- Key insights by CT CLSA Securities

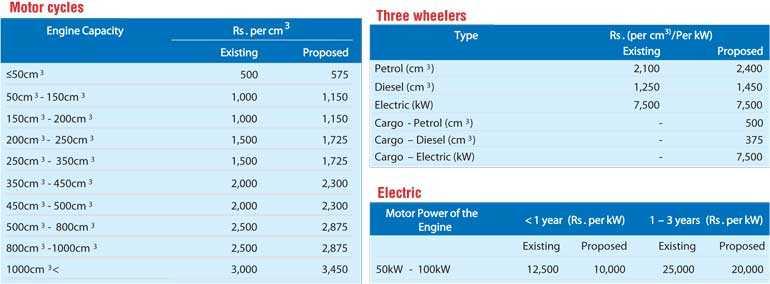

INCOME TAX (INLAND REVENUE ACT NO. 24 OF 2017) AMENDMENTS W.E.F. 1 APR 2019

Proposals

Exempt earnings by any non-resident person on any sovereign bond denominated in local or foreign currency

Exempt interest income earned by any resident person on sovereign bonds denominated in foreign currency including Sri Lanka Development Bonds

Exempt interest income earned by any person on NRFC and RFC accounts for five years

Exempt interest income up to Rs. 5,000 month for minors in relation to any deposit account maintained in a financial institution

Exempt interest paid to any person outside Sri Lanka on loans granted by such person to any person in Sri Lanka (not applicable for companies)

Exempt royalty payments (from WHT) not exceeding Rs. 50,000 month, subject to Rs. 500,000 p.a. made to any resident individual

Exempt rent payments (from WHT) not exceeding Rs. 50,000 month, subject to Rs. 500,000 p.a. made to any resident individual

Impact analysis

- These amendments to the Inland Revenue Act are estimated to stimulate overall investments in Sri Lanka

FOREIGN DIRECT INVESTMENTS (FDI)

Proposals

- Income tax computation for investments both >$ 100 m and >$ 1 b

- Deduct 150% of actual expenditure on investments in depreciable assets, excluding intangible assets for 10 years from commercial operations

- Exempt upfront taxes including NBT, PAL, Cess and Duty and other taxes on negative list items, until commencement of commercial operations

- In addition for investments for >$ 1 b

- Impose a dividend tax rate of zero, to be paid by the investing company to a non-resident, during the period that such dividends are paid out of profits sheltered by enhanced capital allowances

- Income tax computation for mid-size investments >$50 m

- Deduct 100% of actual expenditure on investments in depreciable assets, excluding intangible assets for 10 years from commercial operations

- Exempt upfront taxes including NBT, PAL, Cess and Duty and other taxes on negative list items, until commencement of commercial operations

Impact analysis

- The new proposals are expected to improve inflows of foreign currency and strengthen large scale foreign investments

CAPITAL MARKETS

Proposals

- Introduce scripless Sri Lanka development bonds and enable coupon stripping of Treasury bonds

- Grant tax exemptions on sovereign bonds and Development Bonds (above on Inland Revenue Act amendments)

Impact analysis

- Initiatives likely to attract foreign/non-resident Sri Lankan capital inflows into Government Securities market

TOBACCO

Proposals

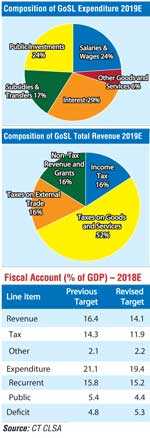

- Increase Excise Duty for the 60mm and above stick length categories by +12% w.e.f. 06 March 2019 – Going forward excise duties will be based on indexation, capturing annual inflation and GDP growth

- Revise unit rate based custom import duty on selected goods including tobacco w.e.f. 06 March 2019

- Introduce Nation Building Tax (NBT) on the manufacture of cigarettes w.e.f. 01 June 2019

- Revise Cess duty on importation of tendu leaves (beedi leaves) from Rs. 2,500 to Rs. 3,500 per Kg w.e.f. 6 March 2019

