Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 17 May 2022 02:26 - - {{hitsCtrl.values.hits}}

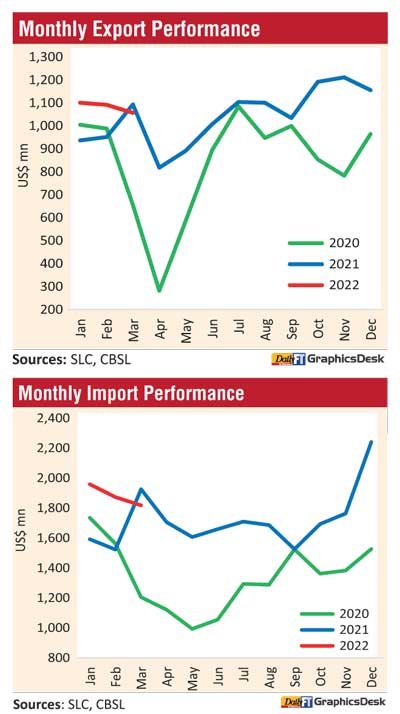

Export sector in March notched its 10th consecutive month of over $ 1 billion performance whilst lower imports saw trade deficit decline during the month year-on-year.

The Central Bank said earnings from exports exceeded $ 1 billion for the tenth consecutive month in March, despite a marginal decline compared to a year earlier. Import expenditure recorded a notable decline, year-on-year, for the first time since February 2021. As a result, the trade deficit declined in March on a year-on-year basis.

The deficit in the trade account narrowed to $ 762 million in March, compared to the deficit of $ 832 million recorded in March 2021 and $ 781 million recorded in February. However, the cumulative deficit in the trade account during January to March widened to $ 2,402 million from $ 2,059 million recorded over the same period in 2021.

Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 16.0% in March, compared to March 2021, as the import prices increased on a y-o-y basis, compared to a corresponding y-o-y decline in export prices.

Performance of Merchandise Exports

Overall exports: Earnings from merchandise exports in March declined by 3.4% over March 2021 to reach $ 1,057 million. A decrease in earnings was observed in agricultural exports and mineral exports, while an increase was recorded in industrial exports. The cumulative export earnings increased by 9.0% during January-March over the same period of the last year, amounting to $ 3,249 million.

Industrial exports: Earnings from the export of industrial goods increased in March by 2.9%, compared to March 2021. This was mainly due to the increase in earnings from export of petroleum products and gems, diamonds and jewellery (mainly gems). Earnings from the export of petroleum products improved due to the increase in both prices of bunker and aviation fuel exports and volume of aviation exports. Further, a sizable increase was recorded in the exports of base metals and articles (mainly lead and aluminium and articles thereof), leather, travel goods and footwear (mainly footwear), transport equipment (mainly cruise ships) and animal fodder (mainly poultry feed).

However, a decline in earnings was reported in the categories of rubber products (mainly household rubber gloves), food, beverages, tobacco (mainly smoking tobacco, animal or vegetable fats and oils and coconut milk powder), textiles (mainly yarn), printing industry products (mainly currency notes), plastics and articles (mainly plastic sacks and bags), chemical products and ceramic products. Export of garments to most major markets improved, though a marginal decline was observed in garment exports.

Agricultural exports: Total earnings from the exports of agricultural goods in March declined by 22.6%, compared to March 2021, with a broad-based decrease in export earnings in all subcategories driven by lower volumes. The export earnings from tea declined significantly by 24% (y-o-y), due to the decline in both volume and price of tea exported. Earnings from spices declined by 39.8% (y-o-y) in March 2022 due to lower export volume of cinnamon, pepper and cloves.

Mineral exports: Earnings from mineral exports decreased by 57.1% in March, compared to March 2021, due to a decline in export earnings from titanium ores categorised under ores, slag and ash.

The export volume index declined by 1.6% (driven by agricultural exports) while the export unit value index declined by 1.8%, (y-o-y), in March 2022, indicating that the decline in export earnings can be attributed to the combined impact of lower export volumes and prices.

Performance of Merchandise Imports

Overall imports: Expenditure on merchandise imports, which has been falling on a month-on-month basis since January, continued the decline recording the first year-on-year decline since February 2021. Accordingly, import expenditure declined by 5.6% to $ 1,819 million in March, compared to $ 1,926 million recorded in March 2021. A decline in expenditure was observed in import of consumer goods and investment goods, while an increase was recorded in import of intermediate goods. On a cumulative basis, total import expenditure amounted to $ 5,651 million during the first quarter of 2022, recording an increase of 12.1% (y-o-y). Considering the continuous pressure on the external sector, the Government imposed several restrictions on selected non-urgent and non-essential consumer items during March, such as import license requirements, while increasing import duties.

Consumer goods: Expenditure on the importation of consumer goods declined by 25.7% in March, compared to March 2021, with a 13.6% reduction in food and beverages and a 37.8% reduction in non-food consumer goods. The year-on-year decline in the food and beverages import expenditure was primarily driven by the lower import volume of sugar and vegetables (mainly onions and dhal). Further, a sizeable decrease was observed in the import expenditure led by lower volumes of oils and fats (mainly coconut oil), dairy products (mainly milk powder) and spices (mainly chillies).

However, expenditure on cereals and milling industry products remained high in March, compared to March 2021, mainly due to the increase in expenditure on rice imports. Expenditure on the importation of beverages also increased to some extent. The decline in the expenditure on non-food consumer goods was driven by the decline in the importation of telecommunication devices (mainly mobile phones), home appliances (mainly televisions) and medical and pharmaceuticals (mainly medicaments), while clothing and accessories, such as footwear and suits, recorded an increase.

Intermediate goods: Expenditure on the importation of intermediate goods increased by 4.2% in March, compared to a year ago. Expenditure on fuel led the increase, although import expenditure on many other intermediate goods decreased, particularly base metals (mainly iron and steel), chemical products (mainly dyeing, tanning and colouring and inorganic chemical elements), plastics and articles thereof, rubber and articles thereof, vehicle and machinery parts (mainly electrical machinery parts and motor vehicle parts) and textiles and textile articles (mainly yarn). Despite the non-importation of crude oil, higher average import prices led the expenditure on fuel (including refined petroleum and coal) that increased by 49.7% (y-o-y), recording at $ 520 million which was the highest monthly expenditure on fuel since March 2012.

Investment goods: The 13.9%, (y-o-y), decline in the expenditure on the importation of investment goods in March, was the result of decreases in all three types of investment goods, namely machinery and equipment, building material and transport equipment. The decline in machinery and equipment was led by lower imports of electric motors and generating sets, machinery and equipment parts, office machines and turbines.

Meanwhile, import expenditure on building material declined, owing to aluminium articles, articles of iron and steel and wood products, despite an increase in the expenditure on cement and iron and steel, while expenditure on transport equipment declined, mainly due to lower imports of tankers and bowsers and tractors.

The import volume index declined by 19.2% while the import unit value index increased by 16.9%, (y-o-y), in March, implying that the decline in import expenditure in March was mainly driven by the volume effect.