Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 6 December 2019 00:00 - - {{hitsCtrl.values.hits}}

Introduced to the island in the late 1960s, the palm oil plant hailed as the ‘Golden Crop’ has taken the world by literal storm and presents lucrative prospects to Sri Lanka. How has this newcomer threatened the ancient dominance of coconut oil in the edible oil market?

From temple running oil mafias, bans backed by feverish

environmental claims and Customs loopholes, the issues plaguing the edible oil market seem never-ending, yet the industry holds a girth of economic potential to rival that of apparel and textiles – and it’s waiting to be enabled.

Sri Lanka with the right open policies and marketing can take advantage of the growing demand for sustainable “ethical” oil governments around the world have pledged to in the wake of the impending climate and humanitarian crisis. Yet could this be another global conspiracy of green washing?

What does this complex multi-stakeholder situation teach us about the importance of strong regulatory institutions for effective policy outcome?

This article explores the long-standing rivalry of the coconut and palm oil industry, the complexities of the edible oil market and what Sri Lanka as a country can do to ensure a sustainable future of two plants

By Aquilah Latiff

Coconut cultivation – a family business

Stretched across 1.1 million acres of land, coconut cultivation is the third-largest net foreign exchange-earner and one of the largest contributors towards GDP, 70% of which is by the small-holder sector consisting of 700,000 families cultivating on plots of land no more than 2.5 acres.

Coconut has been a prolific player in the export sector, providing around 1% of the total national income. This sector employs 135,000 people in production alone and the industry as a whole is responsible for the livelihoods of over 700,000.

In the perspective of the consumer, coconut provides 15% of the total calories in the average Sri Lankan’s food basket – a significant nutritional constitution as evident by an indigenous Sri Lankan diet heavily ladled in coconut milk-based curries, pol sambol and pol roti.

The Golden Crop

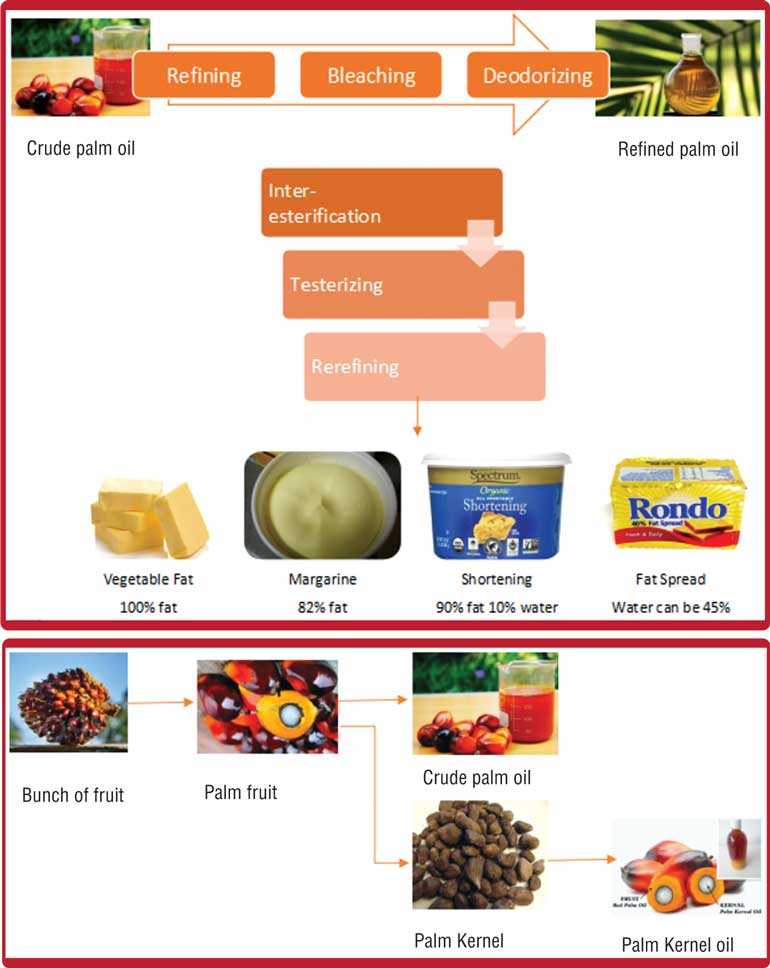

Oil palm is currently the most productive plantation crop known to man, covering just 2% of total cultivated land globally, yet accounting for 35% of the world’s total vegetable oil requirement. Moreover, it is also considered as the single-most versatile plant oil given its ubiquitous applications in everything from toothpaste to soap, lotions, shampoos and beauty products to pharmaceutical preparations, food and beverages such as biscuits, sweets, chocolates and fried foods.

Harvested all year round, oil palm trees produce on average 10 tonnes of fruit per hectare – far more than soya, rapeseed and sunflower crops. This means oil palm requires 10 times less land than the other three major oil-producing crops, soya, rapeseed and sunflower.

