Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 25 June 2020 02:43 - - {{hitsCtrl.values.hits}}

Sri Lanka’s stressed external liquidity position is set to remain a weakness even after the Parliamentary Election in August, Fitch Ratings warned yesterday, as hurdles to accessing additional external financing support will persist even though policymakers may be able to offer more clarity about their economic agenda post polls.

Sri Lanka’s external financing challenges was a major reason for Fitch downgrading the sovereign rating to ‘B-’ from ‘B’, with a Negative Outlook, in April 2020. The country’s external liquidity ratio (defined by Fitch as liquid external assets as a percentage of liquid external liabilities), at around 60% in 2019, is among the lowest in its rating category.

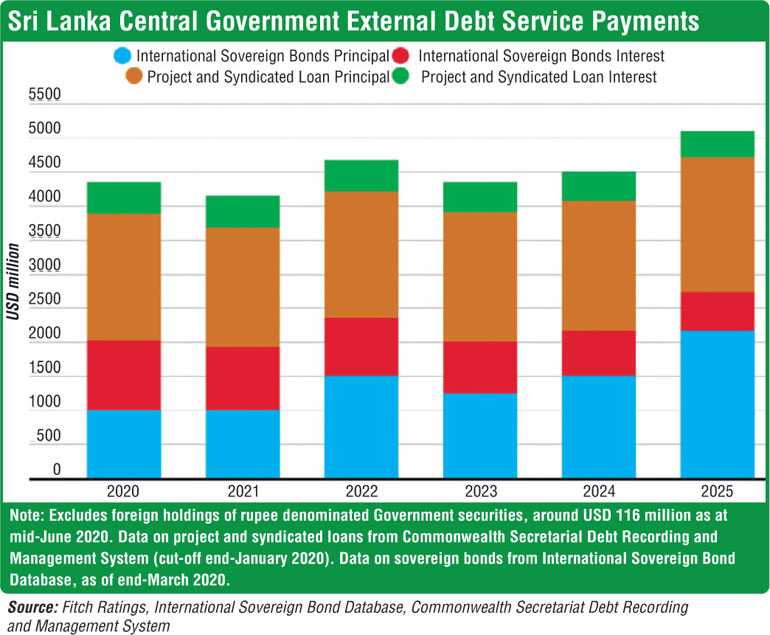

International reserves amounted to $ 6.5 billion at end May after falling by around $ 716 million over the month. This level of coverage is low relative to sovereign external debt that is due the rest of this year. External debt service amounts to around $ 3.8 billion from June to December 2020, including a $ 1.0 billion international sovereign bond payment due in October, the international ratings agency said in its latest report.

“Sri Lanka has yet to receive external financing from the IMF in 2020, either as part of emergency support during the coronavirus pandemic or as part of a regular program. Greater clarity on the Government’s medium-term economic policies after the elections are held could facilitate such financing, but agreeing on policies to place public finances on a consolidation path will be challenging,” the report said.

Sri Lanka’s recent three-year $ 1.5 billion Extended Fund Facility (EFF) with the IMF expired in early June after going off track last year when a new Government introduced tax cuts that were contrary to the programme’s revenue-based consolidation strategy.

“The Ministry of Finance forecast in a recent report that the Budget deficit in 2020 would hit 8.5% of GDP on account of declining revenues, higher than an earlier forecast of 7.5% during the time of our April review. We continue to forecast a wider Budget deficit, at 9.3%, due to our forecast that GDP will contract by 1.3%. Sri Lanka’s growth prospects will depend in part on the evolution of the pandemic in Sri Lanka and globally,” Fitch said.

Fitch estimates the Government’s debt-to-GDP ratio will be elevated at around 94% in 2020, above the ‘B’ rating median of 66%, and will rise further in 2021. The ratio of debt to fiscal revenue, at close to 900%, is also far above the ‘B’ median of 350%.

“We believe the Government will be able to finance its maturing external debt in 2020 through loan disbursements from bilateral and multilateral agencies, apart from the sovereign bond obligation that is due, which we assume will be met out of reserves. Our projections do not assume access to international capital markets or IMF support in 2020, but do incorporate an expectation that Sri Lanka will regain market access in 2021 when external financing conditions improve.”

Sri Lanka’s debt servicing obligations over 2021-2025 are substantial, amounting to an average of $ 4.3 billion per year. Fitch cited a further increase in external funding stress, reflected in a narrowing of funding options and weaker refinancing capacity, threatening Sri Lanka’s ability to meet external debt repayments, as a potential negative rating sensitivity in April when Fitch downgraded the sovereign rating.

The Government remains in negotiations with bilateral and multilateral lenders to secure financing support. On 17 June it also announced that it was seeking proposals from domestic and foreign banks to raise a $ 500 million facility.

“External funding strains could ease, at least in the near term, if the authorities secure substantial support beyond the rollover of existing debt incorporated in our assumptions.”