Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 1 June 2020 00:00 - - {{hitsCtrl.values.hits}}

MTI Consulting, Sri Lanka’s leading specialised management consultancy (and part of the MTI International Network) concluded a pioneering study among 100 of Sri Lanka’s Top CEOs and Directors.

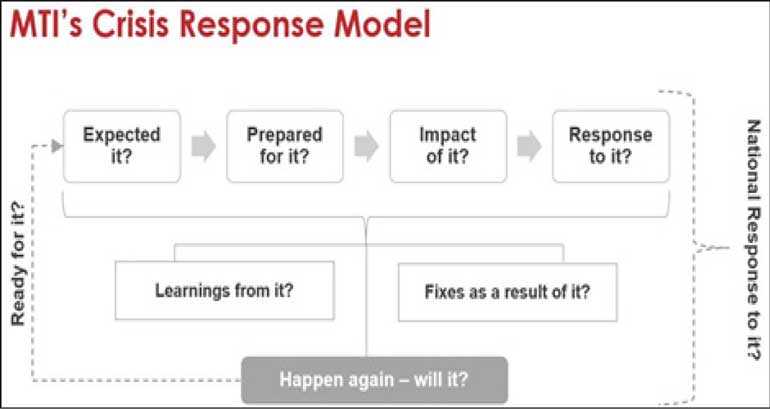

The study is based on one-on-one interviews with Sri Lanka’s business leaders from blue-chip companies, multi-nationals and industry majors, representing a diverse range of industries. It has been supplemented with MTI’s own experience of working on over 650 assignments across 47 countries in  the last 23 years. The study and the reporting of the findings will be based on MTI’s Crisis Response Model (as diagrammatically illustrated below):

the last 23 years. The study and the reporting of the findings will be based on MTI’s Crisis Response Model (as diagrammatically illustrated below):

COVID-19: Expected it?

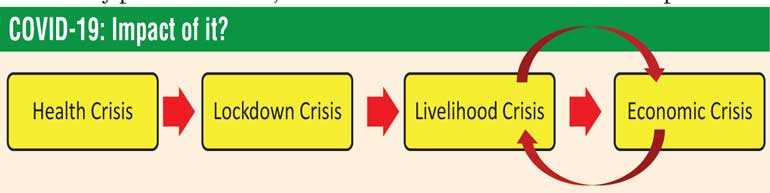

Nobody expected a lifestyle, livelihood and economic disruption of this magnitude – as a result of a health crisis. A few of the business leaders (with active involvement in capital markets) had expected an economic crisis – given that a market correction was due, a decade after the Global Financial Crisis in 2008 and the Asian Financial Crisis a decade prior to that in 1997. But not a crisis of this magnitude!

Businesses with supply chain exposure to China had sensed some early warning signs. Consequently, they responded in two ways i.e. searching for alternate supply sources (e.g. co-sourcing from the likes of India and Vietnam) and by increasing their inventory levels.

Given that previous health crises such as SARS, MERS, Ebola etc. were confined to a particular geographical region (and that too far away from Sri Lanka), most did not expect a pandemic at their door step!

This global economic (and soon-to-be ecological) correction was coming. COVID-19 is the straw that broke the camel's back! - MTI

Some businesses started sensing a possible supply chain disruption around January 2020 and had started working on supply chain solutions. Interestingly one business had received an unusually large order for a personal hygiene product in December 2019, but did not read into it!

COVID-19: Prepared for it?

Given that none of the businesses expected a crisis of this magnitude, they were not fully prepared to deal with it. The level of preparedness and the way in which businesses immediately responded, varies across the different type of businesses.

Multi-nationals, larger corporates, banks and telcos - relied on their formalised BCPs (Business Continuity Processes) and were able to execute these. By contrast, the mid-sized local groups relied more on the agility and resilience of their staff, which came in for a high level of commendation and appreciation from their Directors and CEOs.

Liquidity is the killer!

Businesses with high gearing and extended delays in collecting dues from their customers, were considered to be at the highest risk of closure. Some companies, at the expense of new business  generation, have shifted their entire focus to collections, which under the circumstances would be a prudent approach.

generation, have shifted their entire focus to collections, which under the circumstances would be a prudent approach.

