Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 26 August 2020 02:22 - - {{hitsCtrl.values.hits}}

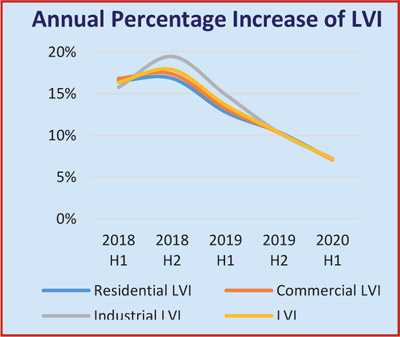

Land value in the Colombo district has become part of the COVID-19 casualty list, with the annual growth rate declining from 13.6% in the first half of 2019 to 7.1% for the same period in 2020, for residential, commercial and industrial property category value indicators, the latest data released by the Central Bank showed yesterday.

Land value in the Colombo district has become part of the COVID-19 casualty list, with the annual growth rate declining from 13.6% in the first half of 2019 to 7.1% for the same period in 2020, for residential, commercial and industrial property category value indicators, the latest data released by the Central Bank showed yesterday.

The Land Valuation Indicator (LVI) measured by the Central Bank showed that there was a growth of 12.8% for residential land in the first half of 2019, and 14.9% for industrial and 13.2% for commercial land when compared to the same period in 2018. However, year-on-year there was only 7.1% growth for residential and commercial LVI, and 7.2% for industrial LVI. The semi-annual percentage change was also slower at 2% in the first quarter of 2020, when compared with 5% in the second half of 2019.

The LVI was also hit by the Easter Sunday attacks, posting slower growth at 10.3% across all categories in the second half of 2019.

“The LVI of the Colombo District reached 141.6 during the first half of 2020, recording an annual increase of 7.1%. Meanwhile, on a semi-annual basis, the LVI marginally increased by 2%. Both annual and semi-annual percentage changes of LVI showed a declining trend over the recent periods,” the statement released by the Central Bank said.

All sub-indicators of LVI, namely Residential LVI, Commercial LVI and Industrial LVI contributed to the overall increase. Industrial LVI recorded the highest annual increase of 7.2%, while both Residential LVI and Commercial LVI recorded 7.1% increases, it added.

The Land Price Index (LPI) was compiled from 1998 to 2008 on an annual basis, and from 2009 to 2017 on a semi-annual basis, covering 5 DS divisions in the Colombo District. Subsequently, from 2017 onwards, its geographical coverage was enhanced to represent all 13 DS divisions in the Colombo District, and hence it was rebased, considering the first half of 2017 as the base period. From the second half of 2019 onwards, LPI was renamed as Land Valuation Indicator (LVI) and released on a semi-annual basis.

Per perch bare land prices are obtained from the Government Valuation Department on a semi-annual basis by the Central Bank to collate the LVI.

The Research Intelligence Unit (RIU), which has monitored real estate markets for 17 years, and conducted a survey among Grade A and B commercial space tenants in their latest update, titled the “Commercial Property Market Report”, said that challenges would remain for many real estate properties in the short- to medium-term.

According to tenants that completed the RIU’s survey, technology firms, healthcare, and telecommunication were considered to be the industries which will drive demand for commercial real estate. Advertising, construction, security firms, and travel were understandably expected to remain stagnant.

“A majority of tenants believe that COVID-19 will affect the number of upcoming office spaces in Colombo, and it could shift demand to outer suburb areas (less urbanised). Our sources confirm that some tenants are considering leaving Grade A offices and moving into smaller spaces in the suburbs. This is mainly due to reduced business activities in the post-COVID-19 era, which has gravely impacted on some companies, and they are unable to keep up with the high rentals in Grade A offices,” the report said.

Safety standards and health guard facilities provided at entrances to buildings (COVID-19 symptom checker, disinfect anyone who enters the building) were the most important requirements for tenants. Above all, tenants have prioritised the safety and health of employees through all reasonable means, the report found.

The RIU survey additionally revealed that most tenants expect concessions from the landlord in the next three to six months, to stabilise and recover from the economic impact of the pandemic. Extended grace periods, rental discounts, consent to sublease, and flexibility over contract negotiations are some of the expected concessions.

“Worker experience should be the top priority for most commercial real estate landlords, developers and business leaders, and post COVID-19 will change this experience in the future. The on-demand economy is reshaping tenant expectations about how real estate is consumed. The pandemic has encouraged the public to practice social distancing and to abide by health and safety protocols, which is now a necessity. Technology-enabled facilities and personalised experiences will escalate tenant satisfaction, and may increase the demand in commercial real estate as a whole. Decision-makers must now re-evaluate how they can effectively and efficiently operate in traditional office spaces.”