Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 6 August 2018 00:29 - - {{hitsCtrl.values.hits}}

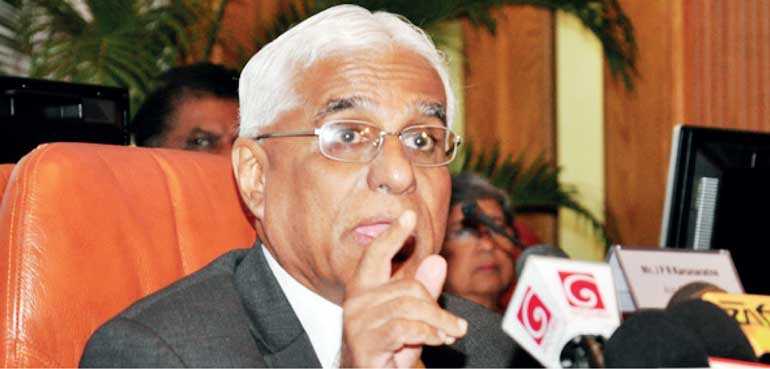

Central Bank Governor Dr. Indrajit Coomaraswamy addresses the media – Pic by Sameera Wijesinghe

By Uditha Jayasinghe

In the backdrop of modest growth and a challenging external environment, the Central Bank has decided to keep policy rates unchanged, voicing expectations for the first half of 2018 to grow about 3.5% to eventually end the year at 4%, behind the initially projected economic expansion rate of 4.5% announced in January.

Central Bank Governor Dr. Indrajit Coomaraswamy on Friday explained the Monetary Board’s decision to maintain rates as an effort to support fiscal consolidation while offsetting vulnerabilities created by a rise in international interest rates and an appreciating dollar. He also pointed out it is advantageous for Sri Lanka to keep interest rates attractive for international capital inflows and to contain an expanding trade deficit by increasing taxes on vehicle imports.

The Governor also called on banks to reduce interest rates to incentivise investment and said the Central Bank would monitor progress on that front.

Private sector credit growth decelerated to 14.9% (year-on-year) in June from 15.1% in May, according to the latest Central Bank data. Private sector credit is expected to grow by around 13-14% by end 2018, which would be about Rs. 650 billion. Broad money (M2b) growth decelerated to 14.9% in June (y-o-y) from 15.0% in May, with the deceleration in private sector credit expansion and net borrowings by the Government from the banking system. Net outflow from government securities reached $ 229 million up to 1 August.

“Last time we met I said growth would be between 4.5-5% for this year. This is not a formal estimate that I am giving you, but if one is realistic, it is unlikely that growth will be more than 4% this year. Our potential growth rate we see as being 5.75%, so there is a significant output gap and one can make a case for easing monetary policy because our growth is well below the potential growth rate. Another factor that favours easing is the high real and nominal interest rates, and if one takes side by side with the Government’s fiscal consolidation process, clearly one needs to ask the question whether the economy is being squeezed too much with both fiscal consolidation and high interest rates,” said Dr. Coomaraswamy.

The Governor noted that the first half of 2018 is likely to grow at about 3.5%, which would mean the second half would have to expand by about 4.6% for growth to end the year at 4%. “It is possible, but I don’t think much more than that. Last year, we were surprised with growth to the downside. Maybe this time we would be surprised to the upside. But, if one is to be realistic, it will unlikely to be above 4%.”

Core inflation remains well within the target range and the inflation outlook remains favourable, despite a small uptick in July, and is likely to remain at that level in August with Central Bank projections expecting inflation to reduce towards the end of the year. Inflation remaining moderate was another reason for the Monetary Board to maintain rates, the Governor added.

However, a rise in interest rates around the world led by the US and backed by several other key Central Banks, including the Bank of England, and the announcement by the European Central Bank that it would curtail its asset purchasing program had limited Sri Lanka’s room to loosen monetary policy.

“If we allow the differential between our rates and the US rates to reduce, then clearly there is an incentive for investors to move out. There has already been some outflow, but there could be an acceleration, which the Monetary Board took into account.

“Several countries have had their currencies deprecate more than the 4.3% seen by the Sri Lankan rupee, and if we reduce interest rates, that could trigger further pressure on the exchange rate.”

Within the emerging market space, a number of countries have actually increased interest rates so you could get a repositioning of portfolio capital if you see some countries raising their rates and we reduce it, which could lead to a change in our government securities. The trade deficit has widened and if one reduces interest rates, it is possible that there would be an increase in aggregate demand and quite a lot of that could leak into imports.”

