Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 15 December 2020 00:34 - - {{hitsCtrl.values.hits}}

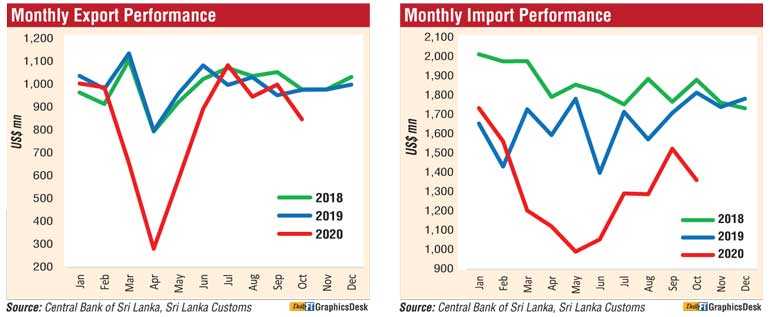

Steep falls in October imports and exports pushed Sri Lanka’s trade deficit contraction to nearly $ 1.6 billion for the first 10 months of the year, the latest Central Bank data showed yesterday, as the impact from the second COVID-19 wave hit the start of 4Q hard.

The external performance report released by the Monetary Authority showed the biggest reduction of $ 1.1 billion came from reduced expenditure on fuel, followed by

$ 520 million from textiles, $ 425 million from building materials, $ 369 million from personal vehicles and $ 270 million from machinery and other equipment.

A deficit of $ 514 million was recorded in the trade account in October 2020, which was significantly lower than the deficit of $ 838 million recorded in October 2019. The improvement in the trade balance was due to the decline in imports ($ 453 million), which was greater than the decline in exports ($ 129 million) during the period under review.

The cumulative deficit in the trade account from January to October 2020 narrowed to

$ 4,852 million from the deficit of $ 6,451 million recorded in the same period in 2019, which is a decline of

$ 1,599 million.

Earnings from merchandise exports suffered in October 2020 due to the impact of the resurgence of COVID-19 cases, although exports of agricultural products continued to grow.

Earnings from merchandise exports in October 2020 were lower compared to October 2019 as well as September 2020, due to the sudden outbreak of the second wave of the pandemic that resulted in disruptions to planned production and support services in the country, especially in the garment industry, the Central Bank added.

Further, adverse global market conditions for Sri Lanka’s key exports were aggravated by the second wave of the COVID-19 pandemic experienced by many countries, leading to low demand for exports of Sri Lanka.

“As a result, earnings from exports in October 2020 amounted to $ 848 million, which was 13.2% lower than October 2019 and 15.2% lower than September 2020.”

Earnings from the export of industrial goods declined by 16.9% in October 2020, on a year-on-year basis, due to the weakened performance of the textiles and garments, and most of the smaller sectors, including gems, diamonds and jewellery; petroleum products; and machinery and mechanical appliances. The export of textiles and garments declined by 18.9%, with reduced exports to the USA, the EU and other markets.

However, export earnings from plastics and articles thereof and rubber products increased, led by their sub categories related to Personal Protective Equipment (PPE) products such as plastic clothing articles, surgical and other gloves.

Export earnings from agricultural goods increased marginally by 0.6% in October 2020, on a year-on-year basis, led by coconut exports (mainly coconut oil and non-kernel products), spices (mainly cinnamon) and natural rubber.

Meanwhile, earnings from tea exports declined by 1.4% due to the decline in volume of tea exports although unit value increased. Other agricultural export sectors which registered a decline during the period under review compared to October 2019 included seafood, minor agricultural products (mainly fruits and edible nuts), and unmanufactured tobacco.

Mineral exports declined by 36.8% in October 2020 compared to October 2019. Exports of earths and stones such as quartz and granite increased, while exports of graphite powder and natural sands declined. Further, export of ores and slag such as titanium and zirconium also declined.

The export volume index declined by 2.8% while the unit value index deteriorated by 10.6%, on a year-on-year basis in October 2020, indicating that the decrease in export earnings was caused by both lower volumes and lower prices.

Merchandise imports declined considerably in October 2020 supported by lower crude oil prices and restrictions imposed by the Government on the importation of non-essential goods.

Expenditure on merchandise imports declined by 24.9% to $ 1,363 million in October 2020 compared to October 2019, thus continuing the year-on-year declining trend observed since March 2020. Declines recorded in all major categories of imports, namely, consumer goods, intermediate goods, and investment goods, contributed to this outcome in October 2020.

Expenditure on the importation of consumer goods in October 2020 was lower by 34.4% compared to October 2019, mainly owing to the decline in the import of motor vehicles for personal use. Expenditure on the import of food and beverages declined by 4.7%. Import expenditure on vegetables, fruits, seafood, dairy products, beverages, and cereals and milling industry products declined. In contrast, expenditure on sugar, oils and fats (mainly coconut oil) and spices (mainly chilli and coriander) imports registered increases.

Sugar prices in the global market was the highest in October 2020 since March 2020 as well as October 2019, due to lower output in the main sugar producing countries owing to low rainfall. Import volume and unit values of both sugar and coconut oil also increased substantially in October 2020 compared to October 2019. Import expenditure on non-food consumer goods declined by 49.4%, due to a decline in most types of imports under this category, led by personal motor vehicles. This reduction in consumer goods was partly attributed to import restrictions. Import expenditure on certain non-restricted items, such as pharmaceuticals, also declined.

Expenditure on the importation of intermediate goods declined by 21.4% in October 2020 compared to October 2019, driven by a 27.5% decline in expenditure on fuel imports, and a 21.3% decline in textiles and textile articles used in manufacturing of garments.

Almost all other large and small subcategories of intermediate goods also recorded declines. Expenditure on fuel imports declined due to a reduction in prices of all categories of fuel; crude oil, refined petroleum and coal imports, due to low oil prices in the world market. The average import price of crude oil in October 2020 was $ 41.77 per barrel in comparison to $66.06 per barrel in October 2019. Volumes imported of crude oil also declined, while refined petroleum and coal increased in October 2020 compared to October 2019.

Imports of investment goods declined by 24.9% in October 2020 compared to October 2019, with reductions in all three major categories, namely, machinery and equipment, building material and transport equipment, as well as almost all subcategories under these three major categories. This outcome was partly attributed to import restrictions.

The import volume index and the unit value index declined by 12.6% and 14.1%, respectively, on a year-on-year basis in October 2020, indicating that the decrease in import expenditure was caused by both lower volumes and lower prices.

Gross official reserves remained at a sufficient level by end October 2020, despite a major debt repayment by way of settlement of an ISB. The level of gross official reserves amounted to $ 5.9 billion with the repayment of the matured ISB of $ 1.0 billion in early October 2020. Gross official reserves were equivalent to 4.2 months of imports. Total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 8.6 billion at end October 2020, providing an import cover of 6.2 months.