Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 9 October 2018 00:00 - - {{hitsCtrl.values.hits}}

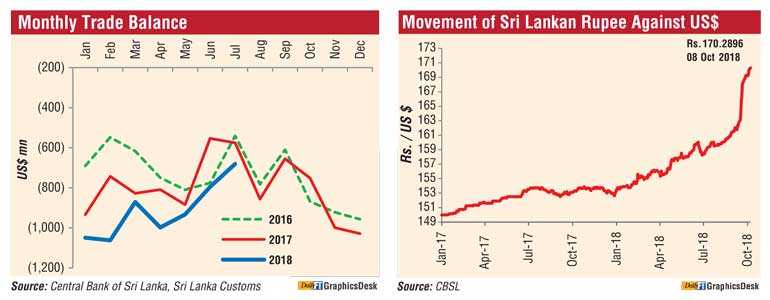

Despite exports topping $ 1 billion in July, Sri Lanka’s external sector delivered a mixed performance with the trade deficit climbing to $ 681 million year-on-year amidst increased imports of vehicles, fuel and transport equipment, the Central Bank said yesterday.

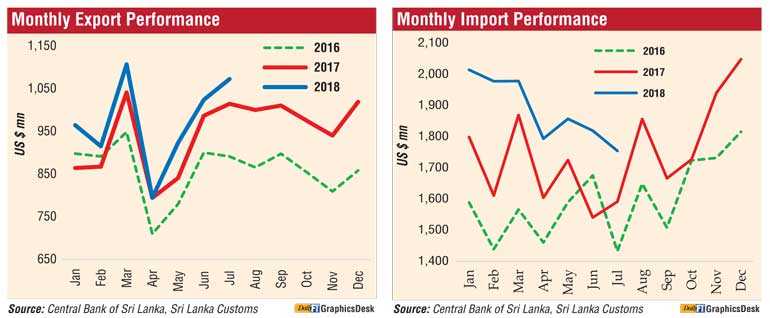

Export earnings grew 5.7% to $ 1,073 million in July from the previous year, while imports rose 10.3% to $ 1,754 million, the Central Bank said in its monthly External Sector report.

“The deficit in the trade account continued to expand in July 2018 in comparison to July 2017 due to higher growth in imports. On a cumulative basis, the deficit in the trade account widened considerably during the first seven months of 2018 in comparison to the corresponding period of 2017,” the Central Bank said.

Earnings from merchandise exports surpassed $ 1 billion for the second consecutive month in July 2018. Accordingly, earnings from exports increased by 5.7% year-on-year to $ 1,073 million. Earnings from industrial exports contributed to increased export earnings, while agricultural and mineral exports recorded poor performance during the month.

However, export earnings from textiles and garments declined marginally in July, due to the decline in demand from the US and non-traditional markets such as Canada, UAE and Australia and the base effect which reflected significantly high export earnings in July 2017.

Earnings from agricultural exports reduced due to poor performance in almost all categories except vegetables and minor agricultural exports. “Export earnings from tea also declined due to the drop in both prices and volumes exported, earnings from coconut declined owing to the reduction in all kernel categories as a result of lower export volumes despite higher prices reported for these products,” the Central Bank said.

Expenditure on merchandise imports increased by 10.3%year-on-year to $ 1,754 million in July 2018. The increased expenditure in all major import categories, on a year-on-year basis, as well as the effect of the low base in 2017, contributed to this growth.

Under intermediate goods, expenditure on fuel imports increased significantly during the month owing to higher import prices of crude oil and refined petroleum products. Expenditure on textiles and textile articles imports increased in July due to higher expenses on yarn and fabric imports.

However, reflecting the impact of the imposition of 15% Customs duty on gold imports, the Central Bank said the expenditure on importation of gold declined considerably for the third consecutive month in July.

Meanwhile, consumer goods imports increased mainly due to higher imports of personal motor vehicles, particularly cars with less than 1,000 cylinder capacity (cc), hybrid and electric motor cars. To curb imports of small vehicles, taxes applicable on these categories were revised upward with effect from 1 August. Further, a 100% margin deposit requirement against letters of credit on non-commercial vehicle imports was imposed with effect from 19 September.

