Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Saturday, 16 January 2021 00:01 - - {{hitsCtrl.values.hits}}

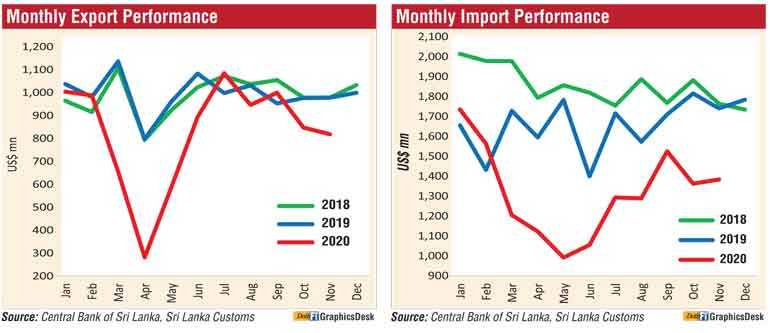

Hit by a downturn in economic activity due to the second COVID-19 wave Sri Lanka’s trade deficit in November shrank by $ 198 million while overall it recorded a reduction of $ 1.79 billion for the first 11 months of 2020, latest data from the Central Bank showed yesterday.

The deficit in the trade account narrowed in November 2020 by $ 198 million to $ 565 million, from $ 762 million recorded in November 2019, due to a larger decline in imports, compared to the decline in exports, the Central Bank’s external performance report said.

Further, the cumulative deficit in the trade account from January to November 2020 narrowed to $ 5,416 million from the deficit of $ 7,213 million recorded in the same period in 2019.

Terms of trade, i.e. the ratio of the price of exports to the price of imports, improved by 0.6% in November 2020, compared to November 2019, with import prices declining more than export prices.

Earnings from merchandise exports suffered in November 2020 due to the resurgence of COVID-19 cases in Sri Lanka and abroad. Earnings from exports declined by 16.3% to $ 819 million in November 2020, compared to November 2019. This was a 3.4% decline compared to October 2020. Measures imposed to combat the second wave of the pandemic locally affected production in key export sectors, garments in particular.

Further, the second wave of the pandemic experienced in export markets affected demand for exports, while significant disruptions to global shipping and logistical chains also affected local businesses negatively.

Earnings from the export of industrial goods declined by 19.6% in November 2020, compared to November 2019, mainly due to the 37.2% decline in garment exports. Health related restrictions in factories contributed significantly to this outcome.

Meanwhile, earnings from the export of petroleum products declined significantly due to the reduction in bunkering quantities as well as prices. While exports of a number of smaller factory-based export sectors also declined, export earnings from some industrial export categories increased.

The latter included gems, diamonds and jewellery; rubber products (with increased exports of tyres and gloves); and plastics and articles thereof (with increased exports of personal protective equipment such as plastic clothing articles).

Export earnings from agricultural goods declined by 2.3% in November 2020, compared to November 2019, due to a reduction in the export of seafood, minor agricultural products (fruits, edible nuts, betel leaves, etc.) and tea. Earnings from tea exports declined by 5.2%, with declines in volumes of black and green tea exported, while unit prices of both types marginally increased. Agricultural exports that displayed an increase in earnings were spices (led by cinnamon and pepper), coconut (mainly coconut oil and non-kernel products) and rubber.

Mineral exports declined by 4.4% in November 2020, compared to November 2019. Exports of earth and stone declined, while exports of ores, slag and ash increased.

The export volume index declined by 7.9% while the unit value index declined by 9.1% on a year-on-year basis in November 2020. This indicated that the decline in export earnings was caused by both lower volumes and lower prices.

Merchandise imports declined in November 2020, continuing the year-on-year declining trend observed since March 2020, mainly due to relatively low crude oil prices and restrictions imposed by the Government on the importation of non-essential goods.

Expenditure on merchandise imports declined by 20.5% to $ 1,384 million in November 2020, compared to November 2019. Declines recorded in all three major categories of imports, namely, consumer goods, intermediate goods, and investment goods, contributed to this outcome.

Expenditure on the importation of consumer goods in November 2020 declined by 31%, compared to November 2019, mainly due to the restriction on the importation of motor vehicles for personal use. Other than the categories of medical and pharmaceuticals and toiletries, all broad segments of non-food consumer goods showed a decline, compared to November 2019.

However, the import of random miscellaneous items within these non-food consumer good categories, some of which are not under restrictions, displayed an increase even on a year-on-year basis, although they did not exert a substantial pressure on the trade balance. Such items included cigarettes, certain clothing items, tissues, carpets, mattresses, refrigerators, fans, clocks, lamps, TV antennas, certain footwear types, razors, umbrellas and certain cosmetic preparations.

Import expenditure on food and beverages recorded a decline of 11.4% in November 2020, compared to November 2019, with imports of most types of food and beverages declining. However, the importation of lentils, oils and fats (mainly coconut oil) and coriander seeds increased.

Expenditure on the importation of intermediate goods declined by 17.6% in November 2020, compared to November 2019, driven by a 44% decline in expenditure on fuel imports, which in turn was due to the reduction in oil prices in the world market.

The average import price of crude oil in November 2020 was $ 45.88 per barrel, in comparison to $ 69.11 per barrel in November 2019. Volumes imported of crude oil slightly increased in November 2020, compared to November 2019, while volumes of refined petroleum and coal imports declined. Other intermediate good categories that showed a marked decline were textiles and textile articles used in garment production, cement clinkers and wheat. Intermediate goods imports that recorded notable increases included fertiliser, chemical products, iron and steel, and diamonds.

Imports of investment goods declined by 18.1% in November 2020, compared to November 2019, with reductions in all three of its main categories, namely, machinery and equipment, building material and transport equipment, with many subcategories within them recording declines, which was partly due to import restrictions. Large value reductions were apparent in articles of iron and steel, medical and laboratory equipment, commercial purpose vehicles, cement, ceramic products, machinery and equipment parts, and uncategorised industrial machinery and transport equipment. However, notable increases in import expenditure were observed with iron and steel, computers, transmission apparatus, agricultural machinery and tractors.

The import volume index and the unit value index declined by 12% and 9.7%, respectively, on a year-on-year basis in November 2020, indicating that the reduction in import expenditure was caused by lower import prices.

Gross official reserves at end November 2020 amounted to $ 5.6 billion. This level was equivalent to 4.1 months of imports. Total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 8.4 billion at end November 2020, providing an import cover of 6.2 months.

The rupee recorded a marginal depreciation against the dollar during November 2020, with increased volatility from the middle of the month. A notable depreciation pressure was observed in December mainly driven by speculative market behaviour. Timely action by the Central Bank through appropriate intervention and moral suasion curbed the depreciation pressure, and the overall depreciation of the rupee was limited to 2.6% against the dollar in 2020.

Meanwhile, reflecting cross-currency movements, the rupee depreciated against the euro, the pound sterling, the Japanese yen and the Australian dollar, while remaining stable against the Indian rupee in 2020. The Central Bank continued its net purchases of foreign exchange from the domestic foreign exchange market in November 2020, which resulted in the Central Bank absorbing $ 305 million on a net basis up to end November 2020.