Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 25 June 2020 00:00 - - {{hitsCtrl.values.hits}}

Nirmalan Nagendra recently conducted an extensive Director of Finance Course for executive committee members of hotels in Sri Lanka.

|

| Nirmalan Nagendra |

|

The target audience for the course were finance professionals, hotel owners, HR Managers, F&B Managers, F&B Controllers and senior sales personnel of hotels. Having worked in the Middle East, Barbados, Bahamas, USA, Singapore and Moscow during his extensive overseas travels as Deputy Manager and Director of five-star hotels, he brings a wealth of knowledge which he is ready

to share.

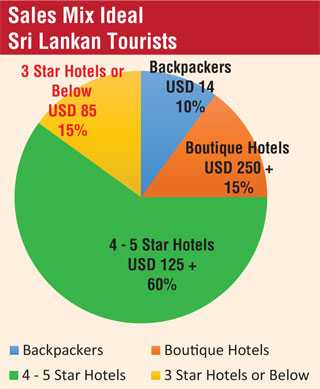

Nirmalan is a strong advocate for maintaining room rates, even during difficult times. He is often of the opinion that Sri Lanka being a beautiful island, must at least have a reasonable room rate in order to make a decent profit. His opinion of an ideal sales mix is shown in the given figure.

Nirmalan is a veteran hotelier with over 33 years of experience. He is an accountant by profession turned Head of Operations. In addition to his hotelier background, Nirmalan possesses over 20 years of strong financial administration at five-star hotels across the globe. His expertise is spread throughout his various stints in various regions around the world including USA, The Caribbean, Middle East and Singapore as well as holding the position of an operation and commercial oriented Director of Finance, with a wealth of business experience. He has worked across international hotels chains including Park Hyatt Jeddah-Marina Saudi Arabia, Le Royal Meridien Abu Dhabi, Al Aqa, Kuwait, Forte Nassau Beach Bahamas and Sandy Lane Hotel Barbados. Nirmalan is a Fellow Member of British Association of Hospitality Accountants, the Institute of Management UK, and the Hotel & Catering International Management Association.

At present, each hotelier seems to be in competition with one another and demoralise each other, thereby making the industry as a whole suffer.

When Nirmalan began his hotel career 37 years ago, 4 to 5 star hotels were breaking even in seven years. However, with the current severe competition in the market, hotels cannot even break even in 15 years.

During the course, Nirmalan went on to explain that for example, if the room rate is kept at $ 125 net, a hotel’s room department can see a profit of 80% based on just room revenue alone. He also stressed that in order for all contributors of the tourism industry to profit and benefit, the country must attract tourists who spend at least $ 200 per night, which includes taking a taxi from the airport, and stay in a hotel that is priced at, at least $ 125 net per night.

Food and beverage

Food and beverage is highly labour intensive and would only produce 30-35% of profit for the department overall through F&B revenue. Since F&B revenue compliments the rooms, hotels must ideally have at least one or two restaurants in order to generate a good gross operating profit (GOP) at a decent average rate which will cost approximately Rs. 3,000.

Food cost and controls

Nirmalan also stressed that the hotel’s management should know their theoretical food cost and the use the hotel’s point of sales system to the maximum, and not as a cash register. He stressed that it is vital for the POS system/cash register to be connected to the kitchen printer, and the chef prepares the orders only off the printout from the kitchen printer, and strictly avoid manual kitchen order token (KOT). Nirmalan explained that the reason for this strict adherence being that when the order is punched through the POS, the revenue is safeguarded, and leaves no room for fraud.

He also spoke on the importance of menu engineering and the need for an F&B Manager, Executive Chef and the DOF to work together in unison to see growth.

Banqueting revenue

Sri Lanka should take advantage of the ‘MICE’ business sector (Meetings, Incentives, Conferences and Exhibitions); especially from our close neighbour India. The wedding business too is a highly lucrative area, where the average check can be Rs. 5,000. At this rate, the banqueting department can profit at least 50% or more.

Other areas covered during the course were:

Good governance

Nirmalan said that to retain employees, keep them happy and have them serve your customers better, hotels and the management must practice good governance. Salaries must be paid by the 26th of each month, service charge by the 15th and all other statutory payments including taxes on the due dates (including VAT, EPF/ ETF payments).

The Director of Finance should be an impartial civil servant and must not take sides between the owner and the operator which does not do well in a practical situation. The owners and the operators must be paid their due profit share, whilst it’s important for the management to strictly adhere to the ‘Management Agreement’.

Accounts receivable

Nirmalan explained to the participants that a sale is not a sale, until the money is in the bank. Having a huge revenue and proportionately high accounts receivable is of no use. He went onto explain that all accounts receivable should be backed by well documented credit applications and proper letters of authorities and backups.

A proper system of bad debt provisions should be made periodically, with no fictitious revenue created and all rebates should be done within the same month to avoid complications.

Closing of month-end

The month-end should be closed latest by the 4th of each month and the accounts must be distributed to all stakeholders by the 5th morning. He also noted that all variances should be against the budget or the latest forecast.