Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 9 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Ceylon Tea Brokers Plc

The second quarter of 2015 has seen a further downward trend in the tea industry as a whole. Due to a continued dependence on exportation to conflict zones and politically unstable and sanctioned countries, the ability to regain momentum is currently severely barred. Hence, sustained reliance on trading with nations such as Russia, Iraq, Iran and Syria, which are some of the largest importers of Sri Lankan tea, does not abode well for the future prospect of a resurgence in this market.

Furthermore, the decline in the price of oil and the appreciation of the US dollar has further aggravated the gravity of the lack of revenue generated by the local tea market due to loss in purchasing power. Additionally, the resurgence in the US economy, the impending interest rate hike and overall appreciation of the US dollar has further affected the buying power of most importing countries. Moving forward it appears to be imperative that the garnering of new exports markets is the only viable means for the local tea industry to maintain its continued stability.

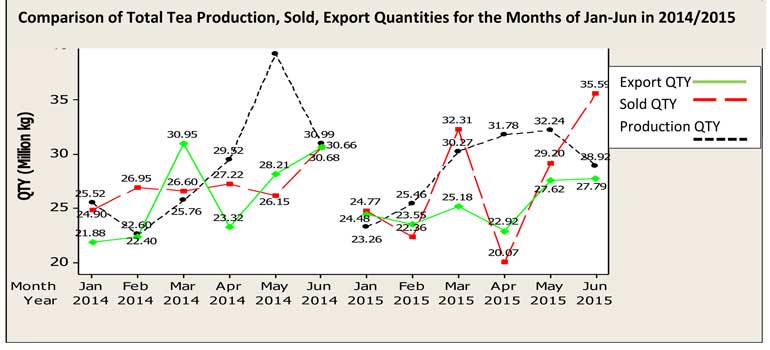

The total production of Sri Lanka tea for the first half of 2015 recorded 172.61 million kilos in comparison to 173.63 million kilos for the same period last year (a differential of – 1.02 million kilos). Therefore, although production levels remain almost at par, exports have dropped by 5.89 million kilos compared to the same period last year, thus creating a larger weight of teas remaining unsold.

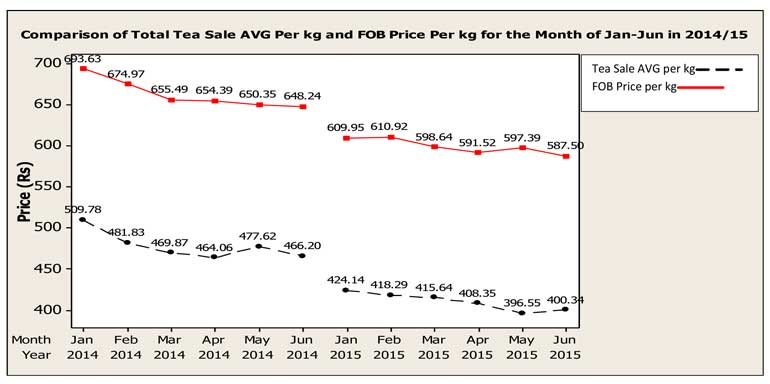

The total National Average of the Teas sold for the first half of the year was Rs. 409.68 in comparison to Rs. 477.55 (- Rs. 67.87) for the same period last year. The rupee and the US$ equivalent average for the first half of 2015 shows a decline from the corresponding averages of 2014 as well as 2013.

Low Growns having the largest market share with 60% of production recorded the sharpest decline at – Rs. 80.63, with Mid Growns recording a decrease of –Rs. 53.75 and High Growns seeing the least reduction of – Rs. 43.63 YOY. Low Growns averaged Rs. 428.42, Mid Growns recorded Rs. 370.26 with High Growns at Rs. 384.71 for the cumulative period January to June 2015.

Sri Lanka Tea Exports for the first half of 2015 amounted to 151.54 million kilos, a decline of 5.89 million kilos from the same time last year. The FOB average price per kilo for this period stood at Rs. 599.03 in contrast to Rs. 661.06 (-Rs. 62.03) YOY for the same period.

The FOB value of tea bags remained stable, however, its export volumes have decreased so far this year. Tea in packets and bulk saw dramatic price reductions. However, tea in bulk has seen a sharp rise in volume due to importation by trading hubs for blending and re-export purposes: A market niche that could have been a valuable asset to Sri Lanka. The total revenue realised for the first half 2015 from tea exports was Rs. 90.78 billion, a sharp decline from 104.74 billion (- Rs. 13.96 billion) realised last year.

