Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 27 August 2018 00:00 - - {{hitsCtrl.values.hits}}

By The Ministry of Development Strategies and International Trade

Is it necessary to enter into FTAs?

The world around us is moving forward with regional and bilateral free trade agreements (FTAs) as the multilateral trade liberalisation process led by the WTO has come to a standstill. There are now 419 regional trade agreements in the World.

If we look at the South Asian countries in SAARC, Sri Lanka is far behind in terms of working out duty-free or preferential market access with other countries. In SAARC, five countries(Bangladesh, Nepal, Bhutan, Maldives, and Afghanistan), by virtue of them being LDCs, qualify for duty-free access to the EU and Indian markets. In fact, nearly 84% of SAARC LDC exports have duty-free access to the world at large. India has preferential market access to ASEAN, Japan and South Korea by various FTAs and CEPAs it has signed during the last decade. Pakistan has FTAs with China, Malaysia and Sri Lanka, and benefits from GSPplus in the EU market. In contrast, Sri Lanka has preferential market access only to India and Pakistan (and some preferential access to APTA members China and Korea, to which Bangladesh and India also qualify). Clearly, Sri Lanka lags behind even with its South Asian neighbours in having preferential market access to its trading partners.

What Sri Lanka needs to do is ensure growth and sustain the two traditional major markets, namely the US and the EU, and negotiate free trade agreements with emerging South Asian and Fareast Asian countries, and with the most dynamic potential trading partners in the Southeast Asian region, thus linking to global production and value chains. Accordingly, Sri Lanka has embarked upon negotiations on FTAs with India, China, Singapore and Thailand.

Does the Government havea national policy on trade?

Yes.

Is the New Trade Policy a fake document?

The Ministry observed that the trade-related policy decisions are taken at different institutions under jurisdictions and following different directions. They were mostly adhoc and fragmented. Those decisions did not follow a clear direction. Absence of a national trade policy led to chaotic decision making and non-effective directions, resulting in poor performance in terms of trade. Recognising this, the Government decided to adopt a national trade policy which can bring together various policy directions demonstrated by different agencies into one platform where there is a clear vision.

The trade policy was formulated through an inclusive process and it took almost one year from May 2016 to May 2017 for the preparation. As it gives a fresh outlook and a broader governing framework to the country’s trade regime and brings the prevalent unclear trade policies into one platform for the first time in Sri Lanka’s history, the document was named ‘New Trade Policy’. The New Trade Policy took into account development objectives of the Government, Sri Lanka’s comparative advantage in trade, past trade performance, recent global trade developments and trade policy formulation experiences of other countries.

The policy was prepared by two committees, a representative committee with the participation of several representatives of government agencies, and later brought to a focused paper by a group of expertsheaded by Economic Advisor to the PresidentDr. Sarath Rajapathirana,and made publicly available for comments.

Cabinet approval was granted for the New Trade Policy (NTP) at the meeting held on 1 August 2017. The Cabinet has directed the Ministry of Development Strategies and International Trade and all relevant line ministries to take action to implement the policy measures contained in the NTP pertaining to the matters under their purview.

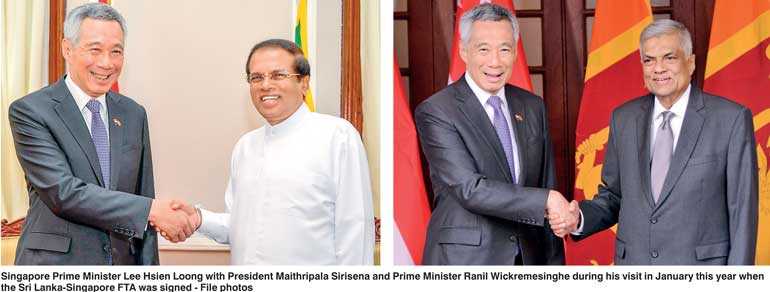

Was the Sri Lanka–Singapore agreement done secretly?