Impact Analysis

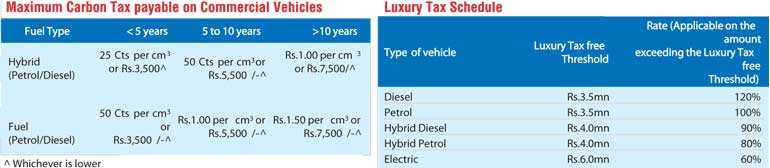

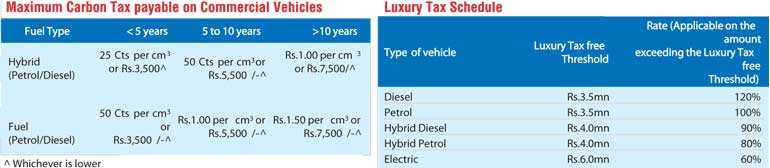

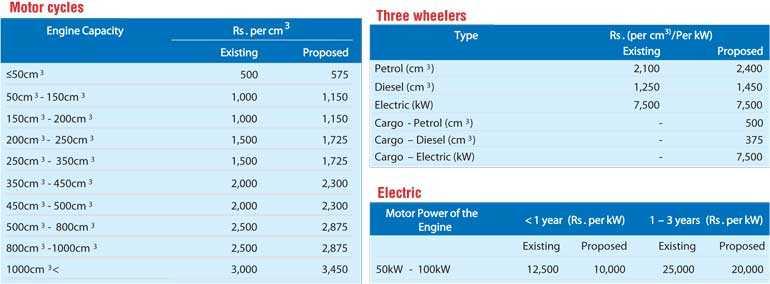

- Tobacco and alcohol Excise and Customs Duty revisions likely to be the highest incremental revenue accounting for Rs. 57 b

- Subsequent to the above mentioned increase in excise duties, Ceylon Tobacco Company (CTC), the sole legal producer and distributor of cigarettes in Sri Lanka, has increased prices of the 60mm and above stick length categories

- Price increase of 84mm length sticks appears to be significantly more than the Excise Duty increase

- Cigarette prices were previously increased in August 2018 to an excise duty increase of Rs. 3.8 per stick which was implemented for the 84mm stick length category. Consequently, CTC increased its product prices by Rs.5 per stick for main stream brand JPGL, and premium segment, primarily Dunhill

- Volumes are anticipated to decline in the short term subsequent to the price increase; however margins are expected to improve given that the price increase is more than the excise duty increase

- Excise duty being indexed to GDP and inflation growth is expected to improve clarity and predictability on price revisions going forward

- CTC is expected to further increase prices w.e.f. 1 June 2019, subsequent to the proposed introduction of NBT on the manufacture of cigarettes

- Revising Cess duty on imported tendu leaves is expected to result in a marginal price increase of beedi (currently 35-45mm length beedi is ~Rs.5-6 per stick). Nevertheless, a notable price discrepancy prevails between beedi and Capstan, the closest equivalent to beedi in CTC’s portfolio

ALCOHOL

Proposals

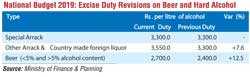

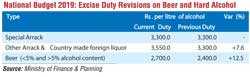

- Revise excise duty on locally-manufactured liquor based on indexation, capturing annual inflation and GDP growth w.e.f. 06 March 2019

- Increase custom duty on ethyl alcohol by Rs. 200 to Rs. 1,000 per litre

- Revise Excise Duty rates of imported liquor; malt liquor (beer) – Rs. 55 per bulk litre, wine – Rs. 110 per bulk litre, other liquor – Rs.215 per bulk litre

Impact analysis

- Distilleries Co. of Sri Lanka (DIST), which holds a dominant position in Sri Lanka’s (legal) hard alcohol market (~65% market share in the core arrack segment) increased the prices of its mainstream brand, ‘Extra Special’ (~90% of total sales mix, alcohol content of 33.7%) by Rs. 20 to Rs. 1,600 per 750ml bottle (+1%) w.e.f. 6 Mar 2019, despite no revision to applicable excise duties, owing to a +25% upward revision to import duties related to ethanol to Rs.1,000 per litre

- Import duties on ethanol were previously revised up by +60% to Rs. 800 per litre in Nov 2016. DIST is believed to typically import ~70% of its total ethanol requirement, comprising ~80% of cost of sales

- DIST previously increased prices of 750ml ‘Extra Special’ by Rs.10 to Rs. 1,580 (+1%) w.e.f. 28 Jan 2019, in response to escalating costs of production

- Tax-led price revisions on DIST’s other product categories to put pressure on volumes, though the overall impact is likely to be minimal due to low contribution