Considering the continuous pressure on the BOP from increased imports, the Government and the Central Bank implemented further measures to restrict the importation of vehicles and certain non-essential consumer goods.

However, expenditure on food and beverages declined in July 2018 as a result of lower rice imports owing to the healthy harvest obtained during the Maha season.

Meanwhile, import expenditure on investment goods increased owing to higher imports of machinery and equipment, building material and transport equipment. India, China, UAE, Japan and Singapore were the main import origins in July 2018 accounting for about 62% of total imports.

In terms of financial flows, the Central Bank said the foreign investments in the Colombo Stock Exchange (CSE), including both primary and secondary market foreign exchange flows, recorded a net outflow of $ 3 million during July. “Consequently, cumulative net inflows to the CSE in the first seven months of 2018 amounted to $ 50 million, with a net outflow of $16 million from the secondary market and an inflow of $66 million to the primary market during the period.”

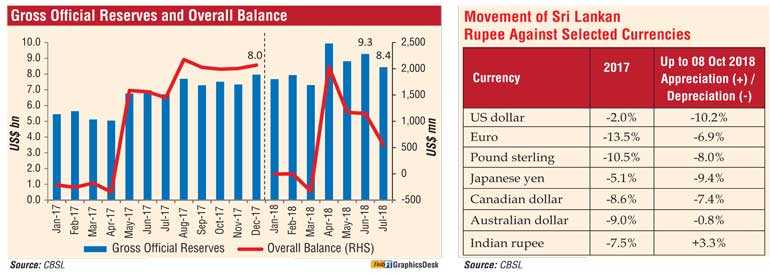

Recent developments in the global financial markets, particularly the strengthening of the US economy, which prompted an increase in policy rates of the Federal Reserve Bank, resulted in outflows of foreign investments from capital markets in emerging economies. “This impact was also felt in Sri Lanka, leading to continuous foreign investment outflows from the Government securities market particularly in the third quarter of 2018. Consequently, foreign investments in the Government securities market recorded a net outflow of $ 53 million in July 2018, resulting in a cumulative net outflow of $ 229 million during the first seven months of 2018,” the Central Bank said.

The rupee depreciated by 10.2% against the US Dollar in the year up to 8 October. Furthermore, reflecting cross currency movements, the rupee depreciated against other major currencies except for the Indian rupee during this period. The weakening of the rupee against the dollar mostly reflects a broad-based strengthening of the dollar globally.

At end July, gross official reserves were estimated at $ 8.4 billion, equivalent to 4.5 months of imports. Consequently, total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, were estimated at $ 10.8 billion as at end July, which was equivalent to 5.8 months of imports.

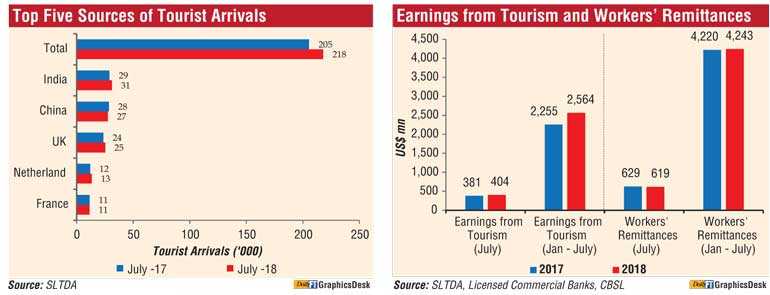

Earnings from tourism in July were estimated at $ 404 million, with cumulative earnings amounting to $ 2,564 million during the first seven months of 2018, the Central Bank said, releasing the External Sector Performance for July.

Despite July being the traditional off-season period of the year, tourist arrivals increased moderately by 6% with 217,829 tourist arrivals in July.

Total tourist arrivals during the first seven months of 2018 were 1,382,476 with a growth of 13.7% in comparison to the corresponding period of 2017.

Growth in tourist arrivals from India, the United Kingdom, Netherlands, Australia and the United States contributed to the higher number of tourists during the period.