doubled, to 56% as of 2021 YTD (Year To Date), compared to its former level of 22% in 2018.

It is noteworthy that the CSE has helped companies raise Rs. 77 billion so far in 2021, which is due in no small part to a whole new generation of retail investors having emerged recently. Currently, these retail investors now account for approximately 55% of all trading on the CSE. In addition, 80% of new accounts opened at the CSE have been done online, which is likely the result of young and tech-savvy investors starting to invest in the CSE.

These new investors are now likely to drive investment in technology companies on the CSE similar to the trends that have been witnessed in other markets. Investors tend to invest in companies and industries that they understand. Sri Lanka has a technology pool of over 100,000 professionals building world class products and generating over $ 1.2 billion in export revenues that can help fuel investment in technology companies on the CSE.

This will be an exciting development to see on the CSE, which has been largely dominated by more traditional industries and investors in the past.

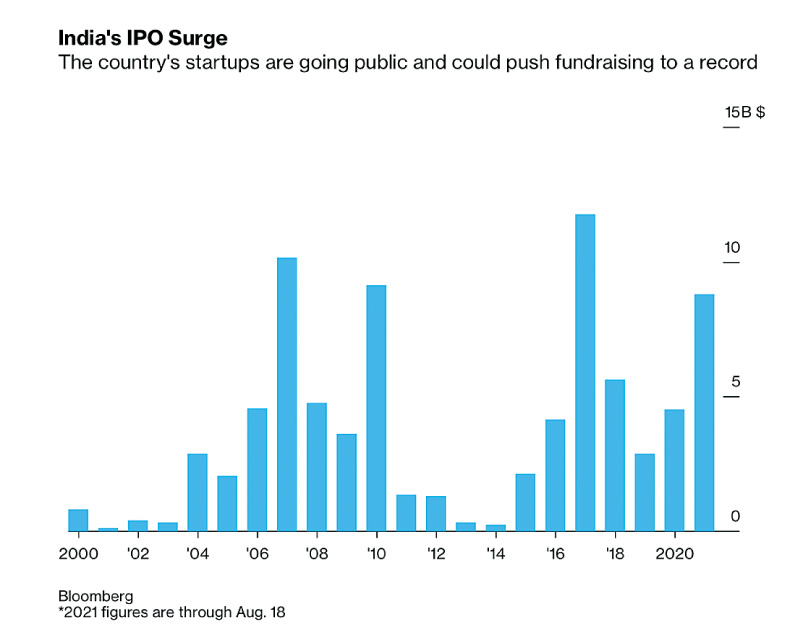

With the evolving local start up ecosystem over the last 10 years, many startups have grown into mature companies, and are now ready to expand globally. With countries like India currently in the midst of an IPO boom and with 20 tech startups doing IPOs in 2021, Sri Lanka’s startup sector will also undoubtedly become a key area of interest for these new investors in the CSE. This will in turn also help local startups accelerate the pace of their innovation and growth in the future, while creating exciting wealth creation opportunities for the next generation of investors and entrepreneurs in Sri Lanka.

(The writer is Co-Founder of BOV Capital.)