Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 4 November 2015 00:00 - - {{hitsCtrl.values.hits}}

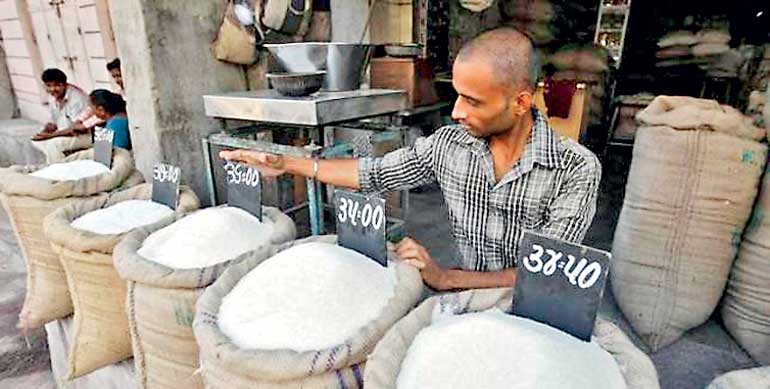

Reuters: Indian mills are prioritising exports of low-quality white sugar, signalling that the world’s second biggest producer is unlikely to emerge as a major raws exporter this season, European traders said on Tuesday.

The trade is focused on how much of India’s exports will be raws and/or whites, and sentiment is growing that mills prefer to offer low-quality, 150-ICUMSA whites.

The latest Indian export deals for more than 200,000 tons of locally produced white sugar have coincided with a rally in world raw sugar futures prices to a nine-month peak of 15.33 cents a pound on Tuesday.

India has been pushing mills to sell sugar on the international market and use the proceeds to clear huge debts they owe farmers for sugarcane.

Many traders expect India to support exports by paying cane growers. The Food Minister last week proposed that a direct subsidy of 47.5 rupees per ton be paid directly to cane farmers.

Some traders believe the latest world sugar price rally has been driven partly by trade houses covering short positions, taking the view that India may not emerge as a major exporter of raws.

Low quality Indian whites traded at a premium of $77 per ton over March ICE raw sugar futures this week.

“Indian millers are happy selling low-quality whites at such premiums over New York and during the start of the campaign are not focused on making raws,” one London-based analyst said. “The traders are increasingly of the opinion that India will not be a major exporter of raws, if at all.

“This changing perception of Indian raw sugar export supply is a major part of this fundamentally driven rally which threatens to take March New York to 16 cents a pound.”

Another European trader said he expected zero Indian raw sugar exports without a raw sugar export subsidy, and he doubted Indian authorities would approve such a subsidy.

Indian mills were stepping up white sugar exports.

“Many mills are making export enquiries as they need money to start crushing in the new season. They are keen to sell last season’s white sugar,” a Mumbai-based dealer said.

“The rally in world prices and the drop in the Indian rupee have been encouraging them to enter into export contracts. Still they are making losses on exports, but far lower than what they were making four months back.”