Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 27 July 2020 00:00 - - {{hitsCtrl.values.hits}}

The COVID-19 pandemic has revealed a great deal of vulnerabilities in our world and our way of life that we never imagined we had. But in this time, technology has revealed itself to be an invaluable tool to help us to continue to meet our basic needs even as we stay home and socially distanced. Whether it is e-education for our kids, tools to help us work from home, or services that allow us to get the products that we need to survive, our reliance on technology has deepened during the pandemic, and it has accelerated the technology takeover.

The four stages of pandemic behaviour

The patterns of altered behaviour brought about by the virus can be divided into four stages. The Danger Zone is the period when the country goes into lockdown to try to contain the virus and flatten the curve. What follows this is the New Normal: the period in which countries try to open up a little again while continuing to keep schools closed, work from home and maintain social distancing. After that, we have the period when we adapt to the virus, we start to go back to more normal lives because we have developed a deeper understanding of how to live with the virus. Finally, after a vaccine is discovered, scaled and distributed, our behaviour can return to how it was before the virus.

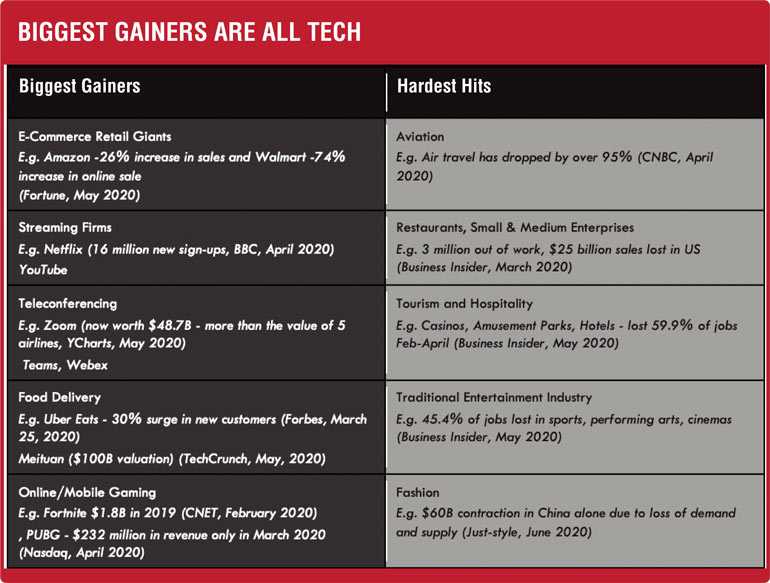

We have seen different companies react to this period differently, and we can predict certain trends going forward (Diagram 1). These companies can broadly be divided into four groups:

1. The first are those completely unable to operate in the danger zone, such as companies in the travel, hospitality and ride sharing industries. These companies have suffered during the pandemic predominantly because the industries that they operate rely on direct services to people.

2. The second group are companies with low long-term stickiness. Companies that prop themselves up during the pandemic by creating a simple business that can address the needs created by the pandemic. They take advantage of the space left open by large companies that struggle to react to the crisis rapidly or effectively. Ultimately, these companies are unable to hold onto all the market share given due to a customer experience that is lacking. Larger players also catch up as the pandemic eases. Companies like small grocers making home deliveries, WhatsApp-run businesses, etc. fall into this category.

3. Then, there are businesses with high stickiness. These businesses see an increased patronage during the lockdown, and only experience a small drop when it ends. Ultimately, the momentum gained through the new customers won during the lockdown may allow them to continue to grow their customer base, even after the lockdown ends. These include video conferencing software like Zoom, online retailers like Walmart or Amazon, and paid online streaming services like Netflix. Companies like this may thrive as they are well positioned to provide good customer digital experiences and only increase market share from pre-COVID-19 situations.

4. The biggest successes of all though are those new outliers whose business is based on changing consumer behaviours. Once behaviour has been changed due to the lockdown, they feel far more comfortable continuing to operate that way post-lockdown. These companies include gaming company PUBG and last-mile delivery companies like China’s Meituan, that have reached a $100 billion valuation during the crisis.

