Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 17 August 2015 00:00 - - {{hitsCtrl.values.hits}}

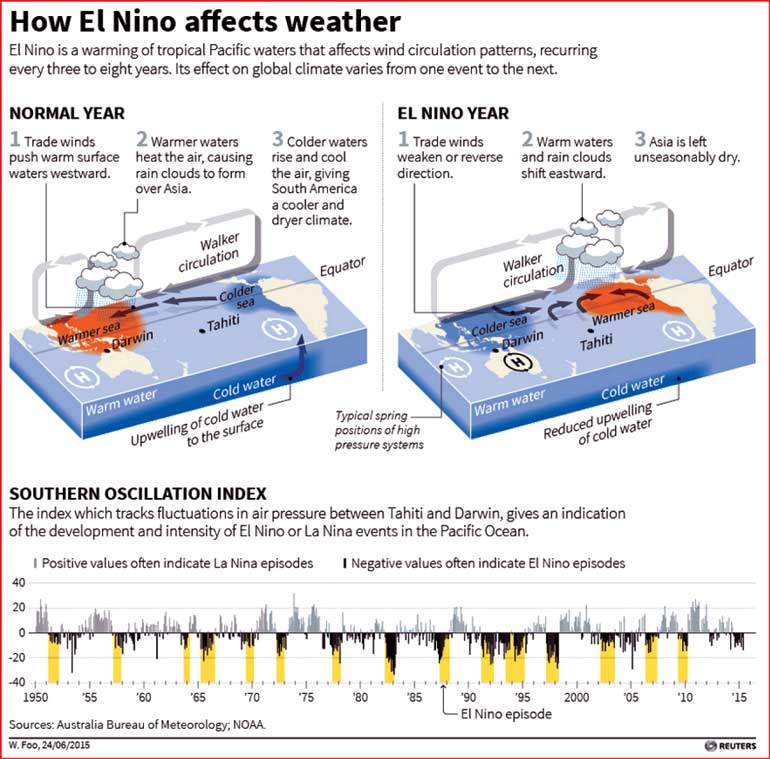

Reuters: Funds are flowing back into agricultural commodities for the first time since 2012 as investors look to capitalise on cheap prices, bullish demand and the threat of crop damage from an El Nino weather pattern.

Figures from ETF Securities, one of the largest issuers of exchange traded products, show a small net inflow so far this year after an outflow of nearly 20% in 2014.

Across the sector, indices and ETFs saw a net inflow of $ 400 million in April and a further $ 400 million in May, according to data from Barclays. This compares to a net outflow of $ 2.4 billion in the last quarter of 2014.

The extent of the trend has been tempered in the last four weeks by an improvement in the outlook for global wheat and soybean crops, which drove down prices. Analysts, however, still expect a net inflow for the year.

“If you do look longer-term into demand trends, you’re likely to see pretty solid growth year-on-year,” said Martin Arnold, director of commodity strategy at ETF Securities.

“Especially now that we are beginning to see the volatility in weather conditions starting to impact the market’s ability to supply the rise in demand.”

Investor appetite for the agricultural sector had waned following a series of large global harvests of commodities like corn and sugar, which triggered rising stocks and falling prices.

Raw sugar futures, for example, have fallen by more than two-thirds from a peak of 36.08 cents a lb in February 2011 to a 6-1/2 year low of 11.10 cents last month.

Rising demand is, however, expected to trigger the first global sugar supply deficit in six years in the 2015/16 season.

“This kind of thing is definitely bullish for the agricultural sector,” said Romain Lathiere, head of dealing at Diapason Commodities Management. “It’s a really good entry point for commodity markets at the moment.”

Sugar output could also potentially be curbed by El Nino, which can lead to drought in key producing countries in Asia such as India and Thailand.

Funds sources said Chinese funds are among those considering increasing their exposure to agricultural commodities in the next few months.

Renewed capital inflows have also been driven by a recent shift away from the perception that investing in agriculture leads to a spike in food prices, a factor that has pushed many European investors and banks out of the sector in recent years.

“It became safer to invest in food commodities after investors realised that it’s not directly related,” said Jodie Gunzberg, global head of commodities at S&P Dow Jones Indices. “Since then, we have seen more investors get back into agriculture in Europe.”

An El Nino weather pattern damaging sugar crops may mean global demand will outstrip production to a greater extent than expected in the upcoming season, hastening a rebound in prices from a 6-1/2 year low hit last month.

Drought has already begun to threaten production in number two exporter Thailand and top consumer India as weather bureaux confirm the return of the phenomenon which can lead to scorching weather across Asia and heavy rains and floods in South America.

“The current drought (in Thailand) is more severe than last year’s and recent reports indicate some cane has been lost in badly affected areas in the north-east,” Tom McNeill, director of analyst Green Pool, said.

“As such Thailand’s 2015/16 cane crop is likely to be less than last season’s with the extent of the downgrade dependent on how long the dry conditions continue.”

A global glut of the sweetener has driven prices down from a peak of 36.08 cents a lb in February 2011 to a 6-1/2 year low of 11.10 cents last month but stocks may now finally begin to erode as El Nino cuts production.

The sugar market is forecast to have its first global supply deficit in six years in 2015/16, according to a Reuters poll issued last week, but stocks of sugar mean there may be only a meagre recovery in prices next year.

“El Nino leads to supply changes, which leads to stock drawdown,” said James Kirkup, head of sugar brokerage at ABN AMRO in London. “We need to lose some of the stock and then we’ll start seeing a price response.”

The combination of low prices and erratic weather is making agricultural commodities such as sugar an attractive bet for investment funds in countries such as China at a time when many other markets are losing ground.

In India, lower rainfall due to El Nino has hit production in the top sugar producing western state of Maharashtra. The state’s output in the 2015/16 year starting 1 October, could drop 7.6% to 9.7 million tonnes, according to the Indian Sugar Mills Association.

“Rainfall in August is crucial in determining cane yields in Maharashtra. Cane is a sturdy crop. It can recover if it gets goods rains in the next few weeks,” said Ashok Jain, President of the Bombay Sugar Merchants’ Association.

The real uncertainty will be the level of intensity of El Nino in sugar growing regions around the world in the coming weeks and months.

“We do know that in the regions where there will be drought, there will be a drop (in sugar output),” Jose Orive, Executive Director of the International Sugar Organization (ISO), told Reuters in an interview, referring mostly to Asian sugar growing origins.

In Brazil, the top producer and exporter, the threat comes from wetter-than-normal weather in the centre-south.

“Our primary concern for the 2015/16 harvest (in centre-south Brazil) is for sugar content,” McNeill said, adding unseasonably wet weather in July would reduce the amount of sugar which can be retrieved from a tonne of cane.

Analysts said a reduction in global sugar output due to El Nino could mean that the deficit currently forecast to occur in 2015/16 may be larger than initially thought.

“If El Nino gets worse and really impacts these countries, the deficit will be even higher,” Claudiu Covrig, senior agricultural analyst with Platts, said.