Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 24 August 2015 00:00 - - {{hitsCtrl.values.hits}}

Chairman Chrisantha Perera

Ceylon Tea Brokers Plc Chairman and industry veteran Chrisantha Perera in the company’s 2014/15 Annual Report has listed several urgent steps that Sri Lanka should take to make Colombo the most competitive global auction centre.

In his review, Chairman Perera has emphasised that all tea industry stakeholders must collectively examine the situation and take the needed policy decisions to ensure that Colombo regains its dominant position as the most competitive global auction centre.

His clarion call comes at a time when current auction prices in Mombasa, which is the largest auction center for tea, are higher than Colombo auction prices. This, he pointed out, is indeed disappointing. “What is more depressing is the fact that the averages at the Mombasa auction, particularly for Kenyan teas, records significantly higher values this year compared to the corresponding figure in 2014, whilst the reverse has taken place with the Colombo auction averages,” Perera said.

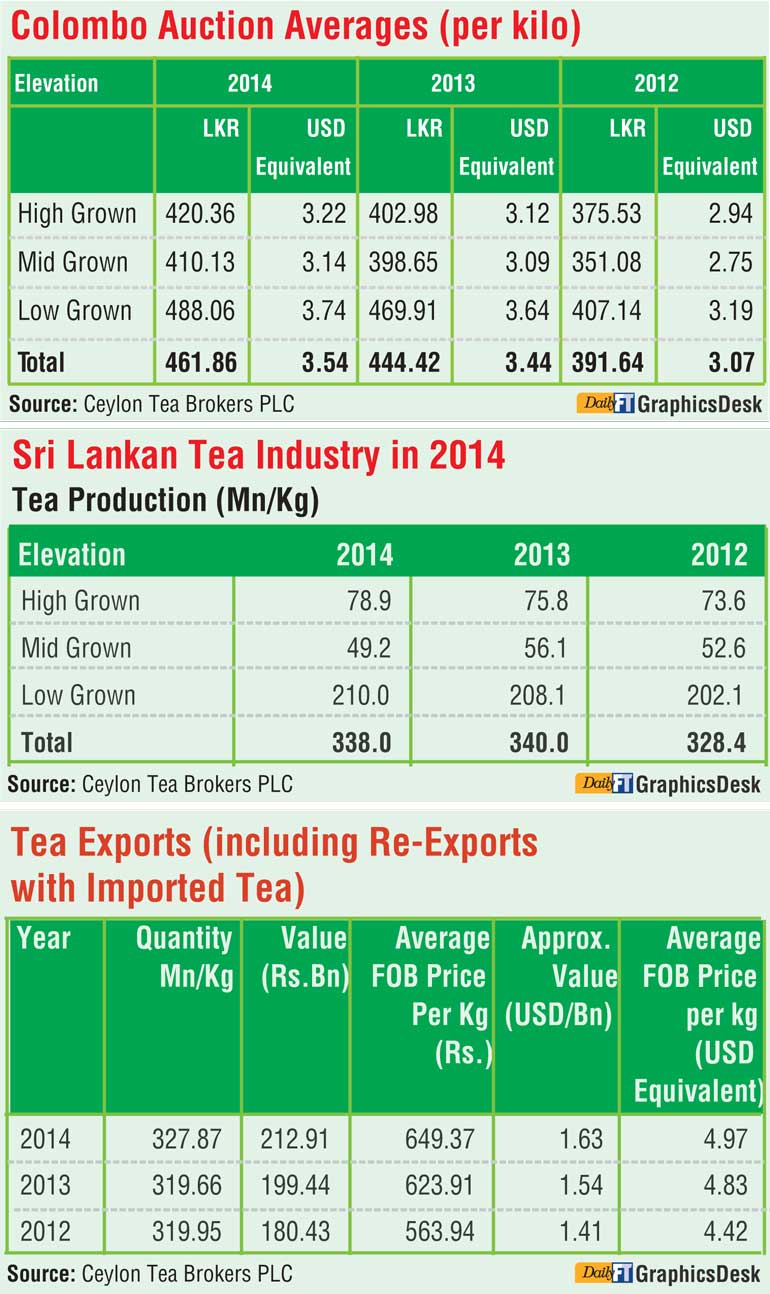

According to him, the total Colombo auction average for the period January to June 2015 at Rs. 409.68 per kilo is substantially lower than the Rs. 477.55 per kilo recorded during the corresponding period in 2014 and even lower than the corresponding average of Rs. 422.77 in 2013.

“This disappointing performance covers all three elevations and is also lower when expressed in terms of US Dollar equivalents,” he said.

Given the challenges facing Colombo tea auctions, Perera listed the following for urgent consideration by all stakeholders.

Structure a wage model for the plantation sector that is based on productivity rather than a fixed daily wage. In other words, incentivise efficiency and create a disincentive for inefficiency. Statistically, on a global basis, Sri Lanka is very low on productivity and the highest in terms of cost of production.

A five-year rolling plan for the tea industry covering all aspects, which includes production, marketing and any other factors that should be taken into consideration.

