Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 18 September 2019 00:00 - - {{hitsCtrl.values.hits}}

By Uditha Jayasinghe and Charumini de Silva

The top representatives of the private sector, experts, public officials and politicians gathered yesterday for the Sri Lanka Economic Summit 2019 to take stock of the country’s economy, its strengths as well as challenges, and map a way forward to promote growth in an increasingly challenging global environment.

The summit, titled ‘Recalibrating Sri Lanka’s Economic Trajectory: Towards 2025’ sought to bring together the best brains and experience available in and outside the country to find the best path forward.

Uncharted territory

The proceedings opened with a session dealing with the ‘Global dynamics in the next decade’ where experts pointed out that in a world beset with trade wars and the rapidly shrinking influence of global institutions such as the World Trade Organization (WTO) it was harder to remain committed to  liberalisation. The speakers also touched upon the shifts in societies that are influenced by technological advancements such as Artificial Intelligence (AI) and data-driven industries that were also impacting politics and the larger functions of democracy.

liberalisation. The speakers also touched upon the shifts in societies that are influenced by technological advancements such as Artificial Intelligence (AI) and data-driven industries that were also impacting politics and the larger functions of democracy.

“The world is entering uncharted territory. We are seeing a faster rate of change, far faster than the world has ever seen before. We are now destroying institutions without finding any alternatives for them or even attempting to reform them,” said former Indian Commerce and Industry and Civil Aviation Minister Shri Suresh Prabhu.

“People are not even considering reform; they simply want to get rid of the institutions. This challenge is being faced by the World Trade Organization, for example. Secondly, the countries that advocated and frowned upon others who did not follow a market-based economy are now the very countries that are moving away from markets. The principle of globalisation was that every country should open up and even though they may lose in the short term, they will gain in the long term. However, it is now those very countries that have gained the most from open markets that are pulling away and not allowing developing countries to reap benefits from the opening of markets.”

He pointed out that the whole idea behind open markets was based on competitive advantage and global supply chains and these were being disrupted as a result of protectionist policies, which meant smaller companies that were supplying goods and services will now face huge challenges in continuing their businesses.

“Therefore we must all find our own strategic advantages. We in India have prepared a roadmap for a $ 5 trillion economy and we are working together to realise that, sooner rather than later. India is working on becoming a $ 5 trillion or $ 10 trillion economy and that will benefit our partners. This will definitely assist Sri Lanka given its proximity and other ties to India. At the same time, Sri Lanka must also come up with plans and policies that can use this growth and create its own.

“Sri Lanka has huge potential in many areas. But the strategies should not disturb what Sri Lanka has, which is its natural beauty. So development should protect the environment and use the huge human resource capital it has. For example Sri Lanka has huge wind potential. Because of Sri Lanka’s location it can generate about 14,000 MW of wind power and it can share its power with other countries. It can export to India and just imagine the amount of revenue it can get. We buy power from Bhutan, we invested in their hydropower and Bhutan has the highest per capita income partly because of the royalties being paid by India. Imagine the energy potential Sri Lanka has without having to destroy its environment? Sri Lanka and India can come together and market its tea. So there can be growth without compromise and sacrifice. With fresh strategies Sri Lanka can be less affected by global geopolitical issues.”

The former Minister pointed out that increased protectionism was leading to lower growth for everyone and that was triggering contentious politics at the local level. This has now become cyclical, he argued, and lower growth was feeding more protectionism and vice versa, rather than finding genuine solutions to problems

“When domestic economies fail we have to find someone to blame. This is what is happening in many countries but they do not realise that by hurting the other country they are also hurting themselves. So in the next decade each country will have to find its own strategy for growth but they also have to revisit this strategy frequently to make sure it adapts to challenges and is nimble enough to take advantage of new opportunities. I am very happy that Sri Lanka is poised for growth and it has the capacity to insulate itself from the rest of the world if it focuses on its advantages.”