The power and pitfalls of Working from Home (WFH)

Operationally, the big revelation for businesses has been the benefits of WFH. As a result of WFH, there have been three realisations for business leaders:

1.Work can be done with less resources – than what current structures / headcounts suggests. n

2. Physical Offices can be smaller in size – considering reduced traffic and shifting to hot-desking

3.Meetings can be done within a shorter duration

Consequently, several CEOs are considering WFH arrangements and virtual meetings – as a regular feature of life after lockdown.

From an employee’s perspective (based on other MTI studies carried out):

All of this has significantly increased employee stress levels, the consequence of which may not show up on short term performance, but will certainly have a laggard effect.

Of course, the above applies mainly to knowledge-based work in a corporate setting, not forgetting the millions of daily wage earners sweating it out for a meagre pay – who importantly make up the supply chain and demand chain that we profit from.

More work can be done with less resources

Arising from their experience of employee work performance during lockdown, nearly half of the CEOs felt that their organisational workload could be done with less resourcing. However, if this period would be representative of ‘normal’ times (to take decisions), this needs to be challenged. Furthermore, even if organisations can do with less staff (which ideally should have been figured out long before COVID-19!), any such decisions now can meet with severe socio-economic consequences.

SMEs, the lifeblood of the economy, at risk

The focus of this study was on large corporates, some of whom depend on SMEs as part of their supply and /or demand eco-system. Some of these CEOs expressed grave concern over the severe impact of the crisis on SMEs, whom they felt may not be able to withstand the blow. Chambers representing the SMEs too have expressed their concerns with regards to the handicaps faced by this sector in accessing bank credit.

stakeholders having their own / other challenges to deal with, it will be a stretch

stakeholders having their own / other challenges to deal with, it will be a stretchCompeting for a shrunk wallet

As the consumer’s wallet shrinks, they will be forced to make tough choices with their shrunk income, in particular the discretionary income. For example, do they pay their life insurance premium or the car lease rental? Pay the credit card bill on time (and avoid interest) or take that holiday? Businesses too will need to make such tough choices

Look beyond core domain capabilities

Businesses that were largely focused on core domain capabilities, as a result of COVID-19, have been challenged to quickly acquire, improve and adapt to adjacent capabilities. For instance, retail chains (thus far focused largely on their core retailing capabilities) have been challenged to improve their logistics and e-commerce capabilities.

supply chain to the ‘last mile’ of your demand chain, both ‘brick and mortar’ and virtually.

supply chain to the ‘last mile’ of your demand chain, both ‘brick and mortar’ and virtually.COVID-19 has reduced carbon emissions, but that's 'choking' the global economy! - MTI

COVID-19: Response to it

Costs: shoot at sight!

Cost cutting (described in many different ways) appears to be an immediate response of almost all (90%) of the businesses.

To about 1/4th of businesses, this appears to be their only ‘master stroke’ to survive the crisis. In such cases, we sensed a ‘kneejerk’ reaction to cost reduction. It was encouraging to see a small minority (about 1/5th) of businesses taking a more strategic approach to cost – by analysing ‘cost drivers’ as the basis of cost decisions.

Pay-cuts: symbolic or sustenance?

A diverse range of approaches were adopted by businesses, which includes:

Interestingly, a very small minority (under 10%) had paid their April bonuses, some even paid additional allowances for working during the crisis period.

In cases where CEOs sincerely engaged with their staff to discuss how they should respond to the crisis, there were instances of staff willing to take a voluntary pay-cut.

In companies that did not resort to pay-cuts (and where CEOs demonstrated a genuine effort to protect employee jobs), there was a very high level of employee engagement. In one such case, the employees took it upon themselves to get curfew passes and get their factories opened. In another, Managers performed the role of Security Guards and Janitors in a showroom.

addressing the associated concerns is important. This is also a good time consider a higher % of performance-based variable pay.

addressing the associated concerns is important. This is also a good time consider a higher % of performance-based variable pay.Head counts appear to be intact – but for how long?

With the exception of terminating contractual staff, none claimed to have retrenched payroll staff. We were told that as per Sri Lankan labour laws, the retrenchment of payroll staff and reducing their salaries, is technically not possible?

