Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 22 December 2021 00:00 - - {{hitsCtrl.values.hits}}

The Budget is a mirror effect of the inconsistency, incoherence and confusion prevailing at different levels of the Government

The second Budget of President Gotabaya Rajapaksa’s Government was presented on 12 November by his younger brother Basil Rajapaksa. Cheerleaders and image builders claim the Budget is extraordinarily beneficial and presented by a Minister exceptionally clever. Hence, one has to think twice before commenting on it.

The second Budget of President Gotabaya Rajapaksa’s Government was presented on 12 November by his younger brother Basil Rajapaksa. Cheerleaders and image builders claim the Budget is extraordinarily beneficial and presented by a Minister exceptionally clever. Hence, one has to think twice before commenting on it.

Further, I am hesitant to comment on the Budget for another two reasons. Firstly, preparation of Budget is a time-consuming strenuous task which involves meticulous planning, patience, consultation, compromise and consensus. At the end of a lengthy process, the finance minister presents an appealing, balanced budget. I equate this to preparation and presentation of a bride by bridal dress designer. Budget review is similar to the bridegroom’s impatient merciless speedy job of undressing the bride. I did this merciless job nearly 50 years ago. Secondly, I studied economics more than 50 years ago. I have long forgotten both.

But a budget that expects to grab Rs. 2,284 billion from us as revenue and spend Rs. 3,912 billion for us within 12 months leaving Rs. 1,628 billion as a debt for generations to pay cannot let go unscathed.

Amidst a myriad of internal and external challenges, Gotabaya Rajapaksa marked a historic landslide victory in 2019 with 6.9 million votes. After nine months, in testament to the leadership of Gotabaya Rajapaksa, the party won the 2020 Parliamentary Election with an overwhelming majority. It’s no secret that the Government is at its lowest ebb of popularity within a period as short as two years.

The Finance Minister’s first task was to rebuild the lost image of his elder brother. The budget starts with a preface. It details out the Rajapaksa family tree and parentage of President saying “The Rajapaksas have a history of never being daunted by challenges. D.M. Rajapaksa was known as the ‘the Lion of Ruhuna’. I am not sure whether the Minister achieved his task or wasted his time and ours. Except the ruling class, majority of the 6.9 million people are on a highway protesting on this or the other. His second task was to live up to the image built upon him by his supporters. When he read out the Budget speech, thumping on desks by backbenchers proved that this task was achieved.

Third task was to justify the mistakes committed by the Government rather than boasting of achievements. The failed and ludicrous attempts to convert the agriculture from chemical to organic material within a single season, to control paddy purchasing and rice selling price and drama performed by Essential Service Commissioner together with Director General of Consumer Affairs Authority are only two of them. In all such cases Government failed; public lost; the fun remains.

The Budget identifies issues, strengths and challenges. This is somewhat a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis. It is a difference from many previous budgets and fairly a reasonable assessment, but incomplete. Finance Minister has mixed up between a budget speech and a political statement.

Social and economic disparities, slow progress of achieving sustainable goals, increased environmental catastrophes owing to increased global temperature, limited assistance from bi-lateral and multi-lateral institutions are identified as major issues.

Among a series of strengths, the Minister’s two elder brothers are identified as great strengths. Budget goes on: “Our President embodies simplicity, and is a leader, who is honest, makes firm decisions, and is dedicated… is a great strength to our way forward,” and “Hon. Prime Minister Mahinda Rajapaksa… is a leader who has rendered an extraordinary service to this nation.”

Drug mafia, fraudulent business operations, forces detrimental to the country, common global challenges, rising cost of living, obsolete economic tools and foreign debt burden, State enterprises are mentioned as challenges.

Budget proposes improving business focus and financial discipline of State-Owned Enterprises (SOE). But proposed measures are not effective; not adequate; touching only the surface. BOI, EDB, and SLTDA have pathetically failed in improving investments, exports and tourism. These agencies pay lucrative emoluments and perks to staff; conduct road shows, fairs, conferences and EXPOs in foreign lands at extravagant costs; import content of material and equipment used in construction and in export products is exorbitantly high; drain out more foreign exchange than what they earn. Is there a better option than bidding ‘good bye’ to such while elephants?

Some SOEs are gobbling a good chunk of public funds but suffer from managerial incompetency. They are created and maintained for prestige. Successive governments appointed business tycoons, owners and shareholders as chairpersons of SOEs. They run their own enterprises with record profits; they run SOEs with record losses. The secret is they own business but do not manage; their business is managed by efficient handpicked managers. Evidence is flying high on the sky.