- Given the upward price revisions in close proximity, DIST’s volumes will continue to face pressure in the near term; currently forecast to decline -15% YoY for FY19E and to remain broadly unchanged for FY20E. However, pressure from the soft alcohol segment is expected to somewhat lessen, given tax-led upward price revisions on ‘Strong’ beer (closest legal competitor)

- Lion Brewery Ceylon (LION), Sri Lanka’s largest producer and distributor of soft alcohol (beer) with a market share of ~86%, increased prices of 625ml Lion Strong by Rs. 20 to Rs. 300 (+7%) w.e.f. 06 Mar 2019, in response to a +13% upward revision to applicable excise duties – margins are expected to witness slight erosion given that price increases are somewhat lower than the upward revision to excise duties

- Excise duties on strong beer (alcohol content >5%) were previously reduced by 33% w.e.f. 10 Nov 2017, subsequent to which prices of 625ml Lion Strong were reduced by Rs. 80 to Rs. 270 (-23%)

- Upward price revisions for both soft and hard alcohol is expected to result in a downward trend in overall consumption, especially in the legal alcohol sector

- Linkage of excise duty revisions to annual inflation and GDP growth likely to result in more predictability in excise duty revisions between soft and hard alcohol going forward

BEVERAGE

Proposal

- Revise the excise duty based on gram of sugar contained in beverages w.e.f. 06 Mar 2019

- Accordingly, a tax of Rs.0.4 per gram of sugar in excess of quantity in carbonated and fruit based beverages were proposed

Impact analysis

- GoSL in Nov 2017 introduced an excise duty of Rs. 12 per litre or Rs. 0.50 gram of sugar contained in carbonated beverages, whichever is higher (no fruit based drinks were captured in this initial proposal). This led to average prices of carbonated beverages increasing by +40%

- Tax based on sugar content however was reduced in Dec 2018 (a tax of Rs.12 per 1L or Rs.0.3 per gram [where content is above 6 grams of sugar out of 100ml], whichever is higher was implemented)

- Whilst a tax was proposed in Dec 2018 for fruit based beverages, the same was not implemented by fruit based beverage manufacturers due to the change in which government took place at the time

Whilst increasing from Dec 2018, carbonated beverages would see a sharp reduction in taxes compared previous quarters. Listed Ceylon Cold Stores (CCS) would see a volumes increase with a potential price decrease. CCS initially only reduced prices of select variants in larger quantities (across the board price reductions were not applied as the re-elected Government signalled a possible change to duty structure)

Whilst increasing from Dec 2018, carbonated beverages would see a sharp reduction in taxes compared previous quarters. Listed Ceylon Cold Stores (CCS) would see a volumes increase with a potential price decrease. CCS initially only reduced prices of select variants in larger quantities (across the board price reductions were not applied as the re-elected Government signalled a possible change to duty structure)- However, carbonated beverages with zero sugar content are not expected to be captured for any tax

- Meanwhile manufacturers of fruit based beverages such as Cargills Ceylon (CARG) would see a slight impact on volumes of fruit based beverages

- No change is however expected with regard to fruit juices as excise duty is proposed only for fruit based beverages with added sugar

TOURISM

Proposals

- Integrate the SME tourism sector into the formal economy

- Any online booking/reservation website can register hotels and similar establishments offering more than five rooms per property, provided such establishments are registered with the Sri Lanka Tourism Development Authority (SLTDA) w.e.f. 01 April 2020E

- Remove Nation Building Tax (NBT) on foreign currency receipts by tourist hotels registered with the SLTDA w.e.f. 01 June 2019

- Reduce Cess rates applicable on selected items, to support refurbishment of hotels w.e.f. 01 June 2019

- Reduce Economic Service Charge (ESC) applicable on the sector from 0.50% to 0.25% w.e.f. 01 June 2019

- Remove Customs Import Duty (CID) and Cess on Go Karts and tyres used in Go Karts

- Increase Embarkation Levy (EL) by $10 to $60 per passenger

- Remitting funds to hotels in US$ made mandatory for travel agents when invoiced in US$

Impact analysis

- Proposals to integrate the SME tourism segment into the formal economy are likely to stymie recent growth in the segment (22% market share in 2017 vs. 16% in 2013), benefitting all listed tourism companies

- Increased focus on new frontiers including sports tourism to benefit sector players across the board, whilst promoting Sri Lanka as a multi-purpose travel destination

- Reduction in Cess and ESC to have a positive impact on sector earnings

- Increase in EL to support Government revenue, though may have a marginal negative impact on tourist arrivals

