Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 10 October 2019 02:14 - - {{hitsCtrl.values.hits}}

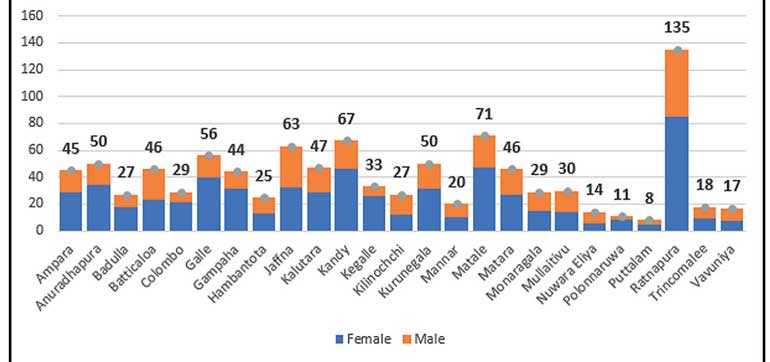

Thurunu Diriya Loan Disbursements – District-wise distribution

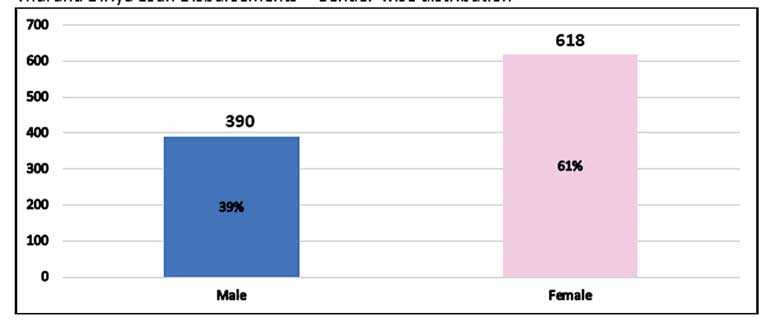

Thurunu Diriya Loan Disbursements - Gender wise distribution

The Prime Minister forwarded a research study of young entrepreneurs conducted in South Asian countries, including Sri Lanka, to the Policy Development Office, to look at the findings of the research team. The report found that around 80% of startup businesses begun by young qualified young people, do not survive beyond the third or fourth year.

The main reason was found to be that they could not access the second injection of capital, in sufficient volume, required for the expansion phase of the business at reasonable rates of interest, without collateral, or Government servants as guarantors or other conditions imposed by lending institutions across the spectrum, rotating saving and credit associations (Seetu Groups) money lenders, coop banks, state banks, commercial banks and other financial service providers.

The research study found that after qualifying from a technical course or graduating with a degree or diploma, and in some cases, serving in an enterprise as an intern, trainee or even as an employee, the young entrepreneurs targeted in the study, those with guts and courage to set out on their own business, rather that look for the traditional ‘permanent and pensionable’ Government employment or paid employment in a private enterprise, the choice, in reality, of the vast majority of young job seekers.

These young people, raise initial seed capital from the legendary sources of ‘Friends, Family and Fools’, a classmate or batchmate, who was already employed, parents or a relative who is employed abroad, or generous hearted do-gooders, who dole out grant funds to people who they consider ‘genuine’ (yes, they still exist! In our complicated society!).

With this start up, the young entrepreneur gets going and with her/his skill, willpower, tenacity and support from the community builds up a business. Then comes the expansion phase, in the third or fourth year. The business cannot remain static; it must compete, expand, diversify, respond to market demands, acquire new equipment and more raw material, meet evolving and changing consumer tastes, etc.

Now comes the problem. Money lenders, pawn brokers, hire purchase institutions are inherently exploitative and unaffordable. The traditional ROCA’s Seetu group, does not provide the volumes required and is virtually unregulated and most often the money contributed vanishes. State and Commercial Banks demand collateral, guarantors, the state banks especially, Government servant guarantors. The aggressive nature of operations of the Credit Information Bureau (CRIB), have put off people from being guarantors for bank loans.

Although there are a plethora of financing schemes in theory, under a variety of names, collateral free, guarantee free, sanction free due to the credit guarantee scheme, half the credit reimbursed by the state, Janasaviya type group lending, etc., but when it comes to actually accessing funds, the type of entrepreneur whom Thurunu Diriya targets, hits the proverbial wall.

Anecdotal evidence and research shows, that generally bank managers, being conservative by nature and being held accountable responsible for Non-Performing Loans, play safe by providing all these wonderful loan schemes to their existing clients, with a good positive credit history. New borrowers, without a credit history with the lending institution, have the same equal chance of borrowing money, without security, without collateral, Government servant guarantors, etc. as the proverbial ice cube in hell, has, in not melting away!

Unfortunately, to the majority of our bankers, simple ‘Project Lending’ per se, is not on. It may be viable for John Keells, Arpico, Dialog, DSI or Abans, but for the young entrepreneur without a credit history, it’s simply not on.

