Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 1 January 2018 00:00 - - {{hitsCtrl.values.hits}}

The country’s external sector performance in October has shown significant improvement with robust exports and financial inflows helping Balance of Payments surplus and lower imports helping shrink the trade deficit.

The Central Bank said higher export earnings, which recorded a double-digit growth for the fourth consecutive month, and a deceleration in import expenditure resulted in a significant year-on-year decline in the trade deficit in October. However, earnings from tourism increased moderately, while workers’ remittances further declined, owing to adverse economic and geopolitical conditions prevailing in the Middle Eastern region.

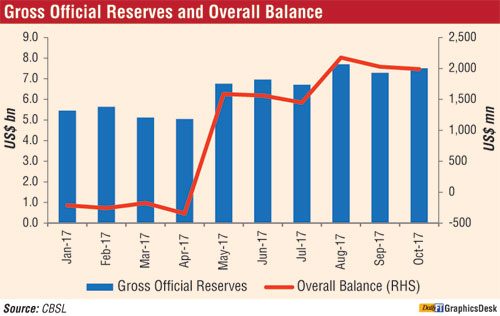

Inflows to the financial account of the BOP continued during the month amidst increased foreign investments in the Colombo Stock Exchange (CSE) and the government securities market. Reflecting these developments, the BOP recorded an overall surplus of around $ 2 billion by end October 2017. Meanwhile, the level of gross official reserves increased to $ 7.5 billion at end October 2017, particularly with the absorption of foreign currency liquidity from the domestic foreign exchange market by the Central Bank.

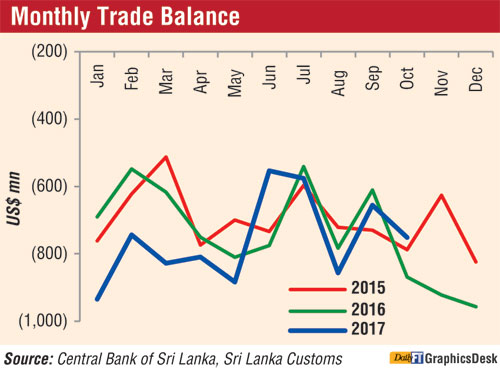

Trade balance

The deficit in the trade account contracted in October in comparison to a year earlier due to the healthy performance in export earnings. However, the cumulative trade deficit expanded at a moderate rate in the first 10 months of 2017.

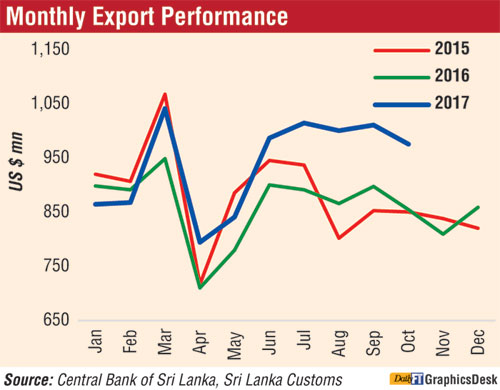

Export performance

Maintaining the growth momentum, earnings from exports increased further registering double-digit growth in October 2017. This was mainly due to higher earnings from industrial exports reflecting the increase in garment exports to the US and the EU market.

Garment exports to the US increased by 14.7%, in October 2017, while those to the EU increased by 8.0% with the benefit of GSP+ facility taking effect reflecting increased demand for garments. With the healthy performance registered in vegetable, fruit and nuts preparations, earnings from food, beverages and tobacco increased during the month.

Further, earnings from rubber products rose mainly due to higher earnings from the export of rubber tyres. Export earnings from petroleum products also increased significantly owing to higher export volumes and prices of bunker and aviation fuel. Meanwhile, earnings from agricultural exports continued to increase in October 2017 as well. An impressive growth in tea exports, with a 13.3% increase in the average tea export price and 11.3% growth in the export volume, mainly contributed to higher earnings in agricultural exports. Earnings from spices increased with higher volumes and the prices of cinnamon. Reflecting the positive impact of the removal of the ban on exports of fisheries products to the EU market and the restoration of the GSP+ facility, earnings from seafood exports increased considerably with a 145%, year-on-year, growth in exports to the EU market.

