Friday Feb 27, 2026

Friday Feb 27, 2026

Saturday, 17 October 2020 00:08 - - {{hitsCtrl.values.hits}}

Sri Lankan exporters are hopeful of a moderate growth for their businesses and economic recovery over the next 12 months despite the growing number of COVID-19 cases, a survey from the Economic Intelligence Unit (EIU) of the Ceylon Chamber of Commerce said yesterday.

The findings of the three-week survey that began in mid-September were outlined in the latest Business Survey on Trade and Labour Market Impacts of COVID-19 on Sri Lankan Exporters.

The survey was designed and conducted by the Ceylon Chamber of Commerce (CCC) Economic Intelligence Unit (EIU) and the United States Agency for International Development (USAID) supported Partnership for Accelerating Results in Trade, National Expenditure and Revenue (PARTNER) project. This is the second assessment of the impact of COVID-19 on Sri Lankan exporters.

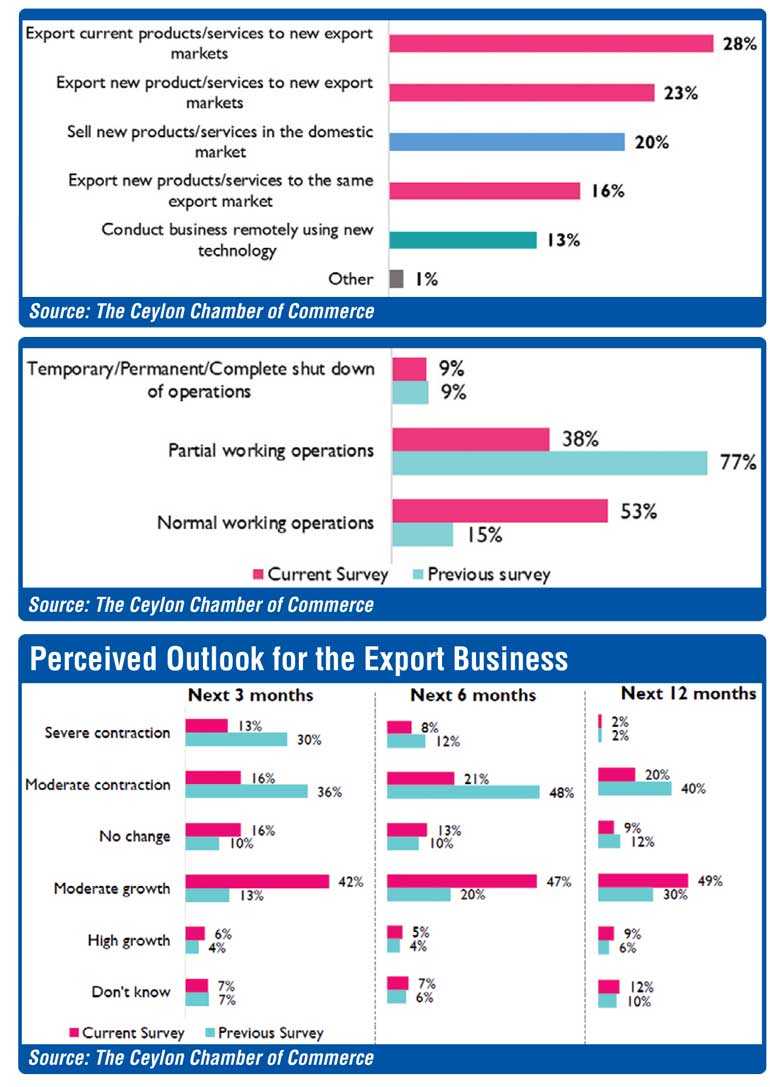

The first business survey was conducted in May and captured insights from the lockdown period. The perceived outlook for export business and the economy in May was an expectation of a ‘severe or moderate contraction’.

The survey was conducted over three weeks, starting from 13 August. It provides insights on how export firms are confronting and overcoming challenges, following the reopening of the economy since May.

The survey covered 39 export segments (including both export of goods and services) and had an almost even split of responses from large firms and small and medium enterprises (SMEs). The survey also captured insights from firms led or owned by women. Responses came primarily from senior-level executives, providing strategic insights on the trade and labour market impacts of COVID-19.

As 49% of the survey participants in the latest survey took part in the May survey, this information provides scope for comparison from the point of view of these firms.

Operations heading back to normal: In addition to the improvement in outlook in the current survey, it was noted that business operations are heading back to pre-COVID-19 levels; 53% of the firms have gone back to normal working operations while 64% of the firms reported that they are at over 60% of their operational capacity. However, about 38% of firms reported that they are in partial operation.

New market opportunities fall in latest survey: The optimism related to finding new market opportunities has fallen from 63% in the last survey to 49% in the current survey. The decline in opportunities would indicate that some of the early opportunities that arose as a result of COVID-19 may not have emerged as planned. Firms are, however, meeting the challenges due to the pandemic with new products and or services.

Outlook for jobs and training improves: The recovery outlook is supported by the survey insights related to employment and training budgets. Over 70% of the survey respondents are now able to pay basic salary with standard allowances for all executive and non-executive grade employees, which is a substantial improvement from the 40% response recorded in May; 47% of firms are now expecting their training budgets to remain unchanged relative to 2019. In the May survey, 65% of the firms stated that they expect a reduction in their training budget relative to 2019.

Government support in maintaining export momentum: Firms had a few specific requests for the Government that could support business recovery and ensure sustainable growth of exports. These were related to tax relief, market access support, robust communication strategy on policy/regulatory matters, financial assistance, and digitisation of Government services.

Tax relief, financial assistance and digitisation requests were also among the top three requests from the firms in the previous survey, highlighting that these continue to remain pressing concerns for the private sector. These firms also require support in addressing raw material sourcing constraints, such as price increases in production inputs both locally and overseas. Addressing these concerns will support a faster recovery for exports while strengthening the capacity of Sri Lankan exporters to make the best use of export opportunities arising in the future.

The full report is available on the CCC ‘Trade Watch’ website https://www.chamber.lk/images/COVID19/pdf/FindingsReportBusinessSurveyImpactonExporters_Oct2020.pdf