But of course, I hasten to add, there are the exceptions; especially after having worked with BoC on Thurunu Diriya, I have personal experience of really dynamic bank managers, who personally visited a young person’s enterprise and decides on the merits and viability of the project and business plan to approve a Thurunu Diriya loan. But these are exceptions, which, to my mind, reinforce the rule!

Coming back to the problem of young entrepreneurs and access to credit, the Policy Development Office of the Prime Minister’s Office (PDO/PMO) was given the challenge of designing a loan scheme to arrest this problem. After wide ranging consultations, the PDO/PMO designed the parameters of a scheme. Professionally qualified young people, under 30 years of age, who have a registered business for three years, who have a viable business loan, who are not on the CRIB list as a defaulter, and have one year’s audited accounts available would be eligible, for a loan up to Rs. 500,000 without collateral, with guarantee of parents or a relative and one more accountholder of the same bank branch of the lending bank, as introductory guarantor.

We took this proposal to the Central Bank and discussed it with the Governor, Dr. Indrajit Coomaraswamy and Assistant Governor S.J. Asoka Handagama who endorsed the approach. The Governor referred to it at a meeting of bank CEOs. The then, newly-appointed General Manager of the Bank of Ceylon, K.B. Senarath Bandara contacted the PDO/PMO and said the Banks’ Development Banking Division would like to further discuss the proposal with us. We had a meeting with the GM and his senior staff. We were fortunate to have Ranel Wijesinha, Senior Chartered Accountant, then a member of the BoC Board of Directors, present at the meeting, who was a positive influence in increasing the BoC’s appetite for risk.

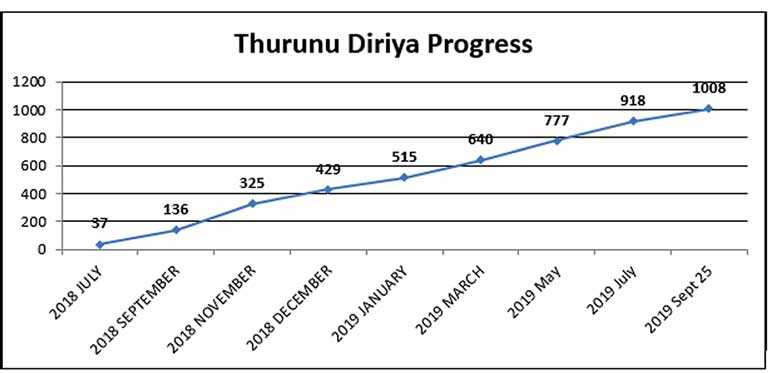

The BoC’s publicity division came up with the brand name ‘Thurunu Diriya’. The loan scheme was launched in the month of March 2018. In one year, by August 2019, the BoC branches had financed 898 entrepreneurs. In the month of September 2019, the landmark number of 1,000 entrepreneurs was reached.

Sceptics and naysayers, (a special breed available in surprising numbers, on this Thrice Blessed Isle), who at the design and launch stage, were critical of the concept, saying it was too specifically targeted and the bank branches would be unable to seek out entrepreneurs so specifically defined, will now mock at the number 1,000, but we challenge them to show a comparative scheme which has reached this number of hither to ‘un-bankable’ entrepreneurs, within this time frame.

Anticipating this sort of difficulty, the PDO/PMO took the strategic decision, to give the task of monitoring the Thurunu Diriya Scheme and reporting progress to the Central Programme Management Unit of the Ministry of National Policy and Economic Affairs, Resettlement and Rehabilitation, Northern Province Development and Youth Affairs, set up with the assistance of McKynsey Consultants. The CPMU’s operating principle is ‘Relentless Follow Up’.

The CPMU decided that the Divisional Secretariat area should be the focal point of monitoring and progress control. One specialist at CPMU proposed, with hindsight a far-sighted and brilliant proposal that we ask the Divisional Secretary to nominate one officer, attached to the Division to lease with the CPMU, on Thurunu Diriya.

Regular meetings were held with these Thurnu Diriya Nominated Officers at the Provincial Level, supported by the Provincial and District Administration. In lagging districts, special meetings were held with Nominated Officers, presided over by the District Secretary.

The Divisional Secretaries and Nominated Officers were able to mobilise around 40 officers attached to the Division, whose primary responsibility was broadly – Enterprise Promotion. The Divisional Secretaries placed Thurunu Diriya on their weekly meeting agenda and really promoted the program. So did the District and Provincial Administration.

The officers of the National Youth Services Council (NYSC), the National Apprenticeship and Industrial Authority (NAITA), the Small Enterprise Development Division (SEDD), were all mobilised towards this task.