In addition to the 3.74 tonnes of palm oil per hectare, 0.4 tonnes of palm kernel oil and 0.4 tonnes of palm kernel cake are also produced from the fresh fruit bunches (FFB). (Daily FT, Palm Oil: Ensuring a sustainable future for the next 50 years)

Introduction of palm oil to Sri Lanka

A planter from Europe, M Jerry Wales, reached the shores of this island in 1968 to begin a humble palm plantation of half a hectare with sixty-eight palm seedlings. Fast forward decades later and local palm oil plantation covers 3,536.00 Ha and has played a significant role in the Sri Lankan plantation sector. It has significantly supplemented revenue, generating export earnings and conserving valuable foreign reserves through import substitution on edible oils, while drastically improving the livelihoods of communities on and around the estate.

With the advent of advanced scientific and manufacturing capabilities throughout the 1980s, the global applications of oil palm multiplied exponentially and saw the growth of the palm oil value-added sector in Sri Lanka. Industry leaders such as Pyramid Wilma and NMK holdings dominate the local market share supplementing the bakery and confectionery industry in Sri Lanka.

In 2015, Sri Lanka’s annual edible oil requirement was around 160,000 Metric Tonnes (MT). However, Sri Lanka only produces a total of 53,000 MT of coconut oil and 18,000 MT of palm oil. The balance 89,000 MT in the island’s edible oil requirement is sourced from the global palm oil giants Indonesia and Malaysia who produce 80% of the global palm oil demand.

In 2015, Sri Lanka spent Rs. 20.8 billion on oil and fats imports with a significant majority of those imports being for palm oil. Collectively, palm kernel, palm olein, palm stearin and crude palm oil accounted for 164,835 MT or nearly 30% of all edible oil and fats imported into Sri Lanka.

The early development of the palm oil industry in Sri Lanka can be attributed to several factors related to opening the domestic economy to international trade. Instrumental to the industry’s growth spurt in its early stages is the Indo-Lanka Free Trade Agreement which enabled Sri Lanka to re-export large quantities of palm oil from Malaysia to the Indian Market, duty-free.

Furthermore, Sri Lanka possesses an untapped comparative advantage to be a manufacturer and distributor of palm oil products in the South East Asian region. Its strategic geopolitical location in South East Asia makes it a gateway to Sub-Saharan Africa.

Rising global demand for sustainable ethical palm oil: an opportunity presents itself

In the wake of the 21st century environmental crisis, the pertinent and heavily debated question of “who gets to emit and who doesn’t?” is posed. Accelerating economic growth with an anti-poverty agenda is a gargantuan task on its own yet policymakers of developing nations find themselves hauled headfirst into the challenge of ensuring this economic growth is sustainable and not at the cost of a liveable planet for future generations. Large staged protests across the globe are forcing the hand of many governments to implement sweeping environmental and ecological reforms without setting off a chain reaction of economic disruption.

But for small island countries like Sri Lanka, this shift presents unique and lucrative opportunities. Naturally restricted by its land size, Sri Lanka can customise its palm oil production to cater to the growing market of ethically produced, sustainable products, and edible oil being one such market by turning over unproductive plantations.

In 2018, more than 50 governments signed the New York Declaration on Forests to halve natural forest loss by 2020 and end it by 2030. Multiple countries in Europe have their own national commitments to source only certified sustainable palm oil, such as the UK and Norway. In response to such market demands, the Roundtable on Sustainable Palm Oil (RSPO, an NGO multi-stakeholder certification scheme established in 2004, is also currently working to improve its certification standards, the Principles and Criteria. This includes no-deforestation requirements – a standard that Sri Lanka can pledge to.

‘Certified’ destruction: Is sustainable palm oil a myth?

In a study conducted in 2018 by researchers at Purdue University in the US state of Indiana, it was revealed that palm-oil forests certified as sustainable are being destroyed faster than non-certified land, leading experts to believe that the certification scheme of sustainability by governments and NGOs alike is simply an attempt at green washing so that business can be carried out as usual.

But the Roundtable on Sustainable Palm Oil questioned the researchers’ methodology and rigour, saying: “The study dismisses the efficacy of certification because according to the authors, the lands were sanitised (deforested already) prior to the creation of the RSPO and other organisations’ certification schemes, and therefore certification provided no added positive impact.”

The group said the tree cover loss data referred to in the study did not differentiate between planted (including clearing of old oil palm for replanting) and natural forest cover. Two other scientific studies, published last year, found lower deforestation rates in RSPO-certified concessions after certification than in non-certified areas.

Government gives the green light to palm oil

Due to the initial appraisal for the crop, promising economic prospects presented by the cultivation of oil palm and the favourable global market for palm oil, the Sri Lankan Government encouraged RPCs to proactively expand palm plantation and invest in extensive R&D into the cultivation process.

By 2016, the Government had given RPCs the green light to commence import of oil palm seeds, and investments of nearly Rs. 500 million were made accordingly, committed by RPCs seeking to align themselves with the government’s stated plan to increase the cultivated extent of oil palm from 3,157 Ha up to a total of 20,000 Ha, 3% of the total land among tea, rubber and other crops.

