Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 14 December 2017 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka, which is known as the Pearl of the Indian Ocean, has been a very popular destination among Europeans during the past four centuries. First it was the Portuguese, then the Dutch and finally the English, who remained in the country until 1948.

Sri Lanka, which is known as the Pearl of the Indian Ocean, has been a very popular destination among Europeans during the past four centuries. First it was the Portuguese, then the Dutch and finally the English, who remained in the country until 1948.

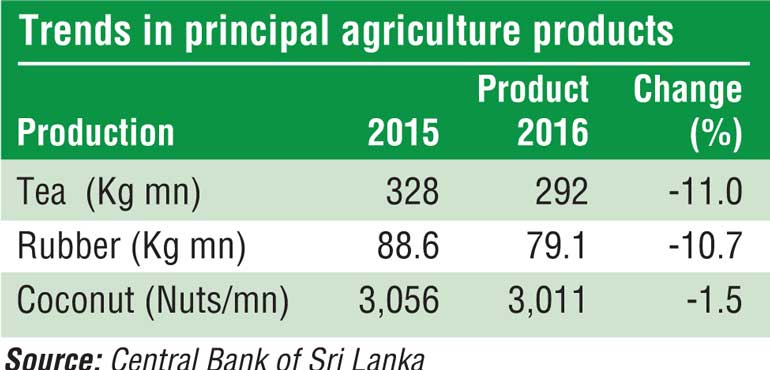

During this period they all concentrated on growing tea, rubber, coconut, spices and other valuable crops because Sri Lanka produced the highest quality products for the world market. These plantations continued to produce the same quality products and volumes until recently. Unfortunately, since independence, due to some unethical land management policies and poor human interventions, all three major export crops, namely tea, rubber and coconut, have seen a severe decline both in quality and quantity. On a year-on-year basis the export of tea, rubber and coconut has drastically come down as per the latest annual report of the Central Bank of Sri Lanka.

Though there are various reasons for this declining trend, the main reason for the low yield and quality is the unethical human intervention. This is particularly true of the coconut industry in Sri Lanka. The extent of coconut plantation land has rapidly reduced. Most of the plantations are neglected due to the high cost of production, fragmentation, labour shortage and drought conditions.

The recent price increase and shortage of coconuts in the local market was predicted 20 years ago by the people in this country when they saw the fragmentation of coconut estates, especially in the coconut triangle. Due to the poor decision-making of local political authorities, most coconut plantations were destroyed and replaced with so-called ‘Development Projects’. As a result of this, the country is now faced with a severe shortage of coconuts for the local market as well as for exporters of desiccated coconut and other coconut-based export items. According to well-informed sources, Sri Lanka produces some of the best desiccated coconut in the world.

In view of the current situation faced by the coconut industry, the Regional Development Bank (RDB), together with the Coconut Development Authority (CDA) and Coconut Cultivation Board (CCB), has come forward to help coconut growers and estate owners revive the industry by introducing some unique financial assistance schemes.

Productive and well-managed coconut estates do not simply contain coconut trees. Inter-cropping - the practice of growing a number of other crops in addition to coconuts - is a widespread practice seen in coconut-growing areas of the country. However, due to a plethora of reasons, coconut estate owners opt to sell their lands and move on to other profitable pastures. This habit can be detrimental to both consumers and the country at large.

The ‘Kapruka Ayojana’ loan scheme and the ‘Kapruka Jaya Isura› loan schemes were launched by the Regional Development Bank together with the CDA and CCB, especially targeting this dwindling sector in an effort to boost growers and once again bring Sri Lanka to a preeminent position among exporters of coconut products in the world market.

The Kapruka Ayojana loan offers up to Rs. 3 million at an interest rate of 9% to customers island-wide. The funds for the loan scheme are provided by the Coconut Cultivation Board and the loan caters to coconut cultivation, coconut estate development, the rearing of dairy cows at coconut estates and inter-cropping. The projects are assessed and inspected by the officers of the Coconut Cultivation Board. A period of five years is granted to customer to repay the loan.

The Kapruka Jaya Isura loan scheme is funded by the Coconut Development Authority and is an islandwide loan scheme granting up to Rs. 2 million. The loan scheme revolves around coconut-based industries (excluding the cultivation of coconuts). The entrepreneurs registered under the Coconut Development Authority are eligible for the loan under the recommendation of the authority.

Under the loan, customers can get the loan for investment purposes at an interest rate of 6%, payable within seven years. For the purpose of working capital, the interest rate is 8% and the repayment period is three years.

The full interest of the loan will be reimbursed to the customer during the first year, while during the second to fifth years, 50% of the interest will be reimbursed.

The Regional Development Bank (RDB), as a 100% state-owned development bank, has been determined to embolden the spirits of the innovative Sri Lankan public from the micro category upwards.

On their journey towards supporting its customer base, the bank has introduced several loan schemes designed to provide financial support to the customer. In addition to the loans targeting the coconut industry, the bank has numerous loans that cater to other sectors as well.

Among them are the SEPI Stage II loan scheme for entrepreneur development, the Swashakthi loan scheme for Micro, Small and Medium Enterprises, Livestock, Agriculture, Industrial Project and Services, and the SMILE 111 Revolving Fund for Micro, Small and Medium Enterprises.

RDB is leading from the front with real-time doorstep banking facilities. Currently it has a network of 268 branches located mostly in outlying areas of the country.

RDB remains the Premier Development Bank in the country with a loyal customer base numbering nearly six million. Public Enterprise Development Minister Kabir Hashim, under whose authority the bank operates, is very keen that RDB provides more and more financial assistance to the private sector in rural areas and helps the rural development of Sri Lanka. He strongly believes that the empowerment of the village entrepreneur is the key to the economic growth of the country as a whole due to the creation of more job opportunities at the grassroots level. Keeping those objectives in mind, the Government in its latest Budget proposed a fresh capital infusion of Rs. 2.5 billion to RDB to strengthen its capital base.