Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 28 September 2018 00:00 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

By Charumini de Silva

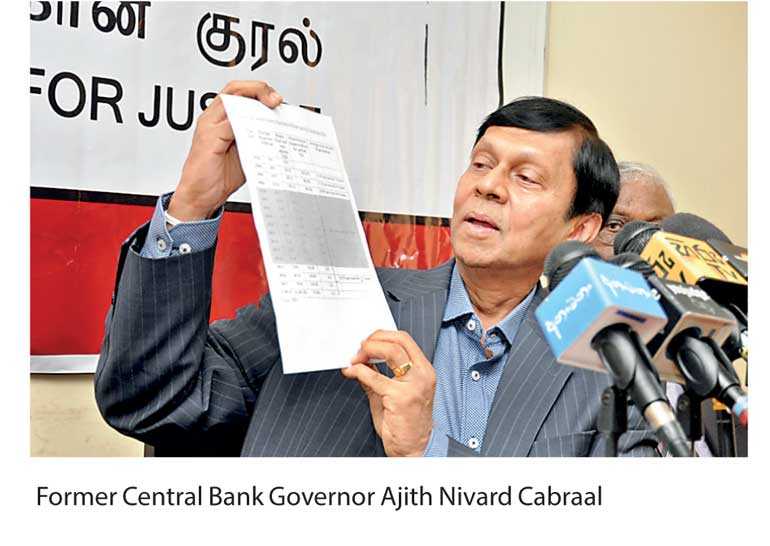

Former Central Bank Governor Ajith Nivard Cabraal on Wednesday charged the Collation Government with bad economic management and damaging investor confidence in the country.

“Trust and confidence are the cornerstones of any economy, and this Government ruined it completely during the past three years and it will continue to deteriorate further,” he told reporters in Colombo yesterday.

Despite presenting nine economic plans within last three years, he said the decision-makers had failed to implement any of them prudently, leaving the country’s economy in difficult position.

“This shows the incompetency of this Government,” he added.

Cabraal asserted that during his nine year tenure at the Central Bank, they forecasted all internal and external factors that could have adversely impacted the economy, and took far-sighted measures without passing on any ‘shockwave’ to businesses, foreign investors and general public.

“We managed the economy during the worst global financial crisis, we continued the war until peace was established, we continued all development and economic activities, carried out the subsidies on fertiliser and Samurdhi welfare. We did not lament on any of these situations, but we found solutions. We did not pass the shock to the general public or investors, but built confidence on our economy,” he explained.

The Government has claimed that the reason for the rapid depreciation of the rupee was due to exogenous factors, particularly the strengthening of the US economy and with that, the US dollar; however, Cabraal said, to date the rupee has even depreciatedbelowBangladeshi,Zimbabwean and Ethiopian currencies.

“Many Government MPs rush to explain that all currencies have depreciated against the USdollar. To support that contention, the Central Bank has carefully selected certain currencies as examples, while neglecting to mention that several have depreciated much less against the US dollar than the Sri Lankan rupee. The average year-on-year depreciation of the rupee from 1 January 2015 to 21 September 2018 was 9.2% per year. Official foreign reserves have been almost flat at around $ 8.4 billion when compared to the level at end 2014,” he pointed out.

Noting that reserves are expected to decline rapidly from now onwards, with the Central Bank (reportedly) having supplied a staggering $60 million (Rs.10,200 million) to the Forex Market on Tuesday, to artificially prop up the crashing rupee.

While instability of the economy has been compounded by the fact that confusing signals have been emanating from those in authority almost on a daily basis, Cabraal said the Central Bank is the only institute that provides sensible responses for the deteriorating economy.

“Central Bank Governor Dr.Indrajit Coomaraswamy proclaims the bank is ‘ready to prevent excessive volatility’, while Senior Deputy Governor Dr.Nandalal Weerasinghe insists the Central Bank ‘will intervene aggressively’. These are the kind of reactions we expect, not lamentation or shocks that further worsen confidence in the economy,” he added.

He claimed that it was unfair by the Government to curtail imports, when Sri Lanka is an economy that is highly dependent on imported goods. “It is absurd to tell people what to buy and what not to. This is indirectly describing that they cannot do a proper job in economic management,” he said.

According to him, the next episode of the economy going downhill would include prices of goods sky rocketing, the country’s credit rating falling below Greece, interest rates declining, the stock market going downwards, reduction in new projects, discontinued foreign investments, high debt burden, expanded trade deficit, a depreciated and highly volatile rupee, as well as increased public demonstration on the ill management of economy.

“With regret we have to tell these to the people, otherwise they will blame us for not cautioning on them. It is sad that decision-makers have not taken any prudent action thus far, and it is hard to believe that they will do anything in future,” he emphasised.

Cabraal insisted that unless a new regime comes into power,the economy will continue to deteriorate, and outlined building business confidence, stabilising rupee, increasing interest rates, and encouraging local investments were the only remedies to rebound the economy.

“Before having to start a new program ‘Enterprise Sri Lanka’, the Government needs to encourage the existing businesses and industries. Not only the foreign investors, but even the local entrepreneurs have lost confidence in the economy at present. Theoretical knowledge alone is not enough, we need practical knowledge as well to run the economy,” he said.

Pic by Lasantha Kumara