Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 28 June 2019 00:00 - - {{hitsCtrl.values.hits}}

Fitch Ratings yesterday said expectation of continued pressure on banks’ financial profiles due to the challenging operating environment, which includes heightened risks, largely on the macro front, with a sharp rise in non-performing loans (NPLs) likely this year.

The operating environment is of high importance to the ratings of Sri Lankan banks, and acts as a constraint on the Viability Ratings of some banks, the rating agency said in their latest banking industry “dashboard” update.

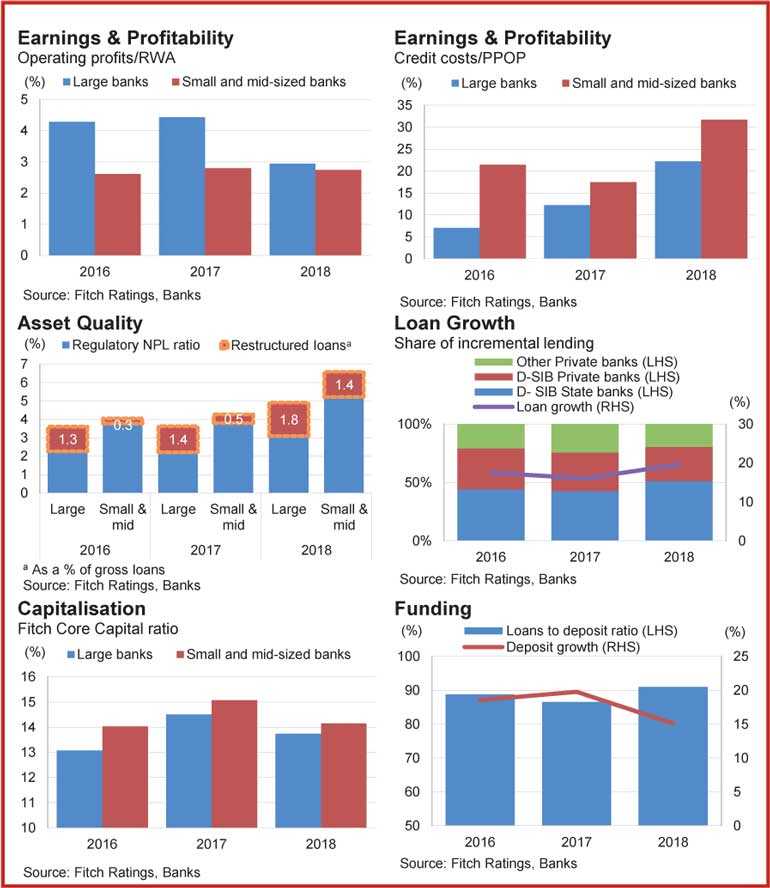

“Our expectation is for loan growth to decelerate in 2019 (down by 0.4% in 1Q19) on muted private-sector credit demand. Loan growth remained subdued through 9M18 at 13%, but closed at 19.6% for 2018, due largely to increased state borrowings. Three large state banks contributed about half of the incremental lending in 2018 (2017: 42%),” Fitch said.

Fitch expects asset-quality pressures to linger in 2019, as seen in the increasing share of restructured loans across Fitch-rated banks.

Sector NPLs grew by 64% in 2018 – the sharpest increase since the pawning debacle in 2013 – driving the sector NPL ratio to 3.4% (2017: 2.5%). This trend continued in 1Q19, with the sector NPL ratio rising further to 4.2% broadly in line with the agency’s expectations for 2019. The adoption of SLFRS 9 saw loan-loss allowances/gross loans increase to 3.7% (2017: 3%).

Pressure on profitability is likely to remain in 2019 from rising credit costs, with SLFRS 9 implementation and weaker asset quality. In addition, the debt-recovery levy imposed in late 2018 should push effective tax rates for the Fitch-rated banks even higher (2018: 49%, 2017: 44%), squeezing profits further. Sector net profit declined by 9% in 2018 (the first time since 2013) as impairment charges more than doubled. This trend continued into 1Q19, with sector ROA declining from 1.1% in 2018 to 0.9%, lower than expectations, Fitch said.

Weaker earnings and asset-quality stress will add to capitalisation pressures despite the capital injections made ahead of Basel III implementation. Capital-raising plans could face execution risks, with recent rights issues of banks being significantly undersubscribed.

The loans/deposits ratio edged up to 91% during 2018 but dipped marginally to 89% in 1Q19 as loans contracted. The funding profiles of banks are fairly stable as deposits remain the main source of funding (2018: 84% of funding).