Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 25 November 2020 00:00 - - {{hitsCtrl.values.hits}}

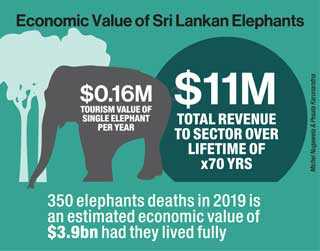

A single elephant, alive, contributes $ 0.16 m a year or $ 11 m over its lifetime to the tourism sector – Pic by Shehan Gunasekara

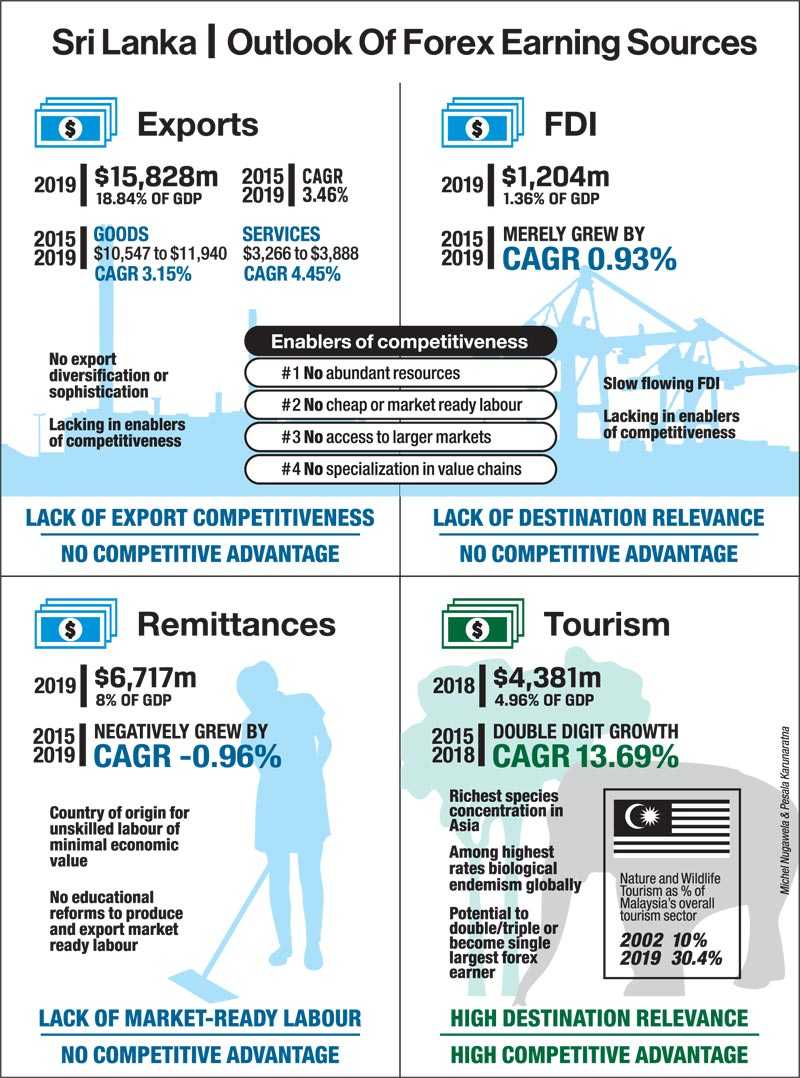

The coronavirus crisis throws into sharp relief the tenuous state of Sri Lanka’s economy. The Government is drastically impacted by a steep fall in foreign exchange earnings. While committed to export expansion, however, it remains handicapped by decades of unpreparedness in strengthening the underlying enablers of competitiveness.

The coronavirus crisis throws into sharp relief the tenuous state of Sri Lanka’s economy. The Government is drastically impacted by a steep fall in foreign exchange earnings. While committed to export expansion, however, it remains handicapped by decades of unpreparedness in strengthening the underlying enablers of competitiveness.