SLSFTA negotiations were started on 7 July 2016,and since then,eight rounds of negotiations were held between the respective negotiation teamswithin about 18 months, with the final negotiationheld on 13 and 14 November 2017.Negotiations were conducted by the Cabinet-approved National Trade Negotiation Committee and 12 of its sub-committees, chaired by all relevant public sector institutions. Over a period of 18months, more than 20 consultations were held with a wide range of stakeholders, including chambers, industry associations, professional associations, etc. There were common consultations regarding all ongoing FTAs, but different sub-committees had sectoral consultations on specific areas under each FTA with relevant associations and chambers.

The Cabinet has been kept informed on the status and the stances taken during the negotiation process. Finally, the first draft of the SLSFTA submitted to the Cabinet of Ministers on 22 December 2017 was tabled at Cabinet meetings held on 2 January and 9 January, along with observations submitted by the President and 14other Cabinet Ministers. Clearance of the Attorney General was obtainedviaa letter, dated 15 January. Approval of the Cabinet for entering into this was given at the meeting held on 16 January,and accordingly,the Agreement was entered into on 23 January.However, the Agreementcame into force on 1 May, after the enactment of the bill on antidumping, countervailing and safeguards.

Do tariffs become zero for all goods immediately after this Agreement?

There are 7,438 total tariff lines in the Goods schedule of the SLSFTA.

It is important to note that Sri Lanka’s 50% tariff lines (3,719 items) are already duty-free, except for a few not only for Singapore, but for any other country.The Tariff Liberalisation Program (TLP) of SLSFTA was done in consultation and with agreementfrom the Ministry of Finance and Mass Media because it has to be carefully designed to have the least impact on the domestic industry and revenue collection.

Under SLSFTA, Sri Lanka undertook (‘TLP’) to liberalise upto 80% of its tariff linesover a period of 12 years to 15 years. As said in the beginning, Sri Lanka’s 50% of tariff lineswill be immediately liberalised when the Agreement comes into force as those 3,719 tariff lines, except for a few, are already duty-free. Consequently, it will not have any impact either on revenue or domestic industries. The rest of the tariff reduction and elimination will be a gradual process, i.e. 15% of tariff lines(1,116 items) from the first to sixth year in equal instalments, next 14.3% of tariff lines(1,064 items) from the seventh to the 10thyear in equal instalments, and 0.7% (51 items) from the 11th to the 15th year. Therefore, all tariff linesof all goods will not become ‘zero’ immediately once the Agreementcomes into force.

Will domestic industries be threatened because of this Agreement?

In almost all FTAs signed by Singapore with its other trading partners, the level of liberalisation is kept close to 90% or more of the tariff lines. Sri Lanka, in comparison, has been able to negotiate to limit it to 80%, thereby keeping 20% of tariff lines,i.e. 1,487 items, in the negative list to protect domestic industries and revenue concerns. Items like footwear, confectionery and many other sensitive items which have a high MFN tariff have been kept in the negative list due to domestic sensitivities, though one can argue that keeping them in the negative list does not benefit the larger segment of consumers.

Furthermore, the bilateral safeguard section under the trade remedies chapter of the Agreementhas provision to increase tariff to the MFN level if import surges take place on a particular product due to implementation of the trade liberalisation program and if such imports cause injury or threaten to cause injury to domestic industries. Therefore, there are provisions in the Agreement to protect the domestic industries. In addition, a mere reduction of tariff will not enable products to be imported, since the products to be imported from Singapore should meet the Rules of Origin criteria. Furthermore, productsimported will also be subject to import license requirement if applicable, and also to regulations for the protection of human, animal and plant life.

Can products originating from other countries (India, Malaysia, Indonesia, etc.) come to SL under the SLSFTA?

The SLSFTA stipulates that there should be a minimum of 35% value addition or change of tariff headings at a four-digit level to ensure that a substantial value addition or processing has taken place within Singapore. Sri Lanka has not accepted ASEAN cumulation proposed by Singapore. Therefore, inputs originating in member countries of ASEAN will not qualify for tariff concessions unless 35% value addition or change of tariff heading at the four-digit level has taken place in Singapore. The Rules of Origin in the Agreement will therefore not allow goods simply to be exported through Singapore or entrepottrade, since minimum value addition or processing has to necessarily take place in Singapore.

