Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 8 July 2015 00:33 - - {{hitsCtrl.values.hits}}

Further to recent articles in the news that present a distorted view of status of estates held by Regional Plantation Companies (RPCs), drawing erroneous parallels to situation on estates post nationalisation and later privatisation and with particular reference to crop development, the Planters’ Association of Ceylon clarifies and wishes to correct the narrative. The Association points out those misleading statements are being made by ex-planters themselves, now claiming to be experts in the field, not realising the overall detriment that these unheeded statements are causing the future well-being of the industry.

Situation of plantations pre-privatisation and rationale for divestiture by Govt.

In 1972 just prior to takeover and nationalisation of plantations, British companies owned 26.5% (158,147 acres), Ceylonese companies owned 25.6% (150,889 acres), Ceylonese individuals owned 25.5% (152, 468 acres), Non-Ceylonese individuals owned 1.8% (10,856 acres), State owned 2.3% (13,350 acres) and the Smallholders owned 18.3% (107,667 acres). After takeover of plantations, Janatha Estates Development Board (JEDB) and Sri Lanka State Plantations Corporations (SLSPC) along with Up Country Development (Usa Wasama) and Youth Development (Jana Wasama) managed these lands of almost 130,000 hectares of tea, 64,000 hectares of rubber and 22,000 hectares of coconut. They also controlled more than 400 Tea and Rubber factories and provided employment to nearly 450,000 workers or nearly 8% of the total workforce in the country.

The complex structure of plantation management and the smooth flow of products did not survive the bureaucratisation, management musical chairs and base political interference in the estates. Although there were very competent, professional and capable planters and administrators in the system they were stymied by the prevailing conditions, political interference, bureaucratic lockdowns and the centralisation of management that nationalisation inevitably brought.

According to the State Ministry of Plantation Industries, in the late 1980s, many Government Officials believed that the efficiency of the estates could not be achieved under Public Sector Management and estates should be returned to the private sector. The two corporations continued to make heavy losses and except for a few profitable years, the management under JEDB and SLSPC put a burden on the government. The two corporations performed poorly throughout most of their existence and relied heavily on Government assistance to off-set mounting operational losses which had increased to about Rs. 1.5 billion per annum for both corporations by 1992. A cabinet appointed high level committee, led by Neville Piyadigama, confirmed in a report that the Treasury had to subsidise almost Rs. 400 million every month to the government plantations for their operational activities.

In 1992, the estates managed by the JEDB and SLSPC were converted in to 23 Regional Plantation Companies (RPCs) under the Companies Act No 17 in a random method and not taking into account if the plantations were viable or not. Most of them were badly managed which compelled the government to privatise and delegate the burden of managing the estates by divesting them to the private sector management.

The findings of the Government Task Force given in the Report issued in 1990/1991 are that ‘The JEDB/SLSPC were facing a financial crisis in spite of the huge Government subsidies to the Corporations, wherein almost Rs. 4,000 million in debt had been converted in to equity in the late 1990. In spite of this, the debt of the JEDB/SLSPC at the time of the final report was approximately Rs. 3,300 million’. (Source: Ministry of Finance Plantation Restructuring Unit CEO Dr. Romesh Dias Bandaranaike).

Crop development by RPCs since privatisation

The ‘Indenture of Lease’ which RPCs signed when they took on management of plantations did not stipulate a mandatory replanting quantum per annum. In fact a replanting clause is not a condition as mentioned in the lease contract signed by the Government of Sri Lanka and the RPCs in 1992.

A 3% replanting rate was a suggestion as result of a discussion with the TRI, RPCs and the Golden Share Holders in 2012 at which TRI was not confident and admitted so, that given the current costs and expected returns, a replanting exercise was not economical and has no justification as an economic investment activity.

Notwithstanding limitations, constraints and difficulties over the years, RPCs have replanted their required extent very judiciously according to the estate and situation specific requirements of each individual Estate and company.

