Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 29 January 2019 03:28 - - {{hitsCtrl.values.hits}}

Expenditure on imports in November down 9.1% to $ 1.76 b

Personal vehicle imports drop 34.8%

Exports in November up 4.1% to $ 980 m

Twin development helps significantly narrow trade deficit

First 11 months imports top Rs. 20 b; Exports near $ 11 b mark

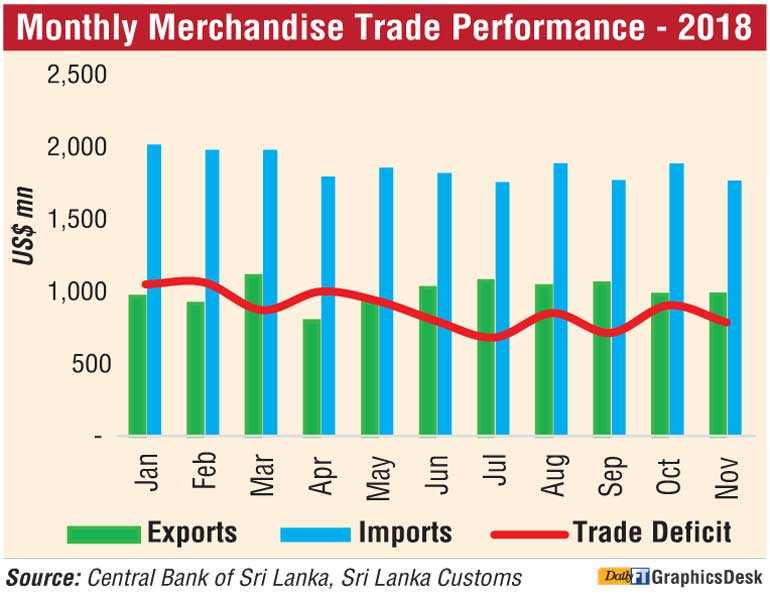

Restrictions and depreciation have triggered imports to report first ever decline in 17 months in November and help significantly narrow the trade deficit with exports improving by a modest 4.1%.

The Central Bank said yesterday expenditure on merchandise imports declined by 9.1% (year-on-year) for the first time since June 2017 to $ 1.76 billion in November 2018.

“The decline in consumer and investment goods contributed to the decline reflecting mainly the impact of restrictions on personal vehicles and non-essential consumer goods imports, while the relatively larger depreciation of the rupee may also have contributed to curtailing imports,” the Bank added.

Earnings from merchandise exports increased moderately by 4.1% (year-on-year) to $ 980 million in November 2018. The growth in exports was driven by industrial exports while agricultural exports continued to decline. The twin development saw trade deficit narrow significantly in November to $ 785 million as against $ 999 million a year earlier.

Exports in the first 11 months grew by 5% to $ 10.85 billion whilst imports were up 8.3% to $ 20.5 billion, resulting in the cumulative deficit expanding to $ 9.64 billion in comparison to $ 8.59 billion in the corresponding period of 2017.

Limits...

Terms of trade, which represents the relative price of imports in terms of exports, improved by 1.6% (year-on-year) to 112.8 index points in November 2018 due to an increase of export prices supported by a marginal decline in import prices.

In November under industrial exports, export earnings from textiles and garments increased notably in November 2018 mainly driven by exports to the USA. In addition, garment exports to non-traditional markets such as India, Canada and Australia as well as the EU market increased along with textile and other made up textile articles.

Earnings from petroleum products increased significantly in November 2018 reflecting higher bunker and aviation fuel prices despite a slight reduction in export volumes in comparison to that of November 2017. Export earnings from machinery and mechanical appliances also increased substantially during November 2018 due to improved performance in all sub-categories therein.

Further, export earnings from food, beverages and tobacco, rubber products and base metals and articles rose in November 2018, contributing towards the increase in industrial exports. However, export earnings from printing industry products, gems, diamonds and jewellery and leather, travel goods and footwear declined in November 2018.

Earnings from agricultural exports recorded a decline during the month due to poor performance in almost all sub-categories except the categories of unmanufactured tobacco and vegetables. Reflecting lower average export prices and exported volumes, export earnings from tea declined in November 2018.

Export earnings from spices also declined during the month due to the lower volumes in most categories of spices. Further, earnings from coconut exports declined due to the drop in both kernel and non-kernel products. Earnings from seafood exports also declined in November 2018 while in cumulative terms, seafood exports rose with higher exports to the EU market.

The export volume index in November 2018 increased by 2.9% while the export unit value index increased by 1.1%, implying that the growth in exports was driven mainly by the increased volume, rather than the price, compared to the volume and unit value indices in November 2017.

Import expenditure on consumer goods declined (year-on-year) notably in November 2018 due to lower expenditure on food and beverages driven by rice, vegetables, dairy products and sugar imports. Such reduction in imports on food and beverages can be attributed to the combined effect of lower import volumes due to higher domestic production and lower commodity prices in the international market. Expenditure on non-food consumer goods such as telecommunication devices and home appliances decreased in November 2018 on a year-on-year basis, partly due to measures taken by the Central Bank to restrict certain categories of non-essential consumer goods imports.

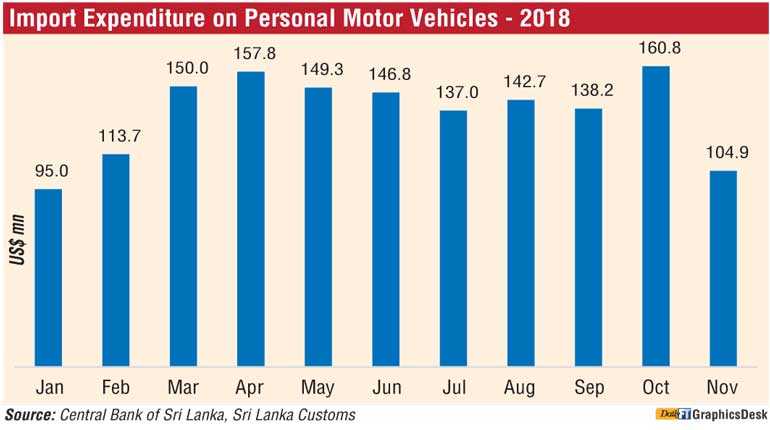

“Expenditure on personal vehicle imports showed a significant decline of 34.8% in November 2018 from the previous month, reflecting the impact of policy measures put in place to curtail personal vehicle imports. It is expected that the importation of motor vehicles and non-essential consumer goods could decelerate further in the coming months,” it said.

Expenditure on the importation of investment goods also decreased in November 2018 mainly due to lower imports under many sub-categories. Specifically, a significant decline was seen in expenditure on the importation of cement and vehicles for commercial purposes compared to November 2017.

In contrast, import expenditure on intermediate goods increased, albeit marginally, driven by fuel, base metals and fertiliser imports.

Expenditure on fuel imports increased with the combined effect of higher import prices and volumes of both refined petroleum products and coal, despite a reduction recorded in the import volume of crude oil. Meanwhile, expenditure on base metal imports increased driven by iron and steel. However, expenditure on gold imports continued to decline significantly in November 2018, reflecting the impact of customs duty imposed on gold in April 2018.

Expenditure on wheat and maize also dropped during the month mainly due to lower imported volumes. Import expenditure on mineral products and textiles and textile articles also declined during the month, contributing to mitigate the pressure on import expenditure.

Both import volume and unit value indices decreased by 8.6% and 0.5%, respectively in November 2018. This indicates that the decline in imports during the month was driven by the reduction in volumes imported despite lower prices of imported goods in comparison to the corresponding period of 2017.