Is there any major impact on government revenue?

There will be little or no impact from the immediate list since 50% tariff lines (3,719 items) are already duty-free.

Import data on products imported from Singapore will show that, out of total imports of $ 1293 million in 2017, $ 750 million were petroleum and related products (in fact, amounting to 60% of imports from Singapore) and $ 228 million were gold. Although gold is under the duty-free list,imposition of excise duty will protect revenue. Since tariffs on petroleum products, tobacco, spirits and alcohol are an important revenue source to the Government, these items have been retained in the negative list (products that will not be subject to liberalisation), thereby protecting revenue. It should be noted that as liberalisation of tariff will take place over a 12- to 15-year period, revenue loss, if any, should be calculated by yearly basis and not as if tariff on all items are reduced immediately. According to the Ministry of Finance, total customs revenue collection from imports from Singapore in 2017 was Rs.35 billion and revenue loss consequent to tariff liberalisation under the Singapore Agreementover the entire period of 15 years is Rs.733 million. Therefore, average annual revenue loss is Rs.49 million. Furthermore, Finance Ministry analysis shows that 97.79% revenue is protected.

Will the domestic producers be badly affecteddue to flooding of cheap products?

Such a situation is prevented through the new legislation on Trade Remedies that the Parliament approved recently.In addition, the Agreementalso contains a chapter on Trade Remedies which covers anti-dumping, countervailing and subsidies, global safeguards and bilateral safeguard measures. Since Sri Lanka has enacted legislation on trade remedies in March, Sri Lanka is now in a position to take legal action if dumping takes place, or subsidies are granted by Singapore to counter them. In addition, bilateral safeguards can be applied during the implementation period of the TLP if increased imports from Singapore due to tariff reduction causes injury to domestic industries. These provisions will enable Sri Lanka to apply such measures, if the need arises, when the SLSFTA is implemented.

Canharmful products, such as garbage, clinical waste, nuclear waste, chemical waste, etc., be imported through the SLSFTA?

Someargue that, since waste products are included in the TLP, such items can be dumped into the country under the Agreement. It needs to be emphasised that reduction or elimination of tariff does not automatically grant entry of a product into the country. For all products imported into the country, domestic regulations, mechanisms and applicable import licensing requirements, applicable standards, and regulations applicable to protect plant, human and animal life will apply. This Agreement does not take away Sri Lanka’s rights underthe International Environmental Protection Treaties to which Sri Lanka is a signatory. Therefore, the current environmental laws and regulations will apply to such products and this Agreement has no exemption for those to enter to the country. Under Article 20 on ‘General Exceptions’ of GATT 1994, Sri Lanka has the right to take measures to protect human, animal and plant life or health. This provision has been incorporated into article 17.7 of the Agreement, which ensures this right. Therefore, if there is a need, such measures can be introduced in the future.

Will the Agreement affect Sri Lankan biodiversity?

It is alleged that this Agreement will affect the fauna and flora of the country as endangered species, such as elephants, reptiles, etc., could be exported to Singapore, and such animals could also be imported from Singapore. It should be mentioned that Sri Lanka is a signatory to the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) and the Convention on Biological Diversity, and the Agreement does not take away our rights under these two conventions or under any other relevant conventions. Such imports and exports will be subject to domestic regulations and mechanisms implemented under such conventions, which include licensing requirement and recommendation and approval of the relevant designated government agency.

Why are such harmful products included in the duty-free list?

In any international free trade agreement, it is necessary to include all tariff lines that is 7438 in the goods schedule,which is either in the negative list, immediate liberalisation list or phasing out list, and a tariff line cannot be excluded.Therefore, such products should be in any one of the lists.

Sri Lanka chose inclusion of these items in the TLP of 80% as it gave flexibility for Sri Lanka to include more domestically sensitive items in the negative list, because such harmful items cannot be imported anyway without obliging the local laws.