- Removal of NBT to benefit registered hoteliers, whilst encouraging tourist arrivals to Sri Lanka; we currently forecast tourist arrivals at 2.7 m for 2019E (+17% YoY) and 3.0 m for 2020E (+11% YoY)

EXPORTS

Proposals

- Further develop the National Export Strategy (NES) and the Export Market Access Program

- Reduce Economic Service Charge (ESC) applicable for export sectors to 0.25% from 0.5% w.e.f. 01 June 2019

Impact analysis

- Further development of the NES is expected to improve foreign exchange earnings and employment opportunities over the medium term; the Government plans to achieve $ 28 b in export revenue by 2020E

- Reduction in ESC may result in a slight boost to export-related sales turnover in the near term

- The above initiatives are expected to have a marginal positive impact on all export-oriented companies, inclusive of Teejay Lanka (TJL), BPPL Holdings (BPPL), Hayleys Fabric (MGT), Dipped Products (DIPD) and Richard Pieris Exports (REXP).

CONSTRUCTION and ENGINEERING

Proposals

- Prohibit foreign construction companies to tender for Government projects, unless the project is fully foreign financed, without forming a joint venture (JV) with a local construction or consultancy company

- Impose para-tariff revisions and the removal of NBT on the main construction contractor

- Reduce Cess on imported construction material by 30%

- Commence work on the Ruwanpura Expressway and the Central Expressway Section I and III

- Commence work on the Colombo City Light Rail Transit (LRT) connecting Malabe to Fort in 2019

- Allocate Rs.10 b for the maintenance and construction of rural roads

- Provide housing for low income groups in urban, rural and estate sectors in the north and the east

Impact analysis

- Listed player Access Engineering (AEL) to benefit through the reduced competition from foreign construction companies, while also enabling a technological knowledge transfer

- Commencement of large-scale infrastructure projects to benefit AEL given their exposure to similar projects in the past

- AEL to benefit from lower costs of construction through the reduction of Cess

- Local cement manufacturer Tokyo Cement Company (Lanka) (TKYO) to potentially benefit from increased demand for cement and concrete through the proposed large-scale construction projects

PROPERTY

Proposals

- Grant residential visas for three years to foreign nationals who invest $ 400,000 or more in condominiums from 2019. This residential visa will not be valid when the foreigner exits from this investment

- Imposed VAT on the supply of condominium housing units w.e.f. 01 April 2019 where deed of agreement relating to such supply is not executed prior to 01 April 2019

Impact analysis

- Likely to witness a surge in apartment sales in 1Q2019 from buyers looking to avoid the 15% VAT imposition. Apartment prices will increase subsequent to the VAT implementation (however, to a lower extent given input VAT can be claimed for most projects), and a deceleration in apartment sales is likely. Listed players – John Keells Holdings (JKH) (property sector expected to account for ~40% of revenue in FY21E & FY22E), AEL (property sales expected to account for ~15% of FY21E revenue), and Overseas Realty (OSEA) (property sales accounted for ~60% of FY18 revenue) are expected to be impacted; however, reduction of imported construction material costs would also help offset the impact

- Anticipate higher foreign demand for high-end luxury apartment projects with the grant of residential visas

BETTING and GAMING

Proposals

- Increase license fee of casinos from Rs. 200 m to Rs. 400 m per annum and rudjino games to Rs. 1 m per annum w.e.f. 01 April 2019

- Charge a casino turnover levy of 15% w.e.f. 01 April 2019

- Impose a casino entrance fee of $ 50 per person, w.e.f. 01 June 2019

Impact analysis

- It is not clear if the casino entrance levy will be on both foreign and local visitors; the general practice in the regional industry is to charge entry levy from the residents of the country only. E.g. Singapore casinos (Marina Bay Sands and Resort World Sentosa) charge an entry levy of S$100 for all Singapore citizens and permanent residents seeking admission to casinos

- No impact seen for listed players. However, overall proposals seen as negative for tourism development in Colombo city

CONSUMER DISCRETIONARY

Proposals

- Revise excise duty on refrigerators to 25% (from 17%) w.e.f. 06 Mar 2019

- Remove CESS on select electrical items including refrigerators and related equipment w.e.f. 06 Mar 2019

- Reduce Port and Aviation Levy (PAL) on select electrical items to 2.5% w.e.f. 06 Mar 2019