At the risk of creating controversy, we are of the view that we should examine the hotly debated topic of making Sri Lanka a tea hub without compromising the inherent value of marketing Pure Ceylon Tea. We believe that there could be a happy medium. When analysing Sri Lanka’s tea export profile, it will be found that our exports to some of the major markets where we had a dominant position have declined, whilst exports to the so-called ‘Tea Hubs’ such as UAE and Turkey have increased. In fact, Turkey is presently the single largest export outlet for our tea although it is likely that most of this tea is traded out of Turkey either to the neighbouring Middle Eastern countries or Russia and other CIS countries.

An encouraging trend which we must develop is the emergence of China as a potential large export outlet for our teas. A significant feature that has taken place in 2015 is also the substantially higher quantities of exports to India.

We should endeavour to maximise the potential of our Free Trade Agreement with Pakistan. A point I made in last year’s message, which is worth repetition, is that out of the five largest tea importing countries, i.e. Russia, UK, Pakistan, USA and Egypt, we have a significant presence only in Russia and that too appears to be declining. Sri Lanka is not the largest Global Tea Exporter in volume, but up to last year, is the country with the highest value of tea export earnings in USD terms. We must therefore ensure that this established position is not only maintained but further enhanced with a more dynamic and outward looking marketing strategy. In this respect, it is encouraging to read reports that the Sri Lanka Tea Board is in the process of utilising the special promotional Cess that was created some time ago for the promotion of value added tea under brands owned by Sri Lankan exporters.

In the 2014/15 Annual Report of Ceylon Tea Brokers, Chairman Perera also made the following observations on the tea industry.

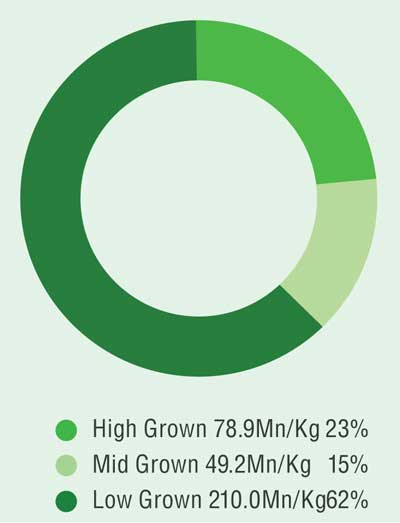

Tea production was marginally down from the all time high of 340.0 million kilos in 2013. Nevertheless, Low Grown production at 210 million kilos increased on the all-time record established in 2013 of 208.1 million kilos. High Grown production at 78.9 million kilos was also higher compared with 2013, although not an all time high. Production from Mid Grown areas unfortunately declined to 49.2 million kilos from 56.1 million kilos in 2013 and this is the first occasion that Mid Growns have produced less than 50 million kilos per annum over the last five years.

It is encouraging to report that average prices for all categories sold at the Colombo tea auctions during the calendar year 2014 realised all time highs in rupee terms as well as USD equivalents. It must however be stressed that the record averages covering the entire year is due to the strong market conditions that prevailed during the first half of 2014, which declined during the second half and has further weakened in 2015 causing some concern at the time of preparing this review.

It is indeed encouraging to highlight that tea exports had a record year in 2014 in terms of volume and value. The 327.87 million kilos exported in 2014 earned a value of Rs. 212.91 billion, which is the first occasion that tea export earnings have surpassed Rs. 200 billion. The dollar equivalent of these earnings at $ 1.63 billion is also a new high bettering the 2013 landmark of $ 1.54 billion.

Current scenario

Unfortunately, given the performance for 2015 up to the time of preparing this report, tea export earnings are unlikely to achieve the 2014 levels, unless there is a dramatic improvement in market conditions during the second half of 2015.

The total Colombo auction average for the period January to June 2015 at Rs. 409.68 per kilo is substantially lower than the Rs. 477.55 per kilo recorded during the corresponding period in 2014 and even lower than the corresponding average of Rs. 422.77 in 2013. This disappointing performance covers all three elevations and is also lower when expressed in terms of the US Dollar equivalents.

Consequently, Sri Lanka’s tea export earnings for the period January to June 2015, which includes imported tea re-exported has realised Rs. 90.78 billion amounting to an equivalent of $ 680 million compared with Rs. 104.07 billion amounting to an equivalent of USD 780 million during the corresponding period in 2014.

A combination of factors has contributed to this disappointing performance during the first half of 2015. The drop in oil prices, together with trade sanctions in key markets such as Iran and the crisis in Russia and Ukraine, contributed collectively to this sharp fall in tea prices at the Colombo auctions.

In our view, Sri Lanka was probably the most affected by these global issues, since we had the strongest presence in these markets compared to other Tea Producer/Exporter countries. There appears to be a silver lining going into the second half of the year, although it may be too optimistic to predict a change of fortunes to the extent to overcome the declines during the first half of the year once the final performance for 2015 is recorded.

A significant point that we must highlight is that the current auction prices in Mombasa, which is the largest auction center for tea is higher than the Colombo auction prices, which is indeed disappointing. What is more depressing is the fact that the averages at the Mombasa auction, particularly for Kenyan teas, records significantly higher values this year compared to the corresponding figure in 2014, whilst the reverse has taken place with the Colombo auction averages.

Some of these global issues may be beyond our immediate control. It is however important that all stakeholders collectively examine this situation and take the needed policy decisions to ensure that the Colombo auction regains its dominant position as the most competitive global auction center.