Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 18 February 2022 00:00 - - {{hitsCtrl.values.hits}}

Introduction – A more advanced securities market

The Securities and Exchange Commission of Sri Lanka Act, No. 19 of 2021 was certified on 21 September 2021. The Act sets out a new framework for capital markets in Sri Lanka, which was felt to be a need for Sri Lanka to continue its development and harness the full potential of the new Port City. In this series of articles, I hope to take a closer look at some of the key features of the Act, and to highlight some of the concerns that arise, particularly through a public law lens.

be a need for Sri Lanka to continue its development and harness the full potential of the new Port City. In this series of articles, I hope to take a closer look at some of the key features of the Act, and to highlight some of the concerns that arise, particularly through a public law lens.

First, a look at the raw numbers will help provide a sense of the breadth of the new Act. The old SEC Act (No. 36 of 1987, as amended) comprised approximately 77 sections across 6 Parts which ran into 25 pages. In contrast, the new Act comprises 189 sections across 8 Parts (each containing several chapters), and runs into 175 pages. The new Act is thus exponentially more intricate and detailed, and sets the foundation for far more advanced capital markets. In this first article of the series, the broad structure created by the Act and some of its novel features will be set out; the reader is warned that it will be more descriptive than analytical.

Part I sets out the objects and purpose of the Act, the establishment of the commission and its composition and powers, duties and functions, and provisions relating to the director-general and staff of the commission. The old SEC Act did not have a separate provision describing its object and purpose, although this was communicated by its preamble. This Act sets out “to create, maintain and regulate a fair, orderly, efficient and transparent securities market”, to protect the interest of investors, and to ensure high professional standards in the provision of services within this system (s. 3). The explicit emphasis on fairness and transparency in a local statute is a refreshing change, and is one of the themes that will be explored in later articles in this series.

Another unique feature of this Act is that each part from Part II onwards begins with a provision setting out the object and purpose of that part of the Act. By doing so, the legislative intent is more easily discovered, which will aid in the interpretation of the provisions under each part, and can assist in the development of solutions where there is a lacuna in the law. Part II establishes ‘market institutions’, among other objects, in order to promote a “fair, orderly, transparent and efficient” securities market, and in order to mitigate systemic risk (s. 24).

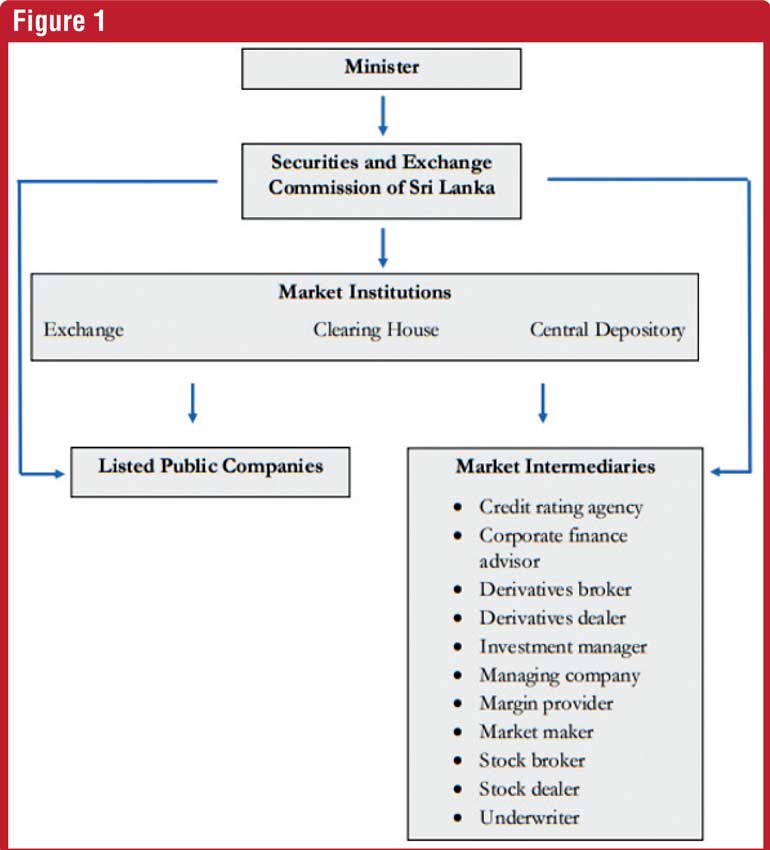

Three types of market institutions are envisaged. First: exchanges (Part II, Chapter 1); this includes both stock exchanges (such as the existing Colombo Stock Exchange) and derivatives exchanges. The Act thus envisages a future in which the securities market becomes far more complex, with both stock and derivative exchanges, and possibly even several of each. Second: clearing houses, which handle the processes of clearing and processing securities transactions (Part II, Chapter 2). Third: central depositories, which perform the processes of recording and maintaining entries of the securities deposited with various depositors and account holders (Part II, Chapter 3). At present, the Central Depository System (CDS) of the Colombo Stock Exchange performs the functions of both a clearing house and a central depository.