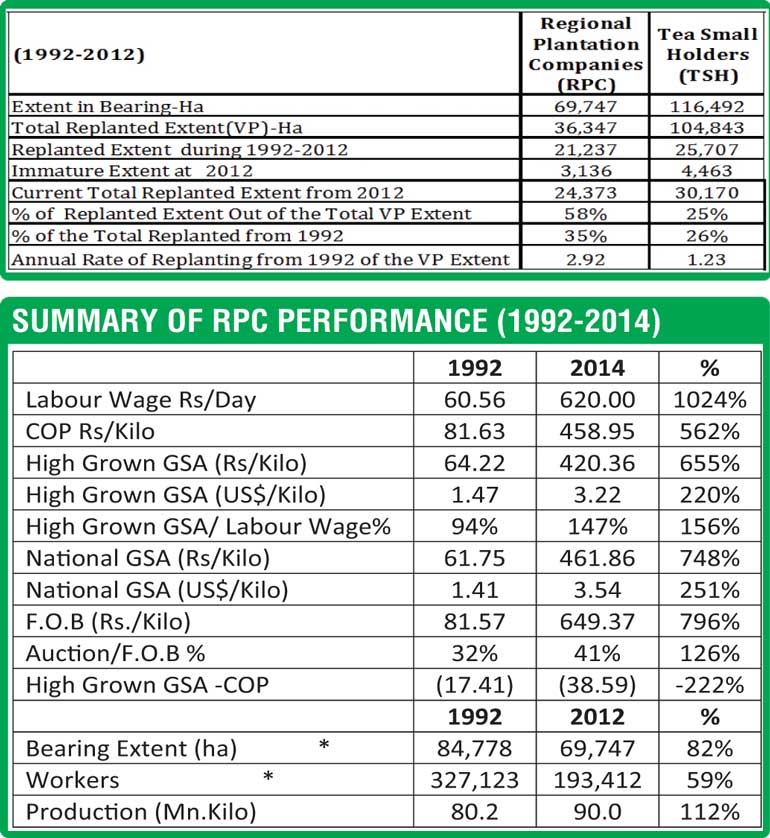

Following graph shows the extent of replanting undertaken by RPCs versus smallholders.

Replanting

It is a well known fact that RPCs manage not only tea plantations but rubber and oil palm as well. In the last 12 years from 2000 to 2012, RPCs have planted 48,086 hectares of rubber which is 98% of the total existing rubber extent of both immature and mature rubber. Furthermore, close to 20,000 hectares of commercial fuel wood has been planted apart from 7,000 hectare of oil palm along with additional large hectarage of cinnamon, coconut, coffee, fruit, dendro thermal trees, community forestry plots, ornamental trees, valuable timber and other useful tree crops.

RPCs have to be commended for their strategic effort in maximising output from unyielding land.

The macro view

Table below shows a macro view of the RPC performance from 1992 to 2014. The crisis related to the industry is one that originates from low prices at the auctions with the same ratio of tea price ratio versus daily labour wages, maintained as at 1992, the High Grown Sale Average in Colombo should be in the region of Rs. 660 per kilo.

The Government in realising the gap has guaranteed a price of Rs. 80 per kilo of green leaf to the Smallholder to cover his cost of cultivation and accordingly the breakeven Gross Sale Average should be at least Rs. 547 per kilo of tea. Likewise the Government has granted a guaranteed price of Rs. 350 for a kilo of RR1 Sheet Rubber only for the Smallholder again, totally ignoring the key growers within the RPCs.

By discriminating the RPCs, the Government has failed to realise the dependency of almost 1 million resident populations on the plantation company’s survival. Despite efforts of the Planters’ Association to bring this anomaly to the relevant authorities and political powers, there has been no response so far.

The Planters’ Association further wishes to highlight that despite having only 59% of the workers and 82% of the crop bearing extent compared with the time of privatisation in 1992, RPCs increased crop production in 2014 by 12% in comparison with 1992, clearly demonstrating greater efficiency and commitment to best practices including good agricultural policy on the part of the RPCs. This clearly demonstrates that allegations regarding underperformance of the RPCs as a whole etc. are baseless.