Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 22 November 2021 00:00 - - {{hitsCtrl.values.hits}}

|

|

Finance Minister Basil Rajapaksa |

|

|

CB Governor Ajith Nivard Cabraal

|

A budget with roses and brickbats

Minister Basil Rajapaksa, called Basil to distinguish from other Rajapaksas in the Government, unveiled his maiden Budget – that was for 2022 – on 12 November. Much has been said about this Budget by his supporters as well as critics so far. Supporters have seen only the virtues of the Budget, while critics have not seen any merit in it.

As usual, chambers have praised the Budget as a development-oriented one, despite the fact that it has increased consumption and not investment in its expenditure program. There is one point which both hailers and wailers have missed. That is how effectively the Budget has addressed the main burning issue faced by the country today. That is the missing link in the Budget.

Sri Lankans licking a honeycomb ignoring multiple death threats

To drive this burning issue to our heads, Basil had used an apt parable when he presented the Tax Amnesty Bill and the Securities and Exchange Commission Bill in Parliament a month ago. Drawing from a poem from a leading textbook on Buddhism, he said that Sri Lankans today could be compared to the man who is licking a honeycomb oblivious to three types of death threats waiting for him in the immediate vicinity.

At that time, the three death threats were depleting foreign exchange reserves, mounting foreign debt servicing problem, and pressure for the rupee to depreciate in the market. After one month, the list has been added to by three more new death threats. They are the possibility of facing a severe food shortage due to low production, inability to import essential medicines, fuel, and foods due to lack of foreign exchange, and the Government’s gradual movement toward bankruptcy. A government becomes bankrupt when it cannot finance its expenditure programs through normal tax channels and is forced to print money in excessive amounts to fill the gap.

All these, except the last one, relate to the fragile external sector of the country. The last one is the handiwork of the Government by offering an attractive income tax and value added tax concession that resulted in a drop of revenue by a minimum of Rs. 500 billion in both 2020 and 2021.

An untenable tax concession: Sow a wind and reap a whirlwind

An untenable tax concession: Sow a wind and reap a whirlwind

When this proposal was made, I warned the Government in December 2019 that it should not be implemented because of the obvious dent in revenue in an article in this series (available at: https://www.ft.lk/columns/Tax-cuts-Control-the-damage-before-the-unconventional-stimulus-backfires/4-691207). It had been hailed by the Government’s policymaking leaders as a stimulus package to accelerate economic growth via what is known as ‘supply side economics’.

Disagreeing with them, I argued that it would not work because of the structural issues present in the economy. I, therefore, concluded the article with the following warning: “With the new Revenue Administration Management Information System or RAMIS and the arrangement to pay taxes through LankaPay operated by LankaClear, it is not a serious issue for IRD to upgrade its systems and handle more tax files with the available human resource base. But it takes time and unless it is handled carefully, the stimulus package will backfire causing a large gap in the budgetary financing. Avoiding this pitfall should be the topmost priority of the Gotabaya Rajapaksa administration.”

This warning went unheeded and the Government implemented the proposal in toto. A wind was sown with no concern for the outcome, but now when things have gone wrong, Basil has been asked to reap a whirlwind.

The sick economy

Sri Lanka’s economy had been ailing for some time, but now the ailment has become severe, turning to a terminal illness. Basil has taken over the finance portfolio in this background. The entire country expects him to do the impossible. He is required to cure this terminally-ill person through an effective system of medication. However, the Budget he has presented has fallen short of this requirement on many counts.

A parable of parents with a sick child refusing to seek medical expertise

This can be illustrated through a parable, as Basil has done previously. Suppose there is a sick child at home, with a terminal illness like a cancer. Instead of taking the child to a qualified physician, the parents think that they know better and decide to treat him at home with some homegrown course of treatment.

This homegrown treatment is made up of various pseudo cult practices like borrowing native medicines from good intentioned friends temporarily. They also shower the child with all kinds of toys which they have bought by borrowing from neighbours and friends domiciled in other countries. They sincerely believe that it will make the child happy helping him to recover fast.

Relatives come to see the child and glorify the parents for the bold stand taken to treat the sick child through homegrown remedies. They admire the toys which the parents have bought out of borrowed money, without thinking how the parents will repay that debt. When some knowledgeable people advise them to take the child to a hospital, they are dismissed with a wave of the hand, reiterating that they know better.