Impact analysis

- Whilst the Excise Duty revision on refrigerators is expected to increase import costs, the removal of CESS (which is at 15%) and the reduction in PAL to 2.5% (from 7.5%) is expected to more than offset the negative impact. Net duty is expected to reduce from 39.5% to 27.5%

- Raw material imported for locally assembled refrigerators are also assumed to receive similar benefits

- Further, the reduction of PAL (from 7.5% to 2.5%) on high tech items would reduce import cost

- Meanwhile, cash margin requirement for consumer durable imports will be removed in the near term – cash margin requirement of 100%

- was imposed during Oct 2018 (not communicated in the Budget speech and has been directly communicated to the importers)

- Prices of white goods and electrical items were facing upward pressure due to steep currency deprecation witnessed in 2018. With the proposals,

- the price pressure would be mitigated. Durable imports are expected to further benefit from the removal of cash margin requirement

- Listed companies such as Singer Sri Lanka (SINS) and Softlogic Holdings (SHL) are expected benefit from the proposals

HEALTHCARE

Proposals

- Improve public healthcare related infrastructure

- Allocate funds to encourage the private sector to offer internationally

- accredited training courses for Nurses and an apprenticeship program for pharmaceutical professionals

Impact analysis

- Medium term potential negative impact on listed private hospitals such as Asiri Hospital Holdings (ASIR), Nawaloka Hospitals (NHL), Ceylon Hospitals (Durdans) (CHL) and The Lanka Hospital Corporation (LHCL), on the assumption that the infrastructure of the urban public hospitals will be developed. However implementation of the same will take time and meanwhile private hospitals are also expected to improve facilities

- Improving skills of nurses and pharmaceutical professionals (assumed to be pharmacists) and allowing the qualified professionals to seek employment in nongovernmental institutions are expected to positively impact the services of all listed private hospitals and pharmaceutical retailers such as Hemas Holdings (HHL), Sunshine Holdings (SUN) and Morison (MORI) in medium term

AGRICULTURE

Proposals

- Hold discussions with the Sri Lanka Tea Board (SLTB) to resolve the current wage issue among plantation workers

- Complete work on the Moragahakanda – Kalu Ganga Multi-Purpose Development Project by 2020E, to ensure cultivation during both the Yala and the Maha seasons

Impact analysis

- Current daily wage of tea estate workers to be increased by a further Rs.50 to Rs.800 (+7%) via a Rs. 1.2 b fund set up by the SLTB, where the SLTB is to be subsequently reimbursed by the Government

- Government initiatives to bear a portion of estate worker wages is likely to have a slight positive impact on all plantation sector companies

- Initiatives to ensure high levels of paddy cultivation during key crop seasons will have a positive impact on the national agriculture sector, which in turn will benefit overall GDP growth over the medium term; agriculture currently contributes ~7% of total GDP