As at 2018, these RPC oil palm plantations generated a collective revenue of Rs. 2.03 billion, as compared with rubber which generated Rs. 107 million. Hence relying on assurances of continuous Government support for their efforts, RPCs committed a further collective investment of Rs. 500 million towards the importation of new seeds and planting material.

Kicked to the curb – Environmental opposition and crippling red tape

Initially lauded, the expansion of palm oil cultivation in Sri Lanka currently struggles against the relentless economic and political backlash. Activists have sirened their grievances over palm oil cultivation despite retaliation from palm oil stakeholders under the eco-terrorism argument that the environmental claims put forth lack scientific conviction and fail to take into account the unique context of sustainable palm oil cultivation on Sri Lankan soil. Ultimately any final decision to be taken will side with the loudest lobby.

Currently, the palm oil association is facing the pressing issue of approximately 550,000 seedlings held hostage in their nurseries. Sitting idle, each day that goes by puts the plants at risk of over maturing and perishing rendering them useless – precisely 500 million rupees worth of it; the economic repercussions detrimental to the future of the palm oil industry.

The question remains, how does Sri Lanka efficiently allocate its resources to ensure sustainable palm oil production while supporting the livelihoods of palm, rubber, coconut cultivators within the plantation economy amidst a rising global anti-palm oil sentiment?

Palm oil vs. coconut oil in Sri Lanka: Battle royale

How adulterated is your oil?

The mixing of unrefined oil in Sri Lanka complemented by the loose sale of oil poses major health implications to the Sri Lankan consumer. Exposing the edible oil market to its heinous health hazards is not a ground-breaking revelation. Its public knowledge that adulterated oils is sold loose in the market, free from the tediousness of quality standards and gravity of moral responsibility. And this oil is the very thing that your favourite isso vades and manioc chips are fried in.

Due to palm olein being a generally low-cost vegetable oil, frugal suppliers often mix palm olein with other virgin vegetable oils, a popular victim being virgin coconut oil. Moving further up the spectrum of adulteration, the coconut development authority has cited claims that certain oil sold in the edible oil market comes from oil lamps in temples and in fact isn’t edible at all.

Although Sri Lankan households and businesses consider vegetable oil and coconut oil highly close substitutes, their molecular compositions differ. Coconut oil though saturated has mostly medium-chain fatty acids whilst palm oil though unsaturated is composed of long-chain fatty acids. Palm olein, when subjected to high heat, breaks downs to its carcinogenic constituents and is strongly advised against being reused in cooking.

Lackadaisical economics: The case of the special commodity levy

The Special Commodity Levy, installed under the Special Commodity Levy Act No.48 in 2007 is a composite levy imposed by ad valorem or specific basis, on certain essential commodity items at the rate specified by the Minister of Finance by order published in the gazette at the point of importation of such commodities.

The collection of Special Commodity Levy is undertaken by the Director General of Customs. In place of the SCL, no other tax, duty, levy, cess, or other charge is imposed in respect of the commodities specified in any such order so to overcome the complexities associated with the application and administration of multiple taxes on such specified commodity items.

A special levy acts as a tariff and is imposed for a variety of reasons including revenue generation for the Treasury and to curb the amount of imports of a particular essential commodity to protect the local industry and small domestic stake-holders along the value chain as well as to encourage consumption of domestic goods.

Due to the close substitutability of coconut and palm oil, the coconut industry and especially coconut refineries producing coconut oil are finding it difficult to adjust to the introduction of a much lower cost competitor, palm oil, especially when nut production seasonally declines and price climbs.

As per the request of coconut growers’ association, the Cost of Living committee decided to increase the SCL on of palm oil by Rs. 25 per kg from 11 July to 11 November 2019. After the implementation of the new revision of the SCL for imported edible oils, local market prices of imported edible oils have increased when compared with the coconut oil by maintaining the margin of Rs. 10 to Rs. 15 and stabilising the decreasing coconut nut prices which were proving detrimental to the coconut cultivating community.

However, the palm oil industry association is faced with a higher cost of production on their palm oil products (margarine and vegetable fat) to the point where they’re no longer competitive with their imported counterparts.

This is a striking example of how economic tools such as SCLs when used alone overwhelming underperform in reconciling parties in an overlapping multi-stakeholder situation. Can a quarterly manipulation of the Special Commodity Levy at the whim of one industry provide a satisfactory solution to such a complex dynamic where multiple players are concerned?

This situation highlights the importance of strong institutions and investment in soft infrastructure forming the groundwork for comprehensive and consistent regulations and incorrupt monitoring schemes – vital to address industry issues.

Loose discipline: Industry reformation to ensure a future for coconut oil and palm oil

There are several proposals to be implemented along the value chain that can transform the efficiency of the edible oil industry while securing safer consumption of oil for the Sri Lankan consumer.

The edible oil market in Sri Lanka is a classic case that highlights the importance of monitoring, incentives and regulatory bodies in achieving the most optimal policy outcome. It also presents the urgency with which countries like Sri Lanka must find the balance between growth and sustainability while maintaining ecological and ethical responsibility.