However, in industries where their entire demand chain has come to a grinding halt (like tourism and apparel), some tough decisions may be inevitable.

COVID-19 propels the digital agenda!

There has been a quantum increase in digital adoption (in both B2C and B2B), in domains as diverse as supermarkets, higher education, corporate banking, commodity trading – to name some. Almost all the respondents felt that COVID-19 has significantly advanced their digital agenda and created internal pressure to activate their digital initiatives.

The 126 year old Colombo Tea Auction going online - stands out as a significant achievement and signals what necessity can do!

More M&A activity expected

A heightened level of M&A activity is expected, due to the following reasons:

Sincerely engaging stakeholders in a crisis

About 1/4th of the CEOs interviewed had personally taken the lead to meet (in person or virtually) with their two main stakeholders i.e. staff and customer (mostly B2B). They felt it was important to sincerely relate to them in times of distress and did so without expecting any immediate commercial benefit.

However, they were all confident that both staff and customers will remember this gesture for a long time. They also emphasised the need to empathise with the deep-seated anxieties that these stakeholders would be experiencing as a result of this unprecedented crisis.

Maslow's Hierarchy re-visited!

Almost all B2C businesses interviewed reported significant changes in consumer behavior (within their domains) – covering the full lifecycle of on-boarding, purchasing, payment and importantly usage. Businesses in education, grocery retailing, financial services and telco reported significant changes in consumer behavior, which had forced them to make quantum adaptations fast

Underlying these consumer behavioral changes was the radical change in lifestyle arising from the lockdown. Consumer Needs took preference over Consumer Wants, reflecting in essential foods being prioritised, increased use / spend on broadband etc.

Given the number of people confined to their homes, there is an opportunity to make 'staycations' more exciting! - MTI

COVID-19: Learnings

from it?

Virtually a lot can be done!

What was once thought impossible or impractical is now being done virtually – from board meetings to job interviews, from training programs to regional sales meetings. Very interestingly, there is wide spread admission that it is getting things done in a much shorter duration, given the interfaces are far more focused.

However, the need to mix this kind of virtual interface with in-person interfaces (that promote social cohesion) has been expressed.

Re-structure when the going is good

There was admission that for some businesses, it may be too late to re-structure – given the kind of blow these businesses have been dealt with. “Much like the coronavirus, businesses with low immunity are the ones that will suffer most” as articulated by a Non-Executive Director. Therefore, some Business Leaders raised the question if re-structuring should be done in good times?

Always lean

Almost half of the business leaders recognised the need to have an ‘always-lean’ mode and not just in response to a crisis. They also recognised that this needs to be driven from the Board and C-suite and needs to go beyond corporate rhetoricn

methodology. ‘Why?’ and ‘So what?’ are two powerful questions to drive this change.

methodology. ‘Why?’ and ‘So what?’ are two powerful questions to drive this change.Greater focus on supply chain management

The following two concepts, considered as best practices, were challenged during the COVID-19 crisis:

Businesses that sensed a possible crisis (between 19 November and 20 January) were able to work on alternate sourcing, but for those requiring recurring high volumes it was not adequate.

Change the lenses with which you see your markets

Most businesses tend to view their market within the boundaries of their industry. This works well in times of stability.

During the lockdown, businesses were challenged with drastic changes in consumer behavior – the kind they have not encountered before. From online ordering to changed dietary habits, from in-home entertainment to online education.

This, of course, has challenged businesses to re-think their conventional approaches to business practices – from supply chain to ‘last mile’ fulfillment. Businesses also have found themselves competing in cross-categories – in trying to get a share of wallet.

Soon the face masks will come off, but businesses will have a lot more to unmask! - MTI

COVID-19: Fixes as a result of it?

Stress Test Business Models

Most corporates claim to have Business Continuity Processes (BCPs) and risk management frameworks in place and effectively practiced. Whilst the larger corporates tend to rely on the processes to ensure contingency management, the mid-tier corporates tend to rely more on the initiative and agility of their management team.

However, in both such cases, their business models were not adequately stress-tested. For instance, what if demand or supply comes to a grinding halt? The very process of asking the question and reflecting on it, better prepares a business for a crisis.