In the meantime, the homegrown remedies fail to cure the child and his condition begins to deteriorate beyond recovery. At that time, it is too late to take him to a hospital and the child dies.

Missing link to Budget 2022

This is the background to the Budget 2022

The missing link in the Budget is the expressed silence about the sickness of the economy. It has come up with expenditure proposals without a sufficient revenue base. There are some onetime revenue proposals made, but such temporary measures will not help the Government to continue the promised expenditure programs. Hence, if the economy dies due to the acute illness, all hopes of ushering prosperity and splendour will also die. Therefore, Basil cannot be complacent about the present state of the economy and the fiscal outcome of his Budget.

The acutely sick external sector is the main risk factor

The acutely sick external sector is the main risk factor for the Sri Lanka’s economy today. This is not a new development and was known as far back as early 2010s. Because of the domestic economy based economic growth model used by Mahinda Rajapaksa administration, the growth in exports fell far short of the growth in the economy.

Accordingly, the share of exports in GDP began to fall from around 15% in 2010 to 13% in 2015. By 2020, it fell to 12%. At the same time, the import bill began to rise relative to GDP. In 2010, it amounted to 24%. By 2015, it increased to 25%, but fell to about 19% in 2020 due to import restrictions imposed.

Negative net forex position of the Central Bank

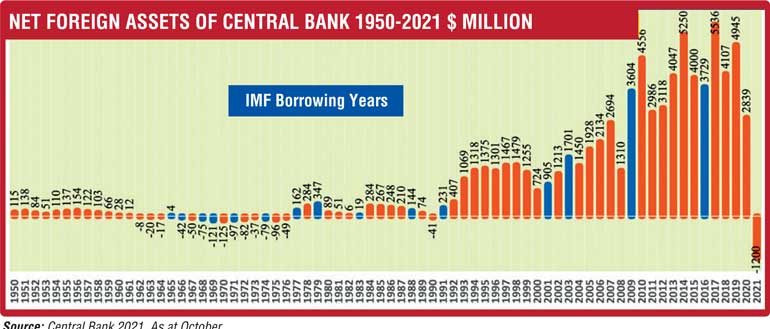

However, since Sri Lanka’s foreign exchange out-payments were higher than inflows, there was a chronic foreign exchange shortage which became acute by mid-2021. From May 2006, the net foreign assets of commercial banks had been negative, but with positive net foreign assets of the Central Bank, the country could still maintain an overall positive net foreign exchange position.

With the decline in the net foreign assets of the Central Bank, this began to change from May 2020 when the overall net foreign asset position of the banking sector became negative. The net foreign assets of the Central Bank fell sharply in the following months due to high out-payments without compensating inflows. As a result, in August 2021, the net foreign assets of the bank became negative by $ 400 million.

The negative position increased to $ 790 million by September, and further to $ 1200 million by October. With the reported decline of the gross assets of the Central Bank to $ 1.6 billion, the negative net asset position is deemed to have risen to above $ 2 billion now.

Will Thai forex fiasco in 1997 be repeated in Sri Lanka?

There are further foreign exchange commitments of the bank in the next six weeks on account of meeting the forex requirements of oil, medicines, and food imports. Unless the bank can generate a net inflow of foreign exchange amounting to about $ 3 billion during this ensuing period from non-borrowing sources, the negative net position of the Central Bank’s foreign assets will deteriorate further. It is a highly alarming situation because it reduces the bank’s ability to intervene in the market to hold the artificially set exchange rate of Rs. 203 to dollar, make available foreign exchange for debt repayment, and meet the requirements of essential imports like fuel, medicines and foods.

When a central bank reaches the wall with no option available, it has to allow the exchange rate to have a freefall. This was what happened to Thailand in 1997 when it had lost an estimated $ 25 billion in a futile attempt at holding the Baht at 25 to a dollar, triggering the infamous East Asian financial crisis of 1997-’98. With a rising negative foreign asset position, our central bank is also reaching this level fast. These are the new death threats which Sri Lankans are facing today.

The threat of the repeat of maligned control raj of 1960s and 1970s

As the graph shows, the Central Bank’s net foreign assets have become negative today for the first time since 1977. Previously, they were negative from 1962 to 1976. During that period, with the gradual increase in the net negative position, the successive governments were forced to adopt the most stringent controls – import, exchange, price, and travel – to keep the system going. It was like cutting the coat according to the cloth rather than the growing size of the body.