This opinion paper proposes a refocus on tourism as the priority sector to drive growth as the government begins the difficult and lengthy task of reforming, restructuring, and strengthening national competitiveness. This will require shifting away from one-size-fits-all marketing under the mass tourism model to developing a product differentiation strategy that targets the best tourists – the high value traveller – with our best assets – nature and wildlife. This broad and diverse segment of travellers outspend mass tourists by 3-4 times and will be the first to travel and visit other countries once global mobility returns in 2021.

However, the high rate of deforestation dismantles the only competitive advantage Sri Lanka now has to compete internationally and increase its exports of services. By stripping away nature and wildlife assets, the destination will be left with only its beaches and reputation for cheap sea-sun-sand tourism in the future.

Stagnant exports of goods and services

Exports of goods and services (% of GDP) was reported at 18.8% in 2019 of which goods accounted for 14.2% and services for 4.6%. In the years 2015-2019, total exports of goods grew from $ 10,547 m to $ 11,940 m – CAGR 3.15% – while total exports of services increased from $ 3,266 m to $ 3,888 m – just CAGR 4.45%.

Sri Lanka continues to lag other emerging economies in Asia that have successfully transitioned from an overreliance on primary goods to achieve export diversification and sophistication. In 1989, our total exports of goods and services as a percentage of GDP was 21.4% against Vietnam’s 16.5%. Thirty years later, our exports had shrunk to 18.8% as Vietnam’s increased to 119.3%. The reasons for this disparity can be found in the underlying enablers of export competitiveness where Sri Lanka’s capabilities are weak or entirely lacking.

Enabler #1 – Resource abundance

We have none. Consider the example of India’s BPO industry which is around 1% of the country’s GDP and 6% share of global BPO, directly and indirectly employing 10 m people. According to Tholons and AT Kearney Indexes of 2019, India remains the leading country to outsource because of cheap labour costs, a huge talent pool of skilled, English-speaking professionals (India’s English proficiency: #35/100 in the world and #5/25 in Asia), and tech-savvy manpower, despite competition from The Philippines, Vietnam and other Asian countries.

Enabler #2 – Price and contribution of unskilled or market-ready labour

We are stagnating at middle-income levels. The unskilled labour market demands higher wages and Sri Lanka lacks a pool of skilled market-ready workers (unlike the example of India, above).

Enabler #3 – Trade agreements that give producers access to a larger market

Domestic interest groups in Sri Lanka have opposed and successfully pressured governments to abandon free trade agreements. Meanwhile, emerging economies like Vietnam have made huge economic advances through trade liberalisation and global integration. Since its Doi Moi reforms, the country has signed 12 (mostly bilateral) FTAs that have increased trade by ten-fold – from $ 30 b in 2000 to almost $ 300 b by 2014 – shifting it away from exports of primary goods and low-tech manufacturing products to more complex high-tech goods like electronics, machinery, vehicles and medical devices.

The competitiveness of its exports will continue to increase, firstly, through more diversified input sources from larger trade networks and cheaper imports of intermediate goods from partner countries, and secondly, through partnerships with foreign firms that transfer the know-how and technology that is needed to leap into higher valued-added production.

Enabler #4 – Ab =ility to enter, establish or move up regional or global value chains and production networks

Today, global firms optimise resources by investing or outsourcing the design, procurement, production, or distribution stages of their value chain activities across different countries. Yet since 1978, Sri Lanka has only captured share in the manufacturing and design stages of the global apparel value chain. The examples of Vietnam and Thailand demonstrate how both economies have become integral to different stages of the smartphone and automobile value chains for Samsung and Toyota.

Vietnam: Vietnam attracted Samsung at the early stages of smartphone evolution. Samsung established its first factory in Vietnam in 2008, when smartphone penetration was 10.8% globally; today it has three factories in Vietnam and world smartphone penetration is at 41%. Samsung remains the single largest foreign investor in Vietnam, with investments totalling $ 17 b (20% of Sri Lanka’s GDP) whilst Vietnam’s exports of smartphones and spare parts, mostly produced by Samsung Electronics, account for $ 51.38 b (20% of Vietnam’s GDP). On top of the current $ 220 m Samsung R&D centre, Vietnamese Prime Minister Nguyen Xuan Phuc has requested Samsung Chairman Lee Jae-yong to next invest in a chip manufacturing plant, further strengthening the country’s competitiveness and sophistication in exports.