Risk manage via focused diversification

Businesses largely confined to one industry, particularly ones that were adversely impacted by COVID-19, expressed a desire for diversification.

If the intent is to diversify by being in very diverse industries, then it needs to be weighed against the dilution of focus by such a move. However, if diversification is by strategic investments, then the above argument is far less applicable. As markets mature and get more specialized, businesses will need to narrow their focus, as could be seen even in emerging markets like India.

Challenge Marketing Spends for ROI

Consumer lifestyles, buying behaviors and usage habits have all undergone significant change. There is also a somber mood that prevails among consumers – given multiple life challenges that they are grappling with.

Given the above, the A&P (Advertising and Promotional) strategies and practices of most businesses have been altered in response. Much like in any crisis, A&P has been on top of the list of ‘cuts’, this time it is likely to be deeper and for longer!

Interestingly on this occasion, several CEOs have raised serious questions on all types of marketing spend, the main ones being:

Critical KPIs that need greater focus

Two types of businesses that have been most impacted by the crisis are:

Self ‘insurance’ for high impact crisis

Some large businesses have been criticised for pay cuts, considering mass-scale retrenchment and even asking the Government for a bail out. The argument being, you make so much money for so long, surely can’t you tide over a few months of paying at least the basic salary?

Of course, this is a one-sided, outside-in view. Therefore, it is also important to understand the views and circumstances of these large companies. The intent of raising this point, coming from a handful of respondents, is not to criticise these large companies, but to look for a future solution.

Boards needs to ask the hard questions, more often

Board Directors, interviewed as part of this study, felt the need for greater focus on business model and strategic risks. Some acknowledged that matters relating to governance and compliance tends to take up most of their energy

Experiment with flexible working models

WFH on a full-time basis, as pointed out earlier in the study, may not be suitable for all. Neither is physically commuting to office daily.

Most corporate offices are located in Colombo, where real estate prices are the highest. A significant % of staff tend to live in the outskirts and spend considerable time commuting to office.

As pointed out by an always future proofing CEO: Consider setting up (or ideally on an out-sourced basis) lean office space in the outskirts of Colombo – which can significantly reduce travel time and still provide employees a conducive working environment that can be alternated with WFH

When confronted with a crisis, there is a choice to make.

Be a cry-sis or be a try-sis - MTI

COVID-19: National Response to it?

Government appreciated for its decisive handling of the crisis

The effective handling of the pandemic by the Government (via its military and healthcare eco-system) came in for commendation by many Business Leaders. Of course, there were the cynics as well! In terms of enabling operational logistics for factories to operate, businesses did encounter ‘road blocks’ early on, which appears to have been subsequently better enabled.

Whilst a few kept on complaining and criticizing the state of affairs, the smarter businesses found practical ways to work around it and get their operations off the ground. In the words of an export-industry CEO “these are unusual times, so you need to find unusual ways to survive and thrive!”

With regards to the gradual easing of the lockdown, the majority of the Business Leaders felt it was a prudent decision - considering the impact it has on both the livelihood of the masses and the continuity of their own business operations. Of course, there are a few who argue that we should wait until ‘Corona’ has been banished for good!

In the words of a Group CEO “In life we have to make choices. Each of these choices has an opportunity cost and risk attached to it. These are calculated judgement calls that we need to make. Only when you execute your decisions will you know how it works! We need to learn from each of these experiences and sharpen our response mechanism.”

MTI Perspective: The Government should consider digital-optimization of the full crisis lifecycle, from early warning systems to police passes to contact tracing.

Import Restrictions is an emergency treatment – not a protectionist privilege

The restriction of imports is considered a necessary short-term measure and it is hoped that local industries will see this as an opportunity to ‘up their game’ and not consider it as a protectionist privilege afforded.

This policy needs to be reviewed in the context of globalization and the principle of comparative advantage. The rising wave of economic nationalism and protectionism needs to be addressed cautiously and prudently.

MTI Perspective: Policy making and economic strategizing needs to be kept flexible and fluid – given that those living today have not handled a crisis of this magnitude.

Moratoriums are largely funded by depositors

The financial services sector is gravely concerned about the impact of the moratorium on their liquidity positions. They point out that approximately 85% of the money they lend is that of deposit holders (including senior citizens) - whose interest they feel is not getting due attention.

