Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 16 August 2019 00:00 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

The Government will soon issue Request for Proposals (RFPs) to raise $ 500 million via Samurai bonds, which will be used to bolster reserves and finance debt repayment, Central Bank Governor Dr. Indrajit Coomaraswamy said yesterday.

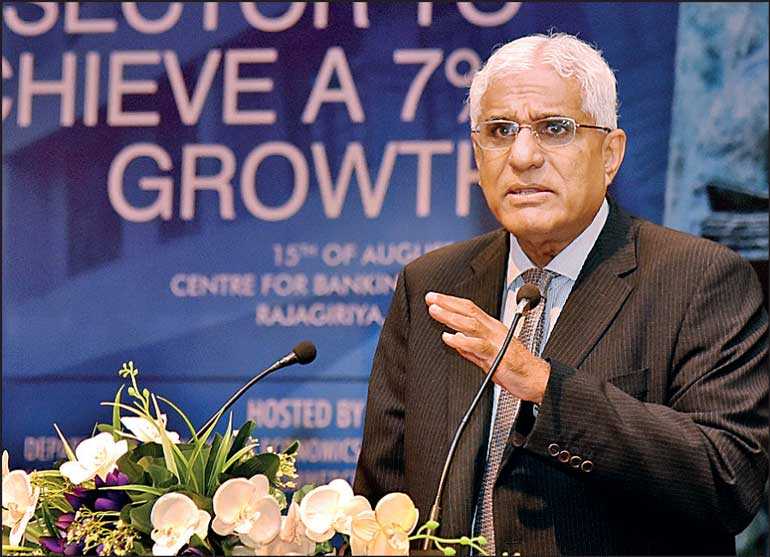

To call for RFPs, a tender board approved by the Cabinet has to be appointed. “We are about to call for RFPs for the $ 500 million Samurai bond. For that, the tender board has to be approved by the Cabinet, and it may take one or two weeks to get through all the administrative procedures before we call for RFPs,” Dr. Coomaraswamy told journalists on the sidelines of the inaugural Sri Lanka Forum of Junior Business Economists Economic Summit.

The Governor expressed hope that they will be able to borrow at below the cost of the recent successful International Sovereign Bond (ISB) issuance, through which Sri Lanka raised $ 2 billion at 6.85% on 5-year tenure, and 7.85% on 10-year tenure. The 10-year $ 500 million Samurai bond is to raise funds for debt repayment.

Delivering the keynote address at the summit, organised by the Department of Business Economics Faculty of Management Studies and Commerce of the University of Sri Jayawardenepura, Dr.Coomaraswamy pointed out that despite economic growth remaining low, the macroeconomic fundamentals have improved.

“Macroeconomic fundamentals have improved. The Monetary Board is also in the process of relaxing the monetary policy to support growth,” he added.

According to him, inflation has been maintained at low single-digit levels of about 3.3% on average. However, because of the Easter Sunday terror attacks, the current account deficit has now been revised to 2.6%, which is marginally higher than the original 2.3%.

The Governor insisted on the importance of getting out of the ‘stop-go policy cycle’ in order to increase macroeconomic stability,so the economy can grow at a much faster pace of around 7%.

Dr.Coomaraswamy believes Sri Lanka’s official foreign reserves will be around $ 8 billion by the end of the year.

Managing debt clearly remains the biggest risk associated with the economy, he said, adding it is critical to maintain the Budget deficit at around 3% to 3.5%. However, to finance the deficit, Sri Lanka needs to have a revenue of about 15% to 16.5% of GDP, he stressed.

“We have seen our debt grow, particularly, our external commercial borrowings. It sounds like we are entirely relying on foreign bond holders, bankers and so on — this makes it more important that we maintain discipline so that markets have confidence in us,” he said.

Sri Lanka has to pay almost $ 6 billion this year, over $ 5 billion next year and $ 4 billion in 2021 and beyond.This means the Government will have to raise around $ 3 billion each year going forward for debt repayment.

Given the country’s situation, the Governor stressed it was critical that political leaders also understand the fact that the economy has very little room to manoeuvre.

Despite the challenging fiscal situation, Dr.Coomaraswamy expressed confidence that Sri Lanka could manage the debt situation through its Active Liability Management Act (ALMA) and Debt Management Strategy.

To maintain growth at sustainable levels, he outlined, it was important to maintain sound macroeconomic fundamentals, export transformation to drive foreign investment, improvement in business management, trade facilitation, as well as leveraging on Sri Lanka’s strategic geographical location.