Thailand: Toyota’s decision to enter the Thai automobile market in 1962 was largely due to the country’s industrial policy regime. Today – after six decades of concentrated effort between the Thai government and Toyota – Thailand is becoming a global passenger car production hub. Toyota’s investments have also helped to transfer knowledge and technology into Thailand, strengthening the R&D capabilities of Thai engineers. Toyota Thailand president Michinobu Sugata has expressed complete confidence in both Thailand and the company’s future direction in the country.

Since 1978, Sri Lanka has repeatedly missed opportunities to enter or establish itself in global value chains and production networks. We continue to be unplanned and unprepared in strengthening the underlying enablers of export competitiveness. Expect meagre export growth to continue.

Slow-flowing Foreign Direct Investment

These enablers of competitiveness are also the most important considerations to increase foreign direct investment. Inflows between 2015 and 2019 totalled $ 6.4 b, averaging $ 1.2 b every year and merely growing by CAGR 0.93% (this excludes the 99-year lease of Hambantota Port to China in exchange for $ 1.1 b). Without improving supply-side constraints, international investors will remain reluctant to sink substantial resources in the country.

Strengthening the underlying enablers of competitiveness will take time. Expect stagnation in FDI inflows to continue.

Sluggish foreign worker remittances

Sri Lanka has become a major country of origin for unskilled workers with minimal economic value. Wage receipts, which amounted to $6,717 m in 2019 or 8% of GDP, negatively grew by CAGR -0.96% between the years 2015-2019. In 2019, the highest inflow ($ 3,459 m) came from the Middle East, a segment that participates in the lowest economic positions and lacks the skills, abilities and qualifications to mitigate any downturn in value in remittance flows.

However, the demographics are changing for neighbouring countries like India, where an increasing number of skilled white-collar workers (a growing cohort of professionals in the IT and engineering fields, according to MoneyGram) are quadrupling the average volume per each remittance.

To export quality human capital and increase our share of foreign-earned wages, Sri Lanka must introduce transformational policy reforms in education. Our university system – supported by proactive primary and secondary education systems – must be restructured to produce market-ready workers with the skills and adaptability to learn, grow and respond to change.

Reforms in the education sector will take time. Improving value in wage receipts remains a remote opportunity in the near future.

Amid no support or concentrated effort, tourism receipts grow double-digit

Tourism continued to expand and record double-digit growth of CAGR 13.69% between the years 2015-2018, despite the absence of a national strategy and a high percentage of low-income visitors. As a single sector, tourism receipts amounted to $ 4,381 m in 2018 or 4.96% of GDP and trended towards topping that in 2019. As Sri Lanka is weak or entirely lacking in the underlying enablers of competitiveness, and continues to be unplanned and unprepared in all other means of earning foreign exchange, tourism is the priority sector to drive economic growth in the short to medium-term.

The myth of mass tourism

For Sri Lanka, mass tourism has its advantages; it produces high revenues at high seasons by attracting tourists looking for the cheapest way to holiday (Sri Lanka’s largest inbound mass tourist markets are India, Britain, China, Germany, France, Australia, Russia, the US, the Maldives, and Canada). The mass tourism sector is also one of the largest employers in the country, providing direct and indirect employment to about 400,000 people.

But there are inherent constraints to the mass tourism model – such as its high seasonality, low average length of stay and low occupancy rates – which accelerate a downward pressure on prices. By repeatedly discounting for shrinking tourism dollars, mass tourism suppliers attract tourists who don’t spend (enough) and the tourism product stagnates: service quality decreases and consumer dissatisfaction increases over time. Finally, the destination gains popularity and is promoted for inexpensive travel.

To increase occupancy rates and avoid economic losses during off-peak seasons, mass tourism suppliers also rely heavily on all-inclusive packages. By inviting tourists to leave their wallets at home and remain within the hotel (typically, the pool, bar and restaurant), they inhibit the dispersion of economic benefits to wider communities or the economically disadvantaged.