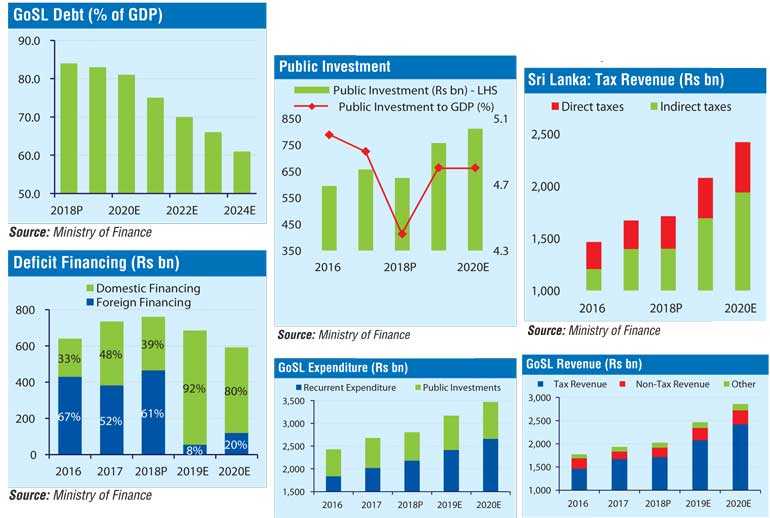

MOTOR VEHICLES

Proposals

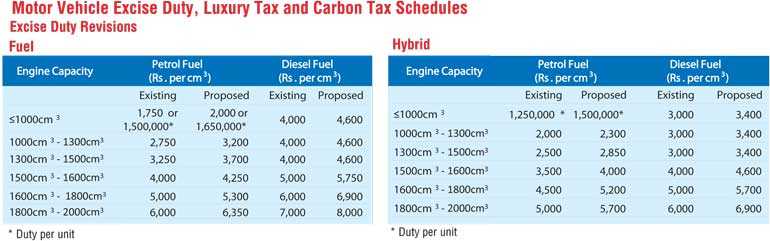

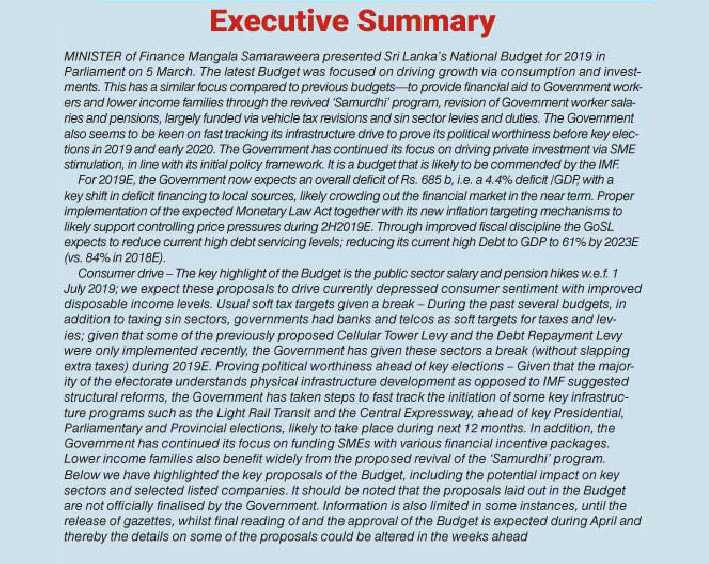

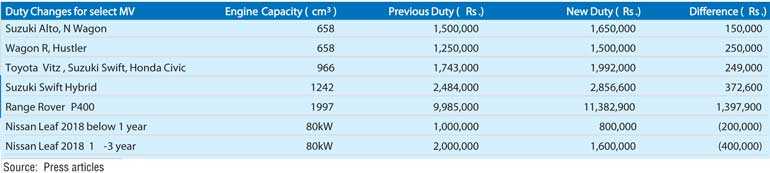

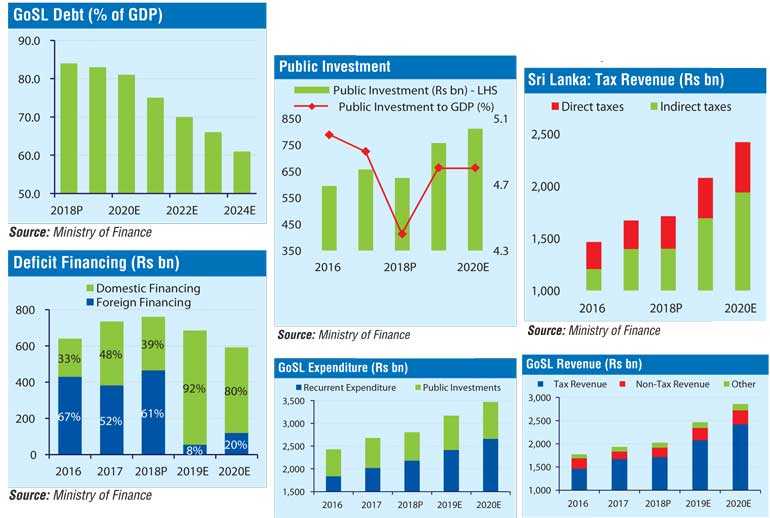

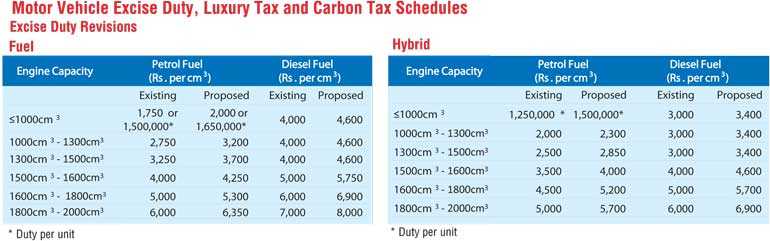

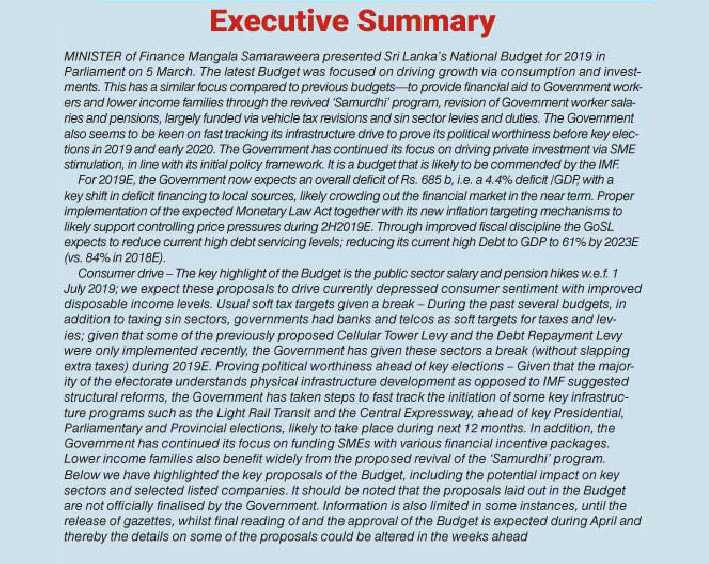

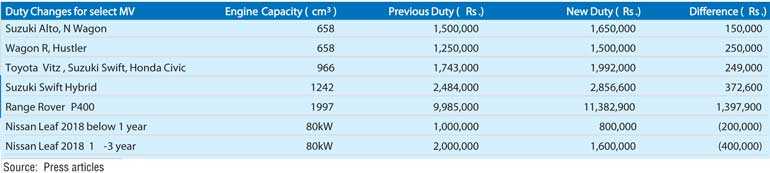

- Revise Excise Duty applicable on vehicle categories including hearses, hybrid and electric vans, single cabs, buddy trucks and passenger vehicles (motorcars, motorcycles, three-wheelers) w.e.f. 06 March 2019

- Implement Luxury Tax on Motor Vehicles on the Cost Insurance and Freight (CIF) value or the manufacturer’s price in excess of the Luxury Tax free threshold w.e.f. 01 June 2019

- Remove 200% cash margin requirements on motor vehicle imports w.e.f. 07 March 2019

- Maximum cap on carbon tax payable on commercial vehicles w.e.f. 01 June 2019

- Revise down the Excise duties on small trucks along with LTV to increase affordability for SMEs

Impact analysis

- Additional revenue of Rs. 48 b expected from Excise duty revisions and implementation of luxury taxes – key revenue raising proposal in the Budget 2019. However, given the steep increases in taxes and anticipated reduction imports, the Government may face a shortfall in the revenue target

- Significant upward revision of taxes to most of the passenger vehicle categories, with the exception of electric vehicles; whilst downward revision proposed on buddy trucks, small trucks and revisions to hybrid and electric vans, single cabs and hearses were not specified

