Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 9 April 2018 00:45 - - {{hitsCtrl.values.hits}}

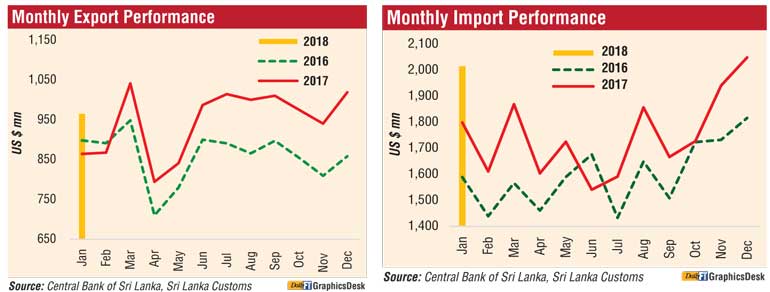

The new year opened on a high note for exports with growth posted at 11.6% to $ 965.4 million in January but the trade deficit surpassed $ 2 billion, dulling the achievement as imports rose 12%, driven by fuel, fertiliser and electric car imports, the Central Bank said.

In its latest external performance update, the Central Bank noted earnings from exports continued to record double-digit growth (year-on-year) reaching $ 965 million in January 2018, partly driven by the impact of the low base as export earnings contracted by 3.8% in January 2017.

Export earnings from food, beverages and tobacco, petroleum products, rubber products and tea contributed largely to the growth in exports. Earnings from food, beverages and tobacco exports increased by more than twofold in January 2018 owing to higher earnings from almost all subcategories except for cereal preparations. Reflecting the increase in volumes, which grew by 72.1%, and the increase in the prices of bunker fuel, earnings from petroleum products exports increased notably in January 2018.

Further, export earnings from rubber products increased due to improved performance in almost all subcategories, particularly the export of tyres.

In addition, export earnings from textiles and garments increased moderately during the month due to the increase in earnings from garment exports to the EU and the US by 4.9% and 1.7%, respectively, although there has been a reduction in exports to non-traditional markets such as Canada, the UAE, China, Saudi Arabia and Japan. Meanwhile, earnings from tea exports increased due to higher prices and volumes.

Further, earnings from gems, diamonds and jewellery, base metals and articles, machinery and mechanical appliances and leather, travel goods and footwear, categorised under industrial exports, as well as seafood and minor agricultural products, categorised under agricultural exports, also contributed towards the increase in export earnings.

However, earnings from coconut exports declined significantly in January 2018 along with the decline in volumes of coconut kernel products such as desiccated coconut, coconut oil and copra as a result of the low domestic production of coconut due to drought conditions.

Export earnings from printing industry products, rubber and spices decreased during the month. In January 2018, the US, UK, India, Germany and Italy were the leading markets for merchandise exports of Sri Lanka, accounting for about 51% of total exports.

Import expenditure surpassed the $ 2 billion mark in January 2018 for the second consecutive month mainly due to high import bills incurred on fuel. Despite the reduction in the volume of refined petroleum imports, expenditure on fuel imports increased significantly during the month owing to high volumes of crude oil imports and significant price increases recorded in all categories of fuel.

The average import price of crude oil increased to $ 72.04 per barrel in January 2018 from $ 57.39 per barrel in January 2017.

Further, import expenditure on fertiliser increased significantly in January 2018, reflecting the combined impact of higher average import prices and volumes of fertiliser, particularly urea. Expenditure on gold imports continued to increase significantly in January 2018.

In addition, following the reduction in taxes on electric motor vehicles in Budget 2018, import expenditure on personal vehicles increased owing to high imports of electric motor vehicles.

Further, import expenditure on base metals also increased mainly due to higher imports of iron and steel.

Despite the decline recorded in the average import prices of rice, import expenditure on rice rose in January 2018 due to the high import volumes of rice. In addition, expenditure on dairy products, paper and paperboard and articles thereof, transport equipment, clothing and accessories, and building materials imports increased during the month.

However, import expenditure on machinery and equipment decreased in January 2018 mainly due to the decline recorded in engineering equipment, telecommunication devices, and medical and laboratory equipment. Also, expenditure on textile and textile articles imports declined during the month, driven by the decline in the import of fabrics.

Import expenditure on agricultural inputs, spices and rubber products also decreased in January 2018. India, China, the UAE, Japan and Singapore were the main import origins in January 2018, accounting for about 58% of total imports.

Foreign investments in the government securities market witnessed a net inflow for the 11th consecutive month in January 2018 in comparison to the net outflow recorded in January 2017. Foreign investments in the CSE including primary and secondary market flows also recorded a net inflow during the month compared to the net outflow recorded in the corresponding period of 2017. Further, long-term loan inflows to the Government recorded a net outflow of $ 2.5 million during the month.

In terms of foreign direct investments (FDIs), including foreign loans to BOI companies in 2017, Sri Lanka received $ 1,913 million, registering the highest ever FDI inflows in history.

The level of gross official reserves of the country declined to $ 7.7 billion, equivalent to 4.3 months of imports, at end January 2018 compared to $ 8 billion at end 2017, primarily due to a periodic payment for the obligations at the Asian Clearing Union (ACU) during the month.

Total foreign assets, which include the foreign assets of the banking sector, also declined to $ 10 billion (equivalent to 5.7 months of imports) at end January 2018 from $ 10.4 billion at the end of 2017.

The rupee depreciated by 2% against the US dollar up to 5 April 2018. Furthermore, reflecting cross currency movements, the rupee also depreciated against other major currencies during this period.