Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 22 March 2018 00:00 - - {{hitsCtrl.values.hits}}

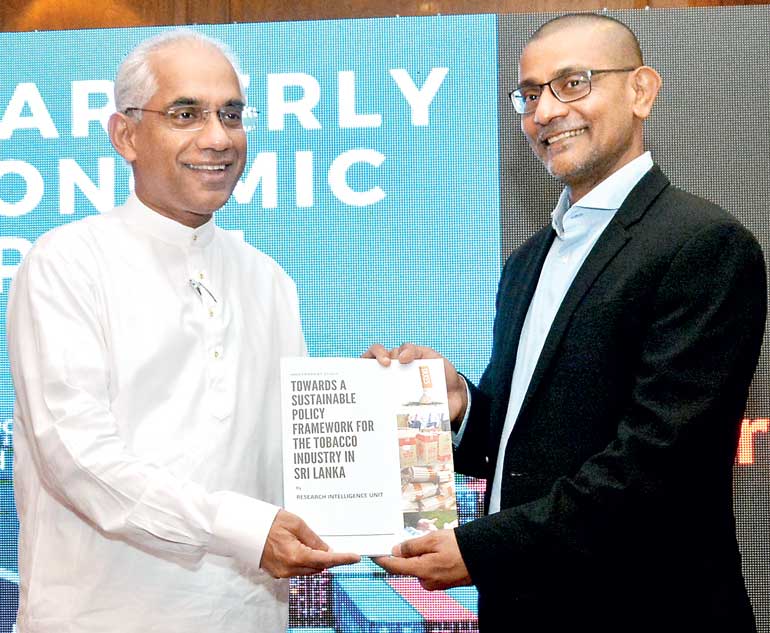

Research Intelligence Unit (RIU) founder and CEO Roshan Madawela presenting the report on the case study of the tobacco industry to state minister Eran Wickramaratne

By Shannon Jayawardena

and Rahel Kirinde

The Research Intelligence Unit (RIU) on Tuesday called for a balance in Government policy on tobacco in terms of dealing with health issues and taxation.

“We have to put our cigarette policy in the context of the economy,” RIU CEO Roshan Madawela said at the launch of the ‘Research Report on Taxation in Sri Lanka: A Case Study on the Tobacco Industry’ by RIU.

According to RIU, in Sri Lanka 0.7% youth and 49.3% adults smoke on a daily basis. In terms of the statistics, the number of smokers hasn’t changed significantly, with the main reasons for smoking being as a mode of stress release or to socialise.

The tobacco industry in the country consists of cigarettes, beedi and a small-scale cigar industry.

According to Madawela, the critical thrust of any Government policy on tobacco should be a focus on maintaining balance between health and securing taxation revenues as the industry is one of the largest contributors, adding that in recent years Sri Lanka has introduced erratic increases in the rate of taxation on cigarettes which has partly been the cause of the current market distortions.

The consistent tax hikes from 2009 to 2015 and the unprecedented tax hike in 2016 have given way to large growth in the smuggled cigarette industry. According to RIU studies, tax increase alone will not deliver the required outcomes but are in fact the least significant of the policy tools that are at the disposal of lawmakers.

According to Sri Lanka Customs, only one out of 10 smuggled cigarettes are discovered and confiscated by law enforcement agencies. Even in cases where large quantities of smuggled cigarettes are confiscated and the perpetrators are apprehended, the fines imposed are not substantial enough to act as an obstacle for the criminal elements involved, Madawela asserted.

According to the World Bank, a 10% rise in tax in a mid-income country will lead to an 8% fall in cigarette consumption. However after 10 years of persistent taxation, cigarette prices have gone up by 257% but overall smoking has not seen any decline.

In an unforeseen development, consumption has in fact increased by 25% in Sri Lanka despite heavy taxation.

In 2017 the excise tax revenue on cigarettes declined by Rs. 3 billion from 2016. Madawela stated that the Government could gain $ 31 billion if the illicit trade were to be eliminated.

“De-politicising the issue of tobacco taxes is critical to ensure that the legal and regulated industry has a predictable and level playing field that generates the forecasted amounts of revenue for the Treasury. Whilst the Government will want to balance the Health Ministry perspective with that of the Finance Ministry, it is essential that all stakeholders are included in the discussion,” Madawala opined.

In Sri Lanka the legal cigarette industry pays excise, NBT and VAT and contributes 6.1% of the total domestic consumption revenue to the Government. In 2016 the Government collected over Rs. 88 billion in cigarette excise and taxes.

According to statistics of the Ceylon Tobacco Corporation (CTC), the annual income generated by the domestic tobacco industry is estimated at Rs. 144 billion, out of which CTC is said to account for Rs. 131 billion and other market players account for the remaining.

Madawela affirmed that the industry has traditionally been one of the largest contributors to Government revenue. In 2016 an estimated Rs. 102 billion was contributed as tax from the tobacco industry, revealed Madawela.

The tobacco industry comprises 45,840 jobs while approximately 20,000 farmers are involved in cultivating.

-Pix by Upul Abayasekara