The consequences were catastrophic. Growth fell, while unemployment and poverty soared. This is because when sufficient foreign exchange is not available, industries that depend on imported raw materials cannot continue production, on one hand, and input allocation systems through preferential treatment of selected parties and waitlists for others add extra costs to running businesses, on the other.

During that period, there was a ‘control raj’ in Sri Lanka with sweeping discretionary powers given to Government agencies that implemented the control system. It was also a fertile ground for breeding corrupt practices. Economists call such corrupt practices as ‘rent seeking,’ an income earned not through productive business but due to the shortages in the economy. The proliferation of such rent seeking opportunities in the economy reduces its efficiency removing incentive for undertaking businesses. With the present shortage of foreign exchange in the country, Sri Lanka is undergoing a repeat performance of the control raj of 1960s and 1970s.

A road map dismissing IMF support

This is a crucial issue. Strangely, the Budget 2022 has been silent about it. It seems that Basil has placed full confidence in the goals and strategies of the Six-month Road Map presented by Governor Ajith Nivard Cabraal on 1 October 2021.

In the Road Map, dismissing the suggestions that Sri Lanka should seek IMF support to get out of the current forex crisis, Governor Cabraal reiterated that he has a homegrown solution to the problem, will buy back the International Sovereign Bonds maturing in 2022 and cancel them, and there are sufficient bilateral forex flows lined-up to meet the forex gap. He was confident that Sri Lanka could get over the crisis without IMF.

The mixed track record of Governor Cabraal

A month and a half has now passed since these promises. The country’s forex situation had changed from bad to worse during Governor Lakshman’s era. Governor Cabraal made a valiant attempt at securing the funding which he had promised in the Road Map. Yet, because of the unexpected out-payments from the reserves of the Central Bank to meet urgent import needs, the level of reserves is reported to have fallen to $ 1.6 billion by mid-November. He had also attempted to correct the excessive money printing permitted by his predecessor by following the recommendations of a breakaway group of economists called Modern Monetary Theory.

During the 21-month period from end December 2019 to end September 2021, Lakshman had permitted the money stock to rise by Rs. 2.9 trillion or 38%, when economic growth during this period was just 1%. Governor Cabraal has placed a plug to money growth by allowing the Government securities rates to rise by about 2.5% and avoiding Central Bank’s financing of Treasury bills. But still the Treasury bill market is concentrated in short maturity bills, indicating that investors are not ready to place their money in six-month and 12-month bills at the rates offered by him. Hence, if he is to realise the full benefits out of his new move, he needs to allow the rates to surpass 10% in the case of 12-month Treasury bills.

Will this homegrown policy package work?

Governor Cabraal still believes in his homegrown policy package and refuses to seek IMF support for financing the balance of payments crisis. Perhaps he may be waiting for the exhaustion of all the options available to him to secure a sufficient inflow of foreign exchange to change his stance as he did in 2009.

Bypassing the international sovereign bond market in which Sri Lanka could not issue bonds except at high yields, he has proposed to tap two unconventional commercial funding flows. One is the tapping of the green bond market in which funds could be borrowed for implementing specific environment protection projects. This will take time since projects acceptable to investors cannot be designed overnight.

The other is the proposal to securitise the remittances flows to Sri Lanka. Securitisation is a technique available for an assent holder to convert an illiquid asset to liquid cash. For instance, a lender could borrow immediately by issuing a security against a loan he has granted and is scheduled to mature after a period. But the remittances which he is planning to securitise are already available to him as liquid cash and once they are transferred to an overseas entity called a Special Purpose Vehicle or SPV, he loses the right to use them. What will happen is that he will get money for longer maturity at a cost. Hence, the securitisation of remittances in this case is a technique to convert an already liquid asset to a costly liquid asset. From a prudential point, this is a meaningless exercise.

What this means is that the possibility for Sri Lanka to secure a sufficient quantum of forex to meet its immediate payment commitments is a remote possibility.

Avoidance of the death of the sick economy

Hence, the current policy strategy adopted by Sri Lanka’s policy authorities to come out of the acute forex crisis is like the strategy adopted by the parents with a child suffering from a cancer. Without taking the necessary correct action in time, the parents permitted the child to die. Governor Cabraal can avoid a similar outcome if he advises Basil that there is no other alternative for Sri Lanka at this stage except seeking IMF support.

This is the missing link in the Budget for 2022.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])