Shaping the world with data

Standard Chartered Bank CEO Vietnam and ASC Cluster Markets Nirukt Sapru sought to address the opportunities as well as the challenges posed by data, digital industries and AI. He pointed out that while the world stood to gain much from technology advancement, it was also undoubtedly impacting labour markets, democracies and individual privacy, posing fresh challenges that would need to be addressed parallel to drawing benefits from these possibilities.

“Data is becoming the world’s most valuable commodity. Look at the top companies by market capitalisation today - most, if not all of them, have data as the main asset of the company. What is becoming more apparent is that technological advances in data usage have outstripped the development of a framework around the ethics of data usage and data privacy.

“The other significant impact of technology is the rise of the digital economy and in particular the ‘mobile’ digital economy. The increasing ubiquity of the smartphone provides a huge boost to democratisation of access to markets and information. The increased ubiquity of the smartphone provides access to markets and information. Businesses can use it to reach consumers. Pokemon Go was downloaded by 50 million users in 19 days. Mobile technology provides opportunities for companies to serve consumers better, for example by using location services but they need to be gathered legally and ethically.”

He noted that while people were seeing the impact of these technologies in their daily lives, technology adaptation and trends were also impacting jobs, supply linkages and skills education. In the race for technology, it was also important to address labour challenges so everyone could continue to be part of the workforce. Technology is increasingly replacing jobs so theoretically this allows humans to concentrate on innovation and creation, which are jobs that cannot be done by machines. But it is then also important for people to be given the right set of skills for this to be possible.

“Disruptions to value chains are the new norms and corporates have to adjust their businesses to deal with these challenges. Inequality and distribution of wealth are exacerbating existing tensions and these will pose increasing problems to governments and societies. The shift from West to East is now embedded and Asia is driving this change. Asia’s GDP by 2030 will match that of the European Union and this is leading to rapid urbanisation, which is driving the middle class and growth in these areas. There is some demographic drag in some countries but 10 years from now Asia will have a significant portion of global GDP,” he said.

Sapru also called on the Government to consider the linkages between labour and productivity to growth emphasising that traditionally the contribution of labour to growth has been lower than capital investment in emerging markets.

“So this needs to change. Sri Lanka has to focus on developing skills, a constant focus on improving productivity and focus on Asia for growth more than it has in the past.”

FDI in trying times

Board of Investment (BoI) Chairman Mangala Yapa acknowledged that Foreign Direct Investment (FDI) trends have been challenging at best as more global volatility discourages investors but acknowledged that developing markets, particularly those in East and South Asia, had managed to buck the trend.

“FDI trends have been a bit of a disaster. If you look at 2018, global FDI dropped by 13%. Given the political and economic vulnerability, I don’t think there will be a recovery. There is no light at the end of the tunnel. However, the biggest impact was to developed countries. Developing countries had the least impact with a positive 2% growth. In that Asia fared very well with India, China, Indonesia, Malaysia and Singapore all continuing to attract FDI. South and East Asia both saw FDI inflows grow by 4%. India alone grew by 6% with new investment. Sri Lanka also fared pretty well, recording $ 2.36 billion, which was a 54% growth over a five-year period but the challenge is to sustain it. Can we keep the growth going?”

Yapa stated that there remain multiple challenges. He stressed that Sri Lanka had to expand its market past the 21 million, which means the country has to move towards trade agreements, which have been started but not completed.

“Skills development and improving competitiveness have become serious. We need to move growth out of the Western Province to other parts of the country. These are the challenges we are facing and solutions need to be found to sustain FDI to Sri Lanka.”

Low base positives

John Keells Holdings Chairman Krishan Balendra, speaking during the panel discussion, opined that Sri Lanka had managed to recover from the Easter attacks faster than anticipated and tourism was likely to see only a 15% drop in earnings when compared to 2018. He also said that continued growth, especially in India, would provide Sri Lanka with more growth opportunities.