Two Sri Lankan companies that succeeded well in this environment are PickMe Delivery and oDoc. oDoc, a company that provides telemedicine software, saw a 374% increase in new customer registrations during the lockdown period in March growing at 10% per day. They became the official telemedicine provider for the Government of Sri Lanka and released an online COVID-19 symptoms checker. While patients may opt for physical consultations post-pandemic, the adoption of video-based consultations has increased, and some patients – now having experienced both options – may now prefer the convenience of telemedicine.

The digitisation acceleration

The digitisation acceleration

So just how much has digitisation increased? According to Forbes, e-commerce retail orders in the US have increased by 146% while revenue has increased by 68% during this pandemic. Amazon and Walmart have both reached their highest market caps to date at $ 1.23 trillion and $ 376.54 billion respectively. But it isn’t just retail where e-commerce has exploded. If this trend continues, US online grocery sales are set to double by 2021 from $ 14.2 billion to $ 29.7 billion.

With 1.2 billion children outside the classroom, e-learning services have grown too. Google Classroom alone has experienced a 150% increase in its user base, and this is all on top of a pre-pandemic prediction that Forbes made; forecasting that the e-learning market would reach $ 325 billion by 2025.

The digitisation of banking has seen a significant change as well. In many countries, the use of ATMs has dropped by 60% while 63% of customers have been inclined to try out their bank’s mobile application.

The rise of online gaming has been a major trend with the annual revenue generated through online gaming reaching $ 18 billion. Leading games like Fortnite are earning over $ 2 billion annually. Usage is up during the pandemic as the amount of non-virtual entertainment available declines.

The AI and Automation acceleration that we have been witnessing over the last few years has only accelerated during the pandemic. The use of AI to handle unforeseen loads in critical situations has been useful during the pandemic, as chat-bots have dealt with high traffic in the healthcare sector and beyond. The deployment of robotics in supply chain management has also allowed work to proceed with indirect physical involvement from human employees (Diagram 2).

The shorter supply chain

Another change that we have seen in this pandemic situation is the shortening of the supply chain. To get products to struggling consumers faster, companies have focused on simplifying their sales process and causing a merging of the B2B and B2C supply chains. Many businesses in the middle of the chain are brick and mortar establishments that have not been able to remain open in the midst of the pandemic, so manufacturers and suppliers are selling directly to consumers online. For example, Chinese cosmetics company Lin Qingxuan closed 40% of their retail outlets and converted their in-store sales staff to online influencers.

Changes to how businesses run

In addition to these industry level changes, it is likely that we will see changes to how businesses operate internally. Many companies were afraid to allow their employees to work remotely, fearing drops in productivity and efficiency. However, as the pandemic spread, 88% of employers encouraged their teams to work from home. Companies found that in most cases productivity did not decrease meaningfully, provided the employee had the prerequisite hardware tools at their disposal and the company had the necessary cloud architecture.

Remote work has increased so much that business apps which facilitate it reached 62 million downloads from 14-21 March, their biggest week ever. Video calls over Microsoft Teams have increased by 1000% and Zoom has reached a market capitalisation of $48.78 Billion as usage went up by 3000%.

This has increased the belief in the effectiveness of working remotely. Now, remote work can mean something as simple as employees commuting less to the office, but it can have deeper consequences too. Many startups and small companies may forgo the need to have physical premises, relying on co-working spaces that can be rented out by the hour for days when they need to have meetings, and having their teams work remotely the rest of the time. Remote work can also mean that the hiring pools of companies have suddenly become global, as the geography in which your team members are located ceases to be a major consideration.

Along with this comes greater investment in cloud architecture. The use of cloud platforms to allow team members to work collaboratively regardless of where they are has proven its worth in the pandemic, and the lessons learned will continue to be valuable in a post-pandemic world.

The strategic role of the CTO/CIO

The role of the CTO/CIO has been traditionally seen as a support role, serving the needs of the core business. But as companies deepen the use of technology to meet customer needs, the role of the head of technology in companies will gain greater importance. CTOs and CIOs have been key players in responding to this crisis, leading the teams that have allowed business to continue to operate where possible, and creating new digital possibilities for doing business where necessary.