For example, mass tourists venturing out of their segregated enclaves to ‘do’ Sigiriya, Polonnaruwa, or Anuradhapura shuttle point-to-point between iconic sites and resorts in the round tour circuit. Individuals and businesses (such as the restaurants, shops, and local transportation services in the vicinity) that aren’t fortunate enough to be part of a package that grants access to this self-contained world receive zero to limited economic benefits. (Studies of all-inclusive packages internationally show that only about 10% of tourism spending directly benefits the local economy.)

Most – if not all – mass tourism suppliers in Sri Lanka also acquire the majority of their business through foreign operators, whose tactics of choice include pitting hotels and resorts against each other to secure the cheapest room rates. By outsourcing their marketing function to these same operators, the suppliers subordinate themselves to the competing interests of the operators and, in turn, diminish their ability to explore more profitable markets and distribution channels.

The same principle applies to destinations. For example, Lonely Planet’s ‘Best In Travel’ listing ranks its top destinations, regions and cities to visit each year. Sri Lanka took the top spot in 2019 – much to the sectors elation – and yet bear in mind that no single destination is featured in any two consecutive years. Countries are elevated one year, only to be tactically removed in the next. Foreign tour operators also promote destinations to prospective customers – once again, a different destination (or list of destinations) each year – ensuring bargaining power against suppliers/destinations remain stacked in their favour (and with it a high dependency on their global brands, markets, and channels).

Even as the tourism sector languishes through the COVID crisis – which, if anything, should motivate a meaningful search to curtail its own unhealthy overreliance on mass tourism markets – there is still no specific strategy or objective to address the non-differentiation of Sri Lanka’s tourism product. This is not entirely surprising; when footfall is high, the mass tourism sector replicates more of the same; when demand is low, it discounts prices instead of differentiating the product. In a crisis, it simply has no response to the need for better tourists, and a better distribution of tourist by season or location, for the destination.

The untapped potential of alternate tourism

The global tourism sector is expected to return to pre-pandemic tourism levels by 2024 – a slow and lengthy recovery period that has significantly impacted the mass tourism segment. Many consumers have lost wages or jobs, and since travelling will take a larger share of their disposable income, it is extremely unlikely that a rebound in visitor flows will equate with a recovery in visitor spending (expect more cheap all-inclusive packages to lure more cheap tourists). According to international research, the travel behaviour and preferences of the mass tourist will also look different in the future as they take fewer, more memorable trips, with a greater demand for experiences in the outdoors away from crowds.

Meanwhile, high value travellers – the segment Sri Lanka has consistently overlooked in its drive for ‘more’ (volume over value/quantity over quality) – will continue to travel in significant numbers as global mobility returns in 2021. Yet here too, their motivations and behaviours converge on the need for unique and meaningful experiences in nature and wildlife – again, where Sri Lanka has failed to develop and differentiate its product.

Many countries have used the pause this year to rethink their business as usual model and search for answers to important questions such as: will the post-Covid tourists be the kind of visitor we want? Will they improve seasonal spend, stay longer, and disperse economic benefits further into local communities? New Zealand, for example, is ‘reimagining tourism’, with key stakeholders arguing for a value over volume approach to managing tourism numbers while they await an industry recovery. Tourism is New Zealand’s biggest export industry, contributing 20.4% of total exports or 5.8 % of its GDP in 2019.

Meanwhile, Tourism Australia has identified a market opportunity of 80 m high value travellers globally, of whom 32 m consider Australia as a destination to visit in the next four years. ‘Nature & Wildlife’ is the #1 driver of destination choice for this demographic from their 14 key inbound markets. This bears repeating: 72% Chinese, 73% Indians, 63% Indonesians, 76% Japanese, 66% Singaporeans, 67% South Koreans, 79% British, 63% US, 74% Germans, 68% Hong Kongers, 65% Malaysians, and 73% New Zealanders from the high value traveller segment visit Australia to experience its nature and wildlife assets.

Malaysia acknowledged the natural wealth of its country to drive revenue even earlier. In 1996, it published its National Ecotourism Plan to attract more visitors and increase visitor spend by developing competitiveness in its nature and wildlife assets. In 2002, nature and wildlife tourism established 10% of the country’s tourism sector; by 2019, this had tripled to 30.4%.