Even though the Government has met its fiscal targets for the first six months of 2018, the Monetary Board would remain vigilant of any slippage and adjust monetary policy accordingly, the Governor assured.

“Monetary aggregates as a whole have come out well, so on that s

ide, things seem to be pretty good. It is also encouraging that the average weighted call money rate has begun to ease a little bit and the Treasury bill rate has also come down, but a matter of some concern is that bank lending and deposit rates are rigid downwards. At the meeting with bank CEOs, we expressed this concern to them. We think that bank deposit and lending rates need to come down. We will monitor that and see how it develops.”

The Government would miss its net international reserve target for June under the $ 1.5 billion Extended Fund Facility (EFF) of the International Monetary Fund (IMF), the Governor stated, responding to questions.

“The target is likely to be missed. We will do our best to negotiate a waiver. When the target was set, the world was in a very different place because in the middle of the year, there was a significant turn in capital inflows to emerging markets and in that context, the target became unrealistic.”

The Central Bank is to release its first panda bond, expected to be about $ 250 million, before the end of the year with the first tranche of a $ 1 billion syndicated loan from the China Development Bank (CDB) expected in mid-August.

Central Bank Governor Dr. Indrajit Coomaraswamy told reporters on Friday that the first $ 500 million tranche from the CDB syndicated loan would be transferred in mid-August with the remainder to come in October. The CDB loan came at 5.25% interest and has an eight-year payback and three-year grace period, which the Governor described as being favourable terms for Sri Lanka. The Central Bank projects reserves would end the year at $ 9 billion once all these funds are received.

“We think we will finish the year with about $ 9 billion, and that’s a comfortable number. The $ 1 billion loan will come from the syndicated loan in two tranches of $ 500 million, one in mid-August and the other in October,” he said.

Dr. Coomaraswamy was upbeat of the support already given by the Chinese authorities and spoke warmly of the long diplomatic relations between the two countries. The Government is also likely to receive a $ 250 million tranche from the International Monetary Fund (IMF) under its $ 1.5 billion Extended Fund Facility (EFF) program.

“We are working towards a $ 250 million panda bond issuance at the end of the year. We went on a road show to China and there seems to be good interest. We met some banks, insurance companies and other institutional investors. Perhaps most encouraging of all was our meeting with the People’s Bank of China, which is their Central Bank where the Deputy Governor, totally unsolicited, suggested we set up a joint task force to examine how Sri Lanka could explore the bond market.

“During consultations (with the Chinese over the loan) it was clear that they see us as a key strategic partner as far as the (Belt and Road) Initiative is concerned, given our location.”

The Central Bank has defended a recent tax increase on small cars, insisting that without such a measure, the trade deficit would have continued to widen, placing pressure on the rupee and if left unaddressed, could have triggered a balance of payments crisis.

Central Bank Governor Dr. Indrajit Coomaraswamy defended a measure announced by the Finance Ministry last week to raise taxes on small cars, emphasising that the fiscal measure was the best way forward to maintain macroeconomic equilibrium.

“The trade deficit worsened by $ 716 million in the first five months of this year and of that amount, $ 350 million can be attributed to the increase in vehicle imports. This is why the Central Bank wanted something done about this. Duty adjustments on gold imports have had the desired effect and have eased off. Hopefully going forward, the pressure on the trade account will be reduced because two of the three pressure points have been contained. The third factor is oil imports, but that is beyond our control.”

Increased demand for dollars also placed additional pressure on the rupee, which has already depreciated by 4.3% this year, the Governor pointed out. He noted that, as Sri Lanka is a largely import-dependent economy, prices of imported essential goods increasing placed a disproportionate amount of pressure on the poor and therefore, it was essential to reduce this strain.

He also warned that a balance of payments crisis would be a serious problem as the Government would have no option but to borrow externally to shore up reserves which, given Sri Lanka’s debt dynamics, would be a significant challenge.

Responding to questions, Dr. Coomaraswamy noted that in the first five months of 2018, foreign exchange outflow from the purchase of 1000cc engine capacity vehicles increased from $ 26 million in 2017 to $ 195 million in 2018, while for 1500cc engine capacity vehicles, it rose from $ 20 million to $ 73.2 million. The higher category of 3000cc petrol vehicles dropped from $ 33.5 million to $ 21.1 million, but 2500cc diesel vehicles rose from $ 1.9 million to $ 5.4 million.