Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 19 December 2017 00:00 - - {{hitsCtrl.values.hits}}

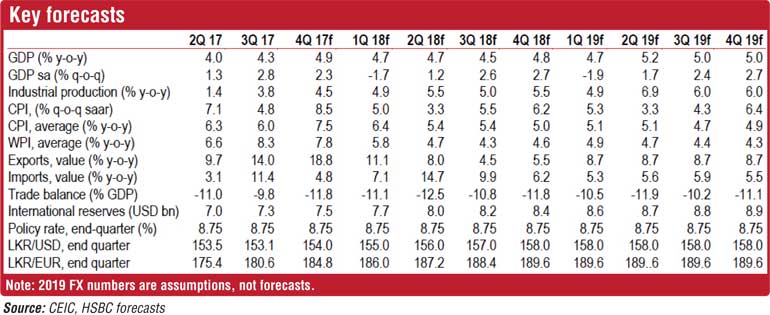

HSBC Global Research has described Sri Lanka as a nation walking on a tightrope, trying to balance the twin targets of invigorating growth in the economy while maintaining macroeconomic stability.

This observation has been made in HSBC Global Research's latest Asian Economics Quarterly which assesses recent developments of and prospects for 16 Asian countries.

It said that with Sri Lanka on the one hand the economy has been weakened by floods and droughts for the past two years. This has resulted in a complete disruption of agriculture, which has been contracting for six consecutive quarters now. And on the other hand, vulnerabilities around macroeconomic fundamentals in the form of a high debt to GDP ratio, the twin deficit problem (current and fiscal deficit), a weak currency and insufficient forex reserves have kept Sri Lanka on its toes. To fix the latter, Sri Lanka entered into the IMF reform program in 2016.

Much has been done and achieved since then. Dedicated efforts have been made towards revenue mobilisation via VAT hikes and the passage of the Inland Revenue Act in Parliament, reducing the fiscal deficit and embarking on a more realistic consolidation path, building up foreign reserves and showcasing a greater commitment to exchange rate flexibility.

While the Government remains committed to the IMF’s recommended structural reforms, growth is likely to be weak in 2018 due to a fragile agriculture recovery, lower household spending and moderating credit growth especially in the services sector. The reinstatement of the EU’s

Generalised System of Preferences (GSP+) in May 2017 is likely to revive exports.

In fact, high frequency data so far has been promising, with export growth outpacing import growth, but it’s too early to be confident about the recovery. The 2018 Budget also tries to stimulate growth, that too on a sustainable basis. It aims at rekindling the entrepreneurial spirit by improving access to credit for small- and medium-sized enterprises, enhancing trade competitiveness through the removal of tariffs, promoting tourism and attracting foreign direct investment (FDI) by doing away with land ownership restrictions and by exploring opportunities around public-private partnership. Undoubtedly, the country has come a long way trying to achieve both the objectives of growth and macroeconomic stability, but things can get tricky going forward as close to Rs. 7,000 billion will be due for repayment in the next couple of years. Such a huge gross financing need may require further revenue consolidation, which may be detrimental for an already slowing economy.

Sri Lanka needs to attract non-debt creating inflow and FDI is one such option. However, it has always lagged in attracting FDI compared to its neighbours. With targeted FDI inflows not being realised, it has relied on commercial borrowing to fund its deficits (balance of payments and budget deficit) to drive growth. This has not been sustainable and has led to steep adjustments in the currency and interest rate in the last seven years or so.

Policy issues

Since 2016, the Central Bank has raised policy rates by 125 bp with an aim of reducing excess liquidity, controlling credit expansion and to contain the build-up of adverse inflation expectations.

While concerns around Sri Lanka’s credit euphoria have been mitigated by a tighter monetary policy, inflation has continued to edge higher, much outside the Central Bank’s target of mid-single-digit. It’s the supply side disruptions due to unfavourable weather conditions that have driven food prices higher, and thereby inflation.

HSBC Global Research believes that as food prices stabilise in the months to come, inflation will start moderating and is likely to ease to the desired levels by 2018.

Sri Lanka’s rate hike cycle is close to peaking and the Central Bank is likely to keep policy rates unchanged in the foreseeable future until the dust around supply side disruptions due to adverse weather conditions settle. A stable rate environment will also support the weak economic recovery.

Risks

Rising crude and commodity prices, along with a depreciating currency, may worsen current deficit levels, and the Government may find it difficult to continue with energy price reforms per the scheduled timeline.

Further, a weaker than expected recovery in growth as a consequence of adverse weather conditions and a loose fiscal policy as the country moves closer to elections could further slow down the pace of fiscal consolidation and raise concerns around macroeconomic stability.