In a lighter vein, one Divisional Secretary confided to me: “Sir, I have officers attached to my Division covering every letter of the English alphabet – A to Z and more! I will mobilise all of them!”

In the course of practical implementation and operation of the scheme, some pragmatic changes were made. Thurunu Diriya age limit was pushed up to 40 years, as Nominated Officers said that most entrepreneurs had started their businesses in their 30s. Further feedback suggested that registering a business was a massive obstacle course, with huge challenges. So a simple remedy of a certificate by the Gama Niladhari certifying that the business was in existence for three years, endorsed by the Divisional Secretary, was substituted.

Certified annual accounts were substituted for audited accounts, as most entrepreneurs, did not have audited accounts. Some bank managers required a connection between the qualification and the skill in the business. One entrepreneur whose business was distilling Citronella oil, challenged the bank manager to find her an institution which will give her a degree, diploma or certificate in distilling Citronella oil! That settled that issue!

Any certified training, public, private NGO, like NVQ, Vidatha, etc. were included. In fact the most successful dressmaking/tailoring entrepreneurs were trained a Singer schools. All these reforms were on the basis of feedback from the field at progress control meetings and suggestions from entrepreneurs and officers working on the program. The flexibility shown by the BoC and the promoters was exemplary. ‘Walk the Talk’ and the old adage that ‘the best fertiliser for the plantation is the sole of your foot’, is proved over and over again, as correct in practical terms.

The Law of Unexpected Consequences really featured in Thurunu Diriya. A retiring Lord Justice in Britain in his valedictory address said, that throughout his 40 plus years as a Judge – “One Law unfailingly applied every time – the Law of Unexpected Consequences!”

For example, although at the design stage, gender was not an issue, in fact over 60% of borrowers in Thurunu Diriya are women; meeting the employment aspirations and expectations of educated and qualified females is a major challenge for Sri Lanka. Free education and free health services have facilitated large numbers of qualified women wishing to participate more actively in the economy.

The traditional responsibilities of child bearing, child rearing and nurture, home making, looking after elders, etc. is an additional responsibility thrust upon females. The development of elder care and childcare facilities, things like paternal leave, equal pay for equal work, are all still works in progress, in this country.

It is this incite that prompted the late D.S. Senanayake and his team to promote cottage industries in the colonisation schemes. Over the time name was changed to income generation activities and to micro enterprises. But the logic is still sound. Women need economic activities which can be juggled around, home making, childcare and assisting in agriculture, etc. in the and around the home itself.

Unexpectedly and not by design, Thurunu Diriya has funded this activity. Professionally qualified women, who had started beauty culture enterprises, sewing businesses, catering enterprises, childcare facilities, plant nurseries, in their homes, have taken Thurunu Diriya loans for the expansion phase of their enterprise; putting up a building, buying equipment and raw material, hiring additional staff, etc.

At the request of the PDO/PMO, the BoC Research Division conducted a review of Thurunu Diriya borrowers. The objective of the research was broadly to: Ascertain motivation in becoming an entrepreneur, technical capacity, socio-economic background, marketing strategies, drive to start up own enterprise.

The results of the survey, in general terms are as follows:

SME sector is considered as a backbone of the economy. It contributes more than, 75% of Sri Lankan economy, 45% of employment and 52% of Gross Domestic Product (Ministry of Industry and Commerce). The research was conducted based on questionnaire (on above factors) survey method among a sample 220 Thurunu Diriya entrepreneurs.

Effect of economic and political environment

The survey brings out many issues which are being addressed. Borrowers have to be continually monitored and supported. Economic shocks are a given and they have to be nursed through them. Both the BoC staff ad SEDD staff follow this up with Nominated Officers. Continuing education and training is required, to upgrade skills and technology. Knowledge of the regulatory environment, taxation, labour, environment, etc. is required. Financial literacy has to be upgraded.A perennial question is Non Performing loans – presently for Thurunu Diriya, this stands at 1.46%. The normal tolerable rate for the financial services sector is 5%. Thurunu Diriya is doing well, and a number of defaulters have been rehabilitated and are now performing due to the intervention of the Nominated Officers and SEDD Officers. Entrepreneurs who are exposed to economic shocks, illness, deaths, crop failure, etc., have to be nursed back to financial health.

Notwithstanding all this, BoC Thurunu Diriya has achieved one landmark target. Demonstrating to young people, who are willing to set out on their own, the pioneers, not looking for permanent and pensionable Government or state-owned enterprise employment, unlike their peers, that if they get going, on their own, the leading national bank, the BoC, the ‘Bankers to the Nation’ and the Government machinery, at National, Provincial, District and Divisional, and Grama Niladhari Division levels, led at the highest level by the Prime Minister’s Office, are willing to support them. That is a huge commendable achievement. 1,000 young entrepreneurs have benefitted. Many more are in the pipeline.

(The writer is Senior Adviser to the Prime Minister.)