However, earnings from coconut declined in October 2017 compared to October 2016 mainly due to lower domestic supply of all kernel categories. In October 2017, the US, the UK, India, Italy and Germany were the leading markets for merchandise exports of Sri Lanka accounting for about 51% of total exports.

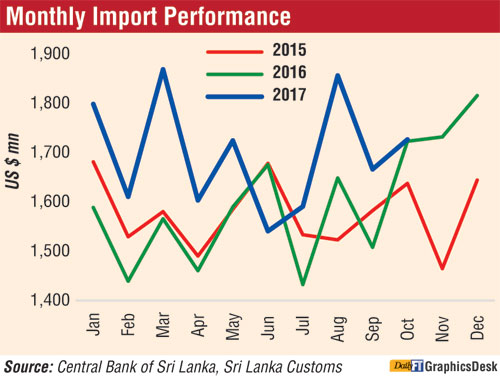

Import performance

Expenditure on imports declined in October due to the dip in expenditure on sugar imports owing to lower prices as well as lower volumes. Comparatively high imports in October 2016 also contributed to the year-on-year growth of sugar imports. Fuel imports declined as a result of low crude oil imports on volumes despite an increase in prices.

Import expenditure on investment goods declined due to lower imports of machinery and equipment led by telecommunication devices and transport equipment.

There was also a decline in imports of auto trishaws and lorries.

Expenditure on construction sector-related imports showed a mixed performance as building materials led by cement imports declined, while imports of iron and steel of both finished and raw forms as well as cement clinker increased in October 2017.

However, continuing the higher increase observed since January 2017 in view of measures taken to fulfil the shortage of rice in the domestic market, the volume of rice imports rose by 2,433% in October 2017 on a year-on-year basis. Increased clothing and footwear imports mainly contributed to the growth in imports of clothing and accessories.

India, China, the UAE, Singapore and Japan were the main import origins accounting for 59% of total imports in October 2017.

Other major Inflows to the current account

In October 2017, tourist arrivals recorded a marginal increase in comparison to October 2016, while earnings from tourism also increased marginally during the month. The top five sources of tourist arrivals, namely India, China, the UK, Germany and France accounted for 52.4% of total tourist arrivals up to end October 2017.

On a cumulative basis, tourist arrivals and earnings from tourism increased during the first 10 months of 2017 compared to the corresponding period of 2016. Meanwhile, workers’ remittances continued to decline significantly by 12.2% during October 2017, as a result of adverse economic and geopolitical conditions prevailing in the Middle Eastern region. Accordingly, workers’ remittances declined by 7.9% (year-on-year) on a cumulative basis during the year up to end October 2017.

Financial flows

The financial account of the BOP continued to strengthen during October 2017. Reflecting positive investor sentiment, the CSE marked a substantial net inflow (including both secondary and primary market foreign exchange flows) in October 2017 and during the first 10 months in comparison to the net outflow recorded during the corresponding period in 2016.

Foreign investments to the government securities market witnessed net inflows for the eighth consecutive month. Meanwhile, long-term loans to the Government increased on a net basis during the first 10 months of the year.

International reserves

Sri Lanka’s gross official reserves increased from $ 6 billion recorded as at end 2016 to $ 7.5 billion by end October 2017 sufficient to finance 4.4 months of imports. The increase in gross official reserve position as at end October 2017 was primarily due to the absorption of foreign exchange from the domestic foreign exchange market and the receipts of the Asian Clearing Union (ACU) during the month. Meanwhile, total foreign assets, which include foreign assets of the banking sector, amounted to $ 9.8 billion, equivalent to 5.7 months of imports.

Exchange rate movements

The Sri Lankan rupee recorded a modest depreciation of 1.9% against the US dollar during the year up to 28 December 2017 in comparison to the depreciation of 3.8% recorded during 2016. Furthermore, reflecting cross currency movements, the rupee also depreciated against other major currencies during this period.