Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 28 August 2018 00:14 - - {{hitsCtrl.values.hits}}

Despite exports

topping $ 1 billion in June Sri Lanka’s external sector delivered a mixed performance with the trade deficit climbing to $ 795 million year-on- year amidst increased imports of vehicles, fuel and transport equipment, the Central Bank said yesterday.

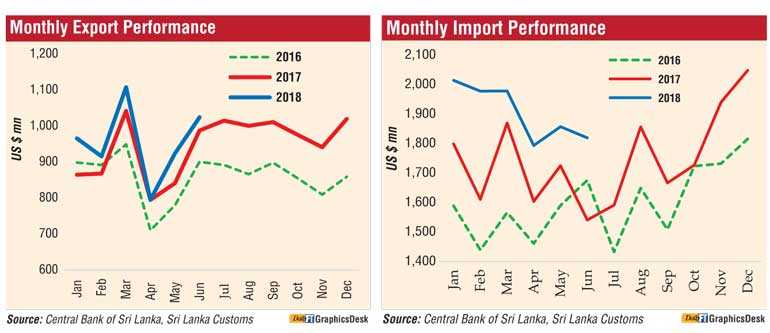

Even though the lowest trade deficit so far during the year in absolute terms was recorded in the month of June, the trade deficit widened significantly in comparison to June 2017 as the growth in import expenditure outpaced the increase in export earnings, the Central Bank said in its monthly External Sector report. Export earnings grew 3.8% to $ 1,024 million in June from the previous year while imports rose 18.1% to $ 1,819 million.

The financial account of the Balance of Payments (BOP) was supported by the fifth tranche of the Extended Fund Facility of the International Monetary Fund (IMF-EFF) and the third tranche of the divestiture of the Hambantota Port, however, outflows of foreign investment from the Government securities market and the secondary market of the Colombo Stock Exchange (CSE) exerted some pressure on the BOP.

Reflecting developments in the domestic and global foreign exchange markets, the Sri Lankan Rupee depreciated by 3.45% against the US Dollar by end June and by 5% during the year up to 27 August. The country’s gross official reserves as at end June were $ 9.3 billion.

The deficit in the trade account continued to expand in June in comparison to June 2017, driven by the higher growth in imports. On a cumulative basis, the trade deficit expanded significantly during the first half of 2018 in comparison to the first half of 2017.

Earnings from merchandise exports surpassed $ 1 billion for the second time during the year to $ 1,024 million in June, mainly driven by industrial exports. Under industrial exports, earnings from textiles and garment exports increased significantly due to the higher demand from the EU and the USA while exports to non-traditional markets also increased.

Export earnings from petroleum products increased significantly in June 2018 due to the combined effect of higher export prices and volumes of bunker and aviation fuel. Export earnings from rubber products increased mainly due to higher earnings from tyre exports. Earnings from exports of machinery and mechanical appliances also increased notably during the month owing to the increase in earnings from electrical machinery and equipment and electronic equipment exports.

Meanwhile, export of base metals and articles increased due to higher exports of iron and steel articles and aluminium articles. However, earnings from transport equipment exports declined significantly mainly due to the effect of higher earnings recorded in June 2017 following the export of two ships. In addition, food, beverages and tobacco and leather, travel goods and footwear exports also declined notably in June 2018 in comparison to June 2017.

Meanwhile, earnings from agricultural exports declined in June due to the poor performance in almost all categories except seafood, unmanufactured tobacco and rubber exports. Export earnings from tea declined as both prices and volumes exported reduced in June. In addition, export earnings from spices declined marginally in June as the growth in cinnamon, and nutmeg and mace was outperformed by the decline in pepper, cloves and other spices.

However, benefiting from the positive impact of the removal of the ban on fisheries exports to the EU and the restoration of GSP+ facility, earnings from seafood exports increased significantly during the month due to higher prices and volumes of seafood exported. Leading markets for merchandise exports of Sri Lanka in June were the USA, the UK, India, Italy and Germany, which accounted for about 48% of total exports.

Expenditure on merchandise imports increased to $ 1,819 million in June mainly due to high expenditure incurred on fuel, vehicles and transport equipment. Expenditure on fuel imports, categorised under intermediate goods, increased considerably during the month owing to higher import prices and volumes of crude oil and refined petroleum products.

In addition, expenditure on textiles and textile articles imports increased in June reflecting higher expenses on all sub categories, particularly fabric and yarn imports. Also, import expenditure on base metals, wheat and maize, fertiliser and food preparations contributed towards the increase in intermediate goods imports during the month.

However, expenditure on the importation of gold, which increased considerably since early 2016, declined notably for the second consecutive month in June. Meanwhile, import expenditure on personal vehicles, categorised under consumer goods, increased significantly in June owing to the substantial increase in imports of vehicles with less than 1,000 cylinder capacity (cc), hybrid and electric vehicles.

As taxes applicable on small vehicle imports were revised upward with effect from 1 August vehicle imports are expected to decelerate to some extent in the coming months. However, the reduction in import of seafood, rice and sugar under consumer goods, contributed towards mitigating the pressure on import expenditure during the month.

Meanwhile, higher expenditure on transport equipment driven by the importation of four ships and road vehicles such as commercial cabs and auto trishaws, led to an increase in investment goods imports despite a decline in machinery and equipment and building material. China, India, Japan, UAE and Singapore were the main import origins in June, which accounted for about 58% of total imports.

Foreign investments in the CSE, including both primary and secondary market foreign exchange flows, recorded a marginal net inflow of $0.3 million during the month of June. Consequently, cumulative net inflows to the CSE in the first half of 2018 amounted to $53 million.

Meanwhile, the Government securities market recorded a net foreign investment outflow of $74 million in June, thus raising the net cumulative outflow to $176 million by end June. Further, long-term loans to the Government recorded a net outflow of $115 million during June.

With the receipt of the fifth tranche under the IMF-EFF of $252 million and proceeds of the third tranche from the divestiture of Hambantota Port amounting to $ 585 million, the level of gross official reserves of the country increased to $9.3 billion at end June from $8.8 billion recorded at end May. This level of reserves was equivalent to five months of imports. Total foreign assets, which consist of gross official reserves and foreign assets of the banking sector, were estimated at $11.3 billion as at end June which was equivalent to 6.1 months of imports.

The Sri Lankan rupee depreciated by 5% against the US Dollar during the year up to 27 August. Furthermore, reflecting cross currency movements, the Sri Lankan Rupee depreciated against the euro, the pound sterling, the Japanese yen and the Canadian dollar while appreciating against the Australian Dollar and the Indian Rupee during this period.