As more of the workforce becomes remote and the reliance on cloud infrastructure deepens, more of the workload will be handled online, increasing security concerns that this data could be hacked. It will be the responsibility of the CTO/CIOs to both spearhead this cloud transformation and ensure that it happens safely.

CTOs/CIOs will also have to play a leading role in guiding the way their organisations face future trends. The emphasis on analysing data from within the organisation and data on how the organisation interacts with its external stakeholders will become a core focus of decision making in the future and tech innovation will drive how this data is collected and utilised. Likewise, the tech takeover will drive the major trends of the near future in most, if not all industries; and having a visionary CTO/CIO is vital to understanding these trends and gaining a competitive advantage.

Tech and the customer experience

Now although it is easy to misinterpret this as a phenomenon brought about by the pandemic, a closer analysis reveals that it is simply an acceleration of a trend that we were already witnessing: the increased use of tech to meet customer needs.

In truth it isn’t a question of tech vs. non-tech, but a question of how technology can empower a company to provide a superior customer experience. In truth, Uber didn’t kill the taxi business through technical wizardry, it simply increased access to cabs, provided customers with greater transparency over their fares, and a more convenient way to make bookings. Likewise, Airbnb didn’t disrupt the hospitality industry through rocket science, it simply used technology to increase the availability of accommodation and offer a greater array of pricing options.

Although we may perceive the trend as a ‘tech-takeover’, it is really a ‘customer-experience’ takeover driven by technology. The shifts in cash, and the changes in customer behaviour caused by the COVID-19 crisis are simply accelerating this trend. At the end of the day, the customer is still key and as a business, being able to adapt to changing behaviour patterns of the customer will define the success of the company.

“Software is eating the world” – Marc Andreessen

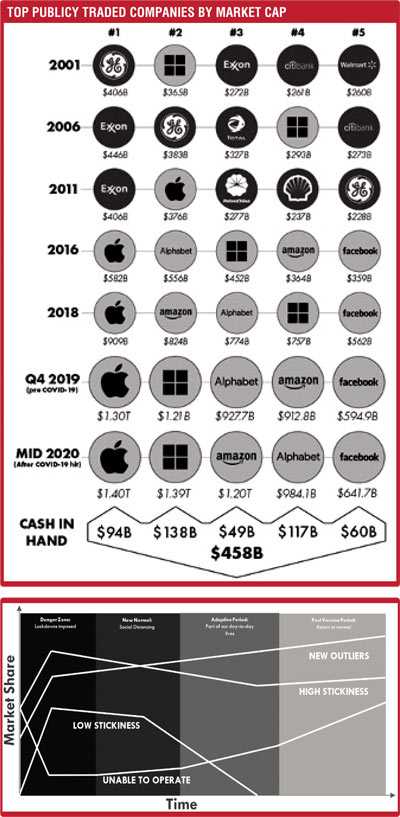

As the quote from one of the founding members of Andreessen Horowitz, one of the most renowned venture capital firms in the Silicon Valley suggests, business models are changing and being disrupted by tech companies. More and more, engineers are heading companies that become industry leaders, tech companies are growing exponentially, and traditional companies are deepening the use of technology in how they serve their customers (Diagram 3).

As the table shows, the five largest companies in the world by market cap are all tech companies: Apple ($ 1.4 trillion), Microsoft ($ 1.39 trillion), Amazon ($ 1.2 trillion), Alphabet ($ 984 billion), and Facebook ($ 642 billion). These companies have continued to earn revenue during the pandemic while other companies have struggled to survive. Today, they have a combined cash reserve of $ 458 billion; so, a likely trend is the acquisition of struggling non-tech businesses by these tech companies who will then work on transforming them into businesses that harness tech to meet their customers’ needs. “Software is eating the world” just got accelerated.

(The writer is the co-founder of Sysco LABS, the innovation arm of the global food supplier Sysco (NYSE: SYY). Prior to this, he was a founding member of Virtusa and overall lead for its global delivery organisation. He is also a keen advocate and change agent for the Sri Lankan IT industry to diversify talent and expertise to focus on product innovation and engineering.)