This is not the first time that these items were brought under the duty-free list. Most of these items have been included in the duty-free list in the Indo-Sri LankaAgreement and Pakistan-Sri Lanka Agreement, and there is no evidence to suggest that these products are coming into the country in any harmful manner. However, such items cannot enter the country because environmental laws and regulations,and import licensing requirements apply to them. Therefore, it is not something that has been granted to onlySingapore.

Why is importation of paddy in the Agreement duty-free after 12 years, resulting in a threat to our food security?

In the case of items like paddy, grains, and wheat, the applicable Rules of Origin criteria is‘wholly obtained’. The wholly obtained product should be obtained from the soil of the country – that is, in Singapore. If such agricultural items like wheat, paddy and other grain are not ‘wholly obtained’in Singapore, such products will not qualify for duty-free entry even if the products are in the free list. In addition, there are no paddy fields in Singapore to obtain such products. It is alleged that rice from Pakistan, Thailand and Vietnam could be channelled through Singapore. Rice is in the negative list and therefore, the question about rice being imported through Singaporedoes not arise.

Does the Agreement make any commitment to liberalise services?

Both Sri Lanka and Singapore decided that the SLSFTA should be limited only to business visitors and intra-corporate transferees. Therefore, the Agreement completely excludes any independent movement of natural persons (i.e. excludes contractual service suppliers and independent professionals). Accordingly, Sri Lanka’s commitments in trade services are limited to within the existing level of openness in Sri Lanka’s current legal and regulatory framework. As per prevailing exchange control laws, mode 1 (cross-border supply) and mode 2 (consumption abroad) are by and large open for market access. Accordingly, as per Sri Lanka’s commitments in scheduled sectors, Sri Lanka places no restrictions on market access for mode 1 and mode 2. Thus, staying in line with the prevailing level of liberalisation, the SLSFTA offers no new market access in this regard.

In mode 3 (commercial presence or investment) as well, Sri Lanka’s commitments under the SLSFTA do not, in any case, go beyond the prevailing level of openness offered through the Foreign Exchange Management Act of 2017. In fact, in some cases such as construction services, the existing regulations allow 100% foreign equity ownership, but the SLSFTA makes a commitment of only up to 40% foreign equity ownership. Therefore, with regard to services provided through investment as well, the SLSFTA provides no new liberalisation but stays within the existing level of openness allowed through prevailing legislation and regulations.

In mode 4 (movement of natural persons), Sri Lanka has made limited commitments only in business visitors and intra-corporate transferees in a few sectors, and the movement of independent professionals is not liberalised or allowed. Here again, the key priority is in supporting measures to attract investment to Sri Lanka. Any company that makes a significant investment overseas would like to have its senior management to accompany that investment to ensure that the investment provides the desired results. Accordingly, in selected sectors, Sri Lanka has made commitments for intra-corporate transferees of senior management.

These senior management categories are defined as managers, executives, and specialists. Each category has a clear definition in the Agreement. For example, an executive is an employee who is either a director of the company or receives only limited supervision from the general body of shareholders.

Therefore, intra-corporate transferees of defined senior management linked to investment are allowed in the following sectors: IT, financial services, subsectors of maritime services, repair, and rental services, the construction industry (where a Sri Lankan company would have a majority ownership), hotels and restaurants, travel agencies (where a Sri Lankan company would have a majority ownership), advertising, technical testing services, and sports events organisation.

Such senior management intra-corporate transferees are subject to all immigrations laws and regulations. They must also have at least five years ofexperience in the relevant industry or professional field. The initial period of work will be up to two years, which can be extended up to a maximum period of five years,subject to approval by the controller of immigration. Furthermore, corporate transferees appointed to senior management positions should work in the same company to which they are transferred and cannot move to work in another company. As per current laws and regulations, BOI-approved companies can bring in project personnel allowing two-year visas for directors, and private companies can bring in foreign employees where skill shortages exist with line ministry approval.