“One industry that is important for the country and for the company is tourism. Last year we had 2.1 million tourists but relative to most of Asia that is a small number so the uncertainties in the world are unlikely to impact the tourism sector. The Easter attacks have had an impact but recovery has been ahead of expectations. It looks as though the sector will recover by winter. Of course returns will be lower and earnings will be about 15% less than last year. One of the reasons for this is because the base is low. Tourism will continue to grow. The Indian explosion of outbound travel is really manifesting itself and Sri Lanka will see an increase in growth because of its proximity to India.”

He also said the ports sector, which is the other important segment for JKH, has also fared comparatively well.

“The Colombo Port is now at full capacity and growth has been rapid. This is again because of the low base. Our TEUs is about 8 million but for a hub port that is low. In Singapore it’s much higher. Here we are again seeing a catch-up after the war and other issues Sri Lanka has faced in the past.”

Balendra was also positive about contracting interest rates but noted that they were likely to be used by the private sector only after the election cycle was over.

“Lower interest rates could also turn out to be an opportunity for corporates, perhaps not till elections are completed, but once the political uncertainty ends there will be interest in availing themselves to capital for investment.”

Tailor-made poverty alleviation

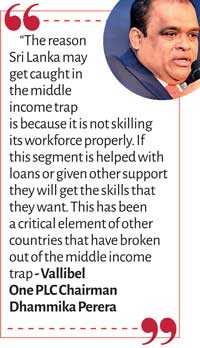

Vallibel One PLC Chairman Dhammika Perera was enthusiastic in his support of technology for innovative uses such as fighting poverty. He pointed out that as much as 62% of the labour entering the market did so without any training and argued that it was essential to give skills to people to increase productivity and pull them out of poverty.

“The reason Sri Lanka may get caught in the middle income trap is because it is not skilling its workforce properly. If this segment is helped with loans or given other support they will get the skills that they want. This has been a critical element of other countries that have broken out of the middle income trap,” he said.

Perera pointed out that current poverty alleviation programs such as ‘Samurdhi’ were ineffective because they provided too few funds to make a genuine impact on the lives of recipients and also because they were not tailor-made for the requirements or specific needs they may have.

Presenting an example, he argued that if the Government used data properly it would know whether a son or a daughter of a family was in need of education and therefore could provide extra funding for three or four years and then stop the money flow as the educated child could then support the rest of the family.

“Our current programs don’t really pull people out of poverty. They only provide something to survive on. As much as 35% of the people experience near poverty because the handouts are simply not enough. So we need to educate people better and we need to pull people out of poverty in a meaningful way.”

He also expressed the view that more than technology, what was needed was an understanding of how to effectively deploy technology to gain results. He noted that Singer had sold 120,000 air conditioners but when the data was collected they were found to be only in 52,000 households. So Perera had demarcated these houses in a grid system so that servicing them would be done easily and effectively. Based on this example, he also proposed geo-mapping of poor people to find ways to track their needs. He also advocated that the Government concentrate on district level jobs, which would be more accessible to vulnerable segments of society.

Seeing opportunity

Sunshine Holdings Group Managing Director Vish Govindasamy called for Sri Lanka to react faster to international events so it could tap into potential opportunities. He pointed out that Sri Lanka’s banking and financial sector could have considered taking advantage of the protests in Hong Kong to attract business to Sri Lanka. He pointed out that countries like Vietnam were using the US-China trade war to attract investment and upgrade their manufacturing and Sri Lanka could do the same, especially in promoting the already competitive ports industry.

“Middle East tensions will have an impact on local tea exports and we need to focus on other exports so we can move out from volatile markets or at least hedge its impact. India is showing signs of a slowdown and that could have potential impact on tourists from that destination,” he warned.

Govindasamy also advocated that Sri Lanka focus more on hygiene and aftercare of patients to promote healthcare tourism along with better diagnostics and skills development in nursing care to attract foreigners to the local healthcare service.