Due to the impact of the moratorium on liquidity, some of the smaller finance companies (whose financial position was weak pre COVID-19), may face ‘life threatening’ conditions! This could create panic among depositors and threaten even the relatively larger institutions.

The moratorium also delays the process of figuring out the impact of the crisis on the ‘going concern’ of the borrowers. This could potentially result in a massive spike in non-performing assets when the moratorium ends, the knock-on effect of which could be disastrous!

MTI Perspective: Consolidation of the NBFI sector (possibly even the Banking Sector?) needs consideration. Banks need to ‘innovate’ ways to sense the financial health of their clients during the moratorium and not wait until it ends for ‘surprises’! Consider incentives to encourage these clients to pay at least part of their dues during the Moratorium period?

COVID-19: National response

to it?

Government appreciated for its decisive handling of the crisis

The effective handling of the pandemic by the Government (via its military and healthcare eco-system) came in for commendation by many business leaders. Of course, there were the cynics as well! In terms of enabling operational logistics for factories to operate, businesses did encounter ‘road blocks’ early on, which appears to have been subsequently better enabled.

Whilst a few kept on complaining and criticising the state of affairs, the smarter businesses found practical ways to work around it and get their operations off the ground. In the words of an export-industry CEO “these are unusual times, so you need to find unusual ways to survive and thrive!”

With regards to the gradual easing of the lockdown, the majority of the business leaders felt it was a prudent decision - considering the impact it has on both the livelihood of the masses and the continuity of their own business operations. Of course, there are a few who argue that we should wait until ‘corona’ has been banished for good!

In the words of a Group CEO: “In life we have to make choices. Each of these choices has an opportunity cost and risk attached to it. These are calculated judgement calls that we need to make. Only when you execute your decisions will you know how it works! We need to learn from each of these experiences and sharpen our response mechanism.”

Import restrictions is an emergency treatment – not a protectionist privilege

The restriction of imports is considered a necessary short-term measure and it is hoped that local industries will see this as an opportunity to ‘up their game’ and not consider it as a protectionist privilege afforded.

This policy needs to be reviewed in the context of globalisation and the principle of comparative advantage. The rising wave of economic nationalism and protectionism needs to be addressed cautiously and prudently

Moratoriums are largely funded by depositors

The financial services sector is gravely concerned about the impact of the moratorium on their liquidity positions. They point out that approximately 85% of the money they lend is that of deposit holders (including senior citizens) - whose interest they feel is not getting due attention.

Due to the impact of the moratorium on liquidity, some of the smaller finance companies (whose financial position was weak pre COVID-19), may face ‘life threatening’ conditions! This could create panic among depositors and threaten even the relatively larger institutions

The moratorium also delays the process of figuring out the impact of the crisis on the ‘going concern’ of the borrowers. This could potentially result in a massive spike in non-performing assets when the moratorium ends, the knock-on effect of which could be disastrous!

COVID-19: Happen again

– will it?

In the near term, the focus of Governments and businesses (around the world) will be on coming out of the crisis, effectively ‘damage control’.

Bird flu, Swine Flu, Mad Cow Disease, COVID-19. See a common thread? - MTI

Ready for the next crisis?

Imagine if ‘COVID-20’ attacks the World Wide Web? It’s an ‘inconvenient thought’, but worth thinking about!

Global Financial Crisis was a 'circuit breaker' caused by the banks.

Currently we are experiencing a 'circuit breaker' caused by a virus.

Imagine when Mother Nature's 'circuit breaker' is applied on

us! - MTI

About MTI Consulting

MTI Consulting (www.mtiworldwide.com) is an internationally-networked, boutique management consultancy, enabling our clients to ‘Analyse > Strategise > Realise’ effective outcomes. Our practices include Strategy, Business Operations, Corporate Finance, HRM, Go-to-Market and Digital and Analytics.

Since its inception in 1997, MTI has worked on assignments in over 47 countries, covering a diverse range of clients, brands, industries and challenges. MTI is powered by a pool of internationally experienced Strategy Consultants and Analysts, augmented by a panel of Specialists – by Industry, Function and Geo-Domains and like-minded boutique consultancy relationships in over 30 countries