Thursday Feb 19, 2026

Thursday Feb 19, 2026

Saturday, 28 March 2020 00:15 - - {{hitsCtrl.values.hits}}

Army Commander Lieutenant General Shavendra Silva heads the National Operation Centre for Prevention of COVID-19 Outbreak

In 2004 when I was heading the Sri Lanka Export Development Board (EDB), just two days into my appointment, the most devastating natural disaster struck Sri Lanka – the 2004 tsunami where the country lost 40,000 people. However, Sri Lanka recovered to end the next year at $ 6 billion in export proceeds.

In 2004 when I was heading the Sri Lanka Export Development Board (EDB), just two days into my appointment, the most devastating natural disaster struck Sri Lanka – the 2004 tsunami where the country lost 40,000 people. However, Sri Lanka recovered to end the next year at $ 6 billion in export proceeds.

Then in 2008, when the US property bubble burst and most economies were crashing (incidentally, I was heading the Economic Council – NCED under the Chairmanship of Dr. P.B. Jayasundera), we once again saw Sri Lanka recover to end the year at a 6.5% GDP growth that sure surprised the world.

The point that I am highlighting is that the Sri Lanka as a nation has a tendency to bounce back due to its strong resilience tendency. I am very sure that on the COVID-19 virus too, Sri Lanka will fight the system and recover. The only issue is that on COVID-19, Sri Lanka is up against an invisible enemy which will require a totally new skill set. I guess the next 14 days will reveal the reality.

Evaluating Sri Lanka

Whilst we can be rhetorical and say that Sri Lanka is resilient, WHO states that on COVID-19 a country will be tested on the areas of skill of governance, experience of the healthcare sector and richness in human capital.

Based on the performance so far, Sri Lanka has done well on the first 100 COVID-19 patients. There are zero deaths – even though three patients are in critical condition and the overall number is at 106 cases with 22,000 suspicious cases. The next two weeks will reveal the destiny of Sri Lanka from a health perspective. Given that the economy at a total lockdown, chances are that Sri Lanka might see Q2 hitting a recession.

SL: Next 14 days?

The logic that the next 14 days are critical for Sri Lanka is based on the insight that has stemmed from the data mining that has been done in the countries such as China, South Korea, Italy, Spain and United States.

The research reveals that when a country crosses the 100 mark on COVID-19, the diffusion of cases to reach 1,000 patients takes five to seven days. This calculation can vary on the culture of the country and density of the population, however the data is as follows; China took four days to cross the 1,000 mark after reaching 100, Italy six days, Iran five days, Spain seven days, South Korea six days, Germany and US eight days.

Sri Lanka, which crossed 100 cases on 24 March is now at tipping point. The GMOA highlights that the based on the maths of ‘source’ of the identified cases there are around 500 ‘infected patients’ which will hit the numbers in the next two weeks. I guess we will have to see if this hypothesis becomes a reality by 7 April.

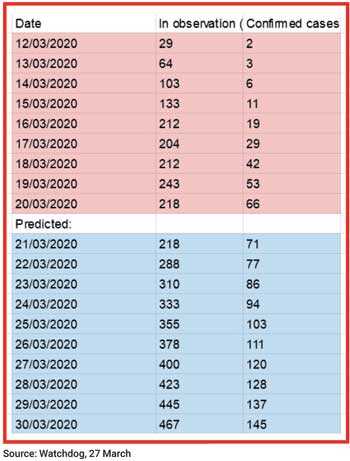

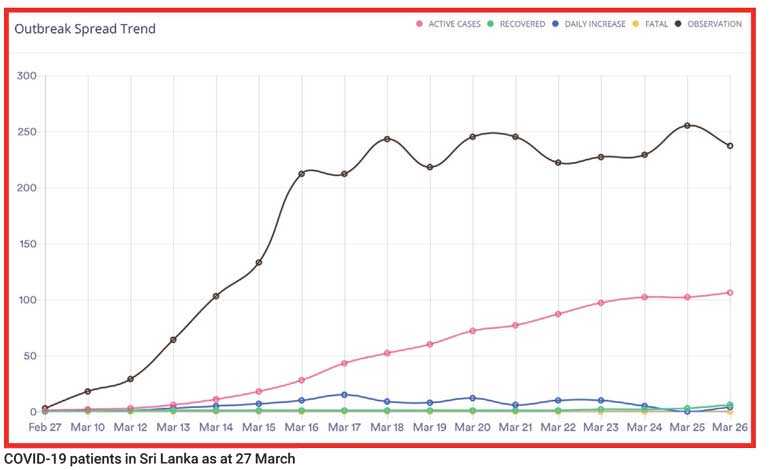

A predictive analysis that I found very interesting taken from ‘WatchDog’ as at 25 March is reasonably accurate, which is interesting. Post that we see a drastic behaviour change that is ‘flattening the curve,’ which is good news for Sri Lanka but it is too early to comment given the insight by GMOA which says that there might be as many as 50,000 infected people in Sri Lanka. Let’s see how things pan out.