Given the stringent definitions of senior management categories within intra-corporate transferees, it is likely that Singaporean companies will only transfer the most required and important categories of employees to a Sri Lankan branch/subsidiary. Considering the significant wage gaps between Sri Lanka and Singapore, it is highly unlikely that these employees will come to Sri Lanka and undercut Sri Lankan wages and take Sri Lankan jobs.

Does the Singapore FTA open up professional services?

The short answer is no. Sri Lanka’s commitments in professional services are limited to mode 1 and mode 2. That, too, in sub-sectors of selected professional services which were requested to support Singaporean investments in Sri Lanka. Mode 4 and mode 3 are not liberalised to any extent in these professional services.Thus,there is no provision for Singaporean professionals to come and work in Sri Lanka under the SLSFTA.

Accordingly, Sri Lanka made commitments in mode 1 and mode 2 in legal advisory services excluding Sri Lankan law. Therefore,this excludes the practice of Sri Lankan law. Mode 3 and mode 4 are ‘unbound’, meaning no liberalisation or commitments by Sri Lanka.

In engineering services, Sri Lanka made commitments in mode 1 and mode 2 in the advisory and consultative services sub-sector. This again does not include the practice of engineering, but only advisory and consultative services provided cross-border. Mode 3 and mode 4 are ‘unbound’,meaning no liberalisation or commitments by Sri Lanka.

In architectural services, Sri Lanka made commitments in mode 1 and mode 2 in the pre-design advisory and consultative services sub-sector.This again does not include the practice of architecture, but is only for advisory services provided cross-border. Mode 3 and mode 4 are ‘unbound’,meaning no liberalisation or commitments by Sri Lanka.

Does the Singapore FTA allow non-nationals of Singapore to take advantage of the FTA and enter Sri Lanka?

In the SLSFTA, Singapore defines a ‘national’ as a citizen of Singapore or a Permanent Resident of Singapore. Singapore has a population of 5.6 million people, and the number of Permanent Residents is 0.53 million as of 2017. Obtaining PR in Singapore is a long and stringent process, subject to more challenging requirements in recent years. It is only this cohort of Singapore nationals that can benefit from the FTA, and all other nationalities are excluded from the FTA. It is highly unlikely that someone who,with difficulty,has obtained a Singapore PR and is earning Singaporean wages would try to sneak into Sri Lanka and take Sri Lankan jobs using the FTA as a conduit. Even if a Singapore national is allowed to arrive as a corporate transferee,they will be subjected to limitationsof five years of relevant industry or professional experience, initial period of visa for two years, which can be extended to a maximum period of five years,and cannot move to work in another company and can only work in the company to which he/she was transferred.

Does the Singapore FTA enable manpower and recruitment service companies to bring down all manner of workers from anywhere in the world?

Sri Lanka’s offer in ‘Placement and Supply of Personnel’ is limited to modes 1, 2 and 3. This means a Singaporean recruitment services company could set up a company in Sri Lanka. This is already possible under prevailing laws and regulations.

Sri Lanka’s commitment in this sector does not include mode 4 in any capacity.It is completely unbound. Unlike in other mode 4 commitments, there is no reference even for senior management personnel for such recruitment companies.

Therefore, a Singaporean recruitment company can set up an office in Sri Lanka, as it is already allowed in the current legal structure, but it cannot recruit personnel from abroad since mode 4 is unbound. Any such recruitment company that wishes to hire work from overseas has to go through the regular processes of immigration and line ministry approvals. The current laws and regulations,and the FTA create no new liberalisation in this regard.

In fact, Singapore has also made a commitment in ‘Placement and Supply of Personnel’, covering mode 1, 2, 3, and in mode 4, for business visitors and intra-corporate transferees. Singapore’s commitment has gone beyond Sri Lanka’s commitment in that it makes some commitment in mode 4, whereas Sri Lanka leaves mode 4 completely unbound. Singapore’s commitment in this sector does not mean that a Sri Lankan company can recruit workers from anywhere in the world to freely work in Singapore.