Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 19 May 2021 00:00 - - {{hitsCtrl.values.hits}}

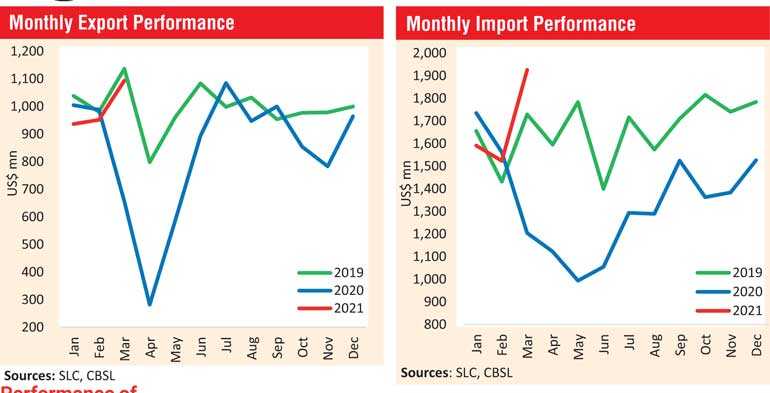

The country’s external sector saw a mixed bag in March, with the trade deficit widening for the first time in a year as imports rose to a three-year monthly high, derailing the benefit of over $ 1 billion in export earnings and robust inflow of worker remittances.

Releasing the latest data, the Central Bank said yesterday Sri Lanka’s external sector showed a mixed performance in March 2021 with a widened trade deficit on the one hand and a healthy growth in workers’ remittances and a slight pickup in the tourism sector on the other.

It said the deficit in the trade account widened in March 2021, for the first time since April 2020. Both exports and imports were significantly higher in March 2021, compared to March 2020 as well as February 2021.

However, workers’ remittances grew steadily, and the tourism sector continued the recovery process, albeit at a very slow pace.

In the financial account, both foreign investment in the Government securities market and the Colombo Stock Exchange (CSE) continued to record marginal net outflows in March 2021 as well. The Sri Lankan Rupee depreciated against the US Dollar during the month, partly reflecting the seasonal demand for imports.

However, mainly supported by the regulatory measures that were in place till mid-March, the Central Bank absorbed foreign exchange on a net basis during the month, to strengthen the gross official reserve position.

In March 2021, the Central Bank entered into a bilateral currency swap arrangement with the People’s Bank of China (PBoC) for Chinese yuan 10 billion (approximately $1.5 billion) with a view to promoting bilateral trade and direct investment for economic development of the two countries, and to be used for other purposes agreed upon by both parties.

Trade Balance and Terms of Trade

Trade balance: The deficit in the trade account widened on a year-on-year basis in March 2021, for the first time since April 2020, to $ 832 million compared to the deficit of $ 549 million recorded in March 2020 and $ 572 million in February 2021. Both exports and imports were significantly higher in March 2021, compared to March 2020 and February 2021.

The cumulative deficit in the trade account during January-March 2021 widened to $2,059 million from $1,853 million recorded over the same period in 2020.

Terms of trade: Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 6.3% in March 2021 as the increase in import prices were higher than the increase of export prices, compared to March 2020.

Performance of Merchandise Exports

Overall exports: Earnings from merchandise exports in March 2021 increased by 66.7% to $ 1,094 million, from low earnings from merchandise export in March 2020 ($ 656 million) during the first wave of the COVID-19. Earnings from exports improved considerably in March 2021 compared to February 2021 also raising export earnings towards pre-pandemic export levels.

Industrial exports: Earnings from all subsectors of industrial goods exports, excluding petroleum products and leather, travel goods and footwear, improved in March 2021, year-on-year. On a month-on-month basis, earnings from Industrial exports increased, except for the subsector of leather, travel goods, and footwear.

Earnings from textiles and garments, rubber products (mainly gloves and tyres), food, beverages and tobacco (mainly value added coconut products), base metals and articles, chemical products, and machinery and mechanical appliances exports recorded considerable growth rates compared to February 2021.

Meanwhile, earnings from the export of petroleum products declined on a year-on-year basis due to the significant reduction in volumes of aviation fuel and bunkering fuel supplied to aircraft and ship arrivals, despite the increase in the average prices of these export products. Earnings from leather, travel goods and footwear export declined in March 2021 both on year-on-year and month-on-month bases.

Agricultural exports: Export earnings from all subsectors related to agricultural goods increased in March 2021, compared to a year ago, as well as compared with February 2021. Export earnings from tea, seafood, coconut (both kernel and non-kernel products), spices (mainly pepper), and minor agricultural products (mainly arecanuts) recorded considerable increases over February 2021.

Mineral exports: Mineral exports in March 2021 were also higher than the exports observed in March 2020 and February 2021, due to increased earnings in subsectors of earths and stone (mainly quartz) and ores, slag and ash (mainly titanium ores).

Export indices: The export volume index and the unit value index increased by 56.5% and 6.5%, respectively, on a year-on-year basis, in March 2021. This indicates that the increase in export earnings were due to the combined impact of higher export volumes and prices.

Performance of Merchandise Imports

Overall imports: Despite the continuation of the import restriction measures, expenditure on merchandise imports increased significantly in March 2021 to $ 1,926 million, which was the highest monthly import value since March 2018. Accordingly, the import expenditure in March 2021 was significantly high compared to the expenditure of $ 1,205 million recorded in March 2020, and $ 1,524 million in February 2021. All major sectors of imports contributed to this increase.