The Budget is correct in “Unproductive high expenditures and weaknesses in expenditure controls have resulted, in often governments not being able to properly engage in expenditure management”. But Budget has increased provisions for ‘unproductive high expenditure’ such as highways and defence and reduced the fuel allocations to MPs by a mocking pittance. The Budget allocates Rs. 280 billion for Colombo Port Access Elevated Expressway, New Kelani Bridge-Athurugiriya Elevated Expressway, Central Expressway, Kurunegala-Dambulla Expressway, Ruwanpura Expressway, Colombo-Moratuwa Marine Drive and Flyovers in the city of Colombo and rural roads and bridges.

This type of infrastructure bears a long gestation period. They will not improve the social and economic standards of majority people. Construction material, equipment, technology and even labour are wholly imported draining limited foreign exchange out. Community participation and benefits will be marginal; maintenance cost is extremely high; invite more highway tragedies; add little or no value; mostly non-paying; hardly promote any economic activity.

The decision to issue quarterly warrants instead of the annual warrant to Government entities is timely and effective. Most Government institutions do not have a disbursement plan aligned to their mandate and objectives. During early part of the year capital expenditure is low and slow. The agencies accelerate spending haphazardly during the latter part to avoid under-expenditure and audit quarries. They make advance payments to other Government entities to demonstrate higher disbursement. Quarterly warrants would keep agencies alert.

The Minister laments over the inefficiency and the overstaffing of the public sector. His solution to ‘inefficient over-burdened’ public sector is “Steps will be taken to offer permanent appointments from January 2022 to over 53,000 graduates who are already recruited to the government service as trainees. It is expected that around Rs. 27,600 million will be necessary for this” and extension of the retirement age of ‘inefficient public servants’ up to 65 years.

New recruitment to public service especially graduates could be terminated. Instead, Government can introduce a lucrative (employer-employee-government) contributory pension scheme for those employed outside the public sector.

This Budget tries to revive the five hubs concept that remained as wishful thinking for over a decade. We talk of knowledge hub but have failed to put our house in order. Instead of becoming a knowledge industry, education has become a money-making industry full of ‘tuition shops’ around. We talk of naval hub. But international shipping lines complain of the presence of hundreds of thousands of small fishing boats crossing international naval route with a faint light interfering and misguiding ship crews at night. Sri Lanka is a best tea-producing country. Dubai situated in the middle of the desert which does not grow a single tea bush but, established the world tea hub while we are dangling with the five-hub concept.

To encourage the usage of non-toxic weedicides and production of organic fertiliser and to introduce new agro-technologies, Budget has allocated a total of Rs. 61,000 million. No implementation mechanism is identified. Budget is silent on how this money would be allocated, for whom for what purpose, how much, how often and beneficiary selection. More questions than an answer.

The scenario unfolded after the President declared that Sri Lanka is the first country in the entire universe to achieve 100% organic farming. Whether the cash trapped Government can afford to bear such a monstrous layout is questionable. The Sri Lankan farmer is already over subsidised and over dependent. More Government assistance would push the farmer further down his current subsistence level. Modernisation and commercialisation of the farming will remain a distant dream.

Budget allocates Rs. 5,000 million to establish new industrial zones with land, electricity, water, access roads both internal and external to accommodate SMEs. In Sri Lanka most of the industrial estates and export promotion zones have ended up with failures and losses due to dislocation, misidentification and mismanagement. The new proposal would add a few more estates to that list. Further, providing mere infrastructure facilities would not address the woes of SMEs.

Budget says that at the time of drafting the ‘Vistas of Prosperity and Splendour’ document people unanimously requested rural schools with teachers of English, Science, Technological Studies and playgrounds, rural hospitals, sanitation facilities, rural roads, safe drinking water, rehabilitation of tanks and canal, electricity, telecommunication, technology, marketing and financing facilities and protection from wild elephants. Unfortunately, the authors of Vistas of Prosperity and Splendour have vanished along with their vision and the majority of 6.9 voters. Problems remain in bigger magnitude.

