Saturday Feb 28, 2026

Saturday Feb 28, 2026

Wednesday, 26 April 2017 00:10 - - {{hitsCtrl.values.hits}}

By Ceylon Tea Brokers Plc

By Ceylon Tea Brokers Plc

The Sri Lankan Tea industry had a challenging year covering production levels which cumulated to a decline in export levels. Climate change which had a significant impact on the tea production in the forgone year resulted in an unforeseen historical decline in production levels. Whilst the averages reached all time high record levels which was portentous to the industry and the marginal increase in total revenue YOY was inconsequential due to the static growth witnessed in the past few years.

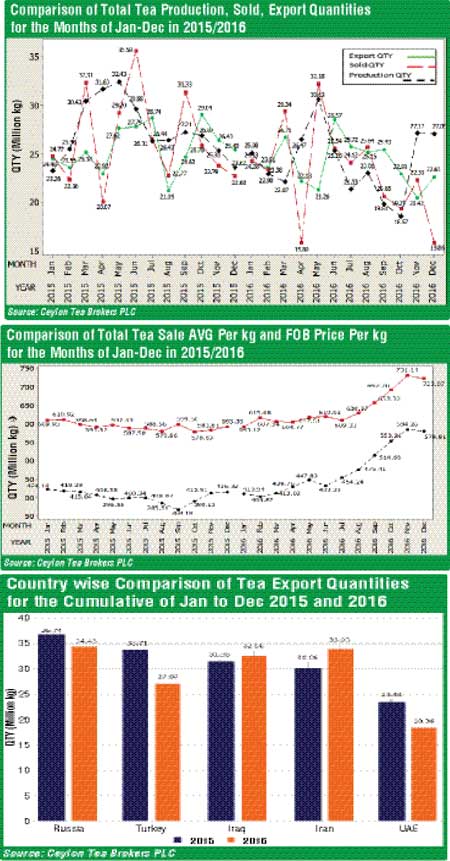

The total tea production of Sri Lankan Tea for the year 2016 recorded 292.4 m kg in comparison to 328.8 m kg for the same period in 2015 (-36.4 million kilos). Though production declined by 36.4 million kilos, exports have decreased by 18.19 million kilos compared to the same period in 2015, thus creating a shortage of tea for exports.

The total National Average of Teas sold for the year 2016 was Rs. 468.61 ($ 3.22) per kilo in comparison to Rs. 402.14 ($ 2.96) (+Rs. 66.47) for the same period in 2015. Low Growns having the largest market share with 60% of the production recorded the sharpest increase at (Rs. +70.42) with Mid Growns recording an increase of (Rs. +57.02) and High Growns recording an increase of (+Rs. 61.47) when compared to 2015. Low Growns averaged Rs. 486.74, Mid Growns recorded Rs. 419.59 with High Growns at Rs. 449.85 for the cumulative period of January to December 2016.

Auction averages January /December 2016 which realised Rs. 468.61 records as the highest ever average for a calendar year superseding Rs. 461.86 achieved in 2014. High and medium grown averages recorded for the year 2016 is also the highest ever recorded. High growns realised Rs 449.85 whilst medium growns recorded Rs. 419.59. On analysing the averages in USD terms 2016 levels show a gain compared to 2015 averages but its lower to 2014 levels.

Sri Lankan Tea Exports for the period January to December 2016 amounted to 288.77 million kilos. A decline of 18.19 million kilos compared with the same period last year. The FOB average price per kilo for this period stood at Rs. 639.88 in contrast to Rs. 593.08 (Rs. +46.80) when compared to year 2015. The FOB value of Tea Bags has moved up in comparison to the same period in 2015. The FOB value in Tea Bags recorded Rs. 1191.55 per kg for the year 2016 vis-à-vis Rs. 1125.41 per kg in 2015 (+66.14). Its export volumes show a marginal increase. Tea in bulk and packets saw a substantial price increase YOY.