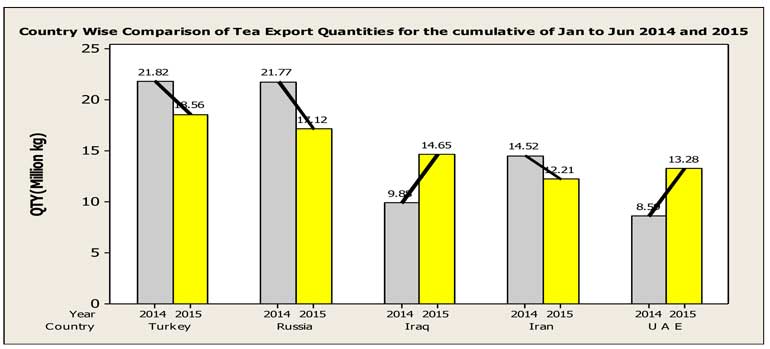

Turkey continues to be the largest export destination for Sri Lankan tea due to its current position as a distribution hub in the region. As a result direct purchases from Syria and Libya have decreased. Russian imports have decreased significantly due to continued sanctions and falling oil prices that affect their buying power. However, Iraq has significantly increased its purchases, whilst Iran has seen a reduction in their imports. UAE continues to evolve as a major hub for blending and redistribution and has therefore significantly increased their import of Sri Lankan bulk tea.

Probable trends in export markets for rest of the year

Turkey continues to dominate the market by retaining its title as the number one importer of Sri Lankan tea. It has also established itself as a redistribution hub in the region directly servicing countries such as Syria, Libya and other Middle Eastern nations. (In 2010, total exports of goods from Mersin, a Southern Port in Turkey, to Syria were valued at $ 17 million, soaring to over $ 150 million this year – an increase of over 700%).

Russia remains Sri Lanka’s second largest tea importer despite the fact that quantities purchased have experienced a decline. The effects of the international sanctions and the depreciation in oil prices (which makes up 58.6% of Russia’s total exports), along with the further loss in value of the Ruble has greatly affected its purchasing power. Additional pressure on the Rouble will further affect Russia’s future buying power. Iraq has seen the highest increase in the import of Sri Lankan tea YOY by an upswing of 4.77 million kilos in the first half of 2015, making it currently the third highest purchaser in the local tea sector. The mobilisation of more personnel within the country has possibly contributed to the visible increase of Sri Lankan tea exports to Iraq.

Since recently establishing itself as a blending and re-export hub for tea, the UAE has almost doubled its purchases from the Sri Lanka tea market. As their success in this sector continues to grow exponentially, it is likely that the volume of bulk teas purchased from Sri Lanka could increase significantly.

As the lifting of international sanctions continues to await a decision from the US congress - whose deadline for acceptance or rejection is later this month, followed by inspection and compliance of nuclear sites by the UN and the International Atomic Agency, and finalized by a staggered release of sanctions over an extended period of time - Iran continues to remain an uncertain prospect.

Furthermore even if compliance was to be established shortly, Iran may still be compelled to stay with the status quo until the gradual phasing out of sanctions can have a significant enough impact on its revenue stream. It is also worth taking into consideration that most Western and specifically US banks are not permitted to engage in business with Iran regardless of any sanctions being lifted until further approval is granted by the American authorities. Therefore, Iran remains uncertain as to the possibilities of an increase of exports in the immediate future.

Emerging markets

China and India continue to exhibit a steady growth in their purchasing trend of Sri Lanka tea. YOY India is up 2.58 million kilos for the first half of 2015 with China purchases having a gain of 1.1 million kilos in the same period.

Moving forward it is imperative that the Sri Lanka tea industry begins to shift its export markets from countries that are affected by the vulnerabilities of oil income dependency, political conflicts and economic sanctions. The recent devaluation of the Sri Lankan rupee should also help to boost the rupee prices at the auction. In order to secure the profitability of the industry, it is therefore vital for Sri Lanka to begin establishing relationships to secure new markets (specifically Western countries). Given the success of the UAE as a tea blending and re-exporting hub, it seems prudent that Sri Lanka should also seek to establish itself along similar lines (with consideration taken into account for its local producers) so as to eliminate the losses. The viability of the Sri Lankan tea industry is currently in jeopardy due to stagnancy in its historical markets. A significant shift in direction is therefore necessary at this juncture, in order to ensure that the Sri Lankan tea industry continues to evolve and keep up with trends in the global beverage sector.