Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 14 January 2020 00:00 - - {{hitsCtrl.values.hits}}

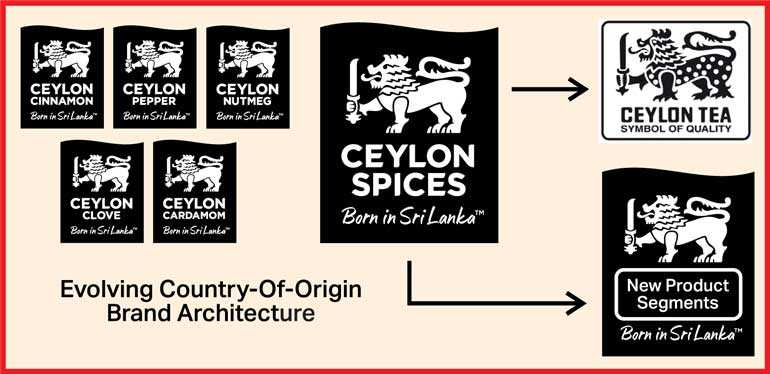

The Sri Lankan Export Development Board’s country-of-origin certification mark for the spices sector supports growers, processors and manufacturers by helping them to identify their products as ‘Sri

|

Interbrand’s Sri Lanka Partner

|

|

Interbrand Global Lead Destination Branding (Exports, Investments, Tourism)

|

|

Brand Strategist Pesala Karunaratne |

Lankan Born,’ and informs customers and consumers that all significant parts, produce, processing and products are of genuine Sri Lankan origin.

The strategy is also underpinned by a third-party accreditation system which ensures that certified products meet rigorous standards in accordance with Sri Lanka-Origin claims.

Spearheaded by the Export Development Board, the matrix of stakeholders includes the Department of Agriculture, Department of Export Agriculture, Department of Commerce, Ministry of Development Strategies and International Trade, Ministry of Primary Industries, Ministry of Agriculture, Ministry of Foreign Affairs, Sri Lanka Customs, Sri Lanka Accreditation Board, Sri Lanka Standards Institution, and the Industrial Technology Institute.

Market dynamics

To develop the final positioning, the 18-month project included a global quantitative study of current and future market dynamics and a segmentation of key competitor countries by volume and value market share, as well as inputs from global value chain experts in France and the UK.

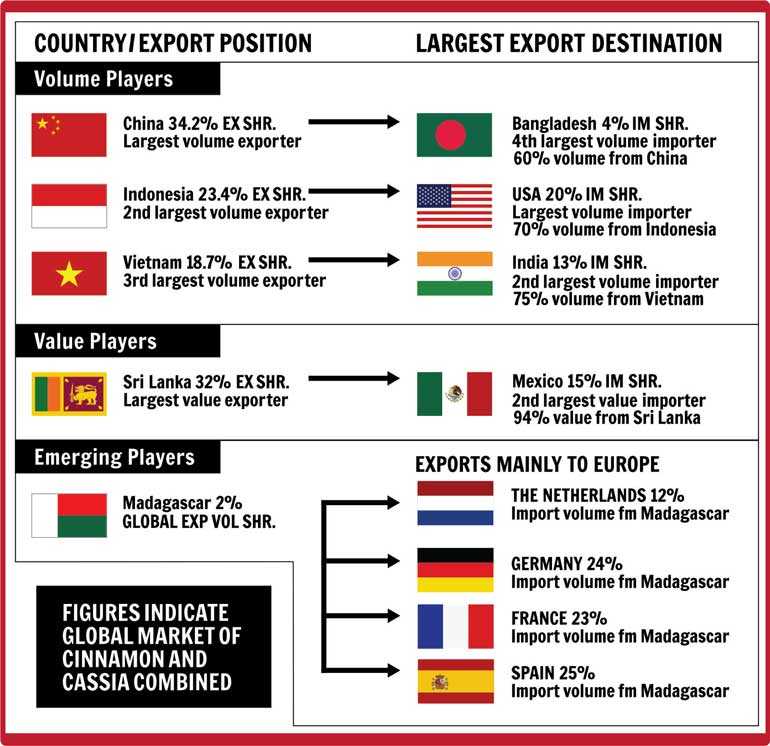

“The key volume import markets globally are the US with 20% vol share, India with 13%, Mexico with 4.4% and Bangladesh with 4%,” said Pesala Karunaratne, Brand Strategist. “The key value import markets are the US with 20% val share, Mexico with 15% and India with 8%.