Case study: Singapore

One of the best case studies where a government was able to keep the curve flat was Singapore. A deep dive reveals that Singapore was aggressive in the combat of the virus and continues to be so today. By the way it was one of the first countries to impose restrictions on anyone with a travel history to China and parts of South Korea. The country adopted a strict hospital and home quarantine regimen for potentially infected patients and had extensively traced anyone they may have been in contact with.

One of the best case studies where a government was able to keep the curve flat was Singapore. A deep dive reveals that Singapore was aggressive in the combat of the virus and continues to be so today. By the way it was one of the first countries to impose restrictions on anyone with a travel history to China and parts of South Korea. The country adopted a strict hospital and home quarantine regimen for potentially infected patients and had extensively traced anyone they may have been in contact with.

The country started a text and mobile web-based software solution which made it a case study globally for good management of the COVID-19 epidemic. Sri Lanka is using some of the ‘best practices’ but I guess the Sri Lankan ground conditions are different and require different strategies.

Impact to tourism – Globally

The key sector that normally gets affected on any issue globally, be it an earthquake, floods, terror attack or a deadly virus attack, is tourism. The Oxford study estimates that the hotel industry supports one in 25 American jobs, totalling 8.3 million jobs, paying more than $97 billion in wages and contributing nearly $ 660 billion to US GDP annually. In addition to major hotel brands those affected in the hotel industry include 33,000 small businesses, which represent 61% of hotel properties in the US.

I guess the last week reported number of 3.2 million application as ‘jobless’ is just the tip of the iceberg given the $ 2 trillion stimulus that President Trump announced. The Economist has already predicted that the US economy will be in recession in Q2, 2020, which means that the $ 5 billion Sri Lankan apparel export revenue will be challenged.

Impact to tourism – China

If we analyse, the first country that fell off the cliff due to COVID-19 was China. The tourism industry occupancy from January to February dropped 40 percentage points. It wasn’t until 23 January that Wuhan went into a lockdown mode. Wuhan was ground zero and in January, TRevPAR dropped 29.4% YOY, which led to an overall 63.8% YOY decrease in GOPPAR.

Meanwhile, labour costs as a percentage of total revenue climbed 0.2 percentage points. In February, when the virus’s shadow loomed larger, TRevPAR decreased 50.7% YOY. The lack of revenue came against a backdrop of cost savings, a plausible outcome of hotel closings.

Hilton was the first off the blocks closing of 150 hotels in China, including four hotels in Wuhan. Labor costs were down 41.1% YOY, but still gained as a percentage of total revenue, because of the vast revenue drop. GOPPAR dropped 149.5% YOY in the month.

The whole of mainland China suffered drastically in February, with occupancy falling to single digits. RevPAR decreased 89.4% YOY, which is in line with major global chains—Marriott said RevPAR at its hotels in greater China plunged almost 90% compared with the same period last year. TRevPAR in February dropped nearly 90% to $10.41 on a per-available-room basis.

The minimal revenue resulted in labour costs as a percentage of total revenue jumping 221 percentage points, despite a more than 30% decrease on a per-available-room basis. GOPPAR in the month was negative at -$27.73 on a PAR basis, a 216.4% drop from the same time a year ago.

Now the world is watching to understand the impact the tourism industry had on the total economy of China due to COVID-19. With this data we might be able to compute the impact on the Sri Lankan tourism sector.

Global impact?

The interruptions to economic activity seen in China – and now in Italy – are on a scale and speed rarely seen other than during periods of military conflict, natural disasters or financial crises. While there is huge uncertainty, quarterly declines in GDP of 3% to 5% may be a reality. The risk is that we shortly see these abrupt interruptions happening simultaneously across all major economies as the global pandemic spreads.

The baseline global economic forecasts have been aggressively lowered by global economic experts. Even though the recovery of China might happen from 2Q20, Chinese growth is expected to fall just 3.7% for the year as a whole, down from 6.1% in 2019. Italian GDP is estimated to fall by 2% this year and Spanish GDP by almost 1%.

The calculation revealed that the Eurozone growth to be minus 0.4% this year. The baseline forecast for US growth is 1% in 2020 compared with a pre-virus outlook of 2% and GDP is expected to fall by 0.5% (or 2% annualised) in Q2, 2020. Sri Lanka will sure to experience a negative growth in Q2, 2020. This reflects the likelihood that travel, tourism, and business will continue to be disrupted for months. The collapse in the equity market with lower business numbers and consumer confidence can lead to and other disruptions to US economic activity that are emerging as authorities seek to contain the virus.

Summary

Whilst Sri Lanka enters the decisive 14 days, the current outlook globally is that growth will fall to 1.3% in 2020 from 2.7% in 2019, which would be weaker than global downturns in the early 1990s and in 2001. The million dollar question is, what to expect for Sri Lanka? Maybe by mid-April a realistic forecast can be made.

[Dr. Athukorala is the CEO of a South Asian Artificial Intelligence (AI) company based in Sri Lanka. The thoughts are strictly his personal views.]