Saturday Feb 21, 2026

Saturday Feb 21, 2026

Saturday, 16 May 2015 00:59 - - {{hitsCtrl.values.hits}}

Virtusa Chairman and

CEO Kris Canekeratne

Virtusa Corporation, a global business consulting and IT outsourcing company that combines innovation, technology leadership and industry solutions to transform the customer experience, reported consolidated financial results for the fourth quarter and full fiscal year 2015, ended 31 March.

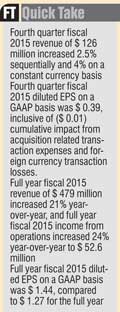

For the fiscal year ended 31 March 2015, revenue was $ 479 million; an increase of 21% compared to $ 396.9 million for the fiscal year ended 31 March 2014. This represents revenue growth of 21% in constant currency.

Virtusa reported GAAP income from operations of $ 52.6 million for fiscal year 2015, an increase of 24% compared to $ 42.4 million for fiscal year 2014.

On a GAAP basis, net income for fiscal year 2015 was $ 42.4 million, an increase of 23% compared to $ 34.4 million for fiscal year 2014. Earning per diluted share for fiscal year 2015 was $ 1.44, an increase compared to $ 1.27 per diluted share, for fiscal year 2014.

Non GAAP results:

Non-GAAP income from operations was $ 68.3 million for fiscal year 2015, an increase of 25% compared to $ 54.9 million for fiscal year 2014.

Non-GAAP net income for fiscal year 2015 was $ 54.4 million, or $ 1.84 per diluted share, an increase compared to $ 44.0 million, or $ 1.63 per diluted share, for fiscal year 2014.

Balance Sheet and

Cash Flow

The company ended fiscal year 2015 with $ 235.9 million of cash, cash equivalents, and short-term and long-term investments.(2) Cash generated from operations was $ 17.1 million for the fourth quarter and $ 48.9 million for the fiscal year 2015.

Fourth quarter fiscal 2015 consolidated financial results

Revenue for the fourth quarter of fiscal 2015 was $ 126 million, an increase of 2.5% sequentially and 13% year-over-year. On a constant currency basis, fourth quarter revenue increased 4% sequentially and 17% year-over-year.

Virtusa reported GAAP income from operations of $ 14.5 million for the fourth quarter of fiscal 2015, compared to $ 14.6 million for the third quarter of fiscal 2015, and an increase compared to $ 12.5 million for the fourth quarter of fiscal 2014.

On a GAAP basis, net income for the fourth quarter of fiscal 2015 was $ 11.6 million, or $ 0.39 per diluted share, compared to $ 11.8 million, or $ 0.40 per diluted share, for the third quarter of fiscal 2015, and an increase from $ 10.0 million, or $ 0.35 per diluted share, for the fourth quarter of fiscal 2014. GAAP earnings per diluted share for the fourth quarter of 2015 included a ($ 0.01) cumulative impact from acquisition related transaction expenses and foreign currency transaction losses.

Non GAAP results:

Non-GAAP income from operations, which excludes stock-based compensation expense and acquisition related expenses, was $ 19.2 million for the fourth quarter of fiscal 2015, compared to $ 19.1 million for the third quarter of fiscal 2015, and an increase compared to $ 16.7 million for the fourth quarter of fiscal 2014.

Non-GAAP net income, which excludes stock-based compensation expense, acquisition related expenses, and foreign currency transaction gains and losses, each net of tax, for the fourth quarter of fiscal 2015 was $ 15.1 million, or $ 0.51 per diluted share, compared to $ 15.2 million, or $ 0.51 per diluted share, for the third quarter of fiscal 2015, and compared to $ 13.1 million, or $ 0.45 per diluted share, for the fourth quarter of fiscal 2014.

Virtusa Chairman and CEO Kris Canekeratne, stated, “The fourth quarter capped off a strong fiscal year 2015 for Virtusa. Our results reflect our leadership position in providing millennial enablement and transformational solutions, which are allowing us to win larger engagements and expand with existing clients. We enter fiscal year 2016 with the strongest client base in our history, and with meaningful opportunity to continue to grow and scale across our client base. Our recent acquisition of Apparatus further supports our growth objectives by expanding our IT outsourcing solutions, increasing our addressable market and contributing to recurring revenue.”

Chief Financial Officer Ranjan Kalia said, “Our fiscal fourth quarter and full year fiscal 2015 results reflect our focused execution and the benefits from the investments we have been making to capture a larger share of our addressable market. Looking ahead, we believe we are well positioned to deliver on our fiscal year 2016 revenue growth and profitability targets.”

Kalia continued, “Beginning with the fourth quarter of fiscal year 2015, we have begun supplementing our financial disclosure to include non-GAAP income from operations, net income and EPS metrics. We believe these financial metrics will provide additional insights to measure the operational performance of our business.”

Financial outlook

Virtusa management provided the following current financial guidance:

nFirst quarter fiscal 2016 revenue is expected to be in the range of $ 132.5 to $ 135.5 million. GAAP diluted EPS is expected to be in the range of $ 0.33 to $ 0.35 and non-GAAP diluted EPS is expected to be in the range of $ 0.48 to $ 0.50.

nFiscal year 2016 revenue is expected to be in the range of $ 569 to $ 587 million. GAAP diluted EPS is expected to be in the range of $ 1.51 to $ 1.67 and non-GAAP diluted EPS is expected to be in the range of $ 2.15 to $ 2.31.

The company’s first quarter and fiscal year 2016 diluted EPS estimates an average share count of approximately 29.9 million and 30.0 million, respectively, (assuming no further exercises of stock-based awards) and assume a stock price of $ 40.66, which was derived from the average closing price of the company’s stock over the five trading days ended on 8 May 2015. Deviations from this stock price may cause actual EPS to vary based on share dilution from Virtusa’s stock options and stock appreciation rights.