“Indonesia, Vietnam and China have emerged as the key volume players, aggressively leveraging scale to build bargaining power and value chain partnerships upstream and downstream to drive higher margins. All three countries produce Cassia, which directly substitutes Ceylon Cinnamon in consumption,” he added.

“Due to the price premiumness of Ceylon Cinnamon and the wider availability of Cassia, industrial buyers use a mix of Ceylon Cinnamon and Cassia in their recipes to lower input costs. This has triggered greater demand for Cassia.”

Karunaratne says the analysis also shows that Indonesia, Vietnam and China strategically focus on different regions globally. “Indonesia concentrates on developed markets in the US and Europe – it dominates the US with 70% vol share and 59% val share.

“Vietnam and China, however, have positioned their industries to supply rapidly growing demand from South East Asia, South Asia and the Middle East. Vietnam commands 75% vol share and 78% val share in the Indian market, while China has 60% vol share and 61% val share in Bangladesh.”

“Sri Lanka accounts for 9% of volume share and 32% of value share globally. It continues to perform strongly in Latin America and dominates the Mexican market, with 84% vol share and 94% val share. Mexico is the third largest volume imports market with only 4.4% volume share, although it accounts for 15% value share, the highest globally.”

A significant competitive threat is emerging from Madagascar, one of the few countries outside Sri Lanka to also cultivate Ceylon Cinnamon. Madagascar’s main markets in Europe include the Netherlands with 25% vol, while 16%, 13% and 10% are exported to Germany, France and Spain respectively. With a 2% volume share globally against Sri Lanka’s 9%, Madagascar records a high CAGR of 17% vol and 31% val respectively.

During the past five years, Sri Lanka has seen a value share gain of 2.2% and a CAGR of 11% against the industry’s 13%, which could be attributable to price growth in the overall category. However, during this same period, the country’s volume share declined by -1.7% with a CAGR at -9% against an industry CAGR of 2%.

Sri Lanka continues to be challenged in increasing volumes in the medium- to long-term due to the country’s limited availability of large-scale land for commercial production and the prevalence of unorganised, smallholder farming.

Karunaratne said the goal must be to increase volumes to meet future global and market-wise demand. “This would enable Sri Lanka to consolidate and grow its share in Mexico and Peru, both traditional markets that have recently seen gains by Madagascar, but more importantly to refocus and diversify into new markets where Sri Lanka’s share is significantly smaller – such as North America – or where its share is negligible, like the UK, Germany, the Netherlands and Spain.”

Transparency and traceability

In addition to the quantitative study, a three-month qualitative research study – with growers,  processors and manufacturers in Sri Lanka and industrial customers in key export markets in Germany, Mexico, the USA, and India – prioritised the demand drivers for the category, as well as cinnamon and pepper.

processors and manufacturers in Sri Lanka and industrial customers in key export markets in Germany, Mexico, the USA, and India – prioritised the demand drivers for the category, as well as cinnamon and pepper.

“Our research in these markets shows that consumer preferences are increasingly establishing food consumption trends,” said Michel Nugawela, Interbrand’s Sri Lanka Partner.

“They are demanding more transparency and willing to pay a premium on credible information prior to consumption regarding origin, how products are produced, how they are certified by authorised bodies, how they are labeled with safety assurances, and how they move through the supply chain.

“But traceability on its own is not valued unless it is associated with food safety management systems and quality management systems like HACCP, SQF, GAP, GHP, GMP, and/or other credence attributes.”

In recent years, supply chain transparency and traceability is increasingly driven by flavour and fragrance producers who now directly sourcing raw material at origin. The close partnership Givaudan has developed with Madagascar based on their ‘Sourcing for Shared Value’ approach, for example, provides the manufacturer with a direct sourcing model that creates value among smallholder producers and village associations, and, in turn, offers the best ingredients to their customers.