- Demand for electric vehicles is expected to rise in the near term, however, the increase will be marginal given the limited number of authorised dealers importing electric vehicles into the country

- Likely negative impact for all the listed motor companies given their exposure to passenger and luxury vehicle, whilst marginal positive impact anticipated for companies exposed to light commercial vehicles

- Likely negative impact for all the listed Licensed Finance Companies (LFC) due to anticipated slow growth in leasing disbursements (Motor vehicle related loans and leases account for ~70% of LFC sector)

- Removal of the existing 200% cash margin requirements on motor vehicle imports is not anticipated to drive vehicle imports, given the steep increase in taxes (Finance Ministry imposed 200% cash margin requirement on the importation of all the vehicle categories other than buses, lorries and ambulances on 29 Sep 2018).

Whilst increasing from Dec 2018, carbonated beverages would see a sharp reduction in taxes compared previous quarters. Listed Ceylon Cold Stores (CCS) would see a volumes increase with a potential price decrease. CCS initially only reduced prices of select variants in larger quantities (across the board price reductions were not applied as the re-elected Government signalled a possible change to duty structure)

Whilst increasing from Dec 2018, carbonated beverages would see a sharp reduction in taxes compared previous quarters. Listed Ceylon Cold Stores (CCS) would see a volumes increase with a potential price decrease. CCS initially only reduced prices of select variants in larger quantities (across the board price reductions were not applied as the re-elected Government signalled a possible change to duty structure)