Country wise analysis of exports shows that the Russia remains as the largest importer of Sri Lanka tea for the period of January-December 2016 followed by Iran and Iraq.

Total export earnings for January to December 2016 amounted to Rs. 184.78 billion showing a slight gain of Rs. 2.72 billion (+1.50%) as against the same period last year.

In terms of the US$ equivalent, based on the respective weighted average exchange rates, export earnings amounted to $ 1.26 billion in 2016 compared with $ 1.34 billion in 2015 and $ 1.63 billion in 2014.

The global GDP growth rate is expected to be around 3.3% in 2017 rising from under 3.0% in 2016 the slowest pace since 2009.

The Russian economy has gathered momentum in the last year despite dual shocks of collapsing oil prices and the continuation of Western sanctions. Considering the Ural oil would average $ 38 per barrel in 2016 the World Bank expects the Russian economy to expand by 1.4% in 2017. Russian economy contracted the steepest since 2009 last year. The Russian Rouble took a dramatic low to an All-time low of 82.4 in January 2016 and has stabilised between 58-60 Rouble per USD with the improvement in economy and oil prices.

The economic outlook for (MENA) Middle East and North Africa is expected to grow at 2.4% this year. Iran would be the best performer with its return to the international markets. Economies of the oil producing countries such as Saudi, Iraq, and Kuwait are expected to decelerate sharply due to oil reduction under the OPEC agreement.

The Eurozone Economy is expected to grow 1.6% in 2017. Improved labour markets, supportive monetary policies are seen as contributing factors.

Chinese economy is expected to grow 6.5% in 2017. Consumption levels have improved, factories have pulled out of deflation and overall growth is expected.

US Dollar – The US federal reserve is expected to hike interest rates thrice in 2017. The recent hike was in March 2017. Sri Lanka rupee has depreciated against the USD 1.5% this year.

Global purchases of imported tea in 2015 totalled $ 5.9 billion in value. From a continental perspective Asian countries accounted for highest Dollar worth of imported tea with purchased valued at $ 2.1 billion or 34.9% of the global total. Second place was European Union at 24% whilst 13.9% of the world wide tea imports were from Africa. North America imports amounted to 10.3%.

1. Russia $ 611.9 m (10.3% of total imports)

2. United States $ 468 m (7.9%)

3. United Kingdom $ 400.9 m (6.8%)

4. Saudi Arabia $ 255.7 m (4.3%)

5. Iran $ 251.3 m (4.2%)

6. Morocco $ 232.7 m (3.9%)

7. Germany $ 221.7 m (3.7%)

8. Japan $ 174 m (2.9%)

9. France $ 165.2 m (2.8%)

10. UAE $ 163.0 m (2.7%)

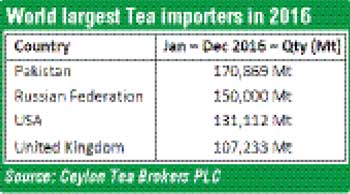

Whilst Sri Lanka being the third largest tea exporting country in the world, it has been unable to command the biggest exporter status to any of the largest tea importing countries in the world namely Pakistan, Russian Federation, USA and United Kingdom. India continues to be the largest supplier to Russian Federation where it exported 44.2 m kg in 2016 vis-à-vis 34.4 m by Sri Lanka.

Pakistan has displaced Russia to be the world’s largest tea importer in 2016, the position which was held by Russia for a long period of time. Sri Lanka’s tea exports to Pakistan, USA and United Kingdom is less than 5% of their total imports and is the second largest tea exporter to Russia; whilst Sri Lanka’s tea production recorded 292.4 m kg for the year 2016 (lowest since 2009, 289.7 m kg). Temperature variability due to climate change has had a drastic impact on tea production. Therefore, it is imperative to conduct research analysis in order to mitigate climate change impact on future tea production.

Therefore, a competitive environment for tea production, environment sustainability, and evaluation of tea producing areas for climate change variability could extenuate the impact of climate change.