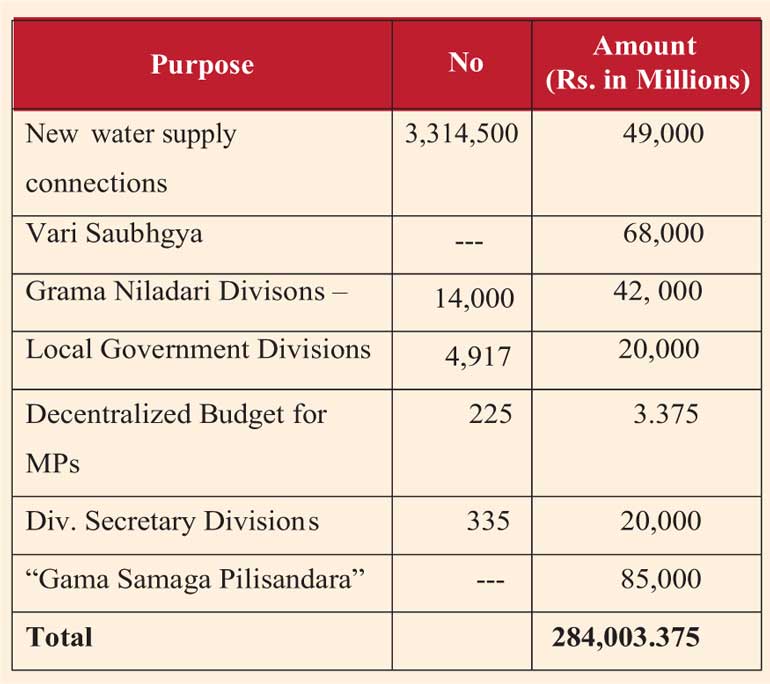

The Budget allocates funds for the rural sector as in the given table.

The Finance Minister explains the objective of allocating such a colossal amount for rural development: “Our foremost objective is to strengthen the rural economy, raise the income level of rural families, liberate them from the subsistence mentality, integrate their economic activities to the mainstream, increase Gross Domestic Product and minimise the income disparity.”

The intention is noble, but not achievable within a span of time as short as three-four years. There are innumerable constraints and bottlenecks in implementation of infrastructure development programs in the rural sector. Capacity issues, unavailability of materials and equipment, lack of technical support, absence of contractors are only a few. Further, the entire responsibility of implementation and coordination of this program will fall upon the Divisional Secretary (DS) who has become jack of all trades. The Finance Minister with all his wisdom has to make available more than 24 hours a day for the poor DS.

The Budget allocates around Rs. 15,000 million to establish a mini supermarket network at the Grama Niladhari Division level while the Trade Minister boasts about opening an additional 1,000 CWE shops. The Government sponsored mini supermarket network will beat CWE in inefficiency and corruption. There is a well working supermarket structure run by the private enterprises in urban/semi urban areas. Government must encourage them to establish mini supermarkets in rural areas.

In brief, the Budget carries a few pluses along with some strategic thoughts and more minuses and wishful thinking arising from the attempt to live up to the boosted image built around its architect. This year Santa Claus has come early with a bulging bag of imaginary Rupees.

Suspension of constructing new public office building, pruning President’s Budget, conversion of the service economy to a producing economy, developing inland fishery sector, strengthening the rural economy are among pluses.

But, some of them cannot be implemented; some are incomplete and inadequate; some are wishful thinking; some are not feasible and realistic; some are damaging. The President’s budget is pruned down but the Defence Minister’s budget is raised. Much attention is paid for inland fishery development but forgotten the fish populous sea around the island and the large fishing community living at the mercy of rough sea and the monopolistic fish buyer.

The Budget is a mirror effect of the inconsistency, incoherence and confusion prevailing at different levels of the Government. The private sector is treated as a source for tax revenue but not as an engine of growth. The Budget is not an integrated program for the year. Using the Budget to build up the Rajapaksa legacy is inappropriate, and harmful. The Budget is a story of faulty and faltering rather than a success. Funds allocation for the apparel industry, SMEs, tourism, school van operators, private bus operators, three-wheelers, wedding and entertainment reflects the failure and the bankruptcy of the engine of growth.

The Budget allocates billions of Rupees for millions of activities without feasibility. Fortunately, it would remain only in the document as Government is cash trapped with no funds. The Minister has forgotten that the country remains a ‘developing state’ since D.M. Rajapaksa, who was his father’s elder brother, represented the second State Council in 1936 to this day his own elder brother is ruling the country.

The writer has served as a secretary to three ministries before his retirement. He is currently a Vice President of Sri Lanka Economic Association. He can be reached via [email protected].)