Consumer goods: Expenditure on the importation of consumer goods increased by 42.1% in March 2021, compared to March 2020, and by 39.2% compared to February 2021, with increases in both food and beverages and non-food consumer goods imports. Expenditure on food and beverages imports, such as sugar and confectionery (mainly sugar), vegetables (mainly big onion and potatoes), and spices (mainly chillies), increased on a month-on-month basis.

Under non-food consumer goods, expenditure on medical and pharmaceuticals, home appliances (mainly televisions, refrigerators, and fans), and telecommunication devices (mainly mobile phones) imports increased on a month-on-month basis. Expenditure on the importation of vehicles for personal use was maintained at near zero levels, whereas import values of some non-food consumer goods that are subject to import restrictions marginally increased compared with February 2021.

Intermediate goods: Import expenditure of intermediate goods increased by 61.5% in March 2021, compared to a year ago, and by 19.5% over the previous month. Although crude oil was not imported in March 2021 due to maintenance work at the refinery, expenditure on fuel increased (both on y-o-y and m-o-m bases) due to higher import volumes and prices of refined petroleum and coal. Average import price per metric tonne of refined petroleum increased in March 2021 to $589.45 compared to $532.75 recorded in February 2021.

Import expenditure on many other intermediate goods increased (on a m-o-m basis), particularly base metals (mainly iron and steel); chemical products; textiles and textile articles; plastic and articles thereof; paper and paperboard and articles thereof; and vehicle and machinery parts.

Investment goods: Import expenditure on investment goods increased by 75.8% in March 2021 compared to March 2020, and by 37.1% compared to February 2021. The increase in investment goods (both y-o-y and m-o-m bases) was driven by expenditure on machinery and equipment and building material imports, while expenditure on transport equipment also increased.

Import expenditure on machinery and equipment increased (m-o-m) with higher imports of machinery and equipment parts, computers, turbines, transmission apparatus, whereas import expenditure on building material increased (m-o-m) with higher imports of cement and articles of iron and steel. Railway equipment, agricultural and road tractors, and tankers and bowsers imports categorised under transport equipment, also picked up in March 2021 when compared to February 2021.

Import indices: The import volume index and unit value index increased by 40.6% and 13.6%, respectively, on a year-on-year basis, in March 2021. This indicates that the increase in import expenditure was attributable to the combined impact of both higher import volumes and prices.

Other Major Inflows to the Current Account

The tourism sector saw some arrivals during the month of March

Tourist arrivals in March 2021 were recorded at 4,581, compared to 3,366 arrivals recorded in February 2021. Arrivals in March 2021 were 93.6% lower than the arrivals of 71,370 recorded in March 2020. Consequently, total tourist arrivals were recorded at 9,629 during the first quarter of 2021, compared to 507,311 arrivals in the corresponding period of 2020.

The main source countries of tourist arrivals during March 2021 were Kazakhstan, Germany and the United Kingdom. Earnings from tourism, which are estimated based on tourist arrivals, amounted to $ 6 million in March 2021, compared to $ 96 million in the corresponding month of 2020. Cumulative earnings from tourism are estimated at around $ 13 million during the first quarter of 2021 as opposed to $ 682 million recorded in the same period in 2020.

Workers’ remittances demonstrated a significant growth in March 2021

Workers’ remittances increased significantly by 24.4% in March 2021, year-on-year, to $ 612 million. The high growth rate was partly due to the base effect of the corresponding month in the previous year when the first wave of the pandemic set in. This increase led cumulative workers’ remittances to record a growth of 16.7%, year-on-year, to $ 1,867 million during the period from January to March 2021, in comparison to the corresponding period of 2020.

Financial Flows

Marginal net foreign investment outflows from capital markets were recorded in March 2021.

Accordingly, a net outflow of $ 6 million was recorded in the rupee denominated government securities market in March 2021, resulting in a cumulative net outflow of around US dollars 5 million during the first quarter of 2021. The total outstanding exposure of foreign investment in the rupee denominated Government securities market remained low at $ 31 million by end March 2021. A net outflow of $ 21 million was recorded from the secondary market of the CSE in March 2021. On a cumulative basis, the CSE recorded a net outflow of $ 91 million during the first quarter of 2021. Meanwhile, long term loans to the Government also recorded a net outflow of $93 million in March 2021.

International Reserves

The level of gross official reserves stood at $4.1 billion as of end March 2021. Gross official reserves as at end March 2021 were equivalent to 2.9 months of imports. Meanwhile, total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 6.5 billion at end March 2021, providing an import cover of 4.7 months. The bilateral currency swap facility signed between the Central Bank and the PBoC of Chinese yuan 10 billion (approximately $ 1.5 billion) is considered as a standby arrangement and is not included in reserves.

Exchange Rate Movements

The exchange rate came under severe pressure during March 2021, partly reflecting the seasonal demand for imports. Accordingly, the Sri Lankan Rupee depreciated by 2.5% against the US Dollar during the month of March. Overall, the rupee recorded a depreciation of 6.7% against the US Dollar in 2021 up to 18 May 2021.

Meanwhile, reflecting cross-currency movements, the Sri Lankan Rupee depreciated against the Euro, the Pound Sterling, the Japanese Yen, the Australian Dollar and the Indian Rupee during the same period. Meanwhile, the Central Bank continued to absorb foreign exchange from the market on a net basis to build up gross official reserves during March 2021, as well as on a net basis thus far during the year.