Givaudan’s inauguration of NATEMA with Henri Fraise Fils et Cie in 2017 also provides Madagascar with the knowledge to develop and process natural ingredients into derivatives for its fragrance and flavours lines. “Since Sri Lanka continues to be challenged in increasing volumes in the medium- to long-term, a stronger industry and government commitment to ramping up research and technology capabilities to manufacture derivatives, as well as entering and consolidating presence in markets with higher purchasing power for value added products, will be a critical success factor,” said Nugawela.

Portfolio strategy

A key objective would now be to develop a larger basket of spice products with the potential to gain visibility, credibility, and growth by closely identifying its offering with Ceylon Cinnamon. “True or Ceylon Cinnamon continues to drive the equity of the ‘Ceylon’ trade name through its positioning as a high-quality, niche offering in an increasingly commoditised global market,” said Nugawela.

“Each of these products – clove, nutmeg, cardamom, and pepper – share equally unique profiles and properties. Ceylon Pepper, for example, boasts the highest piperine levels, between 7-15%, against Indian, Malaysian, and other varieties of pepper which have as little as 2-7%. Cardamom also claims a differentiated profile.

“We are now leveraging these properties through a unified positioning and proposition, against global competitors who have been quicker in branding their products with strong origin claims, such as Telicherry or Vietnam Pepper.”

‘Born in Sri Lanka’

“Nation branding strategically steers the image of a country in order to increase trade, attract  companies and foreign direct investment, or stimulate tourism,” said Guido van Garderen, Global Lead Destination Branding (Exports, Investments, Tourism), Interbrand, who closely worked on the strategy.

companies and foreign direct investment, or stimulate tourism,” said Guido van Garderen, Global Lead Destination Branding (Exports, Investments, Tourism), Interbrand, who closely worked on the strategy.

“When differences between products become arbitrary, perception of the brand dictates reality. One way to think of a nation brand is as a set of associations, and a well-defined brand helps countries gain a strategic long-term brand advantage.”

Tangible and intangible demand drivers, including emotional contributors such as geography and heritage of place, were also derived through the three-month qualitative research study, and resulted in the positioning strategy.

“The ‘Born in Sri Lanka’ platform communicates four key associations which, when taken together, competitively define Sri Lanka-Origin claims in this sector, and broadly correspond with the ongoing process of Geographical Indication for Ceylon Cinnamon: 1. Indigenous and/or endemic products; 2. agro-climatic conditions; 3. proprietary knowledge; and 4. the spirit of the small farmer.

1. Born in Sri Lanka because ‘true’ cinnamon (Cinnamomum verum) spread to the rest of the world from its native home of Sri Lanka.

2. Born in Sri Lanka because Sri Lankan spices are grown from seed to crop and processed exclusively in the island, which has the prime agro-climatic conditions and properties required for their cultivation – unique soil conditions, nourished by monsoon rains, and energized with bright sunlight.

3. Born in Sri Lanka because of age-old knowledge and expertise not found elsewhere in the world. Sri Lankan spices are handpicked and cared for by farmers, as they have for generations (or centuries).

4. Born in Sri Lanka because it’s brought to customers from Sri Lanka, by Sri Lankans, who passionately understand the value of spices, use them in their favourite meals and dishes, and believe in their transformational flavour and fragrance qualities.

Wider strategy for standardisation

The country-of-origin mark is administered by the Sri Lanka Export Development Board and part of a wider strategy of standardisation for ‘Sri Lankan Made’ products that raises their profile in international markets.

“Just as Sri Lanka lends its personality to indigenous brands, successful brands also influence perceptions of their homeland,” Nugawela said.

“The more brands that consumers know are ‘Sri Lankan Made’, the more likely they are to prefer Sri Lanka as a country-of-origin. This is essential if Sri Lanka-Origin claims are to be represented by a single standard of quality and unity for Sri Lankan businesses and brands in the global market.

“The goal is for Sri Lankan produce and products to enjoy significant recognition and trust around the world, as an identifier of genuine Sri Lankan origin.”