$ 11 m is a wild elephant’s lifelong intrinsic value to tourism

We can no longer be blind to what we are most blessed with. Instead of playing to our strengths, we continue to run a race in a global tourism market where the ten major destinations attract 70% of the worldwide tourism market. It is now time to match our best assets – nature and wildlife – with the best tourists – the high value traveller. And this can be done. Our natural landscapes and attractions boast of the richest species concentration in Asia and one of the highest rates of biological endemism in the world, for both plants and animals.

Consider the wild elephant population: 70% roam outside the protected areas, offering the best viewing opportunities in Asia and representing a huge revenue stream for the tourism sector. We determine the tourism value of a single elephant, alive, to contribute $ 0.16 m per year. Since elephants live for up to 70 years, the total revenue that a single elephant can generate is immense – $ 11 m over its lifetime to our hotels, resorts, airlines, travel companies, and – potentially – local economies.

We say potentially, because the value per elephant is significantly diminished under the mass tourism model, where the asset is perceived as an irrelevant pest rather than an important generator of profits. (Conversely, these assets are precisely what high value travellers – who outspend mass tourists by three to four times – value most). As global demand rises, therefore, Sri Lanka’s supply diminishes: 350 elephants perished in 2019 – an estimated commercial loss of $ 3.9 b to the sector, which is the value the animals would have distributed among the recipients in the tourism sector had they lived their lives fully.

Deforestation also dismantles the very assets – animal or plant, elephant or forest – that are required for a product differentiation strategy. When ancient migratory corridors are disrupted, elephants will die. When forests are uprooted, we will no longer be ‘green’ – a fundamental driver of destination choice for high value travellers. When the damage is done – when our natural assets are stripped away – Sri Lanka will no longer be able to position itself as anything other than a cheap destination for sun-sea-sand tourism. The entry of international budget hotel chains over the past half-decade point to our destination relevance in the future.

Amid the increase in deforestation, the silence from the mass tourism sector is deafening, revealing, firstly, just how disconnected its suppliers are from the wider ecology within which they operate, and secondly, the poverty of their vision for the sector and country.

It should come as no surprise, then, that disruption to the mass tourism model has come from the market’s edges rather than any single operator within the mass tourism sector. Dilmah has brought its compelling vision and business strategy to compete against commoditisation in the tea industry to the tourism sector. Its luxury offering can generate eight times more revenue per tourist than the mass tourism offering, indicating the potential Sri Lanka has to pivot from mass to class and drive revenue as a destination.

We would question whether it is even possible to carve out other profitable niches without building on Sri Lanka’s strengths in nature. Consider the wellness segment which reconnects consumers to nature through the restorative benefits of Ayurvedic medicine and Hela Wedakama, the mindfulness meditation techniques of Buddhism, and yoga retreats. In a short span of time, the segment already accounts for $ 180 m export revenue (while the spices sector, which has existed for centuries, accounts just $ 300 m).

A reality check

Sri Lanka is weak or entirely lacking in the underlying enablers of export competitiveness. Without improved FDI flows, the government remains incapable of single-handedly investing in infrastructure and injecting working capital to promote export-driven businesses.

Allocating forest-land to export development (when Sri Lanka is weak or entirely lacking in its enablers and as the 12 BOI export processing zones remain largely unutilised) also dismantles the only competitive advantage Sri Lanka has to compete in international markets and double or triple its export earnings, or, as in the case of New Zealand, to push the tourism sector to become the primary source of foreign exchange for the country.

By stripping away these assets, we are left with only our beaches and reputation for cheap sea-sun-sand tourism. The tourism sector is therefore not a fringe player in what happens next – it is right at the centre, because it is these very assets that enable its future competitiveness.

Managed strategically, our nature and wildlife assets can bring an overall volume of revenue to support economic growth as we begin the difficult and time-consuming task of reforming, restructuring and strengthening capabilities in the enablers of competitiveness. We must now urgently commit to a diverse tourism portfolio targeting different tourism segments. A cut tree, a dead elephant, is a lost tourism dollar in the future.