Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 24 August 2020 00:00 - - {{hitsCtrl.values.hits}}

Concessionary financial support for COVID-hit businesses and entrepreneurs from the banking sector has topped the Rs. 100 billion mark, the Central Bank revealed has revealed.

It described the Rs. 100 billion mark as a “milestone” and said that this was the amount as at 18 August.

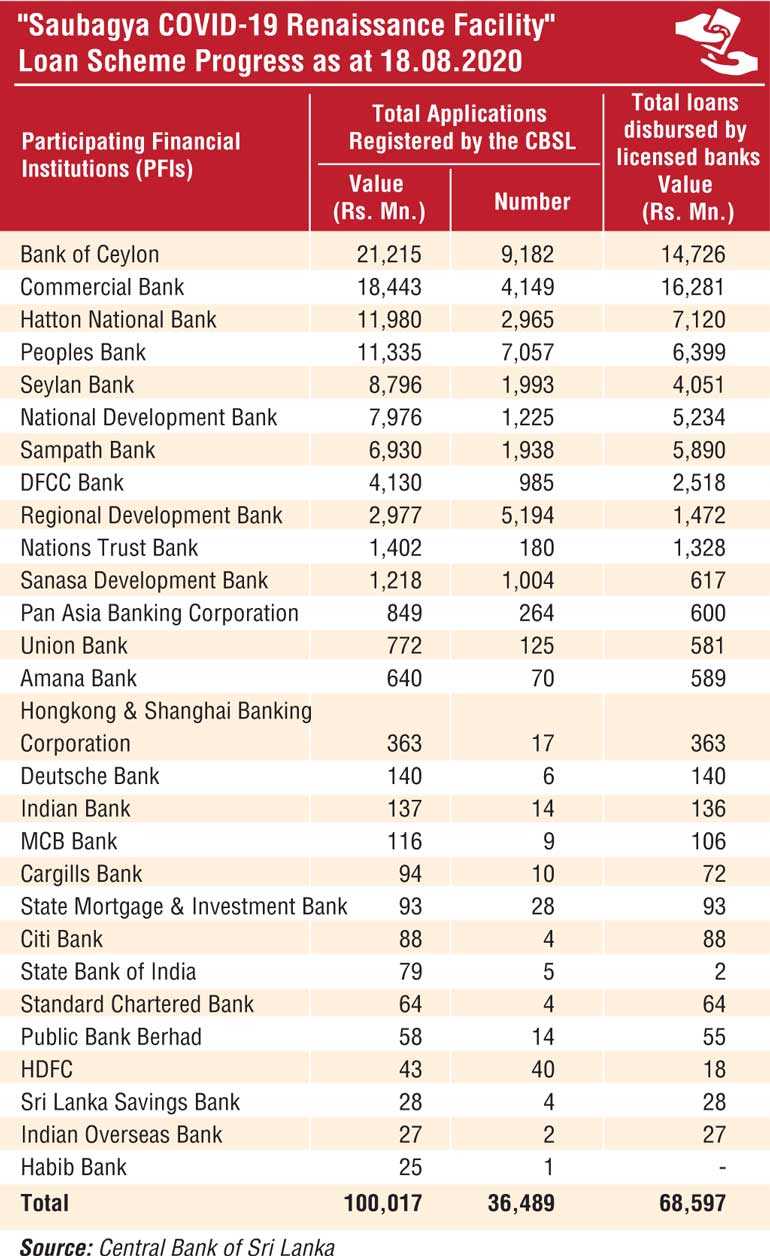

The banking sector has submitted 36,489 applications requesting for Rs. 100.017 billion worth of financial support to the Central Bank. Of that Rs. 68.6 billion has been disbursed as at 18 August.

As of 23 July the previous update by Central Bank, total value of loans approved by CBSL was Rs. 72 billion of which Rs. 45.7 billion had been approved.

Last week Sri Lanka Banks Association President Dimantha Seneviratne told a webinar that Rs. 95 billion worth of financial support has been allocated for COVID-hit businesses and individuals with bulk of its disbursed under three phases of the Saubagya COVID-19 renaissance facility.

As per the Central Bank data, state giant Bank of Ceylon topped the list in terms of applications submitted (9,182) and value (Rs. 21.2 billion) whilst private sector giant Commercial Bank had disbursed most funds worth Rs. 16.2 billion.

The Monetary Board at its meeting last week decided to extend the deadline for the Saubagya COVID-19 renaissance which offers much needed working capital at 4% interest rate.

Central Bank said out of Rs. 100 billion approved under the Scheme, 50% has been provided to businesses in the services sector, led by trade services, while distributing 34% and 16% among businesses in the industry sector and the agriculture sector, respectively.

The Central Bank of Sri Lanka, in consultation with the Government of Sri Lanka, introduced the Saubagya Covid-19 Renaissance Loan Scheme Facility in three phases to provide working capital loans at the interest rate of 4% per annum, with a repayment period of 24 months, including a grace period of six months, to businesses, including self-employment and individuals, adversely affected by the COVID-19 outbreak.