Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 12 June 2020 10:40 - - {{hitsCtrl.values.hits}}

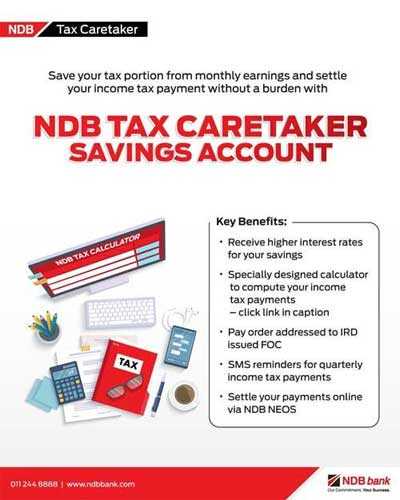

Staying on par with the current trends and the advances of lifestyle, the Inland Revenue Department (IRD) recently introduced an Alternative Tax Payment System (ATPS) to enable tax payments via online fund transfer facilities of banks. With the introduction of the ATPS, NDB has taken a pioneering initiative to launch its ‘NDB Tax Caretaker’ account. Income tax plays an integral role for many and it can be difficult to calculate the income tax to be paid or have trouble visiting the IRD given the current island-wide restrictions. NDB's newest addition – 'NDB Tax Caretaker' has got all that covered in all ways possible from calculating to paying your income tax online following the Alternative Tax Payment System introduced by the IRD.

The NDB Tax Caretaker account empowers users to set aside an amount each month from their monthly income to build an estimated ‘Total Tax Payable’ for each tax quarter. The exclusive ‘Tax Calculator’ assists customers to estimate the ‘Income Tax Payable’ and to decide on the amount to be saved every month to support the quarterly tax payment. Besides, at the end of each tax quarter, customers are required to check on the income tax payable by rechecking the taxable income and any qualifying payments and reliefs as per the rules/regulations of the IRD and then finalize the income tax amount. The NDB Tax Caretaker account offers many beneficial features including SMS reminders on upcoming tax payment well ahead of time, higher interest rates for savings, unlimited withdrawals, debit card and mobile banking facility and to better manage all types of income including from investments, foreign currency and other financial instruments.

Unlike the conventional method of income tax deduction from monthly earnings, the ‘NDB Tax Caretaker’ facility enables its customers to pay income tax directly to the IRD every quarter via the bank's online platform NDB NEOS. The safe and digital method of the quarterly tax payment by the customer to the IRD is a noteworthy enhancement of NDB’s seamless online banking experience.

For users who prefer the conventional method of payment, they could visit one of the NDB branches with the Income Tax Paying Slip and obtain the Pay Order in favor of Commissioner General of Inland Revenue Department, issued free of charge. The NDB Tax Caretaker account can be opened with an initial deposit of LKR 1,000/- by showing the identification and residential proof and placing a monthly standing order of the estimated tax amount. As a leading bank offering innovative and inspiring financial solutions to all its customers, NDB Tax Caretaker is a timely online solution that meets and exceeds the needs of its customers. With a vision to build a financially empowered nation, NDB has been a front runner and a pioneer in delivering efficient, effective and enhanced banking experiences to all its loyal patrons. Its deep-rooted core values drive constant excellence and its longstanding clientele stands as a testament to the bank’s persistent growth and success over the years.

Visit https://www.ndbbank.com/personal/accounts/ndb-tax-caretaker