Part III covers the issue of securities, market intermediaries, and the protection of clients’ assets. While detailing the preconditions for issuing new securities, this part sets out the Commission’s new power to issue ‘stop orders’, in such instances as when the commission is of the opinion that a prospectus contains false or misleading information, or the issuer has contravened any provision of the Act (s. 83). This part also sets out the provisions relating to ‘market intermediaries’, where several new categories of intermediaries are envisioned. Among these are ‘corporate finance advisors’, derivatives brokers and dealers, and ‘market makers’. Other entities - including a credit rating agency, investment manager, managing company, margin provider, stock broker and dealer, and underwriter - existed under the old act, but have been brought within the meaning of the term ‘market intermediary’ under the new Act (s. 188 - Interpretation).

Part IV creates a framework in which unlisted securities can be transacted in a ‘transparent manner’ through a ‘recognised market operator’. This is a new feature of the act.

Market-related offences are set out in Part V. Whereas the old Act only dealt with insider dealing, the new Act contains two chapters under this part - the first on ‘Prohibited Conduct’, and the second on insider trading. Five categories of prohibited conduct are described: (i) false trading and market rigging; (ii) stock market manipulation; (iii) the making of false or misleading statements; (iv) fraudulently inducing persons to deal in securities; (v) using manipulative and deceptive devices (ss. 128-132). The provisions on insider trading are set out in exhaustive detail, also indicating the exceptions to the offence, and possible defences. Offences under this part are triable by the High Court, and are to be instituted and conducted by the Attorney General (ss. 148-149). A novelty under this Act is that persons who suffer loss or damage due to another person contravening any of these provisions, may file a civil action against such person in order to recover losses, regardless of whether or not they have been charged with an offence in respect of such contravention (s. 151). The commission may likewise institute civil proceedings against a person who has contravened these sections (s. 152).

Part VI deals with finance. Chapter 2 thereof continues the compensation fund which existed under the old act, to grant “limited compensation to any investor who suffers pecuniary loss” due to a stock broker or dealer being found to be incapable of meeting its contractual obligations.

The final part (VII) of the Act deals primarily with the transition to the new act, and its full implementation, but also contains several important new provisions. A new power given to the commission is to issue a ‘freezing order’ (s. 167). These may be issued where the commission has “reasonable suspicion” of a contravention of any provision of the Act, (i) at any time where an inquiry is being carried out; or (ii) where a person is being investigated in terms of section “165” (though perhaps it should be section 166, which deals with inquiries and investigations).

It also formalises a ‘Complaints Resolution Committee’ to hear complaints against entities or persons coming under the regulatory purview of the commission. The committee may make findings and recommendations and submit them to the commission, which has the discretion to decide how to Act on such recommendation (s. 168). Crucially, the Act also provides for whistleblower protection, prohibiting employers from discharging, terminating, demoting or harassing an employee who provides information to the commission on violations or potential violations of the Act or rules, regulations, or directives made thereunder. The commission may also grant a reward to a whistleblower who is first to provide information which leads to a successful prosecution or any other sanction imposed by the commission (s. 172).

In chapter 2 of this part, the commission is also given the power to impose administrative sanctions on persons who have contravened provisions of the Act (except for offences in Part V). These include imposing a penalty, issuing a reprimand, making restitution to a person aggrieved by the contravention, and imposing a moratorium on the trading of securities (s. 178). These ‘soft’ punishments which take place outside the judicial system allow greater flexibility to the commission, and may serve as an effective tool to ensure compliance with the Act without having recourse to the long process of a trial.

The new SEC Act is a vast undertaking, and has been designed to allow for greater complexity, efficiency and transparency in capital markets. Figure 1 is a crude representation of this new structure. In future articles in this series, the governance and processes enshrined in the act, the duties imposed on various stakeholders, and offences, exceptions and defences will be explored in greater detail.

(The writer is an Attorney-at-Law, and can be reached for feedback at [email protected].)