Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 5 April 2021 00:00 - - {{hitsCtrl.values.hits}}

The tourism sector has received more time to repay low interest bearing working capital loans obtained to cope with the COVID-19 pandemic.

The grace period has been extended up to 30 September, and the repayment period up to 36 months for loans obtained by individuals and enterprises in the tourism industry under all three phases of the Saubagya COVID-19 renaissance facility. The loan was given at a 4% interest rate.

The Central Bank said the extension was given upon identifying the challenges faced by the businesses and individuals engaged in the tourism sector due to the ongoing COVID-19 pandemic.

Businesses and individuals registered with the Ministry of Tourism, Sri Lanka Tourism Development Authority and agencies under it, Department of Cultural Affairs and The Hotels Association of Sri Lanka are eligible to obtain this extension of concessions.

Eligible borrowers who wish to avail the concessions need to make a request to their financial institution on or before 23 April, and the participating financial institutions (PFIs) of the Saubagya scheme have been requested to notify the Central Bank by 7 May.

In November last year, the Central Bank extended the grace period from six to nine months.

The concession granted on the repayment of working capital loan is a further relief for the tourism industry. Last month, the Central Bank extended the moratorium on capital and interest of loans obtained by the tourism industry by a further six months from 1 April. The debt moratorium was to originally end on 31 March.

Banks were requested to convert capital and interest falling due during the moratorium period commencing from 1 April to 30 September into a term loan at a 7% interest rate.

During a recent discussion with Tourism Minister Prasanna Ranatunga, representatives from the various professions engaged in the tourism industry pointed out that tourist hotel owners have to pay interest of about Rs. 105 billion for the loans, amounting to Rs. 350 billion, and they were in great difficulty while attempting to pay back these loans and interests.

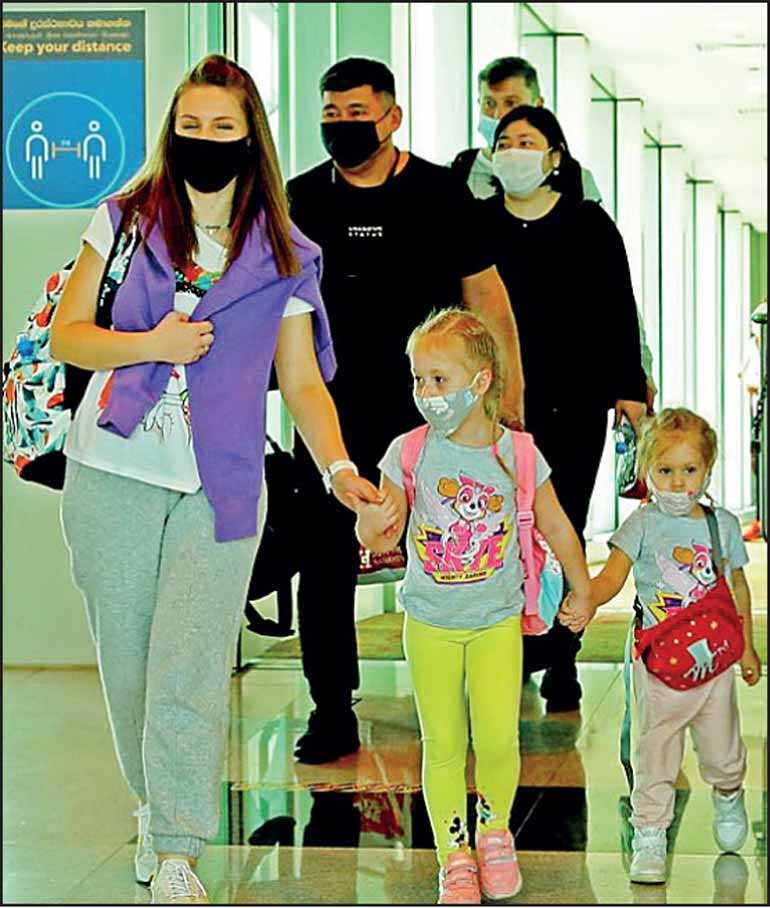

After a 10-month closure, Sri Lanka re-opened borders and resumed international tourism on 21 January. Since then, over 9,000 tourists have arrived whilst complying with health and safety guidelines on account of the COVID-19 pandemic.

Under the three phases of the Saubagya COVID-19 renaissance facility, the Central Bank approved 61,907 loan applications worth Rs. 178 billion received from COVID-19-affected businesses and individuals.