Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 18 December 2020 00:00 - - {{hitsCtrl.values.hits}}

From left: Asia Securities Chairman Dumith Fernando, State Minister of Money and Capital Market and State Enterprise Reforms Ajith Nivard Cabraal and Hatton National Bank Managing Director/Chief Executive Officer Jonathan Alles

|

| State Minister Ajith Nivard Cabraal delivering his keynote address at the 4th Annual Asia Securities Sri Lanka Investment Conference |

|

| Jonathan Alles of HNB shares his insights at the 4th Annual Asia Securities Sri Lanka Investment Conference |

|

| Jonathan Wilmot, Global Strategist, Aletheia Capital, Founder, WilmotML, and former Chief Global Strategist, Credit Suisse |

|

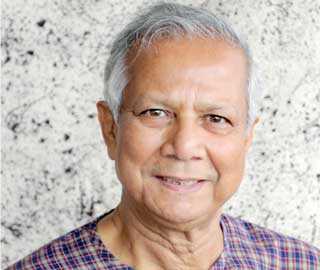

| Prof. Muhammad Yunus, 2006 Nobel Peace Prize Recipient and Founder of Grameen Bank

|

A panel of key experts stated that a stronger and sustained economic recovery is on the horizon in the coming year.

Speaking at the 4th Annual Asia Securities Sri Lanka Investment Conference, Jonathan Wilmot, Global Strategist, Aletheia Capital, Founder, WilmotML, and former Chief Global Strategist, Credit Suisse stated: “The forecast we have is for a short-term dip followed by a period of above trend growth which takes us back roughly to trend or slightly above by the middle of 2022. Essentially, we have already had our V-shaped recovery in global industrial production even though GDP remains well below pre-COVID levels. Key indicators are showing a lagged impact from the winter wave in the US and Europe. However, global industrial activity reached above our estimation of 80-85% of pre-COVID levels, thanks to China.”

Day 2 of the conference hosted by Asia Securities, Sri Lanka’s leading independent investment banking and wealth management firm, featured an exciting line-up of global and local thought leaders including, Ajith Nivard Cabraal, State Minister of Money and Capital Market and State Enterprise Reforms; Prof. Muhammad Yunus, 2006 Nobel Peace Prize Recipient and Founder of Grameen Bank; Jonathan Wilmot, Global Strategist, Aletheia Capital, Founder, WilmotML, and former Chief Global Strategist, Credit Suisse; and Jonathan Alles, Managing Director/Chief Executive Officer, Hatton National Bank PLC yesterday. The panel discussion was moderated by Dumith Fernando, Chairman, Asia Securities.

Delivering his keynote address at the conference, Cabraal remains optimistic of the outlook for 2021 noting that, “Even with the COVID situation, Sri Lanka has been able to generate reasonable interest and robustness within the markets. Sri Lanka has adjusted to the ‘new norm’ reasonably well which can be seen in the 3Q GDP results.”

Speaking about the balance between the health sector and the economy, he stated that “These are two competing interests that are tough to reconcile. There is a need to isolate and lockdown the economy against the need to do business to take the country forward. However, Sri Lanka has been able to strike a reasonably good balance in this sense. Sri Lanka will not seek funding from the IMF as the country hopes to manage with the available resources, and we have sufficient resources to get through 2021. We will also see wide consolidation program between the banks and finance companies, ensuring strong and stable institutions to take the country forward. Further, the economy is to expect investments to come into the economy.”

He also stated, “The Government believes that $ 2.5 b is an achievable FDI target for 2021 as commitments made for the Port City alone amount to $ 1 b. The Hambantota tyre factory should generate ~$ 300 m, with at least $ 175 m expected in 2021. Investments in pharmaceuticals and education should be in the range of $ 200 m. Meanwhile, other investments are also continuing, and materialisation of these inflows should encourage further investments. The public sector order book of investments amount to Rs. 5.2 t, and even realising 15.0% of this should amount to $ 780 b. Private sector participation has been facilitated even in the COVID-19 environment by maintaining stable macro fundamentals. Targeting 5.0% of GDP to come from FDIs by the latter part of the current government’s term is a tall order but achievable by setting the right foundation.”

On social development, Minister Cabraal added that the Government has identified several areas to drive economic activity at the grassroots levels. One such investment made towards managing the human-elephant conflict feeds into this as a swift resolution to minimise disruptions to business activity in affected areas. He further added that the Government will continue to strive to expand the electricity and water coverage in the country, so that daily lives including educational activities can continue unhindered.

The conference also focused on how social economics play a key role in inclusive growth in the new normal. The speakers stressed on the need to drive economic growth at grassroot levels and explored whether the Government initiatives were largely aligned with this agenda. The panel also noted that banks and other financial institutes should consider how they can take advantage of the low-rate environment to drive growth in the new normal.

Delivering his keynote address, Prof. Muhammad Yunus highlighted that, “The entire a banking system is designed around wealth accumulation. However, more than half the population of the world, categorised as the informal sector, is excluded from the formal financial system, and left at the mercy of the loan sharks. We classify them as the informal sector, but really these are micro-entrepreneurs, a segment that can take of themselves, if given the right support. Governments should design micro-financing policies that do not look at making money for ourselves, but instead look to support these entrepreneurs.”

Commenting on interest rates, Jonathan Alles, Managing Director/Chief Executive Officer, Hatton National Bank PLC, noted that “Two to three years back, AWPLR was ~12.5%. We have seen this come down a two-third of it and it is at an all-time low at this stage. Given the current context of the country, this makes sense as there is minimal activity going on in the economy. The good thing about this is, even if rates go up marginally, is that it would be sustainable still and good for the depositors. However, it is important the banking industry rides this through successfully given the current low interest rate environment.”

Asia Securities is a leading investment firm in Sri Lanka providing Investment Banking, Research, Equities, and Wealth Management services to local and international corporate, institutional, and individual clients. Hosted by the firm’s award-winning Research team, the Annual Sri Lanka Investment Conference series is an integral part of Asia Securities’ calendar that focuses on in-depth discussions with veterans in industry and policymaking and has garnered significant investor interest in the last few years.